UAE. Sometimes you need to delve beneath the headline-grabbing numbers to discover the most intriguing aspects of a story, writes Martin Moodie.

UAE. Sometimes you need to delve beneath the headline-grabbing numbers to discover the most intriguing aspects of a story, writes Martin Moodie.

And headline-grabbing numbers were certainly in abundant supply as Dubai Duty Free (DDF) revealed this week that its November sales – AED876.56 million (US$240.16 million), a +16.77% spike year-on-year – represented the highest monthly revenues in the retailer’s distinguished 42-year history.

Equally startling were the year-on-year increases for several categories, including confectionery (especially), up +42.9% to US$22.8 million (another all-time monthly record), luxury fashion (+40.3%), perfumes (13.3%) and tobacco products (+11.4%).

But arguably the most interesting statistic, one noted by Dubai Duty Free Managing Director Ramesh Cidambi, was the burgeoning growth in high-value transactions.

Individual purchases above AED500/US$136 grew +15.16% in number and +20.54% in value, accounting for an impressive 75% of revenue. In contrast, sales under AED500 (US$136.150) increased just +1.35% in number and +6.94% in value, contributing the balance of 25%.

“It was also interesting that within transactions over AED500 (US$136), the highest growth was in the AED10,000 (US$2,720) and above segment, where we had 7,952 transactions in November showing a growth of +37%,” Cidambi observed.

“The next highest growth was in the AED5,000-10,000 segment (US$1,360- 2,720), where we had 12,628 transactions showing an increase of +21.08%. The overall growth in the above AED500 (US$136) slab that included the above two segments was +20.54%. In contrast, the sub-AED500 slab grew +6.94%.”

Spirited performance in high-end liquor

Cidambi, who has driven the retailer’s remarkably sustained 2025 resurgence (November was the ninth record-breaking month this year) so impressively, told The Moodie Davitt Report the upwards trajectory in high-end sales had particular resonance for certain key categories.

“I looked further at liquor and checked the price segment of items sold (AED0-200/US$54; AED201-1,500/US$408; and above AED1,500) as opposed to transaction value,” he explained.

“There was no growth in the AED0-200 price segment, +5.3% in AED201-1,500 and +16.9% in the above AED1,500 slab. We are definitely doing better with higher-priced items in this category.”

Earlier this year, Dubai Duty Free completed an ambitious renovation of its its arrivals shopping offer at Dubai International Airport across terminals 1, 2 and 3. The multi-million renovation project, which began in April 2024, covered over 2,171sq m or 54% of the company’s arrivals retail space. The Moodie Davitt Report Founder & Chairman Martin Moodie toured the new-look stores with Dubai Duty Free Managing Director Ramesh Cidambi in June, filming courtesy of our Moodie Davitt STUDIO division. Click on the YouTube icons to view.

In terms of percentage of total liquor sales, the AED0-200 component contributed 33%, AED201-1,500 61% and above AED1,500 6%. If the current momentum is maintained, that 6% is set grow accordingly, good news for any retailer, and particularly a wines & spirits-focused one such as Dubai Duty Free. {Main story continues following the communication below}

Perfume and tobacco see strong premium growth

Liquor wasn’t a one-off. Within perfumes, DDF’s number one category with some 18.3% of total sales in the month, the high-price segment above AED1,000 (US$272) was the standout performer, rising +48.44% year-on-year to represent an encouraging 25.77% of category revenue.

That was in contrast with cosmetics, where the mid-price segment (AED101 to AED800/US$28 to US$218) showed the strongest growth (+13.93%), generating 67.13% of sales.

In tobacco, always a key DDF category (fourth-ranked in November), the high-price assortment above AED1,500/US$408 increased +33.74% while the AED100-1,500/US$27-408) mid-level rose +15.12%, accounting for a predictably high 72.5% of sales.

Those numbers reflect growing demand for heat-not-burn products (sticks and devices) and (likely) strong sales of cigars.

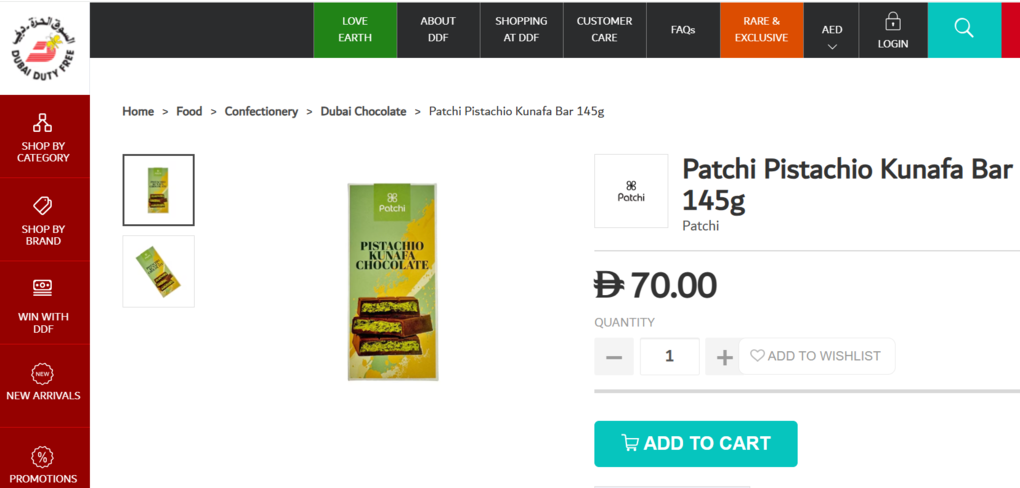

A single SKU, Patchi Pistachio Kunafa Bar (a Dubai Duty Free exclusive) posted almost US$4.3 million in November sales. That is a whole Willy Wonka’s chocolate factory worth of product.

Dubai Chocolate takes super-sized share

And here is another big talking point. In confectionery, the high-price segment above AED100/US$27 rocketed +88% year-on-year to take a 19% share of category sales.

The mid-priced range of AED10-100/US$2.70-27 grew +35.89% to account for around 79% of sales (figures rounded).

“This category is skewed by the higher prices for Dubai Chocolate,” Cidambi said, a view borne out by the astonishing figures for both the sub-category and the total confectionery segment.

Confectionery sales soared +42.93% year-on-year to US$22.8 million in November – another all-time monthly record. The Dubai Chocolate sub-sector – introduced on a phased basis from October to December 2024 to immediate success, so there is a valid comparative baseline – accounted for an extraordinary 42.86% of total confectionery sales. A whole symphony’s worth of music no doubt to Cidambi’s ears.

And speaking of extraordinary statistics, how about this? A single SKU, Patchi Pistachio Kunafa Bar (a Dubai Duty Free-exclusive) posted almost US$4.3 million in November sales, nearly half of the sub-sector’s revenues.

That is a whole Willy Wonka’s chocolate factory worth of product – 223,298 pieces weighing 32.3 tonnes to be precise. And each 145g bar sold for AED70/US$19. Truly a chocolate blockbuster.

The lure of luxury

Talking about the pan-category premiumisation trend, Cidambi concluded: “My sense is that the more expensive items in the major categories are selling more.

“Our value per transaction in the luxury boutiques is at an all-time high of AED8,634/US$2,350 as compared to AED7,818/US$2,130) in January.”

The numbers certainly support that narrative. With Dubai Duty Free’s future structure still being debated behind doors locked more tightly than those at Fort Knox, they will make for positive news whoever the viewer. ✈

“November just blew us away”Following the November results announcement, Dubai Duty Free Managing Director Ramesh Cidambi took to the local airwaves this week to discuss the stellar performance. Speaking to presenter Tom Urquhart on Dubai Eye 103.8 radio station’s The Business Breakfast show, Cidambi said: “The month finished very strong. We did AED30.5 million (US$8.3 million), up +34.86% on the 27th; AED35.9 million (US$9.8 million) or +44.51% up on the 28th; AED37.55 million, (US$10.2 million) up +24.90% on the 29th and AED33.16 million (US$9 million), +7.4% up on the 30th.

“We had a fantastic Dubai Air Show [17-21 November] week where we were up +23% compared to the show in 2023 and all that put us in a situation where we finished the month with AED876.56 million (US$240.16 million), which beat last November’s record of AED750 million (US$204.2 million). But more importantly, we beat the all-time high for a month, which was December of last year, AED820.1 million (US$223.3 million), by AED56 million (US$15.2 million). “And that is extraordinary if you think about the fact November has only 30 days [compared with December’s 31]… and we don’t have the anniversary [of DDF’s founding on 20 December 1983, a day each year that the retailer hosts a blockbuster sale] in the month and don’t have the Christmas buying. Considering all that, AED876 million was a fantastic performance in November. “I sometimes feel like a teenager using words like amazing, incredible and extraordinary. But all of those words don’t do justice to what we did in November. And we were able to do all that because the operation really worked very hard on the 29th and 30th of November. “To give you an idea, we moved 1,057 pallets of merchandise to the shops. We moved 650,000 pieces of merchandise across 12,000 items. So we really had an amazing month, and the team did a fantastic job.”

Asked if the strong results simply reflected fast-growing passenger traffic, Cidambi retorted: “We had +6% more people going to the airport, and we had a +16.7% increase in sales. The sales beat the passenger growth by +10 [percentage points] which is extraordinary. And in terms of spend per passenger, we did AED8.50 (US$2.31) more this November compared to last November. So by that metric, to use an American phrase, we hit the ball out of the park.” Urquhart then asked how year-end sales might look compared with the record-breaking 2025. Cidambi replied, “It’s a great question Tom, because yesterday [2 December] was National Day, and at 1.15 in the afternoon we crossed our sales budget for this year of AED7.8 billion (US$2.124 billion)… with almost a month to spare. So we are more than +10% over budget and +9.5% over last year. “In my ten-year plan of what we are going to achieve next year, we have already achieved this year.” Cidambi noted the consistently strong performance across DDF’s top ten categories, which represented around 88% of sales. “What I’m very happy about is that the top ten categories, including confectionery, are up +16% but the top ten categories, excluding confectionery and excluding Dubai Chocolate, are up +14%. “Dubai Chocolate continues to do well… 87 tonnes sold last month. But it’s not just a Dubai Chocolate story,” Cidambi insisted, highlighting the vibrant showing of high-value transactions across multiple categories (see main story above). “For example, in liquor and in perfumes, the higher-priced items are doing much better. In perfumes, items that cost more than AED1,000 (US$272), which is a lot of money for a perfume, are up +43%, whereas items that cost less than AED1,000 are up +5%. So people are spending more money on higher-price items and the value per transactions are higher. “And when you check, for example, transactions of more than AED10,000 (US$2,720), which is a lot of money in an airport, they are up +21%.” Key drivers of the improved spend per passenger have included new stores (notably Cartier and Louis Vuitton in luxury), enhanced brand partnerships and the extensive renovations of the liquor & tobacco arrivals shop (see videos above), Cidambi added. “People are encouraged to be more relaxed. They have a better shopping experience, and they spend more money, which is what we see when we analyse the transactions.” ✈ |