CHINA. A new survey by travel analyst Dragon Trail conducted in November for its latest Chinese Traveler Sentiment Report shows a significant rise in the number of people who are now eager to travel overseas. As the prospect of Chinese travel restrictions being lifted moves closer, the figure has risen from 20% recorded in September 2021 to 42% this time.

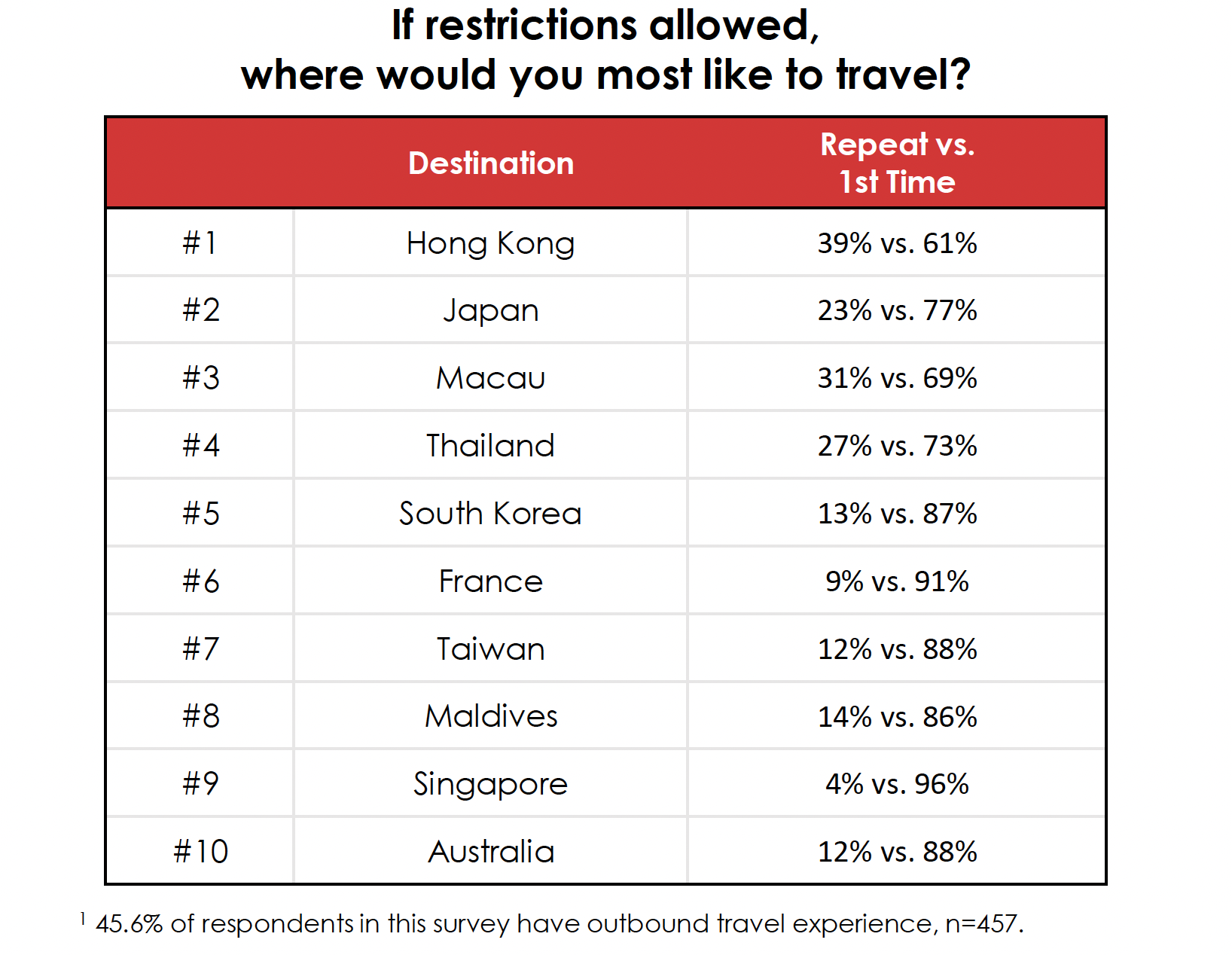

The survey – which last month canvassed the opinion of more than 1,000 mainland Chinese travellers – also revealed that the Special Administrative Regions of Hong Kong and Macau, as well as overseas destinations Japan, Thailand and South Korea are at the top of Chinese travellers’ wish lists for when leisure travel opportunities open up. France tops the list of non-Asia Pacific destinations.

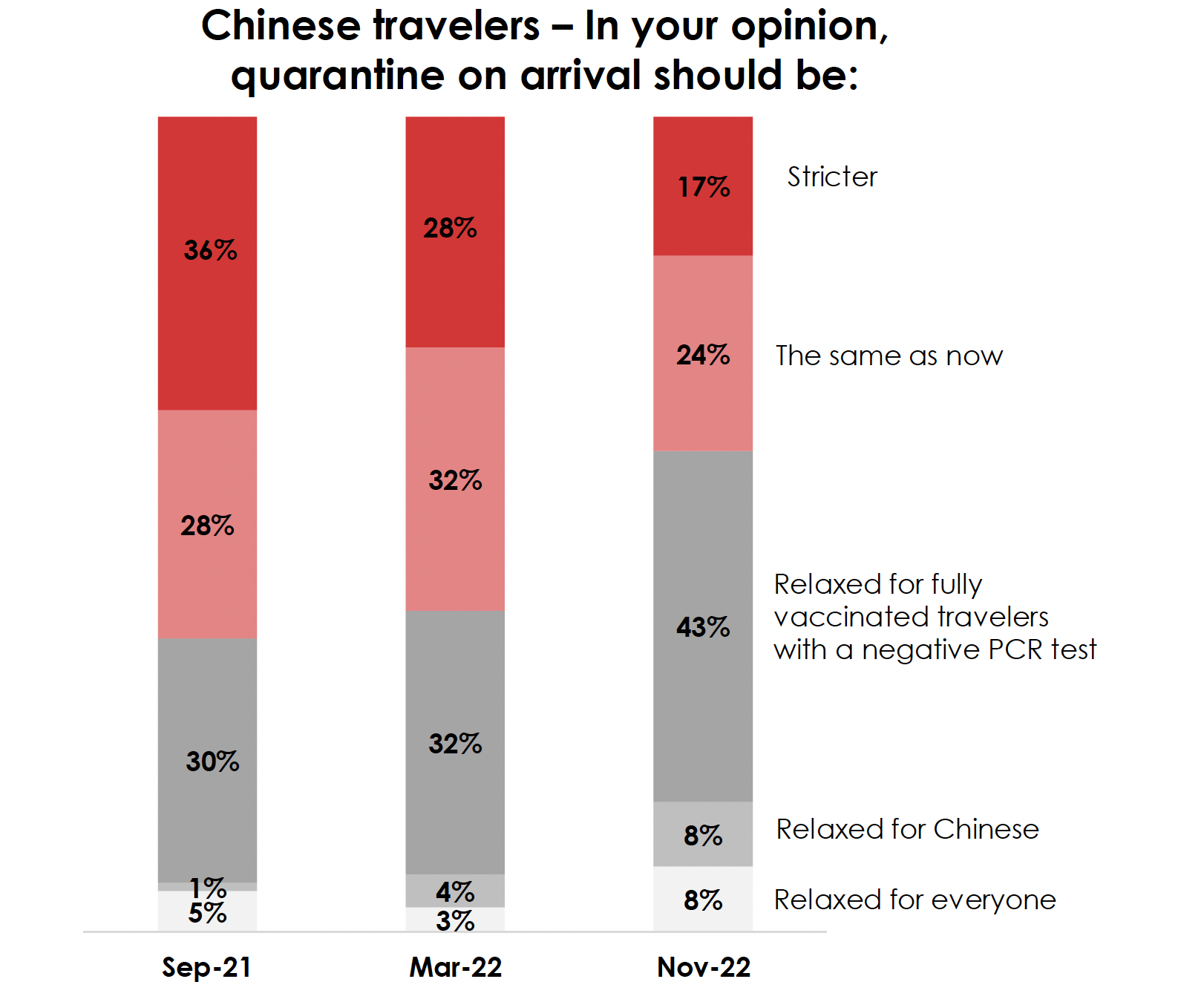

The report reveals that popular opinion about quarantine-on-arrival has changed dramatically since last year, with nearly 60% now saying it should be relaxed (see table below). This is an increase of 20 percentage points from Dragon Trail’s Spring 2022 Chinese traveller sentiment survey.

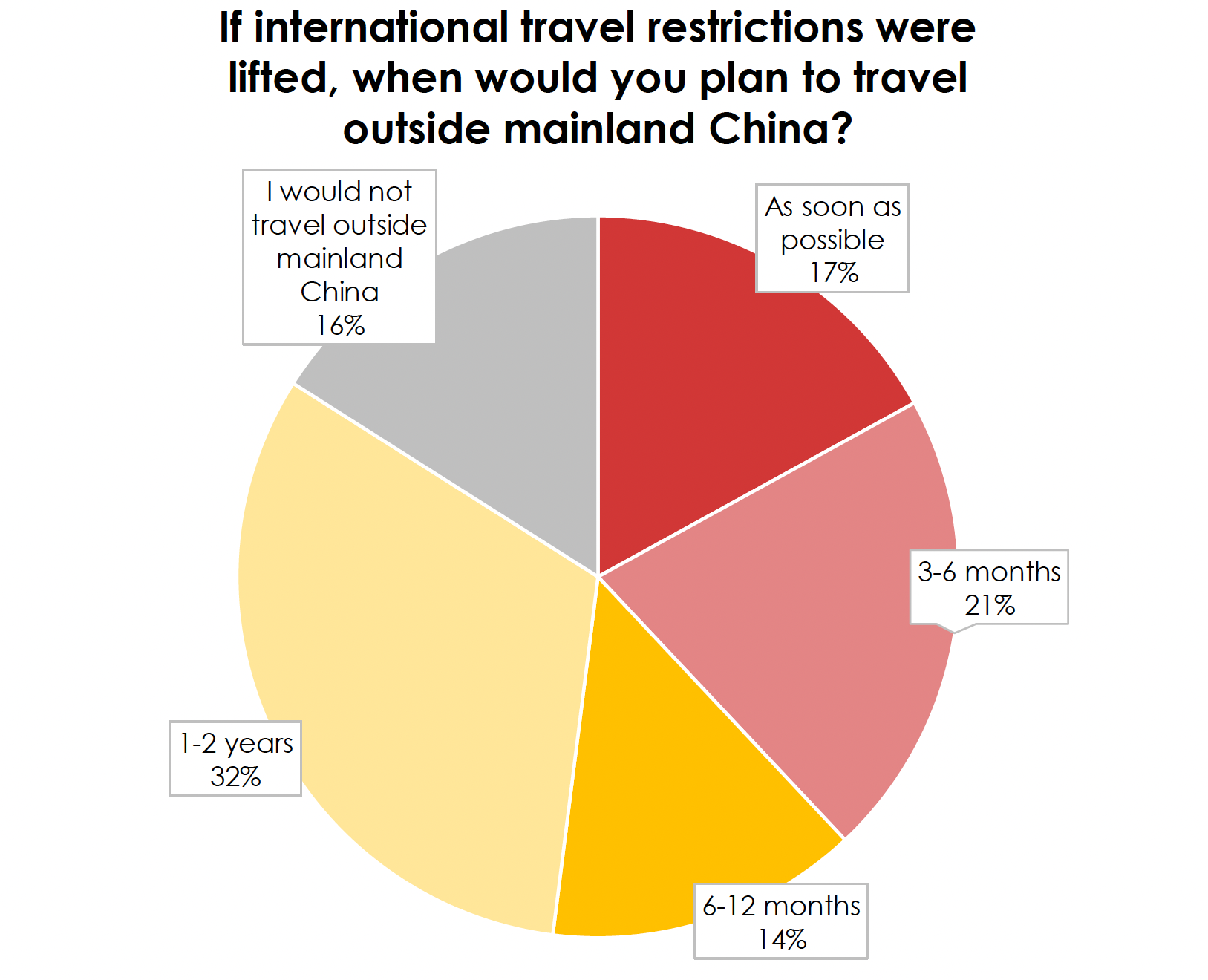

Some 17% of survey respondents say they will travel outside the Chinese Mainland as soon as possible when restrictions are released, with the number rising to 52% for the first 12 months after this occurs. “Pent-up demand is real, and growing, and the travel industry should get ready,” the report said.

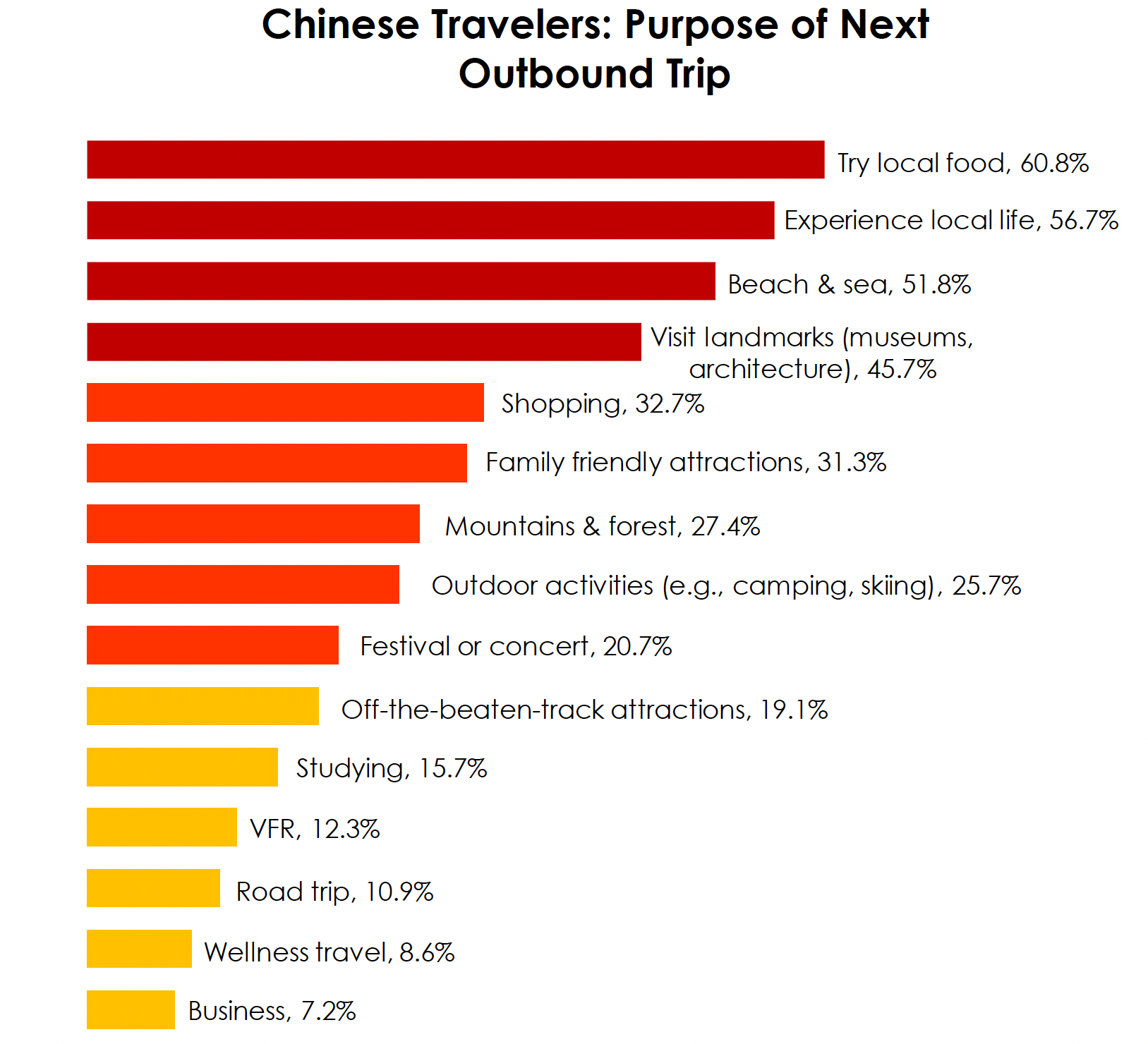

Asked for the purposes of their next outbound trip, trying local food (60.8%) and experiencing local life (56.7%) are the most appealing factors to survey respondents (see table below). The equivalent figure for shopping was 32.7%.

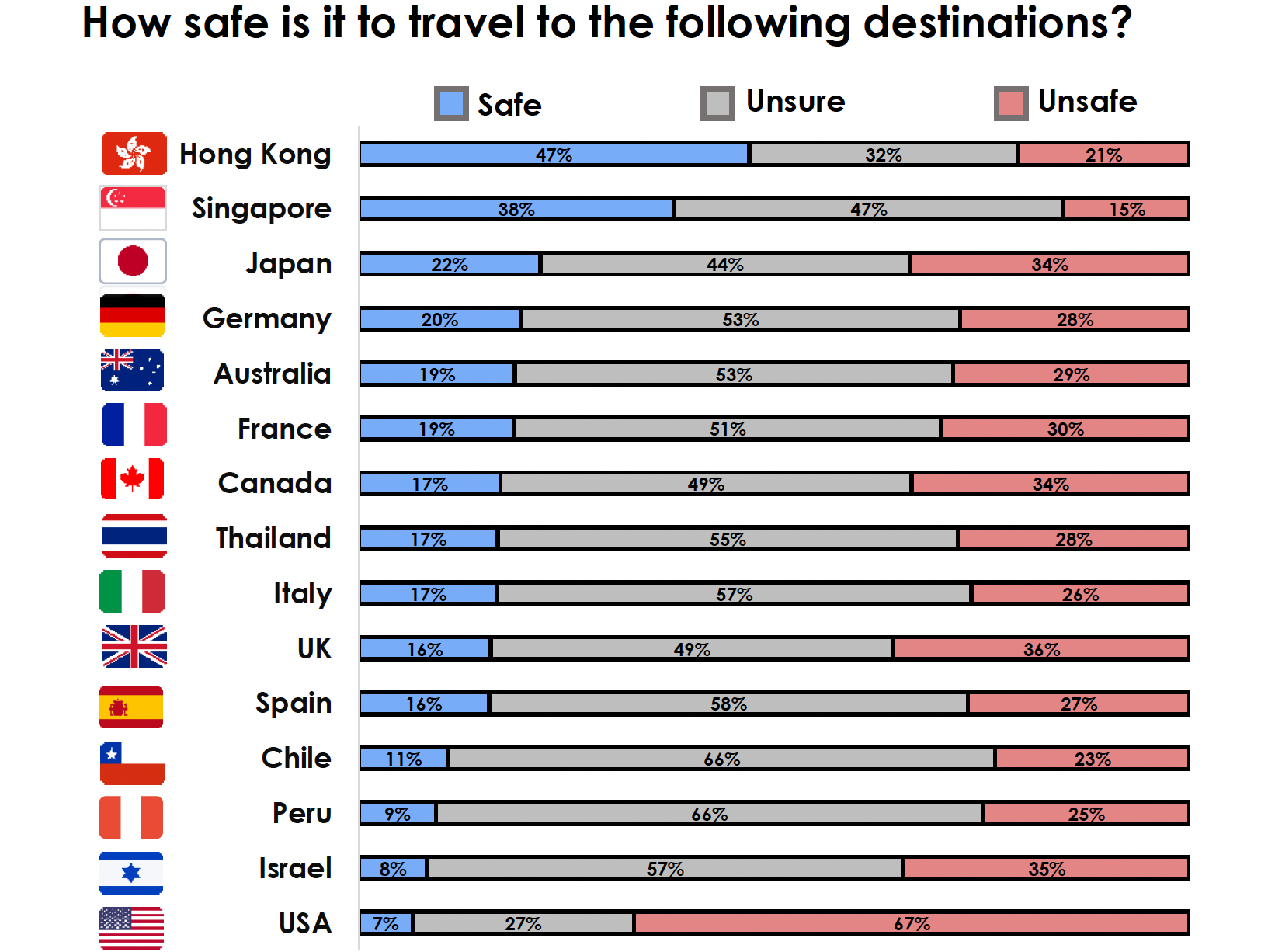

When assessing 15 outbound destinations around the world (see table below), the survey shows that Chinese travellers are now less likely to categorise these destinations as ‘unsafe’.

However, uncertainty as to whether each destination is safe or unsafe grew across the board. This means destinations need to do more marketing, education, and publicity to improve knowledge and public opinion of their safety, the report recommended.