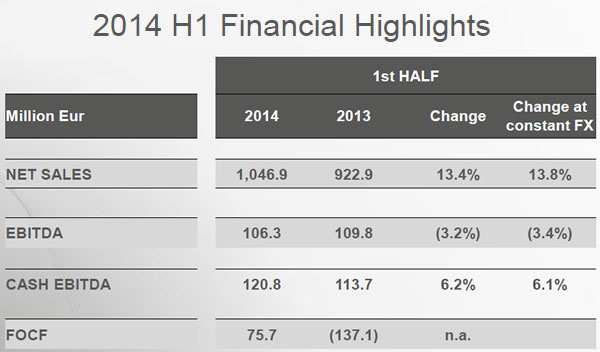

INTERNATIONAL. World Duty Free Group today reported a solid rise in first-half revenues but a dip in EBITDA for the period.

Revenues for the half rose by +13.4% (+13.8% at constant FX rates) to €1,046.9 million. Excluding the contribution of US Retail (consolidated through the acquisition of the HMSHost retail business in September 2013) the figure was €981.8 million (+6.4%).

EBITDA declined by -3.2% (-3.4% at constant FX rates) to €106.3 million. Excluding the contribution of US Retail the figure was €105.6 million (-3.8%; -4.0% at constant FX rates).

Cash EBITDA (which includes the recovery of annual concession fees paid in advance to AENA for the Spanish airport concessions) was €120.8 million (+6.2%; +6.1% at constant FX rates).

Net profit was €28.0 million against €42.5 million in H1 2013 (-34.1%). The group’s net financial position was €977.4 million, an improvement of €49.3 million compared to the end of 2013.

|

The company noted: “UK revenues showed a solid performance even with strong appreciation of the [Pound] Sterling. Sales in Spanish airports reported growth in the period despite the poor performance of Madrid.

“EBITDA was lower than same period in 2013 mainly due to higher rents paid in the new contracts of the Rest of Europe (Spain and Germany) and for the dilutive contribution of the US Retail business [which command lower margins -Ed].”

|

|

Revenues in detail

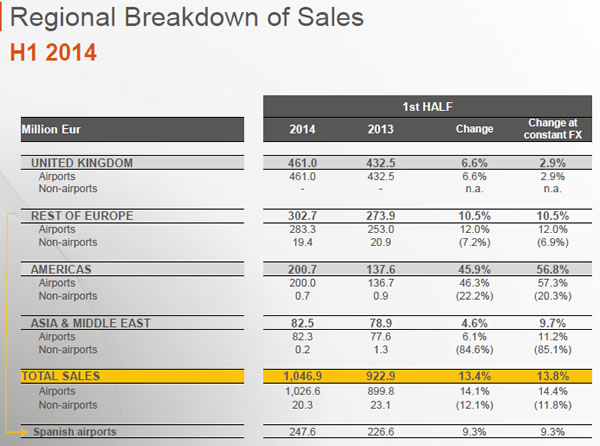

Revenues related to the airport channel amounted to €1,026.6 million or 98.1% of the total revenues generated in the first half of 2014. The group also supplies services in certain cultural institutions in Panama and Spain and logistics and wholesale services for different categories of customers, which combined amounts to 1.9% of WDFG’s total revenues, or €20.3 million.

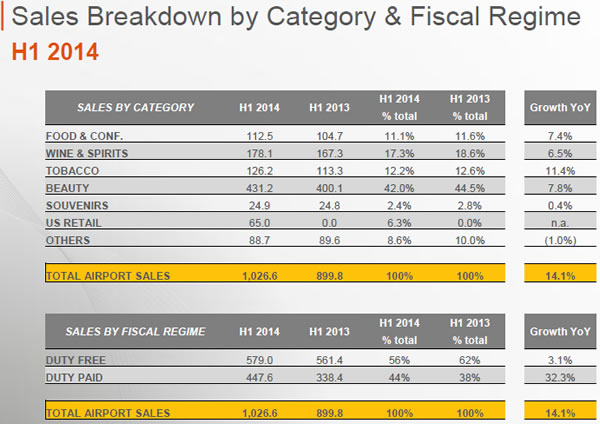

Category sales mix movements versus the first half of 2013 were impacted by the inclusion of the US Retail business, which has a different category profile (and lower margins). Excluding this effect, airport sales growth above the average was seen in the beauty, tobacco and food categories. This was supported by a strategy focusing on beauty excellence, noted the group. Beauty airport sales, at €431.2 million (+7.8% versus 2013), are 42.0% of the business. Wine & spirits sales grew in line with the average.

In the UK revenues reached €461.0 million, compared with €432.5 million in 2013, representing an increase of +6.6% versus the first half of 2013 despite the weak performance of Heathrow, offset by the other main airports. At constant exchange rates the growth was +2.9%.

Rest of Europe sales were €302.7 million, up +10.5% versus 2013. Of this, some €19.4 million in sales were from the Wholesale and Palacios y Museos businesses, which were down by -7.2% versus 2013.

Rest of Europe airport sales were €283.3 million, up +12.0% compared to H1 2013. This increase includes €8.0 million in sales from the new Helsinki business. A sales increase of €22.2 million was seen across Spain, Germany and Italy combined, +8.8% versus last year.

Spain airport sales (at €247.6 million) improved +9.2% while traffic increased by +4.2%.

|

|

Americas revenues amounted to €200.7 million, up +56.8% on constant exchange rates. The acquisition of the US Retail business in September 2013 contributed sales of €65.0 million. Americas sales growth at constant exchange rates (excluding US Retail) came to +7.5%.

Asia and Middle East revenues amounted to €82.5 million, up 9.7% on constant exchange rates.

Net profit

Net profit was €28.0 million, lower by €14.5 million on the €42.5 million recorded in the same period of 2013. This was mainly driven by lower Ebit and higher net financial expenses. Net profit attributable to controlling interest and to minorities was €25.3 million and €2.7 million, respectively, while the first half of 2013 saw €41.4 million and €1.1 million, respectively.

Capex was €35 million in the half, or 3.4% of sales, principally directed at the projects at Heathrow, Stansted and in Spain. This proportion should come down to 2% of sales by 2016, noted the company.

Q2 performance

Group revenues hit €608.5 million in the second quarter of 2014, up +15.9% at current exchange rates (+8.9% at constant exchange rates and excluding the contribution of US Retail) against the same quarter in 2013. Adverse Easter timing from Q1 fed into stronger Q2 sales.

Ebitda in the second quarter amounted to €71.0 million, up by +1.7% versus the same period in 2013. Excluding the US Retail Division, Ebitda would have remained flat compared to the second quarter of 2013. The Ebitda Margin of 11.7% decreased by -1.6pp from 13.3% in the second quarter 2013, mainly due to higher rents and operating costs along with the dilutive contribution of the US Retail business,

Net profit reached €25.6 million compared to €30.4 million in the same period of 2013. The profit attributable to owners of the parent company amounted to €24.0 million compared to €29.8 million in the second quarter of 2013.

|

The vital role of the UK in driving EBITDA is clear from the latest figures |

Outlook for the rest of 2014

The first 30 weeks of 2014 (ending 27 July) delivered a growth rate in airport sales of +14.7% (+13.4% at constant exchange rates) compared to the same period of the previous year. Excluding the contribution of the US Retail activity acquired in September 2013, revenues grew +7.2% (+6.1% at constant exchange rates) with all the regions recording positive growth rates at constant exchange rates.

The group expects to generate revenues for the 12 months of 2014 between €2,375 million and €2,425 million, thanks mainly to the full-year consolidation of the US Retail business acquired in September 2013 as well as to the contribution of the new operations in Helsinki and the expected overall growth across all the regions and the additions of new operations.

Cash Ebitda is expected to be between €284-294 million; this translates into Ebitda between €255-265 million, with margin on sales below the previous year, due to the dilution derived from the contribution of the US Retail business and higher rent levels (particularly in Spain).

UPDATE

Speaking to analysts on Friday afternoon, WDFG CEO José María Palencia highlighted some of the key events in the period.

|

“The transition to [Heathrow] T2, is having an impact; and there is the impact of weaker spend among Russians and Chinese, but we expect that [negative impact] to be short-term, and it does not reflect the overall pattern of the business.“ |

José Maria Palencia Chief Executive Officer World Duty Free Group |

In the UK, major new openings included four stores covering 2,100sq m at the new Heathrow T2, where “initial results are in line with forecast”. Most of the passenger traffic at the new terminal will be transferred across to T2 by October 2014.

In other developments, the company’s largest ever store – at 3,000sq m – opened on 18 July at London Stansted Airport (double the size of the previous space, including additional luxury space – part of a contract extension at the location), while a new outlet of 1,400sq m opened on 8 July at Glasgow Airport.

Commenting on the UK performance, Palencia said that Heathrow had performed below the level of traffic growth in the period, but he said some key factors had contributed. “There is the transition to T2, which is having an impact; there is the impact of weaker spend among Russians and Chinese, but we expect that to be short-term, and it does not reflect the overall pattern of the business.” He noted that Russians account for 4% of WDFG sales at Heathrow, while sales to Chinese are around 10% of the business. (By region, Middle East travellers deliver the highest spends per head at Heathrow to WDFG).

In Spain, outside Madrid (where sales are down by -11%, Palencia said) there have been some good performances, including double-digit growth at tourist destinations such as Palma de Mallorca; Malaga; Canary Islands and Alicante.

So far, just over 55% of space has been refurbished and opened at the Spanish airports under WDFG’s new contract. The latest openings are at Alicante, Barcelona, Gerona, Lanzarote, Madrid, Malaga, Menorca and Tenerife.

Crucially, noted Palencia, of the €28 million in added sales delivered by the Rest of Europe region (outside UK), two-thirds came from Spain. He also noted the beginning of a domestic recovery in Spain, with traffic increases encouraging – making it more likely that Spanish customers would return to the market after being “out of the game” for a lengthy period.

“In Spain we are seeing month after month of traffic increases, and we are in turn growing ahead of traffic today,” said Palencia.

Elsewhere, the company’s Düsseldorf refurbishment is to be completed in August while its Helsinki operation will fully open in early 2015.

In the Americas, the company gained exclusivity for liquor & tobacco sales at its Jamaica airport operations in April, which has pushed sales up by +73% to date, it noted. As reported the company also opened a new concept store in partnership with Estée Lauder in June at Detroit.

Palencia hailed the new concept store, saying its partnership with “a beauty powerhouse in the US” could be a lever for growth in the US and could help it accelerate its business in North America. He said the concept could be a model to showcase brand partnerships, that it helped to individualise and bring out brands’ identity at travel locations and that WDFG would aim to negotiate further such agreements in the future.

Speaking more broadly about the US business, the company said it aimed to target duty free concessions at larger airports and work in higher margin categories such as beauty and spirits – compared to the lower margin convenience and speciality business that it owns today. “This is what we do in Europe, this is what airports expect from us, and this is what we plan to do in the US.”

In Jordan the business is delivering double-digit sales growth versus 2013 at the new airport, while in Chile WDFG is trying to offset the impact of weak local currency, lower Argentine spending and a phase of investment in the stores.

Adding detail to the performance above, WDFG noted that sales in H1 were 56% duty free and 44% duty paid.

Within the categories, beauty continues to dominate at 42% of sales, liquor 17.3%, tobacco was 12.2% and food & confectionery 11.1%.

Palencia said he was “really pleased with our sales performance”. He said that traffic in certain key locations, notably Spain, had been improving so far this year, and continues to gain momentum. But he also noted that weaknesses in currency (especially versus Sterling) has affected spending among for example, Russians, Argentinians and Brazilians.

Looking ahead, Palencia said that growth in full-year sales (see guidance above) would be driven by the consolidation of the US retail business, the performance of new operations at Düsseldorf and Helsinki, plus the recovery of the Spanish airport business.