EUROPE. Airports Council International (ACI) Europe’s 2025 airport traffic report highlights a resilient air travel market, with passenger traffic across the region’s airports reaching a record 2.6 billion, up +4.4% year-on-year.

The Full Year 2025 Airport Traffic Report underscores strong travel demand, despite what ACI Europe described as generally lacklustre European economies, high airfares, significant supply and capacity pressures, and increasingly volatile geopolitical tensions.

Following the post-pandemic rebound, the 2025 performance reflects a steady recovery towards “normalised” growth patterns, with an additional 100 million passengers.

Passenger traffic sustained positive momentum throughout 2025, accelerating to +6.1% in Q4 and pointing to continued growth in 2026.

The rise was largely attributed to international traffic climbing +5.6%, while domestic traffic remained stable at +0.2%.

Non-EU+ airports led the strong performance, with passenger numbers rising +6.2%, compared with +4% growth at EU+ airports, mainly due to the more mature EU+ market and lower travel propensity in non-EU+ regions.

Despite many airports reaching new passenger highs, regional performance remains uneven, with 41% still below pre-pandemic (2019) levels, underscoring the impact of traffic volatility, airline dominance and consolidation, and rising competition.

Aircraft movements across Europe rose +3.2% year-on-year, with EU+ airports recording a +2.8% increase and non-EU+ airports growing +5.6%.

ACI Europe Director General Olivier Jankovec said, “If anything, last year’s traffic performance is yet another proof that air connectivity is a powerful and largely resilient economic driver, increasingly intertwined with tourism.

“This reflects the rise of experiential consumption over material consumption – a deep‑seated cross-generational structural shift that is reshaping our economies, and for which Europe is uniquely well positioned.

“This means aviation is a critical enabler of competitiveness. Yet too many governments and policy makers still fail to connect the dots, and do not treat aviation as the strategic asset it is – especially in the EU.”

Mixed passenger volumes across Europe’s airports

A notable geographic shift marked EU+ market performance, with momentum moving steadily from south to the east of the bloc. The top growth markets were Slovakia (+20.2%), Poland (+14.4%), Hungary (+11.1%) and Slovenia (+10.7%), alongside Malta (+12.3%) and Cyprus (+10.7%).

Passenger traffic in some of the largest EU+ markets slowed, with modest gains in the UK (+1.7%), France (+2.1%) and Germany (+3.2%), largely due to punitive taxation. Domestic traffic in Germany and France fell sharply by -48% and -27%, respectively, and remains well below 2019 levels.

Passenger traffic in some of the largest EU+ markets slowed, with modest gains in the UK (+1.7%), France (+2.1%) and Germany (+3.2%), largely due to punitive taxation. Domestic traffic in Germany and France fell sharply by -48% and -27%, respectively, and remains well below 2019 levels.

In contrast, Italy and Spain saw passenger traffic rise +4.4% and +3.9%, supported by favourable macroeconomic and aviation policies.

In Iceland (-2%), Latvia and Estonia (both -0.1%), passenger numbers either declined or remained flat, as local airlines reduced or ceased operations.

Performance across non-EU+ airports reflected geopolitical influences, with Moldova (+46.8%) serving the Ukrainian diaspora, Israel (+31.3%) benefitting from enhanced security, and Russia experiencing a further drop (-9.5%).

Low-cost carrier expansion also played a key role in traffic growth, particularly at Western Balkans airports, with Bosnia & Herzegovina (+22.2%), North Macedonia (+9.5%) and Albania (+8.7%) posting significant increases.

In the key Türkiye market, passenger traffic jumped +5.8%, bolstered by dynamic growth at its largest airports. Meanwhile, Georgia (+14.1%) and Uzbekistan (+10.1%) led the region with the strongest performances in Central Asia & the Caucasus.

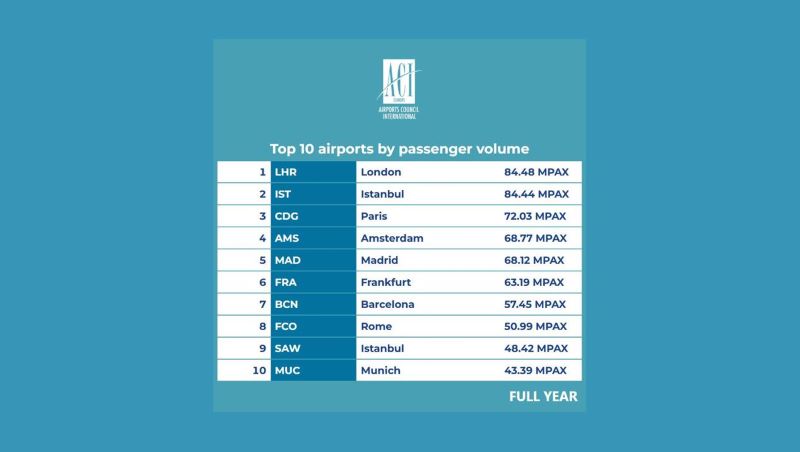

Top 5 airports by passenger volumes

London Heathrow continued to lead European airports in passenger traffic, with 84.48 million, up +0.7% year-on-year, as airlines deployed larger aircraft into the capacity-constrained British hub.

Istanbul remained the region’s second-busiest airport, just 40,000 behind London Heathrow, with traffic up +5.5%, and has seen growth of almost a quarter over the last five years.

Paris Charles de Gaulle maintained its third-place ranking with 72.02 million passengers, up +2.5%, followed by Amsterdam Schiphol, which recorded 68.77 million passengers, an increase of +2.9%.

Madrid also posted higher gains, with passenger numbers reaching 68.12 million, up +3%.

Beyond the top five airports, Istanbul Sabiha Gökçen stood out among major airports (over 40 million passengers), recording a strong +16.7% increase to 48.41 million passengers.

Major airports lag behind large and smaller hubs

Across the region, major airports posted passenger growth of +3.5%, lagging behind large airports (10-25 million passengers) at +5.8% and small airports (under 1 million passengers) at +6.1%.

The outcome reflects several factors, including selective low-cost carrier expansion across both smaller and larger markets, along with significant route churn.

Capacity constraints at major and mega airports (25-40 million passengers) were another factor influencing the outcome.

Despite nominal gains, small airports remain the only segment to lag behind pre-pandemic passenger levels, down -33.2% from 2019.

Data by airport groups

The airports that reported the best performance in passenger traffic for the full-year 2025 compared to the preceding year are as follows:

Majors (over 40 million passengers): Istanbul Sabiha Gökçen (+16.7%), Istanbul (+5.5%), Barcelona (+4.4%), Munich (+4.4%) and Rome (+4.3%)

Mega airports (25-40 million passengers): Milan (+8.6%), Copenhagen (+8.5%), Athens (+6.8%), Paris Orly (+5.5%) and Dublin (+5.2%)

Large airports (10-25 million passengers): Tel Aviv (+31.9%), Krakow (+19.5%), Warsaw (+13.2%), Budapest (+11.7%) and Izmir (+9.9%)

Medium airports (1-10 million passengers): Chișinău (+46.8%), Trieste (+25.2%), Bratislava (+25.2%), Sarajevo (+22.2%) and Varna (+19.8%)

Small airports (fewer than 1 million passengers): Bucharest (+572.9%), Burgos (+56.6%), Oradea (+51.9%), Syros Island (+51.1%) and Linz (+45.1%)

Looking ahead to 2026, Jankovec said: “Passenger traffic at Europe’s airports is set to continue expanding this year, with growth expected to further normalise at around +3.3%.

“Upside potential stems from modestly improving European economic prospects, while travel remains among consumers’ top discretionary spending priorities – even as geopolitics and geoeconomics are likely to further test the sector’s resilience.

“Many airports are also likely to benefit from Europeans being more prone to travel within Europe rather than externally, while our continent will remain a destination of choice for non-Europeans.

“Meanwhile, Europe’s airlines are projected to deliver the strongest financial performance globally, and the supply chain pressures constraining their capacity deployment are expected to somewhat ease.

“However, infrastructure capacity both on the ground and in the air will remain a key bottleneck. We are especially concerned with the full roll-out of the Schengen Entry/Exit System as of April.” ✈