ISRAEL. Israel Airports Authority (IAA) has unveiled further key details of the duty free tender covering terminals 1 and 3 at Ben Gurion International Airport.

ISRAEL. Israel Airports Authority (IAA) has unveiled further key details of the duty free tender covering terminals 1 and 3 at Ben Gurion International Airport.

As revealed by The Moodie Davitt Report, the tender was issued on Monday.

Bidders can make offers on either or both businesses. The contract/s run for seven years from 1 January 2018 with a three-year extension at the Authority’s discretion. Submissions are due by 9 August.

The two-terminal tender is a result of the full re-opening of Ben Gurion Airport T1 to international departing (not arriving) passengers on 19 June. Incumbent JR/Duty Free will open a near 500sq m store in T1 on that date, operating under its contract that expires on 31 December.

Contract changes announced

In an important change, IAA has lowered the contractual linkage rate for the increase in passenger traffic from 70% to 40% due to an anticipated continuation of the recent heavy rise in traffic at Ben Gurion Airport. As such the authority is attempting to reduce the risks faced by the retailer (or retailers in the case of two winners) if traffic continues to surge. It has doubled over the past decade.

Israel Airports Authority said: “With the full opening of Terminal 1 for international low-cost flights, the mix of passengers departing from Terminal 1 at Ben Gurion Airport will be changed as every year an estimated 1.5 million passengers will pass there, whereas the [outbound] passenger traffic from Terminal 3 is expected to exceed 8 million passengers for a year.”

T1 is expected to handled 216 international flights from 24 countries and 45 destinations each week once fully re-opened. Airlines operating from the facility include Israir, Arkia, Wizzair, Easyjet, Up, Pegasus, TOS, Ryanair and Blue Bird.

As reported, IAA has also doubled the space dedicated to last-minute duty free stores in each of the T3 concourses.

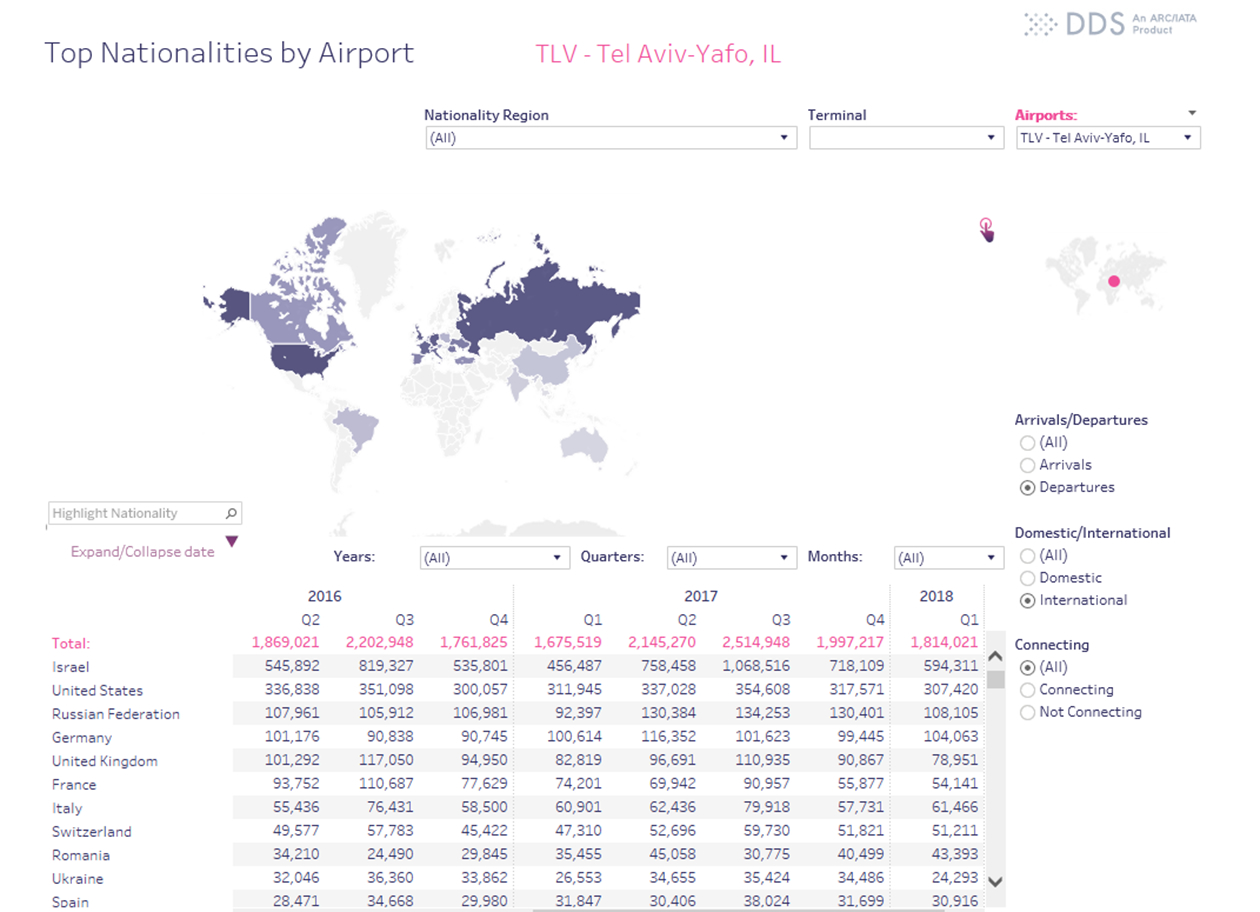

Business 1ntelligence Service offers key insights into Ben Gurion passenger traffic

The tables below on Ben Gurion International Airport are courtesy of a new and exclusive relationship, unveiled today, between The Moodie Davitt Report and leading travel retail research and analysis house m1nd-set. The Swiss company recently launched its Business 1ntelligence Service (B1S), a unique air traffic forecasting tool, developed with IATA and ARC’s ‘Direct Data Service’ (DDS) database.

The DDS program is built on travel agency sales data captured through ARC and IATA’s financial settlement systems and ticket sales contributed by airlines participating in the programme. DDS is able to estimate 100% of global airline sales data, including scheduled and charter flights and low cost airline traffic, and will even distinguish between travel classes. For more information e-mail m1nd-set Founder & CEO Peter Mohn at pmohn@ms-research.net

The tender is open to international duty free retailers and local companies.

The T3 (and soon T1) incumbent is JR/Duty Free. As reported, JR and Heinemann entered a joint venture earlier this year for future contracts. Given that the alliance has since been approved by the Israeli Antitrust Authority, it seems likely that the two parties will bid together on the new operation/s.

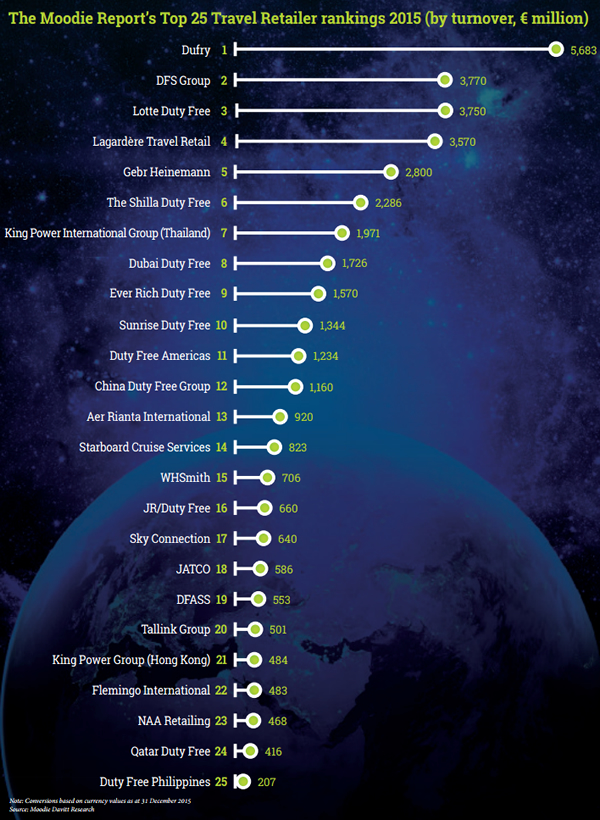

Noting strong retailer interest in the concession, IAA said: “Among the companies interested in the tender for the management and operation of the duty free at Ben Gurion Airport are the world’s largest companies with sales turnover exceeding €2 billion each.” Other likely candidates include Duty Free Americas and DFASS.

As reported, JR/Duty Free won the last seven year and three-month contract (with a three-year extension option) in 2014 with a minimum annual guarantee of US$169 million, narrowly heading off a rival bid from Gebr Heinemann Israel (a joint venture between Gebr Heinemann and Russian-Israeli company Alfa).

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie atMartin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.