Introduction: The Moodie Davitt Report was on location for the Thélios seasonal eyewear showcase in Rome on 24 May. The event, which welcomed retailers from all over the world, was hosted at the magnificent Palazzo Brancaccio in the heart of the city.

It was a suitably grand setting for Thelios, founded in 2017 by world luxury leader LVMH in a partnership with eyewear manufacturer Marcolin (since bought out). Thélios designs, produces and distributes sunglasses and optical frames for some of the luxury powerhouse’s most prestigious Maisons, including Dior, Fendi, Celine, Givenchy, Loewe, Stella McCartney, Kenzo and Fred.

At the Rome event, Thélios teamed up with Vogue Business to host a panel discussion called ‘Framing Luxury Eyewear’. The panel discussed how luxury has the power to elevate the eyewear category and outlined the biggest trends shaping the sector today (stay tuned for an in-depth on location report on the discussion soon).

The Moodie Davitt Report Brands Director Hannah Tan-Gillies caught up with Thélios Chief Brand and Product Officer Sara Osculati and Head of Travel Retail Alessandro Eucaliptus to discuss Thélios’ ambitions in travel retail, its selective approach to growth, and how it can leverage LVMH’s luxury expertise to elevate the sunglasses category.

Thélios may be a fledgling player in the burgeoning global eyewear category but the star-studded power of its brand portfolio and the heavyweight backing of luxury goods giant LVMH, mean it is an equally formidable one.

Thélios, launched in 2017, had earmarked travel retail as a key growth and visibility channel. But crisis, in the almost definitive form of the global pandemic, struck and the company’s heady ambitions had to be put on hold.

Assessing the brand’s current position, Head of Travel Retail Alessandro Eucaliptus remarks: “2023 is the year we’re going big in travel retail,” he says. “We’re pushing in Asia Pacific where we’re forming a new local team. In 2022, we’ve enjoyed very good results in Europe, where COVID eased earlier than Asia. Now, Asia Pacific is our geographical focus for the next two years.”

Nowhere in Asia has shone more brightly throughout the pandemic than the offshore duty free market in Hainan and according to Eucaliptus, the island offers plenty more promise for Thélios.

“Hainan is one of the shining lights of travel retail. It is a very interesting destination with lots of luxury brands investing there,” he says.

“In Hainan, you can see the best of the best in terms of retail investment and what brands can show in-store. Hainan is one of our key priorities with Haikou and Haitang Bay being two of our key locations.”

A total luxury immersion

Thélios hosts a product convention three times yearly to immerse buyers and retailers into the rich worlds of its glittering luxury brand portfolio.

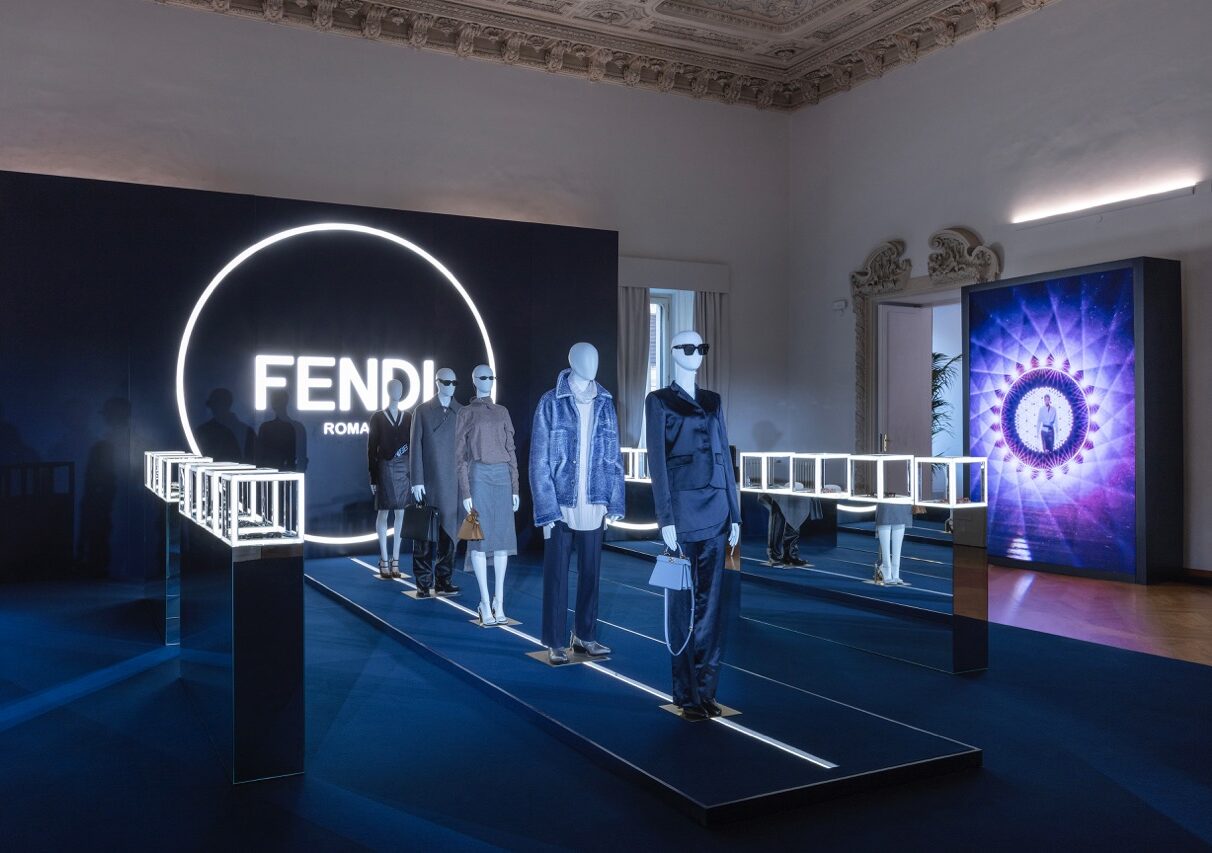

The Rome showcase shone the light on Fendi, Dior, Givenchy, Loewe, Kenzo, Stella McCartney, Fred and Céline with each brand brought to life through immersive branded zones.

From colour palette, product design, merchandising and visuals, the respective areas offered a clear reflection of the distinctive luxury brand codes of each house.

“This is what I mean when we say we want our clients to be really immersed in the brand experience,” Thélios Chief Brand and Product Officer Sara Osculati explains.

“For example, we have different pop-ups activations and windows in-store. We’re always looking at excellence of quality and ideas because that is what differentiates us.

“We’re committed to ensuring that every single piece of eyewear or optical frame brings the brand equity to life. We will never be a company that just stamps our logo on different frames. We want our consumers to immediately understand that this is a Thélios product, no matter what environment it is in.”

Highlights from the convention included Givenchy’s 3D printed sunglasses, which are not just 3D printed in the sampling stage, but also during the production phase. The sunglasses were debuted during the Givenchy runway show in ‘See Now, Buy Now’ format, which means they were immediately available for purchase afterwards.

Fendi showcased its latest menswear and womenswear eyewear pieces from the brand’s latest ready-to-wear collection. The Fendi brand zone mimicked that of a runway, while models dressed in Fendi’s latest collection wore a number of eyewear model. Dior brought its fall collection to life via a colourful Egyptian-inspired tent filled with rich tapestries and fabrics.

The Givenchy sunglasses are a key example of Thélios’ innovation strategy. “Innovation is one of our key pillars,” Osculati explains. “Research and innovation is essential in any product strategy as it allows a fluid dialogue between technical and design. Givenchy is a good example because we were able to use 3D printing for commercial production. We’re trying to innovate in other activities too and are experimenting with Virtual Try On, filters and 3D rendering.”

Commenting on how Thélios’ approach differs across the brands in its portfolio, Eucaliptus says: “For Loewe, we are testing the brand and convincing retailers to believe in this brand which has a strong cult following.

“Loewe is available in Asia Pacific travel retail and will launch in the top fashion-forward client in travel retail in EMEA Region.

“Dior is our biggest brand in Asia Pacific travel retail,” he adds. “In 2025, 25% of the world’s luxury business will come from China and Chinese consumers really love Dior. Our clients are asking us to be more engaged in presenting Dior and our other brands differently. So, we’re looking to enhance the travel retail shopping experience by adding furniture and other key brand elements that consumers want to see.”

Thanks to the power of its portfolio, Thélios can offer everything from travel retail-exclusives to cross-category brand collaborations. “Thélios has vertical integration across the board, which means there is a lot of synergy with our business and the fashion houses,” Osculati explains.

“In travel retail, we’re trying to work on cross merchandising with our brands in some of the most important locations. There are a lot of opportunities to explore thanks to our powerful portfolio.”

Selective Distribution

As it intensifies its travel retail focus, Thélios is simultaneously doubling down on its selective distribution approach, Eucaliptus explains.

“We want to grow and have very big ambitions in travel retail. However, we don’t want to be everywhere. Instead we want to be perfectly expressed in the right locations,” he says.

“One of the most important pillars for Thélios is selective distribution. This is a very worldwide approach and travel retail is part of this logic. Across all our doors we insist that we need to have the space to express the brand fully.

“We are looking at expanding in hub airports that can catch the right consumers,” he adds. “Doha is a great example because LVMH recently unveiled the first Louis Vuitton café there. We are strongly investing in Asia Pacific, especially in Hainan, Hong Kong, Macau and Bangkok, which is an important hub in Southeast Asia. In Europe, we’re going to have better visibility in main locations like Heathrow. Our job is to spectacularise the sunglasses shopping experience in travel retail.”

Osculati echoes the sentiment. “It’s not about the number of stores,” she adds. “Our mission has been very clear from the beginning. It is all about consistency between excellence of the product, vertically integrated production, luxury messaging, communication and strategy. We have criteria to follow when selecting locations to open new stores and retailers to partner with. We believe in creating partnerships where our partners know how to play the game and understand what we need.”

Maintaining luxury codes

Digitalisation is an increasingly important topic in the retail world, but Thélios takes a specific approach to embracing digital. “These days, everybody is talking about digital,” Eucaliptus explains. “ Our point of view is that we need to know what we want from digital before we invest in it. What I’ve realised is that going fully digital sometimes takes something away in terms of brand value.

“Thélios wants to stay true to the elements and codes of the maison, which is why we’re pushing our customised furniture and prime materials in our stores. Having complementary digital elements is important – but without sacrificing the power of the brands. Digital is great, but not when it means adopting a generic approach across all brands.”

Osculati says digital is just one part of the luxury equation. “It’s all about consistency, long-term ambition, respecting and understanding brand equity and conveying all that through the visibility of the brand,” she comments.

“There are formulas you can apply like the right product mix, window displays, visual merchandising story telling and digital experiences – but when it really comes down to it, it’s all about expressing brand equity in a luxurious way.”

Blockbuster animations have become part and parcel of the travel retail landscape and according to Eucaliptus, Thélios is adopting a highly selective approach to animations as well. “We have a big high-profile animation area in Hainan which was designed to be impactful without pushing or promoting our products in a mass-market way.

“We want to maintain our luxury statement and engage the consumer differently. We believe that we are the best-in-class in luxury and so we have to deliver luxury elements and messaging consistently. Otherwise, our luxury messaging might get muddled in the delivery. Thélios is committed to maintaining a luxury approach no matter what, or we risk going back to how it was in the past – where sunglasses were not given much attention.”

Better, not bigger

Sunglasses ranks among travel retail’s highest ROI categories yet is often afforded the least space, the brand notes. Thélios, as a luxury leader, is ideally positioned to change that old world approach through excellent brands, merchandising and strong partnerships, it believes.

“Sunglasses is one of the fastest-growing categories in travel retail but we remain with very old logic in terms of space,” Eucaliptus explains. “We need to convey a luxury message to consumer, and this will eventually lead to conversion and long-term brand loyalty. This is what we’re trying to do in terms of investment. We want to change the way that retailers view the category.

“Our partners and colleagues keep talking about bigger and bigger spaces, but what we really need are not just bigger spaces but more qualitative spaces. We need bigger and better spaces otherwise you risk not catching the right consumers.”

Osculati adds: “The sunglasses category is present in many different channels, but in travel retail specifically, it has fallen behind other categories in terms of brand expression. If we look at how travel retail expresses perfumes & cosmetics brands, there is a big gap.

“Our dream is to build partnerships with operators in a way where we are able to express our brands fully – which we believe will offer something special to the final customers because it sells the luxury dream.”

“We are trying, testing, learning and listening, talking with consumers and retailers who believe that they have to invest in luxury with us,” Eucaliptus adds. “The win/win approach is the best approach to long-lasting mutually beneficial partnerships and travel retail is a great channel for that.”

Offering a final message to the industry, he says: “We want to elevate the category. We believe that through good partnerships and dialogue that we can change the approach to sunglasses and drive consumers to more luxury experiences. Our ambition is to create something new and get rid of the old logic of ‘sunglasses corners’ in travel retail.” ✈