Key talking points

|

CHINA. Today The Moodie Davitt brings you more exclusive coverage from Friday’s invitation-only press conference conducted online by China Tourism Group Duty Free Corp (China Tourism Group/CTG) and China Duty Free Group (CDFG) senior executives, which spelled out the purposes and benefits of CTG’s secondary listing on The Stock Exchange of Hong Kong, which kick-started that day.

The Moodie Davitt Report joined leading Chinese media houses in reporting on the event.

[Note: This story was sent by e-alert to our entire opt-in readership. To join that complimentary subscription list and receive all the industry’s biggest breaking stories, many of them exclusive to The Moodie Davitt Report, direct to your inbox please email Kristyn@MoodieDavittReport.com headed E-ALERT REQUEST]

As reported, CTG hopes to raise at least US$2.17 billion from the listing, which complements its existing presence on the Shanghai Stock Exchange.

The high-level conference was led by CTG Chairman of the Board and Executive Director Peng Hui; Executive Director and General Manager Chen Guoqiang (Charles Chen, President of CDFG); CTG Executive Director and Standing Deputy General Manager Wang Xuan; CTG Deputy General Manager, Secretary to the Board and Joint Company Secretary Chang Zhujun; and Chief Financial Officer Yu Hui.

Dealings in the H Shares on The Stock Exchange of Hong Kong are expected to commence on 25 August, with some 103 million shares on offer at between an expected HK$143.50 (US$18.30) to HK$165.50 ($20.88). CTG said that the proceeds will be used primarily to consolidate domestic channels; expand overseas business; improve supply chain efficiency; upgrade IT and marketing systems; improve membership systems; and for working capital and other general corporate purposes.

Leading off the presentations, CTG Chairman of the Board and Executive Director Peng Hui said, “This year marks my 31st year in CDFG,” Peng revealed. “I have had the honour to witness the development of CDFG and I’m really proud to be a CDFG employee.”

He added, “Since its establishment CDFG has gone through nearly 40 years of development. Over the last 40 years the market environment has been constantly changing, but CDFG’s pioneering spirit has remained unchanged. We have continuously promoted CDFG’s reform and innovation. With the joint efforts of all employees and the support of our partners, we have grown from a new duty free business to the largest travel retail operator in the world today.

A milestone in CDFG’s history

“We are committed to expanding our global presence. We will be focusing on the most important port duty free scores at home and abroad, the establishment of Hainan’s landmark duty free complex [the Haikou International Duty Free Shopping Complex -Ed] and to the innovative development of online business.”

Talking of the secondary listing, Peng said, “This is an important milestone in CDFG’s history. With the support of the world’s best investors, we are confident that we will open a new chapter in its development and take CDFG to the next level to provide better services to global travellers. I’m confident that the future of CDFG will be even brighter, while we are also committed to providing better returns for shareholders.”

CDFG President Charles Chen [who will speak at The Trinity Forum in Singapore on 1-2 November] noted that the company had become the world’s number one travel retailer by sales for the first time in 2020, a position it had maintained in 2021 [Source: The Moodie Davitt Report Top Travel Retailers].

“In 2021, we accounted for 24.6% of the global travel retail market and 77.8% of the China market,” he said, adding that for duty free in isolation, CDFG’s Chinese share was 86% in 2021. In the same year the company accounted for a 90.1% share of the Hainan offshore duty free market.

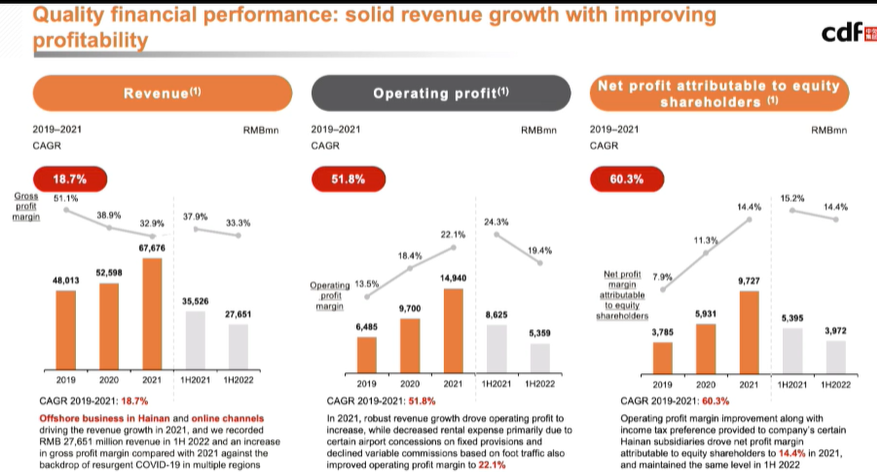

“We’re the only travel retail operator that covers all duty free retail channels in China, and we have significant advantages in terms of brands and product categories,” Chen said. “Despite the COVID resurgence in 2021, revenue and profit continued to grow at a rapid pace. Our revenue in 2021 was RMB67.7 billion and our net profit RMB9.7 billion. CAGR for revenue and net profit over the past three years reached +18.7% and +60.3% respectively.”

Today, CDFG offers more than 1,200 brands and over 316,000 skus. Importantly in terms of returning shoppers, CDFG’s membership base showed a CAGR of +311% between 2019 and 2021 to 23.3 million. “In terms of supply chain, we have established direct sourcing channels with over 430 suppliers worldwide,” Chen commented. “We have seven logistics centers, creating the one and only nationwide duty free logistics and distribution system in China.”

CDFG operates 193 stores, including 184 stores in 28 provinces, municipalities and autonomous regions across China, embracing some 100 cities. Chen said that the group expects the global travel retail market to show a CAGR of +57.4% between 2021 and 2023.

“China’s travel retail and duty free market is expected to grow to RMB450.9 billion in 2026 driven by favourable factors such as the dual circulation economic development policy; policy support for the duty free industry; consumption upgrades; rapid development with new travel retail formats; and a fast recovery from the pandemic,” he concluded on an upbeat note.

Haikou International Duty Free Complex to open on 30 September

CTG Executive Director and Standing Deputy General Manager Wang Xuan said, “As the leader in the travel retail industry we have unparalleled competitive advantages… with both scale and a huge potential for growth.

“We have ranked number one among all Chinese duty free operators for five consecutive years, with a market share of 86% in China in 2021, outpacing the number two by a factor of 20. Our growth rates far exceeded those of other top global travel retail operators.”

Wang highlighted the strength of the group’s Hainan business, particularly in Haitang Bay, which offers “the best destination for mid-to high-end tourists, giving us a prime location for travel retail in Hainan.

“We are building an even larger complex in Haikou, which will go into operations on 30 September. We have duty free concessions at nine out of the top ten airports in China. We run duty free stores at Beijing Capital International, Shanghai Pudong, Shanghai Hongqiao and Guangzhou Baiyun airports, which [collectively] served more than half of the outbound travellers from China’s airports before the outbreak of the pandemic.

“In terms of our overseas business, we have duty free stores in Hong Kong, Macau and Cambodia and at the end of 2021 we opened a flagship [downtown] store in Macau.”

Wang said that the group’s M&A activities had proven highly successful, citing the Sunrise China (2017) and Sunrise Shanghai (2018) acquisitions, deals which had brought critical access to airports in Beijing and Shanghai. “Our post-merger integration capabilities have also helped our acquired companies increase performance significantly. For example, after our acquisition of Hainan Duty Free in 2020, CDFG’s revenue to external customers increased by +258.5% year-on-year in the second half of 2020.”

Culture + commerce + tourism

On top of CDFG’s existing seven logistics centres, the company is building a new intelligent logistics centre in Haikou. “In addition, we’ve built a robust supply chain management system thanks to our strict classification system and distribution standards as well as our digital warehouse management system.

“We’re working on online-offline integration and seek long-term growth through multi-dimensional value-added services before during and after the customer journey,” Wang said. Citing the 150,000 square meters of retail space at the new Haikou operation, he added, “We’ll leverage our travel retail complexes as hubs to support duty paid business innovation and create an attractive mix of businesses and brands with culture + commerce + tourism at the core.

In an important observation, Wang noted that besides building traditional downtown stores, CDFG has developed a “replicable and scalable” travel retail complex model that can be applied to cities where the new downtown duty free policies will be implemented. That is a reference to the anticipated introduction, probably as early as 2023, of a Korean-style downtown duty free shopping model where Chinese travellers can buy (with airport pick-up) before they leave the country.

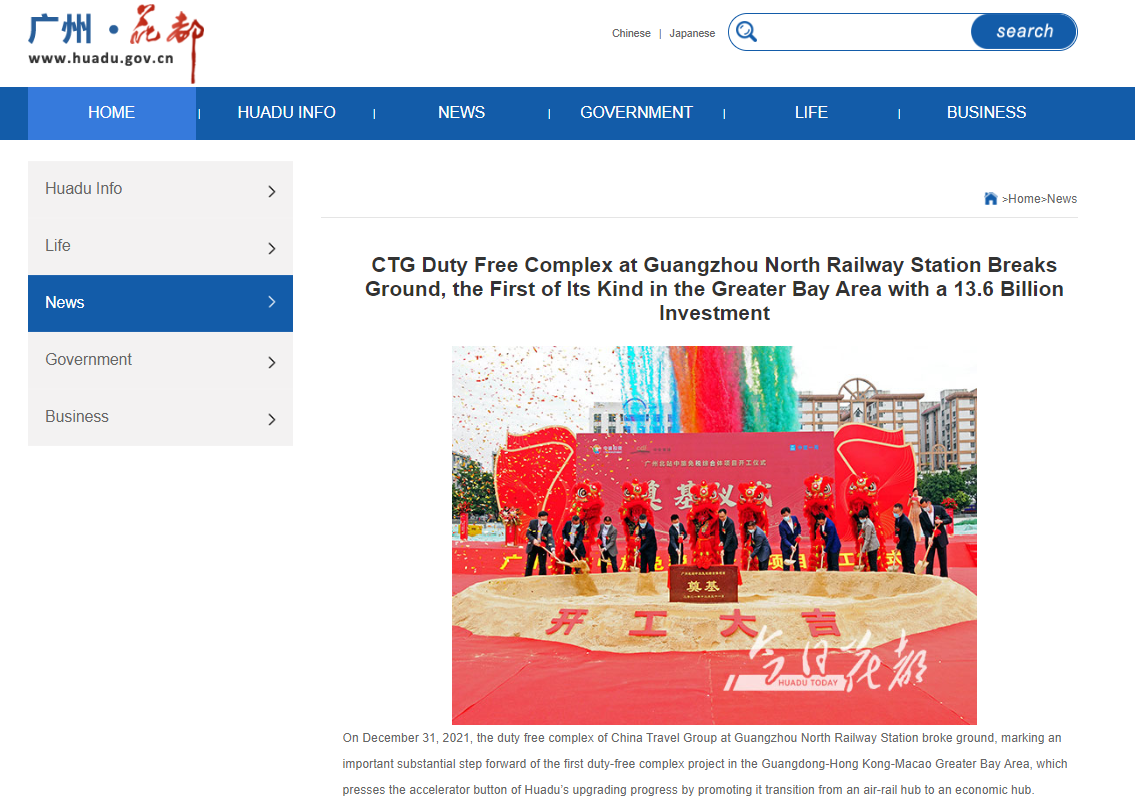

Last year, he said, CDFG had begun the construction of a duty free complex at the Guangzhou North Railway Station in cooperation with the Guangzhou City government. CDFG will operate the duty free side of the business when the project opens.

[Editor’s note: The complex, for which ground broke on 31 December 2021, is expected to open in 2025. It will form a key part of the Guangdong-Hong Kong-Macao Greater Bay Area development as an economic hub. The CDFG operation will cover some 90,000sq m out of a total construction space of some 600,000sq including an outlet mall, office tower, two commercial towers and other facilities. It will be the first duty free complex in the Greater Bay Area.]

Wang said that the pandemic has led CDFG to accelerate its online strategy. “We launched online platforms such as CDF member shopping and adopted online preorder services. In addition, we further integrated all memberships and subsystems and used big data analytics to better understand customer behavior and improve operational efficiency,” he said.

He said that the Hainan International Duty Free Shopping Complex will attract elite customers with high spending power. It will feature many distinctive elements, including the world’s largest whisky museum and the first China-chic beauty store in a global and travel retail setting. It will also offer a world-first multi-experience store combining retail, cultural creativity and collectibles auctioning, as well as a pioneering custom-designed immersive Weta-themed atrium [designed by Weta Digital, a world-leading VFX studio =Ed].

“In addition, our Haikou complex will provide customers with a unique, experience-based hybrid business format – featuring retail + coffee shop + tearoom + bars – in an effort to provide customers with comprehensive and value-added services before during and after their travels.”

Wang emphasised CTG’s strong shareholder support and experienced management team. “Our controlling shareholder, China Tourism Group, is the largest central SOE in the tourism industry. Its business scope includes duty free, travel, investments, finance, assets, hotels and cruise ships. As a subsidiary of CTG we are able to coordinate with the group’s resources and travel agencies, transportation and other aspects of tourism. This creates a unique travel plus duty free synergy that helps us further activate our potential in travel retail and provide better services and experiences for our customers.”

The senior management team has an average of 20 years of experience in the travel retail industry, Wang said. Chairman and Executive Peng Wei has nearly 30 years of travel retail experience and was named the 2014 Travel Retail Person of the Year [by The Moodie Davitt Report], an award received by CDFG President Charles Chen four times,” he added.

Expansion opportunities

CTG Deputy General Manager, Secretary to the Board and Joint Company Secretary Chang Zhujun talked powerfully about the group’s development strategy, which he said comprises five main five areas.

“One, we’re continuing to build our competitive barriers, develop duty free business on Hainan, and take advantage of a post-pandemic recovery to enhance our airport business. We are also developing a high-quality duty paid business to ensure sustainable growth.

“Secondly, we’ll also develop new businesses including our travel retail complexes, online business, downtown stores and overseas channels, which are all future growth drivers. Thirdly, we will also strengthen our ties with brands through investments and M&A and actively seek acquisition opportunities in domestic and overseas markets to expand our global competitive position.

“Fourthly, we continue to strengthen our operational and procurement capabilities; and to improve our supply chain; upgrade our IT systems; and boost our marketing capabilities in order to enhance our management effectiveness. At the same time, we’re also focused on attracting high-quality strategic talents, building a global HR management platform and offering competitive salaries and incentives.”

Chang also spelled out the group’s long-term commitment and heavy investment in a wide range of Corporate Social Responsibility projects, such as the China Foundation for Poverty Alleviation and the China Youth Development Foundation.

Chang also spelled out the group’s long-term commitment and heavy investment in a wide range of Corporate Social Responsibility projects, such as the China Foundation for Poverty Alleviation and the China Youth Development Foundation.

“We have always implemented the concept of green low carbon and recycling, integrating energy conservation and ecological protection throughout our operation. We have also recently released a bilingual ESG report. We have made significant contributions to society through ethical corporate behaviour and results. This is our way of giving back to the society.”

Chief Financial Officer Yu Hui closed out the main session with a strong portrayal of the group’s robust financials.

“On the financial front, we have delivered a high-quality financial performance despite the impact of the pandemic in terms of revenue. This has been driven by the high growth of our Hainan business and online business. Our revenue in 2021 grew to RMB67.7 billion, up by +28.7% year-over-year.”

Noting that H1 2022 performance had been affected to some extent by the pandemic, Yu said that the situation eased from late May – especially with the lifting of the lockdown in Shanghai – boosted by the issuing of consumption vouchers in Hainan among other policies to stimulate consumption.

Interprovincial travel had recovered [pre the current hiatus in Hainan which has seen stores closed in Sanya and Haikou over recent days -Ed] and store sales had rebounded significantly since late May, he pointed out. “According to our earnings report, the company’s sales improved significantly starting in June with revenue increasing +13% year-over-year.”

Gross margin for 2019 to 2021 reached 51.1%, 38.9% and 32.9% respectively. The decrease in 2020 and 2021 was driven by discounting and promotions to combat decreasing customer traffic and temporary store closures caused by repeated outbreaks of COVID on the Mainland.

“Our gross margin has recovered to 33.3 points in the first half of 2022 through precision marketing and optimisation of promotional policies,” he said. “In terms of operating profit, solid revenue growth in 2021 supported the increase in operating profit. The rent reduction at Beijing Airport in Q3 2021 had a positive impact on our operating profit, contributing to an increase in operating profit margin to 22.1% in 2021.”

Developing the duty paid business

Yu said that the group had achieved excellent profitability and improved both the return on capital and shareholder returns year-over-year. “Our return on total assets has steadily increased over the past three years from 16.4% in 2019 to 24.6% in 2021, thanks to the high growth in net profit.”

Along with the online and new Haikou business, duty paid retail is another key growth area, he said. Duty paid sales represented 35% of revenue in 2021 but almost 40% for H1 2022. Hainan duty free revenue, which reached RMB47.1 billion in 2021, accounting for about 70% of total revenue in the year.

“This trend is continuing in 2022,” Yu said. “By product category our Hainan business and online business drove a recovery of the duty free beauty category in 2021, while sales of duty free fashion accessories and duty paid merchandise have continued to increase from 2019 through 2021.

“Our cash flow in the past few years has been excellent with operating cash flow reaching RMB8.8 billion in 2020. And it was pretty stable at around at above RMB8 billion,” he concluded.

QUESTION AND ANSWER SESSION (FIRST REPORTED ON 12 AUGUST)

In a question and answer session that followed the main presentations, CTG was asked about the positive impact of the listing.

CTG Chairman and Party Secretary Peng Hui replied: “This listing is primarily serving our strategy. We’re trying to become a more internationalised company. Internationalisation is a very important long-term goal of ours. So we highly value this Hong Kong listing, which is very important for us.

“We believe that it will further boost our global recognition and brand influence and will consolidate our leadership in the travel retail landscape.”

He added: “Secondly, this will help us access international capital. So we will have access to international capital markets and a domestic capital platform [Shanghai Stock Exchange -Ed], which will provide a lot of funding for future development. Thirdly, it will further expand and increase our financial moat. So the funds could be partially used on our Haikou project [the Haikou International Duty Free Complex, set to open later this year], downtown duty free developments and other projects.

“Fourthly, it will facilitate our overseas expansion and internationalisation.”

The Moodie Davitt Report Chairman Martin Moodie asked whether CDFG believed it had the opportunity to create a Chinese traveller-led version of DFS Group’s success story from the early 1960s through to the 90s when it built a retail empire everywhere that Japanese people travelled.

CTG Executive Director and Standing Deputy General Manager Wang Xuan replied: “Since our founding in 1984 we have always closely followed our consumers’ evolution. So as more and more Chinese consumers travel abroad and become the most important spenders in the global duty free industry, we are also following wherever they are going by opening new stores overseas.

“So for the next step, we will continue to go to top destinations for Chinese consumers in order to create more business and also more returns for us.”

Asked by powerful state media China Daily what were the key reasons for having achieved world number one travel retail status [according to the industry benchmark – The Moodie Davitt Report Top Travel Retailers ranking] Charles Chen said: “The first thing is the breadth of our channels – we are present in all of them. We run 193 stores, including 184 in the Mainland and out of ten international airports we have the concessions to run duty free stores in nine and we have signed a long-term contract with all of them.”

Chen also spelled out the company’s strong presence in Hainan where it operates in Sanya, Haikou and Bo’ao.

“The second reason is our relationship with the brand owners,” he said. “We do direct purchasing with 430 of them and we offer more than 300,000 SKUs. We have established long-term relationships with these suppliers and this was very pronounced during the COVID period, where we expressed mutual understanding and mutual support.

“Another fact is our understanding of the Chinese consumers. The mainstay of duty free shopping in the world [over recent years] has been the Chinese and we have a great understanding of them in terms of their preferences. For example, with Generation Z there have been a lot of changes in their consumption behaviours and patterns. We have a lot of insights into those consumers which other duty free or travel retail operators have no comparison with.”

Chen also cited the strong support CDFG receives from parent company CTG. “They provide us with a lot of travel resources and a lot of travellers. So there’s a strong synergy between us and a lot of sharing of resources. This is a great advantage that other duty free players cannot enjoy – we have access to the largest travel agency in China, and the hospitality system related to it.”

Experienced management is another big plus, Chen said. “I’ve been in this space for 35 years and my boss [Peng Hui] has also been in this sector for decades. And we have a lot of professional buyers, as well as employees from all over the world – from Hong Kong, Malaysia and Singapore. They are very experienced when it comes to sourcing goods.

“So all of these things contribute to our leadership as does the strength of our partnerships with suppliers. So with these advantages, it is really very hard for other players to surmount us.”

“For our sales revenue in Q3 and Q4 we expect a significant increase. So we maintain our original sales target for the entire year.”

Several reporters asked CTG about the impact of the current COVID-19 outbreak in Hainan which has seen CDFG’s stores in Haikou and Sanya closed over recent days with some limited negative impact on the company’s stock price.

Chang Zhujun replied: “As we all know, we are seeing a resurgence of the COVID pandemic in Hainan recently and our stores have also been closed as a response. But we believe that this is going to be a short-term impact. In the medium to long term, we don’t think there will be any further impact.

“Last year there were also some sporadic outbreaks. And in March to May this year we also closed stores temporarily in Hainan and in Shanghai due to the pandemic. However, at CDF, we are running a business that’s both online and offline. We embrace challenges and we are ensuring a steady growth for our business despite the pandemic.

“Last year we achieved 97.4% of traveller volume for the entire Hainan Island but our revenue actually grew by +250% compared to 2019. We also saw a very quick recovery in June this year. We achieved a margin increase year-on-year and we have also made a lot of preparations to ensure that once the ports are open again, our stores in Hainan and elsewhere will be ready to receive customers.

“We also have a number of new projects in Hainan, including the New Harbour complex in Haikou, the second site in Sanya and some additional projects. In the medium and long term they will be the growth drivers for CDFG and will also create an even better experience for our customers.

“In the near term, we actually saw a similar impact in Hainan last August, which was actually the lowest month in terms of revenue for the entire 2021. So we made adjustments.

“And from January to now our gross margin has actually been quite stable. And with the ongoing outbreak in Hainan we are also seeing that the city government in Sanya has been very proactive, and the provincial government is also very proactive in containing the pandemic.

“Because most of the people in Hainan are travellers, we are seeing the government putting a lot of efforts into COVID tests and ensuring that the recovery can happen in an orderly fashion. We therefore have reason to believe that in August and September, which are our traditional low seasons, we’ll be able to make sure that once the recovery happens we are ready for it.

“And at the same time we continue to offer our online platform so that our customers can make pre-orders and retrieve their products and their purchases at the airports. We will also open a new French-style space occupying an area of 3,000sq m in Sanya Phoenix International Airport.

“And therefore, for our sales revenue in Q3 and Q4 we expect a significant increase. So we maintain our original sales target for the entire year.”

In June The Moodie Davitt Report launched a new quarterly eZine called The Moodie Davitt China Travel Retail Report. The cover story is dedicated to China Tourism Group and CDFG. Click on the image to read the bi-lingual title. The next edition will be published in October. Please email Kristyn@MoodieDavittReport.com for a free first year subscription.