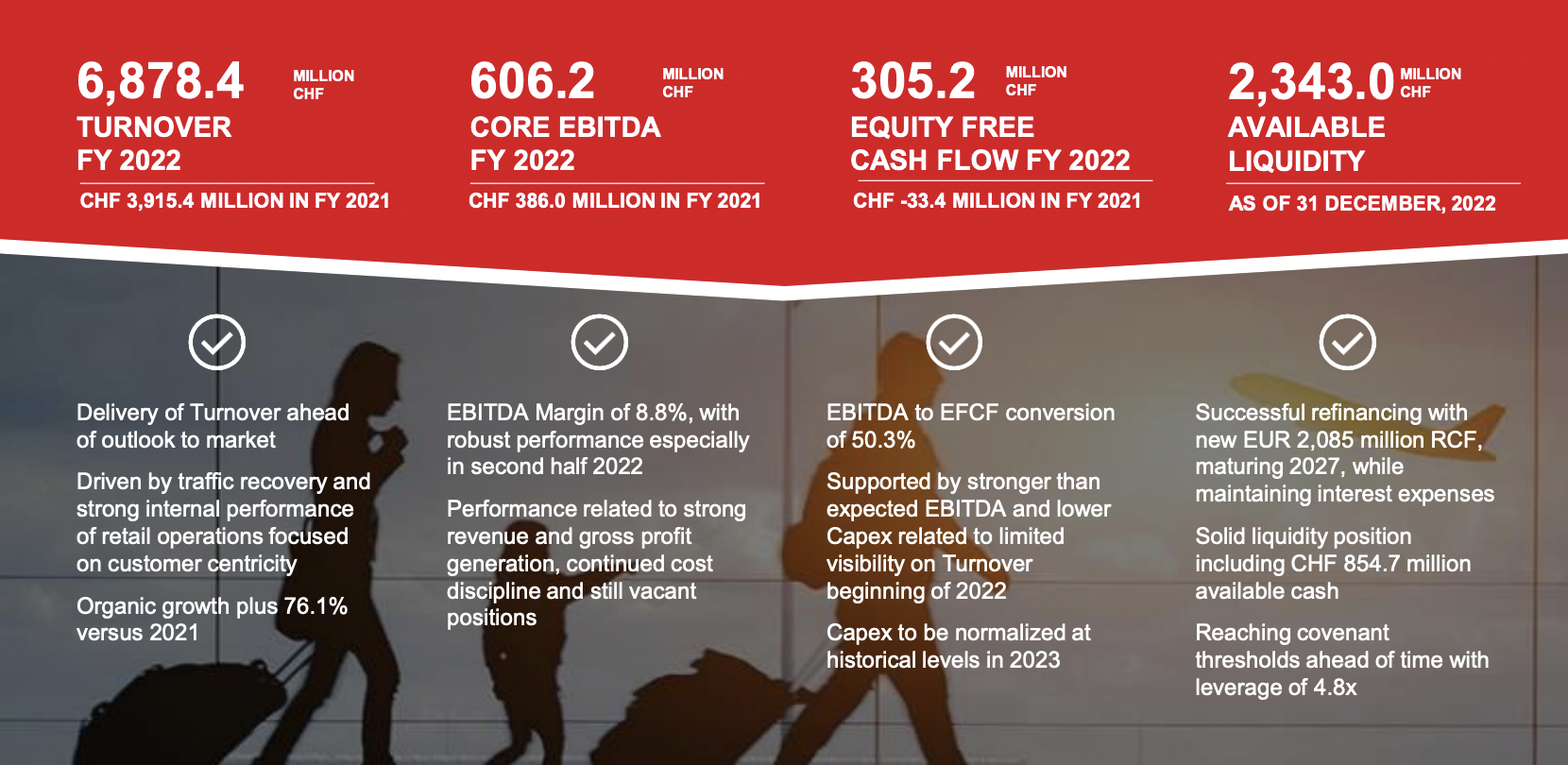

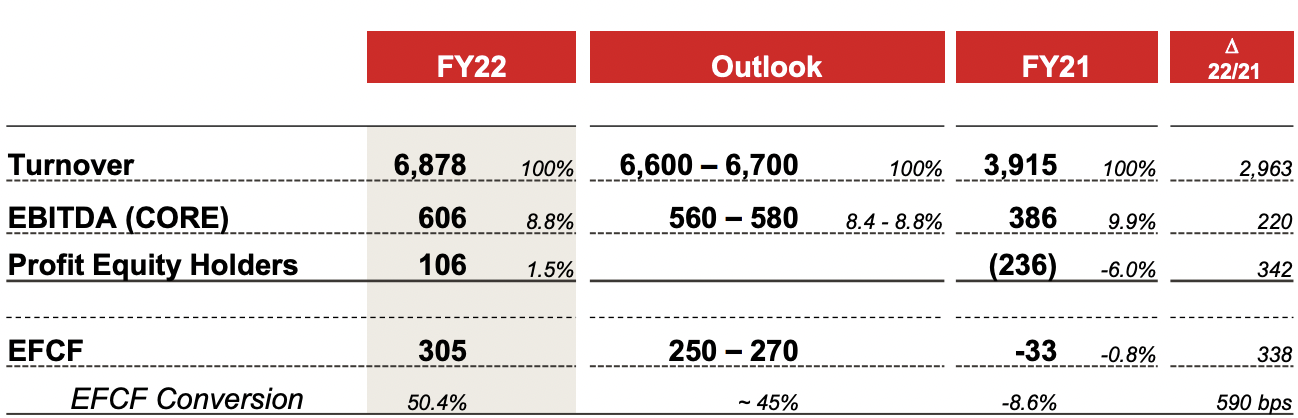

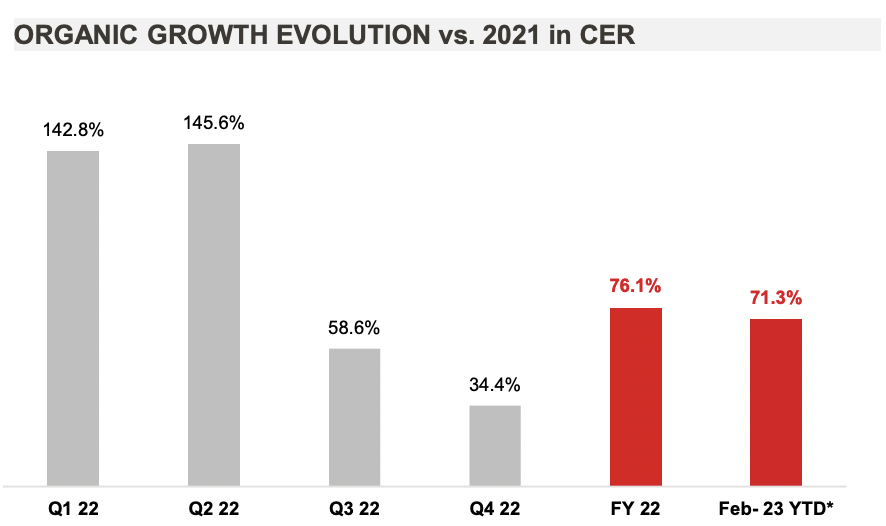

INTERNATIONAL. Global travel retail powerhouse Dufry today posted a +76.1% organic growth rate in turnover to CHF6,878.4 million (US$7,396.5 million) based on constant exchange rates for 2022.

The company said it had delivered its financial targets, including a core EBITDA margin on 8.8% and EFCF of CHF305.2 million (US$328 million).

The results, in line with expectations, were driven by robust demand for travel following the lifting of restrictions across most geographies, Dufry said.

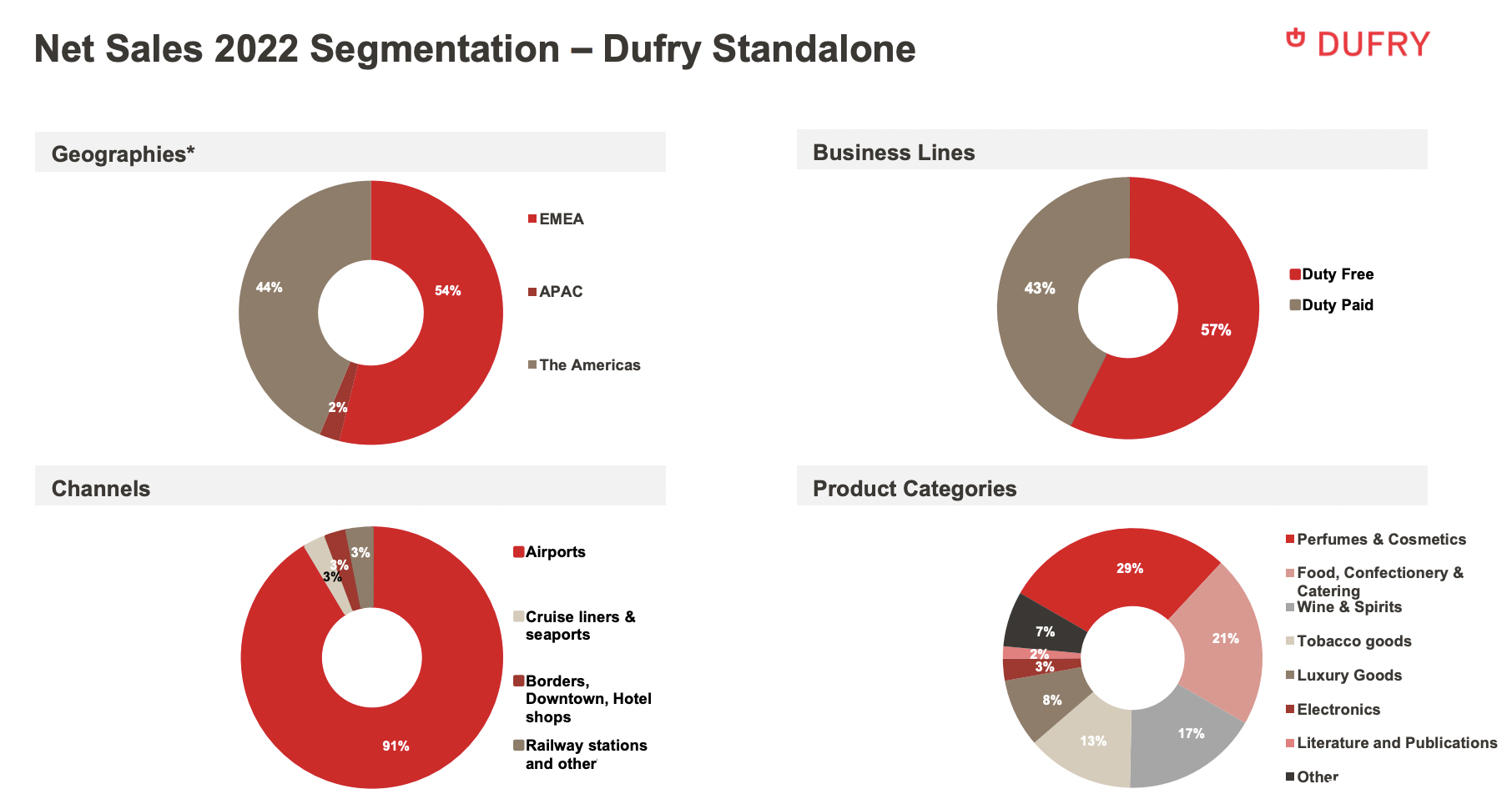

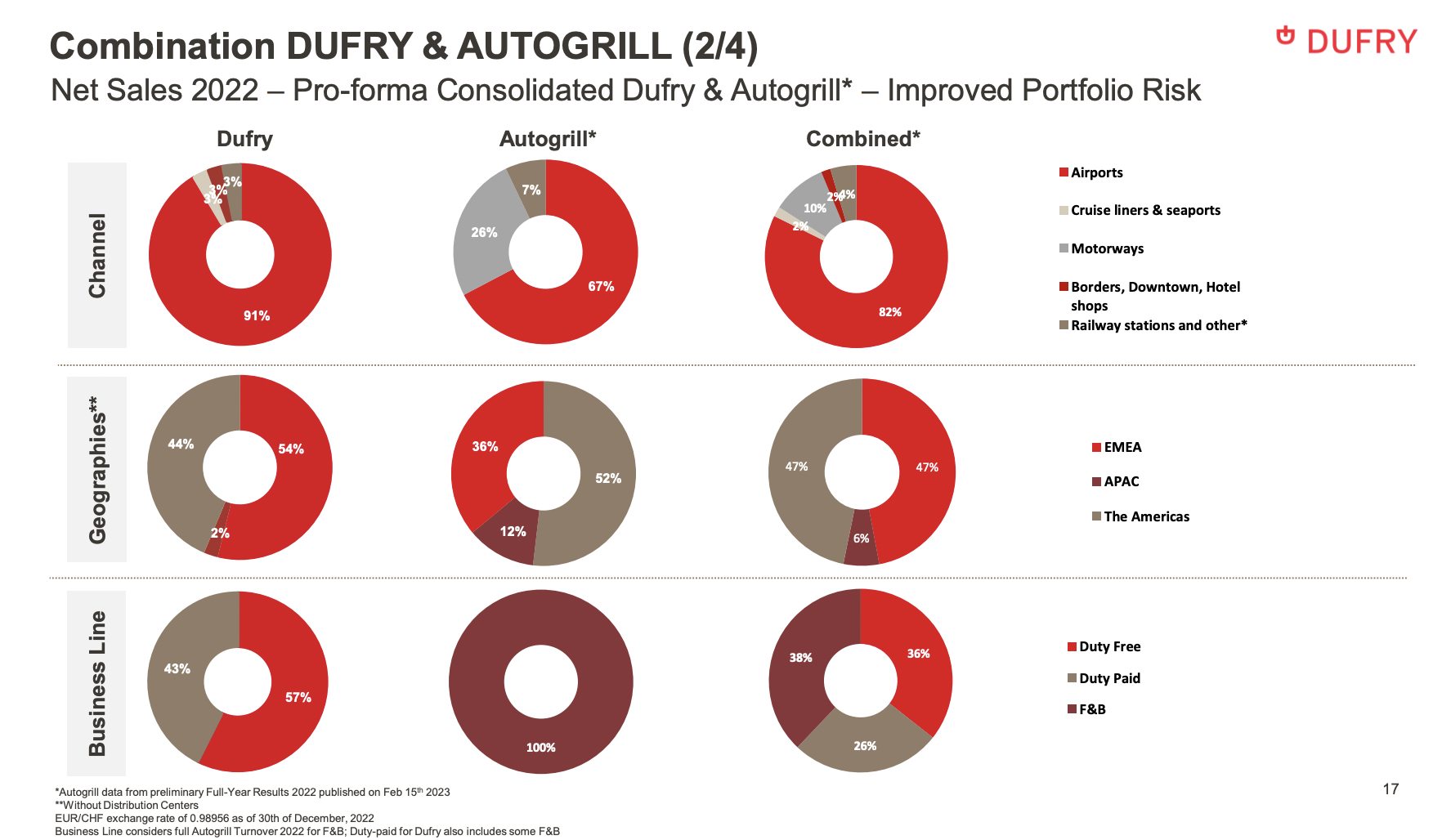

The category mix “mirrored the continued normalisation of travel” said Dufry. Duty free accounted for 57.4% of net sales versus 42.6% duty paid, close to historical levels; the airport channel contributed 91.4% of turnover.

Gross profit reached a 61% margin compared to 56.5% in 2021, said the company. This was driven by “robust consumer demand, active and improved category management and adding new product lines as well as a change in geographical and channel mix”.

Core EBITDA reached CHF606.2 million (US$652 million) with a margin of 8.8%. Drivers were: improved gross profit margin, and moderate personnel and other expenses, partly related to some delays in hiring, and offsetting impacts from the current inflationary environment. Concession fees were still supported by some MAG relief.

Core EBITDA reached CHF606.2 million (US$652 million) with a margin of 8.8%. Drivers were: improved gross profit margin, and moderate personnel and other expenses, partly related to some delays in hiring, and offsetting impacts from the current inflationary environment. Concession fees were still supported by some MAG relief.

Core net profit to equity holders turned positive at CHF105.7 million (US$114 million) versus a negative CHF236.2 million in 2021. Basic Earnings per share stood at CHF1.14, versus CHF -2.69 in 2021.

Net debt was reduced to CHF 2,810.7 million with available liquidity of CHF2,343 million, supported by recent refinancing at attractive terms and a strong cash position, said the company.

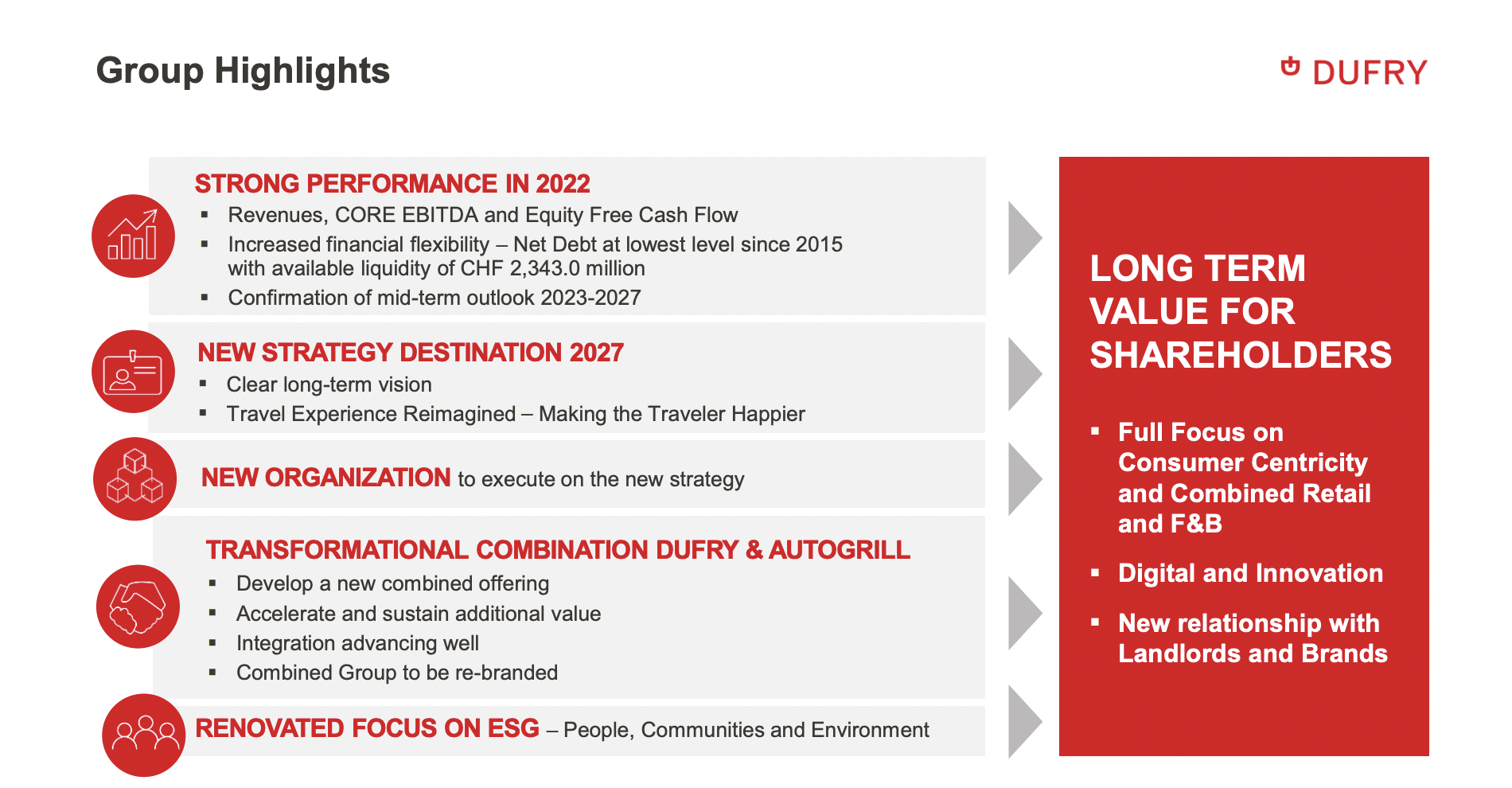

Dufry Group CEO Xavier Rossinyol commented: “I am delighted to be reporting on a successful year for the business and proud of the achievements the Dufry team has delivered. While Covid-19 related restrictions in most regions globally remained in place at the beginning of the year, the easing of travel-related requirements since Q2 have uplifted demand significantly.

“Most importantly, we have seen robustness in travel-related spending despite macro-economic and operational challenges within the travel industry. Our turnover of CHF6,878.4 million came in above projections – all the more remarkable considering the ongoing macroeconomic headwinds of inflation, rising interest rates and travel disruptions.” He added: “With our focus on profitable growth and cash generation, we delivered a solid Core EBITDA performance of CHF606.2 million, resulting in a margin of 8.8%. EFCF came in at CHF 305.2 million – equal to a conversion of 50.3% from CORE EBITDA – significantly exceeding our expectations at the beginning of the year. We have maintained strong Capex discipline, especially during the first half of 2022, due to limited visibility on Covid-19 variants and the broader geo-political environment. We anticipate a more normalised environment in 2023, facilitating investment activity in line with our targets.”

He added: “With our focus on profitable growth and cash generation, we delivered a solid Core EBITDA performance of CHF606.2 million, resulting in a margin of 8.8%. EFCF came in at CHF 305.2 million – equal to a conversion of 50.3% from CORE EBITDA – significantly exceeding our expectations at the beginning of the year. We have maintained strong Capex discipline, especially during the first half of 2022, due to limited visibility on Covid-19 variants and the broader geo-political environment. We anticipate a more normalised environment in 2023, facilitating investment activity in line with our targets.”

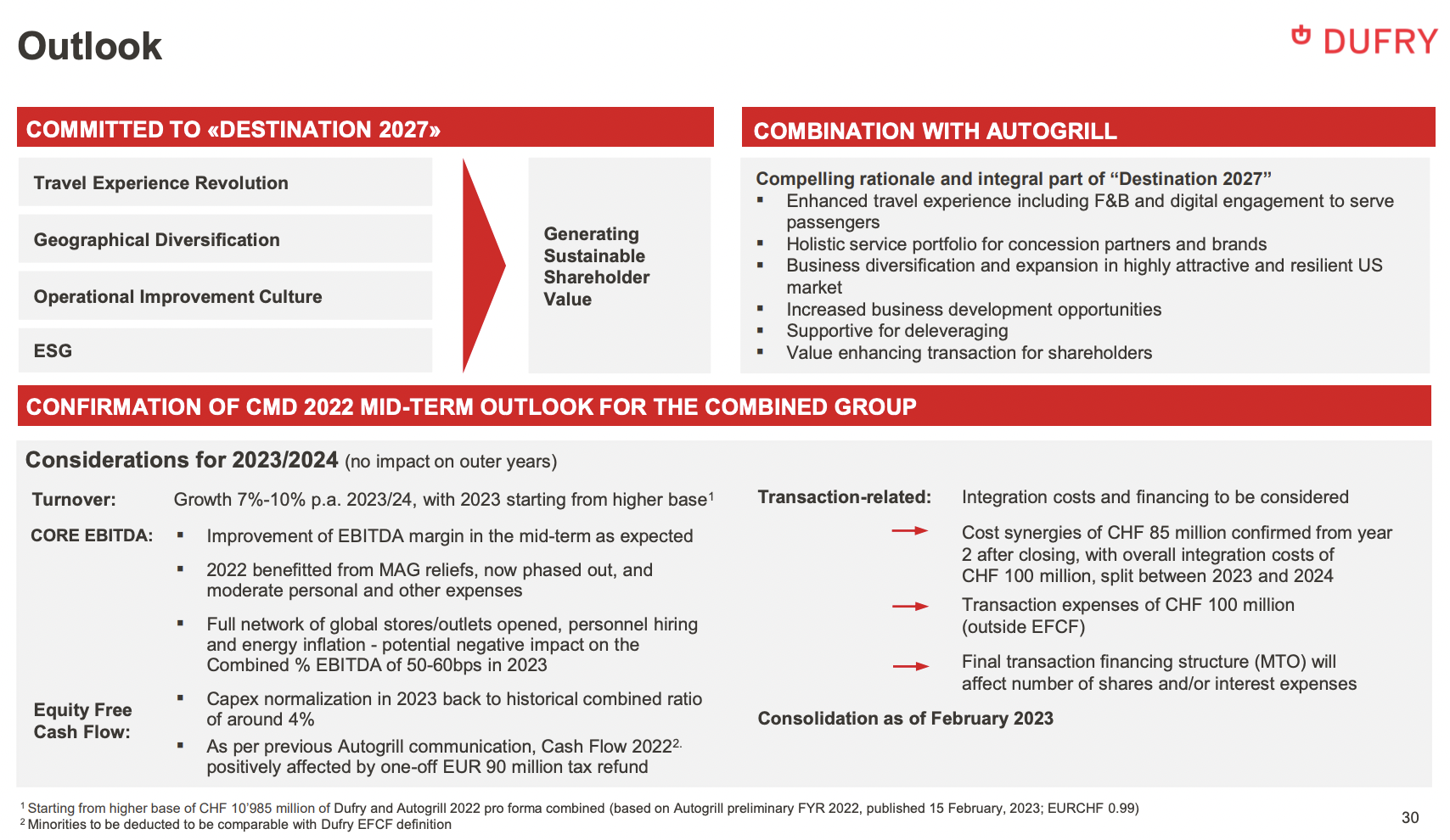

Rossinyol said that during 2022, Dufry has set “the cornerstone for a prosperous future of our company as the global leading Travel Experience player. Dufry’s new strategy ‘Destination 2027’ sets out the path including our focus on geographical diversification, customer-centricity and digitalisation, and a strong emphasis on our people and on ESG.

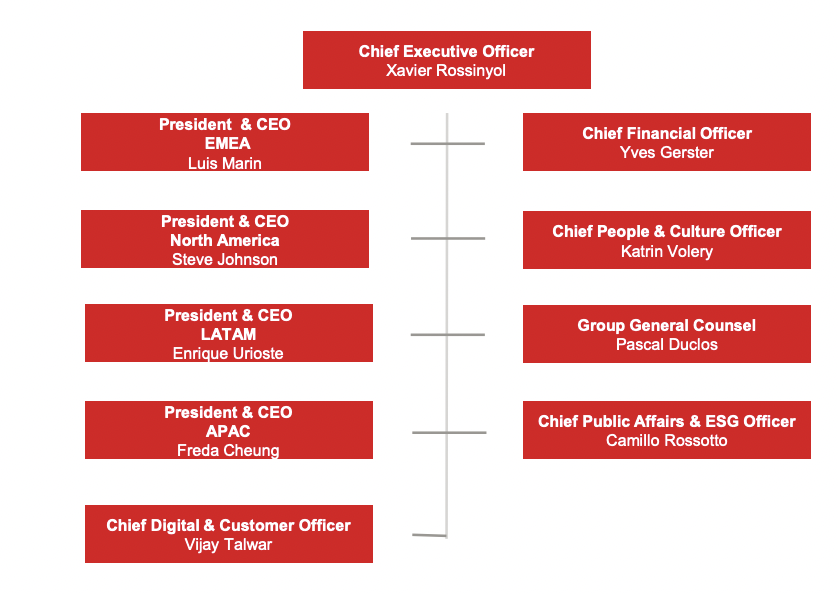

“The transformative business combination with Autogrill is an integral part of our long-term strategy and essential to delivering on our ambition. We are on track to close the transaction towards the end of the second quarter while rapidly advancing on the implementation of ‘Destination 2027’ – including the integration of both companies and delivery of related synergies. Dufry’s new organisation reflects our strategic priorities, driven by talent from both companies.”

Business development

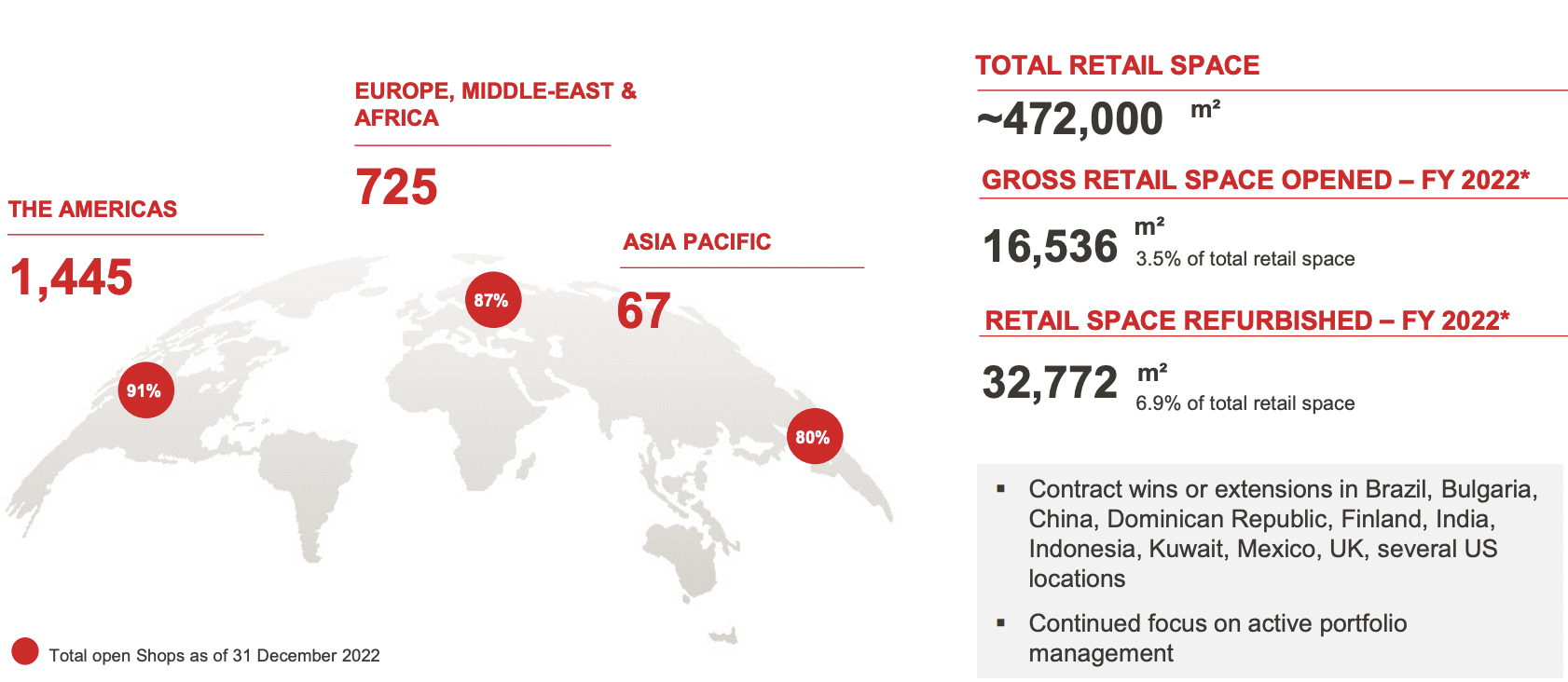

Key developments in 2022 included the three-year extension of Dufry’s Heathrow Airport contract to 2029; plus new concessions at Helsinki, Sofia, Bali, Recife, Chongqing, Colorado Springs and Santa Lucia airports.

Dufry announced a partnership with Starbucks with the first stores at New York LaGuardia, while Hudson’s Nonstop travel convenience stores opened at Nashville and Dallas Fort Worth airports.

In total, Dufry opened 16,536sq m of new shops and refurbished 32,772sq m of sales space, corresponding to 3.5% and 6.9% of total space respectively. Total retail space amounted to 471,591sq m.

Regional performance

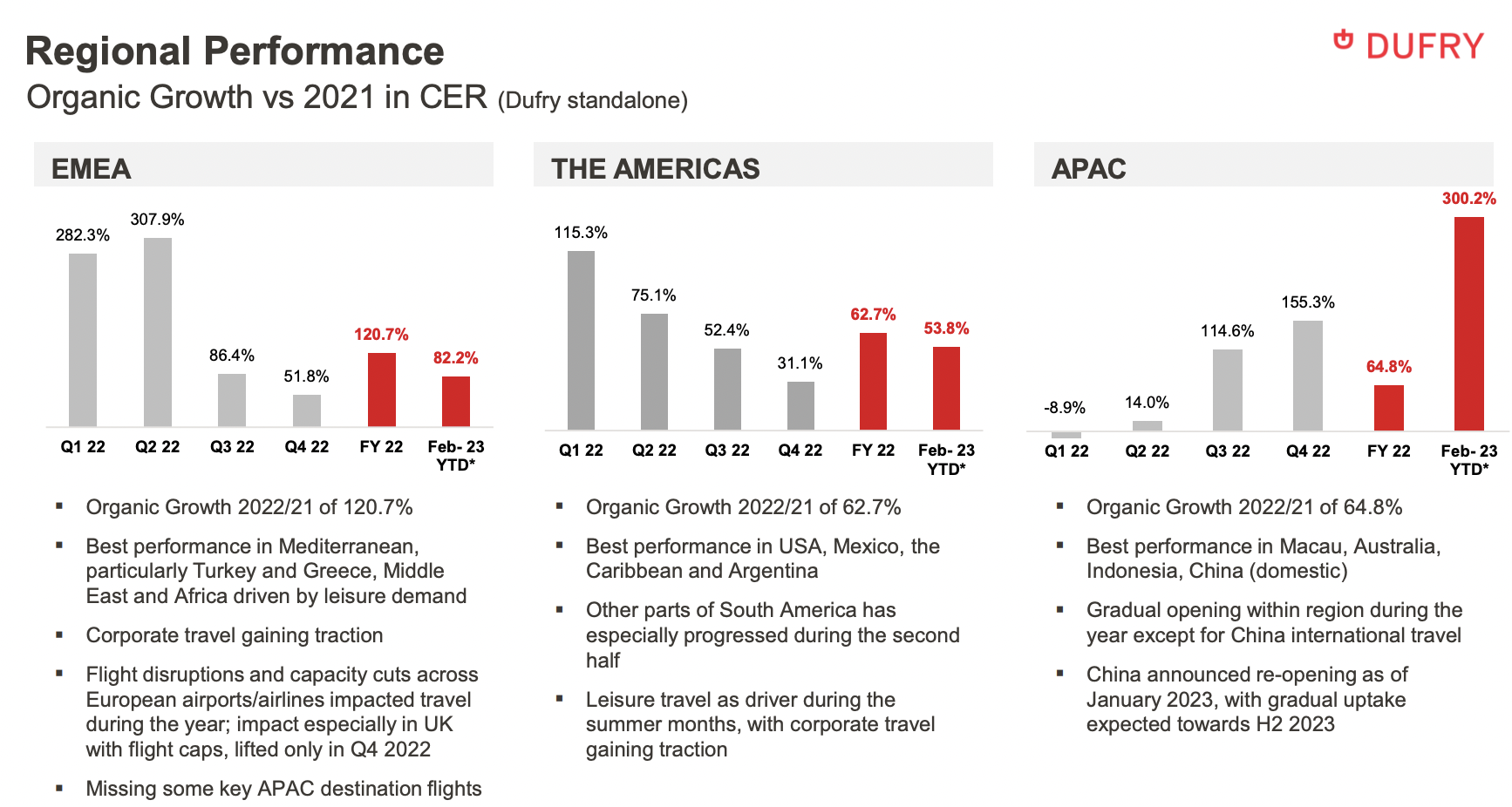

Turnover in Europe, Middle East and Africa was CHF3,586.0 million in 2022, up by +120.7% on 2021 (in organic terms at constant exchange rates). The best performing markets were in Turkey, Greece, Middle East, Southern Europe and Africa driven by strong leisure demand. The EMEA performance was strong despite flight disruptions and capacity cuts across European airports and by airlines. Asia Pacific turnover reached CHF165.9 million in 2022, climbing +64.8% in organic terms year-on-year, with the business affected by strict Covid-related policies in some markets. Since Q3, Dufry’s locations in Macau, Australia, Indonesia and China (domestic) saw steep increases compared to last year but still performed at a low level versus other regions globally.

Asia Pacific turnover reached CHF165.9 million in 2022, climbing +64.8% in organic terms year-on-year, with the business affected by strict Covid-related policies in some markets. Since Q3, Dufry’s locations in Macau, Australia, Indonesia and China (domestic) saw steep increases compared to last year but still performed at a low level versus other regions globally.

Turnover in the Americas hit CHF2,918.3 million in 2022, up by +62.7% at constant exchange rates with strong performances in particular from the USA, Mexico, Dominican Republic and Argentina. Dufry said it is “engaging with airports in the region on combined travel retail and F&B offerings to enhance travellers’ experience”.

Strong start to 2023

Dufry said that year-to-date net sales performance by February had climbed by +71.3% versus 2022, in constant currency terms.

“Dufry sees strong demand and positive trends on all key indicators; however, we remain vigilant given limited visibility regarding the geopolitical environment, the economic situation and related consumer sentiment as well as global travel industry operational challenges.”

For the business combination with Autogrill, key milestones have been achieved including all regulatory approvals and the transfer of the 50.3% stake in Autogrill, formerly held by Edizione. Dufry is consolidating Autogrill as of February 2023. Under Italian law, Dufry will shortly launch a mandatory public exchange offer on the remaining Autogrill shares, and expects to close the full transaction towards the end of 2023, including the mandatory exchange offer settlement.

Looking ahead, Dufry projected turnover growth of +7% to +10% a year in 2023/24 for the combined group, from a base of CHF10,985 million (based on 2022 pro forma figures).

Looking ahead, Dufry projected turnover growth of +7% to +10% a year in 2023/24 for the combined group, from a base of CHF10,985 million (based on 2022 pro forma figures).

The Board of Directors has resolved to propose not to pay a dividend for 2022. “This allows Dufry to focus on strengthening the company’s financial position and on closing the business combination with Autogrill.

“The Board of Directors will consider re-initiation of dividend payments in line with Dufry’s overall capital allocation policy considering deleveraging, growth opportunities and returning cash to shareholders. Dufry expects attractive shareholder value generation to result from the successful execution of its ‘Destination 2027’ strategy including the business combination with Autogrill,” said the company.

Dufry also said it had made “considerable progress” on implementing its ESG strategy. This includes a Science Based Targets initiative (SBTi) validation of its emission reduction targets, publication of a first Task Force on Climate-Related Financial Disclosure Report and advancing Diversity & Inclusion (D&I) and Community Engagement initiatives.

Dufry has also completed the Supplier Code of Conduct recertification process across North America, now covering 59% of purchasing volume (COGS) globally. In the context of recent events, Dufry has committed to support the communities affected in Turkey and Syria suffering from the tragic impact of the devastating earthquake with initiatives from the company and its customers.

In the context of recent events, Dufry has committed to support the communities affected in Turkey and Syria suffering from the tragic impact of the devastating earthquake with initiatives from the company and its customers.

Rossinyol said: “In the name of the combined teams of Dufry and Autogrill, I would like to renew our sincere sympathy for the communities affected by the devastating earthquake in Turkey and Syria. Our thoughts are with these people and their families and I can confirm Dufry’s commitment to support them with combined initiatives on the part of both the company and our customers.

Rossinyol concluded: “I want to thank our external business partners, including our concession partners, brand suppliers, the financial community and our share- and bondholders who continue to support the company. Our common vision is to further develop Dufry and drive the Travel Experience revolution. My thanks go to our Chairman, Juan Carlos Torres, and the Board of Directors for their trust and support in evolving our company. A special thanks to Edizione and its Chairman, Alessandro Benetton, for their support in combining the two companies.

“Above all, I want to thank our employees for the extraordinary motivation and hard work they have given the company, demonstrating a great level of dedication and deserving my and our managements’ respect and gratitude.”