|

“We are running with full speed to execute important projects in Brazil, Asia, and the US.“ |

Julián Díaz CEO Dufry |

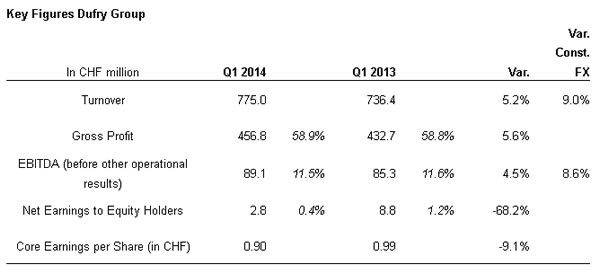

INTERNATIONAL. Dufry’s turnover grew by +9.0% at constant exchange rates (+5.2% reported) in Q1 2014, reaching CHF775.0 million (US$885 million), driven by a combination of organic growth and the acquisition of Hellenic Duty Free Shops. During the first quarter EBITDA reached CHF89.1 million (US$102 million, +4.5%) and EBITDA margin stood at 11.5%.

The first quarter is the lowest quarter in terms of seasonality, and there was also a calendar effect from Easter, which in 2013 took place in the first quarter and this year moved to the second quarter, noted the group.

Organic growth was also affected by currency volatility suffered by some nationalities, like Brazilians and Russians. The appreciation of the Swiss Franc against the US Dollar resulted in an exchange effect of -3.8% in the first quarter.

Dufry Group CEO Julián Díaz said: “Overall, we had a good quarter. Profitability and cash generation were very healthy, even as we have invested in many new projects resulting in higher capital expenditure and net working capital. Only turnover growth was held back by FX movements and the shift of Easter holidays.

“As mentioned many times, we [have] a number of projects in 2014 and we are running with full speed to execute these important projects in Brazil, Asia, and the US.”

Turnover

In the first quarter of 2014 Dufry’s turnover grew by +9.0% (at constant rates of exchange), of which 6.8% was the contribution consolidation of the Hellenic Duty Free acquisition. Organic growth was +2.2%, to which like-for-like growth contributed +0.7% and new concessions, net, added +1.5% as the result of openings of 4.3% versus closings of 2.8%. Reported turnover in Swiss Francs reached CHF775.0 million from CHF736.4 million in the first quarter of 2014, a growth of +5.2%, after a -3.8% translational impact, driven by the appreciation of the Swiss Franc in the period.

|

Turnover in Region EMEA & Asia grew by +31.4% in the first quarter of 2014 and reached CHF239.8 million from CHF182.5 million in the previous year. Besides the consolidation of the business acquired in Greece in April 2013, other operations in the region performed solidly as well, said Dufry.

In Europe, France and Spain had strong growth. Africa showed a positive performance as Morocco and Ivory Coast had double-digit sales growth and helped mitigate the lower results in Egypt. In Eastern Europe, Serbia and Armenia performed well, while operations in Russia were hit by the depreciation of the Russian Rouble and the political situation in the Ukraine. In the Middle East and Asia, growth was strong as a combination of like-for-like in the existing operations especially in China and Cambodia as well the effect of the first openings in Asia.

Turnover in Region America I stood at CHF174.7 million in the year to March, versus CHF190.5 million in the same period in 2013. The performance of this region was affected by the devaluation of local currencies, especially in Uruguay, where like-for-like sales were negatively impacted by the reduction in purchasing power in local currency terms.

In addition to that, Argentina and the Caribbean operations had the negative impact of a calendar effect from Easter, which in 2013 took place in the first quarter and this year moved to the second quarter. Despite the devaluation, Dufry registered growth in sales of +14% in America I when accounted in local currencies.

Turnover in Region America II stood at CHF138.4 million in the first quarter of 2014 compared to CHF158.6 million in the same period in 2013. When measured in Brazilian Reals, sales continued to grow, as in the previous quarters, but the devaluation of the local currency versus the US Dollar of -18% in the first quarter masked the positive performance.

On the business development side, Dufry noted that it is “well on track” with the expansion of its operations in the country, most notably in São Paulo and Brasilia – the first Hudson News shops have been opened in the latter. Dufry expects to be operational in these locations ahead of the Football World Cup in June.

Turnover in Region United States & Canada grew by +13.2% at constant FX rates. In Swiss Franc terms, turnover came to CHF205.0 million in the first quarter of 2014 from CHF189.8 million in the same period in 2013. The region managed to largely outpace the increase in the number of passengers by improving the retail operations and expanding its footprint in the United States, where 1,400sq m were added in so far in the year.

|

Click on the above to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

Díaz said: “In Brazil, the core of the new operations will be located at Sao Paulo Guarulhos, Brasilia and Viracopos International Airports. We are putting all our efforts and working to open the shops ahead of the Football World Cup. As for Asia, another region where we are going to increase substantially our footprint, all plans are on track. We have already started operations in Bali, Indonesia, in Astana, Kazakhstan, Sri Lanka and South Korea. The remaining operations to be opened in Taiwan and China, should be fully operational by the beginning of the second half of 2014.

“Regarding our operations in US & Canada, the pipeline keeps healthy as we opened already in the first quarter 17 shops with almost 1,400sq m in several airports. It is worth noting that these new shops already reflect the new Hudson model with new logo, shop layout and assortment. We also opened brand boutiques in Newark, New York, Chicago and Sandford. Looking ahead, our project pipeline still shows several opportunities for expansion being as duty paid or duty free with total area of almost 3,600 sqm to be opened almost entirely in 2014.

“Last but not least, our Hudson operation continues to deliver excellent results and our plan is to roll out the concept further outside US & Canada. Today we are present in 12 countries including Brazil, where we opened our first Hudson shop earlier this year in April. In addition, we have been awarded to operate 9 Hudson shops with a total retail space of 1’900 square meters at five airports in Spain that will open along 2014. Our target going forward is to double the number of Hudson shops internationally to about 200 shops by 2015 and for that we have developed an internal group that will focus all the effort and expertise to achieve it.

Gross profit grew by +5.6% and reached CHF456.8 million in the first quarter of 2014 versus CHF432.7 million one year before. Gross profit margin expanded by 10 basis points to 58.9%, notwithstanding the negative impact from the consolidation effect of the business in Greece, which has below average gross margin. Excluding this effect, gross margin improvement was 60 basis points, which reflects the reorganisation of procurement and logistics structures, as announced in 2013.

Selling expenses as a percentage of turnover remained practically stable at 24.2% in the first quarter of 2014, from 24.1% in 2013. In absolute terms, they reached CHF187.2 million in 2014 versus CHF177.7 million one year earlier.

Personnel expenses increased to CHF127.8 million in the first quarter 2014 from to CHF115.9 million in the same period 2013. As a percentage of turnover it went to 16.5% versus 15.7% in the first quarter of 2013. The consolidation of Hellenic Duty Free is the main reason for the increase, as a result of the strong seasonality of the business.

|

Click on the above to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

Depreciation was CHF18.3 million in the first quarter of 2014, compared to CHF15.6 million in the same period in 2013 and increased as a percentage of turnover to 2.4% from 2.1% in the first quarter of 2013. Amortization increased by CHF6.0 million, as a result of the consolidation of the Folli Follie Travel retail business, and reached CHF31.9 million in the first quarter of 2014 from CHF25.9 million in the same period last year.

Other operational result (net) was minus CHF3.8 million in the first quarter of 2014, which are mainly due to the transaction costs and start-up costs of new projects in the period.

EBIT reached CHF35.1 million in the first quarter of 2014 versus CHF37.8 million in the year before.

Net earnings for the first quarter of 2014 stood at CHF9.9 million versus CHF15.4 million reported last year. Net earnings attributable to equity holders for the quarter ending 31 March 2014 reached CHF2.8 million. Hellenic Duty Free, which has been consolidated since April 2013, has a very strong seasonality with the first quarter being the lowest quarter. For this reason, the respective personnel expenses, as well as depreciation, amortization and interest expenses, had an above average impact on net profit.

Cash flow before working capital changes reached CHF93.6 million in the first quarter of 2014 versus CHF81.0 million one year earlier. In the year to March, capital expenditure stood at CHF 49.3 million and free cash flow reached CHF21.4 million. The increase in capital expenditure of CHF27.8 million, when compared to the first quarter 2013, is a result of the several shop openings expected for 2014 mainly in Brazil and Asia.

Net debt at the end of March 2014 was CHF1,726.6 million compared to the CHF1,753.4 million at the end of December 2013. The main covenant at group level, net debt/adjusted EBITDA, stood at 3.66x as of March 31, 2014.

Díaz added: “Regarding the travel retail industry, we continue to see a positive scenario for the economy and the travel retail in general. So far the number of international passengers grew by +6% in the year and is expected to grow by +4% in 2014.

“With several new projects expected to become operational in Q2 2014, there will be growth momentum building up in the second half of 2014 and in 2015 we should see the full benefit of this additional retail space. We are committed to our strategy of profitable growth organically or through acquisitions and we continue to develop new projects.”