ASIA PACIFIC. Pi Insight has released findings from a research study into beauty shopper motivations and influences in the Asian duty free arrivals channel. It is the second in a series of studies that will be published through The Moodie Davitt Report, with the first on the liquor category released recently.

As reported, the research agency has conducted over 5,200 15-minute quantitative interviews with recent Asian arrivals shoppers (including 1,000 among beauty shoppers). This was supported by qualitative interviews to provide a detailed understanding of the channel across the beauty, liquor, confectionery and tobacco categories.

Pi Insight’s findings for the dynamic beauty category profiled the Asian arrivals shopper, of whom 68% are female with more than half aged over 35. It also found that 69% of these beauty buyers travelled regularly for leisure and that one quarter took four or more flights per year.

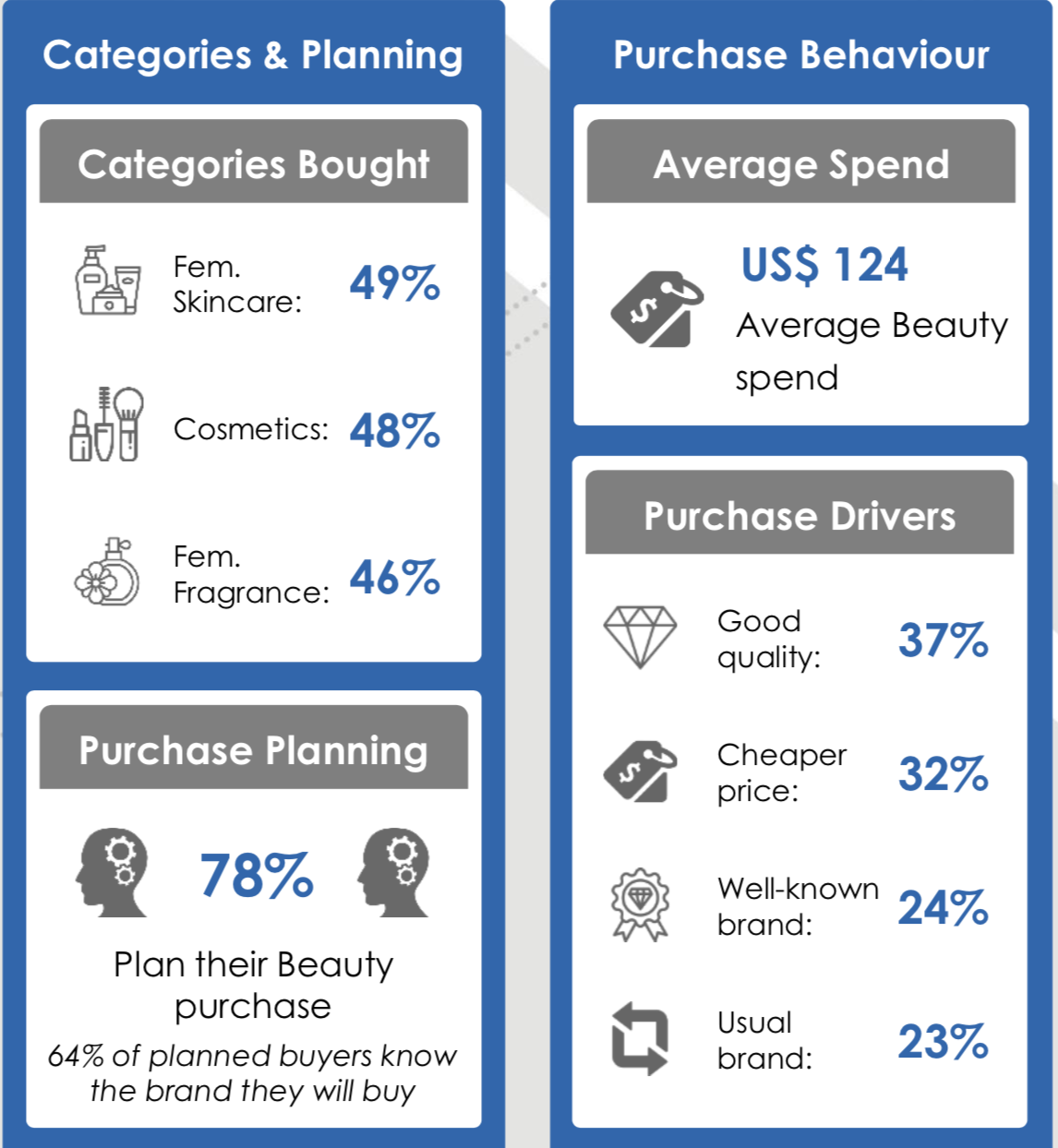

It found that female skincare, which featured in 49% of purchases, is the most popular sub-category within beauty, followed closely by cosmetics at 48% and female fragrance at 46%.

According to Pi Insight, there is a high level of cross-beauty buying, which indicates that there is potential to further drive multiple item and cross-category purchasing within the channel.

Of the four categories researched by Pi Insight, the beauty category has the highest average spend per customer at US$124. This can be partially attributed to high purchase planning within beauty customers.

78% of beauty buyers in the Asian duty free arrivals channel planned their purchases ahead, while only 22% of beauty buyers bought impulsively. Of the 78%, 64% already knew the brand they would be buying. These findings suggest that in-store influence has less of an impact than communicating with shoppers ahead of their visit.

Unsurprisingly, quality and value are the leading factors that drive beauty category purchases for arrivals shoppers. The study indicates that 37% of beauty buyers’ purchases were driven by quality; while 32% were driven by price. Pi Insight also stated that there is a growing trend towards affordable luxury within the channel. It also highlighted the importance of clearly communicating brand USPs and supporting this with a clear value proposition.

Self-purchase was found to be the leading purchase occasion for arrival shoppers. It found that 68% of beauty buyers purchased for themselves, 24% purchased for a gift/request, and only 8% purchased to share. This shows that while gifting plays a role, in-store promotions should be focused on communicating messages of ‘self-care’ and ‘self-treating’ to attract more self-purchasing arrivals shoppers.

Pi Insight concluded its report by stressing the need to meet the immediate in-store expectations of the Asian duty free arrivals customer. Some of the most important strategies include highlighting popular international brands, communicating with shoppers ahead of their trip, exploring the ‘affordable luxury’ trend, communicating the offer’s quality and value proposition, and streamlining in-store communication on self-purchase buyers.