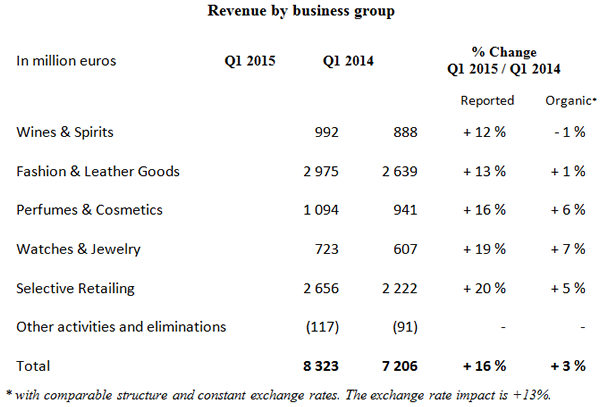

INTERNATIONAL. LVMH Moët Hennessy Louis Vuitton has posted a +16% increase in first quarter reported 2015 revenue to €8.3 billion. Organic revenue growth was +3% compared to the same period in 2014.

The group’s Selective Retailing arm posted +20% reported growth with organic revenue growth of +5%. LVMH said: “DFS continued to be faced with a complex situation in Asia and has been impacted by currency and geopolitical developments in certain tourist destinations.”

Trading in locations such as Hong Kong and Macau has been difficult due to the recent restrictions on Chinese luxury spending. In Hong Kong in particular there has been an impact on tourism shopping from recent political protests and mounting anti-Mainlander sentiment from locals. The retailer has been experiencing severe double-digit sales declines year-on-year in Hong Kong as a result.

The Wines & Spirits business group recorded stagnant organic revenue in the first quarter of 2015 as a result of the continued destocking by distributors in China, noted LVMH. Despite the situation in this region, Hennessy Cognac displayed an overall increase in volume thanks to the strength of the US market. Other spirits, Glenmorangie and Belvedere continue to grow. Champagne experienced a good start to the year with solid volume growth, said the group.

The Fashion & Leather Goods business group grew despite a very high comparable period in 2014, particularly in Japan. Louis Vuitton displayed “strong momentum” while Fendi, Céline, Givenchy, Kenzo and Berluti experienced “an excellent quarter”.

In Perfumes & Cosmetics, organic revenue growth was +6% in the first quarter of 2015. Christian Dior continued to see good momentum led by J’adore and Miss Dior and the performance of the make-up segment. Guerlain continued the roll out of its new fragrance L’Homme Idéal and inaugurated its new production facility in Chartres which is dedicated to skincare and make-up. Benefit performed well while Fresh and Make Up For Ever are expanding rapidly, added LVMH.

The Watches & Jewelry business group recorded organic revenue growth of +7% in the first quarter of 2015. Bvlgari continued to deliver good growth, driven by the success of its jewellery collections and its new Lvcea watch for women. Hublot had a very good start to the year while TAG Heuer continued to refocus on its core offering. LVMH watch brands introduced several innovations at the Basel watch fair, during which a partnership between TAG Heuer, Google and Intel to launch a smartwatch was announced.

|