|

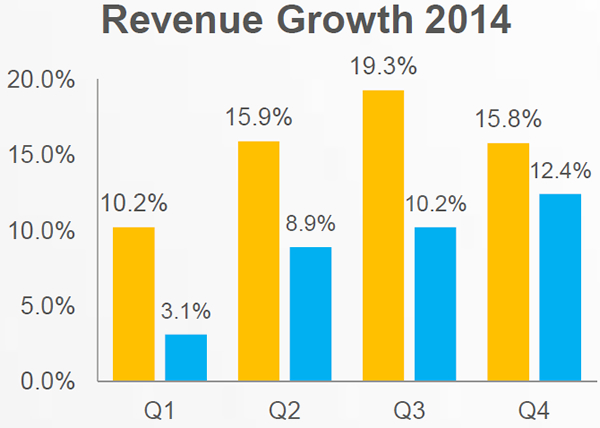

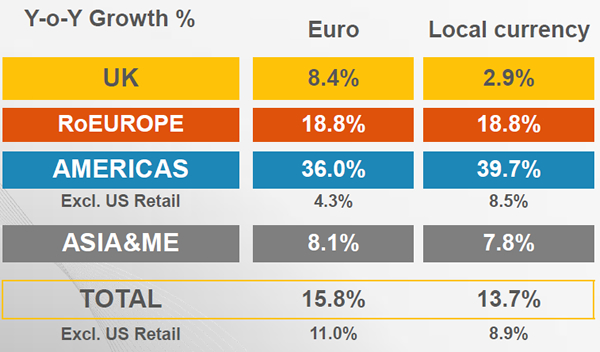

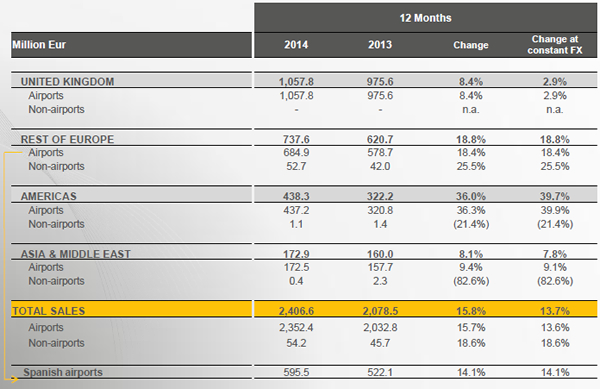

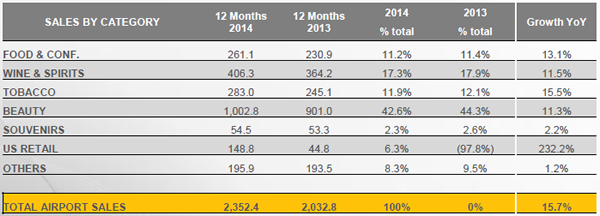

INTERNATIONAL. World Duty Free Group (WDFG) revenues climbed by +15.8% year-on-year to hit €2,406.6 million in 2014 (+13.7% at constant exchange rates).

The performance was buoyed by sales across all regions, together with the contribution of the US Retail business. These included new operations at Düsseldorf and Helsinki, the opening of new stores in London Heathrow Terminal 2 and Belem in Brazil and later in the year in Spain (Tenerife South) plus Saudi Arabia (Riyadh and Dammam). These helped drive a sixth consecutive quarter of growth to year-end.

Revenues contributed by US Retail were €148.9 million; excluding this contribution, revenues would have grown +11.0% (+8.9% at constant exchange rates). Against, this, net profits fell sharply from a year ago (see below).

|

“Revenues in Euro terms were positively impact by the strength of the Pound Sterling, but on the other hand it made our UK business tougher to trade.“ |

Eugenio Andrades CEO WDF Group |

CEO Eugenio Andrades said (in a conference call with investors this afternoon): “We are pleased with the results for 2014, which are very much in line expectations and with our three-year budget. Revenues in Euro terms were positively impact by the strength of the Pound Sterling, but on the other hand it made our UK business tougher to trade.”

The results announcement comes against the backdrop of strong investor interest and intense market speculation of an imminent trade alliance, merger or takeover deal for WDFG. WDFG management would not comment on speculation of a deal in their call with investors today.

Revenue by region

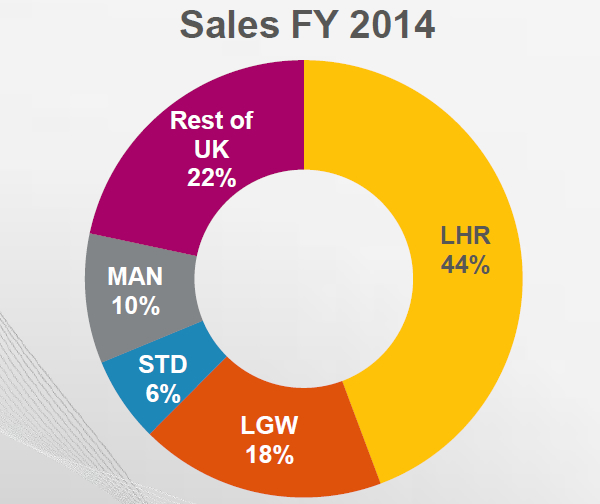

In the UK revenue reached €1,057.8 million, compared with €975.6 million in the full year of 2013, representing an increase of +8.4%. Strong Sterling rates supported this and at constant exchange rates the growth was +2.9%. UK passenger growth of +4.9% and spend per passenger increases countered weak spend performance that resulted from a loss of value perception to international travellers due to the exchange rate effect, noted WDFG.

Andrades said that the UK business was aided by strong store investment and passenger traffic, but noted the negative impact of the Pound Sterling’s strength, notably at Heathrow.

“Heathrow has been the most difficult airport to trade at in in the UK, with sales down by -2.4% versus last year, below our initial expectations (traffic rose by +1.4%). Heathrow was affected by external factors including currency movements, political challenges globally (notably in Russia) and airport reorganisations and developments (T2 opening, T5 investment).

“Russian passengers, who account for 3% of the sales at Heathrow, were impacted by these trends. Total sales to Russian passengers fell by -17.5% and their spend fell by -9%.

“Chinese passengers account for 7% of sales at Heathrow, and their spend was down by -6%.

“For the Euro nationalities, the Pound’s strength also made the value perception of Heathrow less attractive.

“The combination of reduced spend among Chinese, Russians and the strength of the Pound made our sales negative at this airport.”

However, he added that the other UK airports (56% of the UK business) had performed strongly, with Stansted benefiting from its new walk-through store in particular.

Andrades added that following extensions to key concessions, the contract portfolio in the UK now runs to an average 11.5 years.

Rest of Europe sales were €737.6 million, +18.8% higher versus 2013. Of this, some €52.7 million sales were from Wholesale and “˜Palacios y Museos’ businesses, +25.5% versus 2013. This latter business was disposed of on 30 September 2014.

Rest of Europe Airport sales were €684.9 million, up +18.4% compared to 2013. This increase includes €27.7 million of sales or +4.8% from the new Helsinki business.

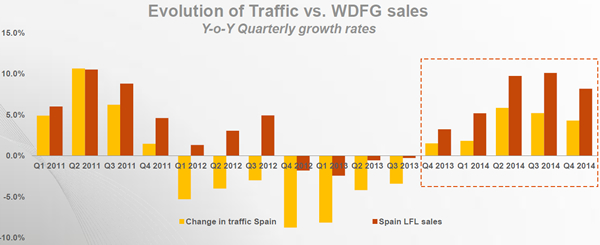

A sales increase of €78.6 million, or +13.6%, was delivered across Spain, Germany and Italy combined. In Spain airport sales at €595.5 million improved by a robust +14.1%. The growth was despite the collateral disruption caused by refurbishment works being carried out in Spanish airports.

|

WDFG’s quarter by quarter revenue performance in 2014 |

Traffic increased by +4.6%, with new developments supporting spend gains of +9.5% versus 2013 to which the opening of the new main Tenerife Sur store has significantly contributed, added the company.

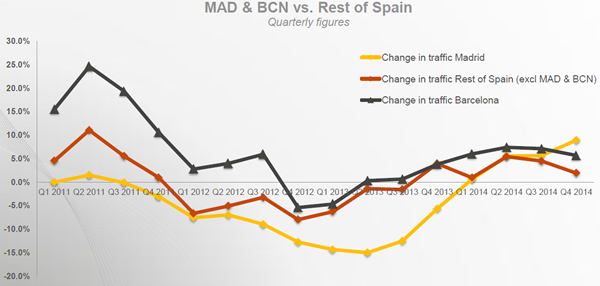

Andrades told investors that the programme of store refurbishment is now around 60% complete in Spain. He noted that the best performances in the Spanish network came at tourist location such as Tenerife South, Mallorca, Malaga, Alicante and Palma.

Madrid and Barcelona were hit by slower passenger growth but also “by the Russian profile”, he added. Madrid full-year sales dipped though Andrades noted that they recovered strongly in the final quarter and spends were now at 2013 levels again. At Barcelona, Q4 sales climbed by +9.1%, with weak Russian spend being compensated partly by growth in UK visitor spend.

Other airports in Europe outside Spain posted sales growth of €32.8 million (+58%), driven mainly by Helsinki’s opening last March, which added sales of €27.7 million in the year.

|

Revenue in the Americas amounted to €438.3 million, up +39.7% at constant exchange rates. The US Retail business had sales of €148.9 million in 2014, versus €44.8 million for the September-December 2013 period. America’s sales growth at constant exchange rates excluding US Retail came to +8.5%.

Vancouver sales climbed by +19.4% from a development to improve the beauty and luxury proposition.

|

UK performance by airport by airport |

|

Asia and Middle East revenue amounted to €172.9 million, up +7.9% on constant exchange rates. This growth has been driven mainly by Jordan (where a new walk-through opened in Q4 2013), with sales of €83.0 million up +14.3% at constant exchange rates.

Adjusted Ebitda was €289.7 million, improving +5.2% from last year. 2014 adjusted Ebitda margin was 12.0% of revenue compared to 13.2% in 2013. The US Retail business diluted gross margins by -0.6 percentage points over 12 months of sales in 2014, against a dilution of -0.3 percentage points in 2013 over three months.

Excluding the US Retail business, 2014 adjusted Ebitda margin was therefore 12.6% against 13.5% reported in 2013, a decline of -0.9 percent points.

|

Spain has recovered but Madrid and Barcelona continued to struggle in 2014, not least due to the downturn in Russian arrivals and spend |

|

Adjusted EBITDA on sales was reduced mainly due to the increase in rents, particularly in Spain, and the consolidation of new countries with a sales mix that involves a structurally lower gross margin, said the group.

In 2014, net profit was €41.5 million, lower by €69.3 million compared to €110.8 million recorded in 2013, mainly driven due to higher provisions for risks and restructuring charges, the linearisation of concession fees as well as higher borrowing costs and higher income tax. Net profit attributable to owners of the parent and to non-controlling interests was €34.9 million and €6.6 million, respectively, while 2013 saw these figures hit €105.8 million and €5.0 million, respectively.

Enhanced concession portfolio

The company said that enlarging and extending its concession portfolio has been a priority in 2014.

It noted: “The six years and six months extension of the retail agreements to operate at London Heathrow airport – that accounted for 44.3% of the group´s total revenue in the UK in 2014 and 19.5% of the total global sales of World Duty Free Group for that year – was a major milestone for the company in 2014. Other contract extensions over the period include a five-year contract extension to operate in Kuwait City Airport and a number of other small retail contracts. With these contract extensions, the average portfolio length of WDFG is nearly nine years, one of the longest in the travel industry.”

In terms of new concessions, the group secured three new operations. These include a six-store retail package of Los Angeles International Airport Terminal 6; a new beauty store at San Francisco Airport T3; and a 13-year agreement to operate the Eurotunnel Charles Dickens Terminal store from Q1 2015. This is a 790sq m duty paid unit on the French side of the Channel Tunnel.

The group also completed the acquisition of Finnair’s travel retail operations at Helsinki Airport, as reported.

|

Sales by region broken down for 2014 |

|

How the performance by category broke down last year |

Major store upgrades

The main retail refurbishments have taken place in the UK, with new walkthrough stores at London Stansted and Glasgow airports; Spain, at Malaga and Barcelona, and in Chile, Jamaica and Mexico. It also highlighted the introduction of new concepts, including the opening of the first Estée Lauder specialist store at Detroit Airport in the US.

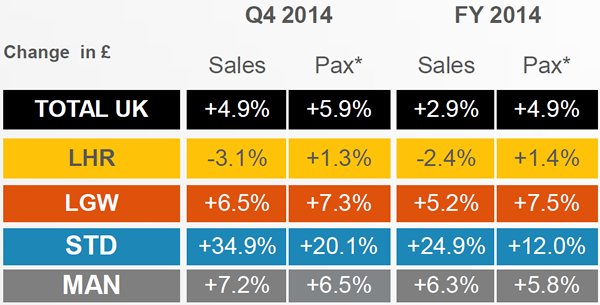

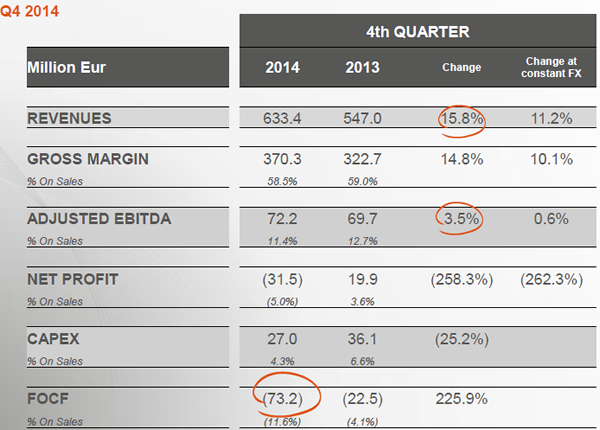

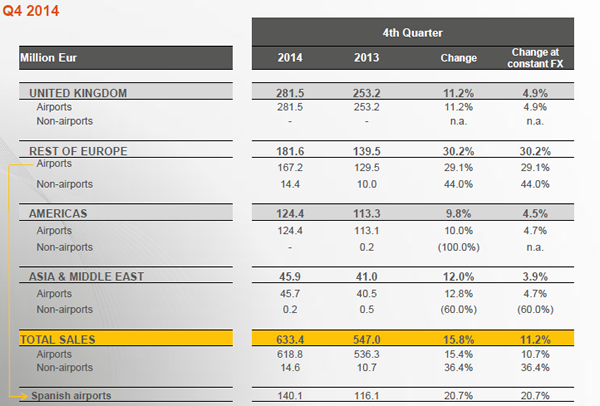

Q4 performance

Group revenue hit €633.4 million in the fourth quarter of 2014, up by +15.8% at current exchange rates, and +11.2% at constant exchange rates.

Revenue at UK airports reached €281.5 million, up +4.9% at constant exchange rates (+11.2% at current exchange rates) compared to the fourth quarter of 2013, driven by traffic (up +5.9% across listed airports) with spend per passenger lower by -1.0%.

Rest of Europe sales were €181.6 million, up +30.2% compared to the fourth quarter of 2013. Airport sales of €167.2 million were +29.1% higher year-on-year. The new Helsinki business delivered €10.9 million, with Dusseldorf adding €2.3 million on completion of its refurbishment.

Spanish airports sales of €140.1 million improved by +20.7%. This was supported by a +4.3% passenger increase, alongside +16.4% average spend increases. A €11.1 million sales gain was delivered through the new Tenerife Sur main store.

Americas revenue amounted to €124.4 million, up +4.5% at constant exchange rates compared to the same period in 2013.

In Asia and the Middle East, sales were €45.9 million in Q4, up +4.1% at constant exchange rates.

|

WDFG’s Q4 2014 results (above and below) |

|

Adjusted EBITDA

Adjusted Ebitda in the fourth quarter of 2014 amounted to €72.2 million, an increase of +3.5% versus the same period of 2013. Excluding the US Retail Division, it would have remained basically flat compared to the fourth quarter of 2013. The Adjusted Ebitda margin was 11.4% compared to 12.7% in the fourth quarter of 2013.

Adjusted rents worsened by -1.6 percent points in Q4, noted the retailer. There was an increase in Heathrow rents from October 2014 through the newly signed contract extension. WDFG’s Spain sales did not reached the expected levels, and therefore activated the minimum airport guarantees on this concession.

WDFG posted a net loss of €31.5 million compared to net profit of €19.9 million in Q4, compared to the same period in 2013.

|

Another view of where revenue growth came from in 2014 |

Outlook for 2015

On 15 January, the board of directors of WDF S.p.A. approved a three-year budget for the years 2015 to 2017, as reported previously.

The objective, said WDFG, is “to focus activity towards maximising the value of the portfolio of existing concessions, the completion of the integration process, improving the profitability of the Spanish business and expanding the US business”.

Actions towards completing the integration process include a single IT platform, a single supply chain and logistics model and the simplification of the corporate structure and central functions at the UK and Spain offices. The UK will become the corporate centre and headquarters of the group.

For 2015 the forecast is for consolidated revenues in the range of €2,630 million to €2,670 million, with Adjusted EBITDA between €279 million and €294 million.

The first eight weeks of 2015 (ending 22 February) delivered a growth rate in airport sales of +19.5% (+8.6% at constant exchange rates) compared to the same period of the previous year. Growth was concentrated mainly in the Rest of Europe region and especially in Spain, which posted an increase of +22.5% against the same period in 2014.

Crucially, Heathrow sales continued to fall (-7% in early year trading) though other UK operations delivered growth. Sales in the UK grew overall in the eight weeks by +2.7% in Sterling terms, and +12.3% in Euros.

|

World Duty Free Group’s UK operations continue to drive growth (Heathrow T2 pictured), though the strong Pound Sterling had a mixed impact, positive for UK travellers and negative for overseas visitors |

|

|