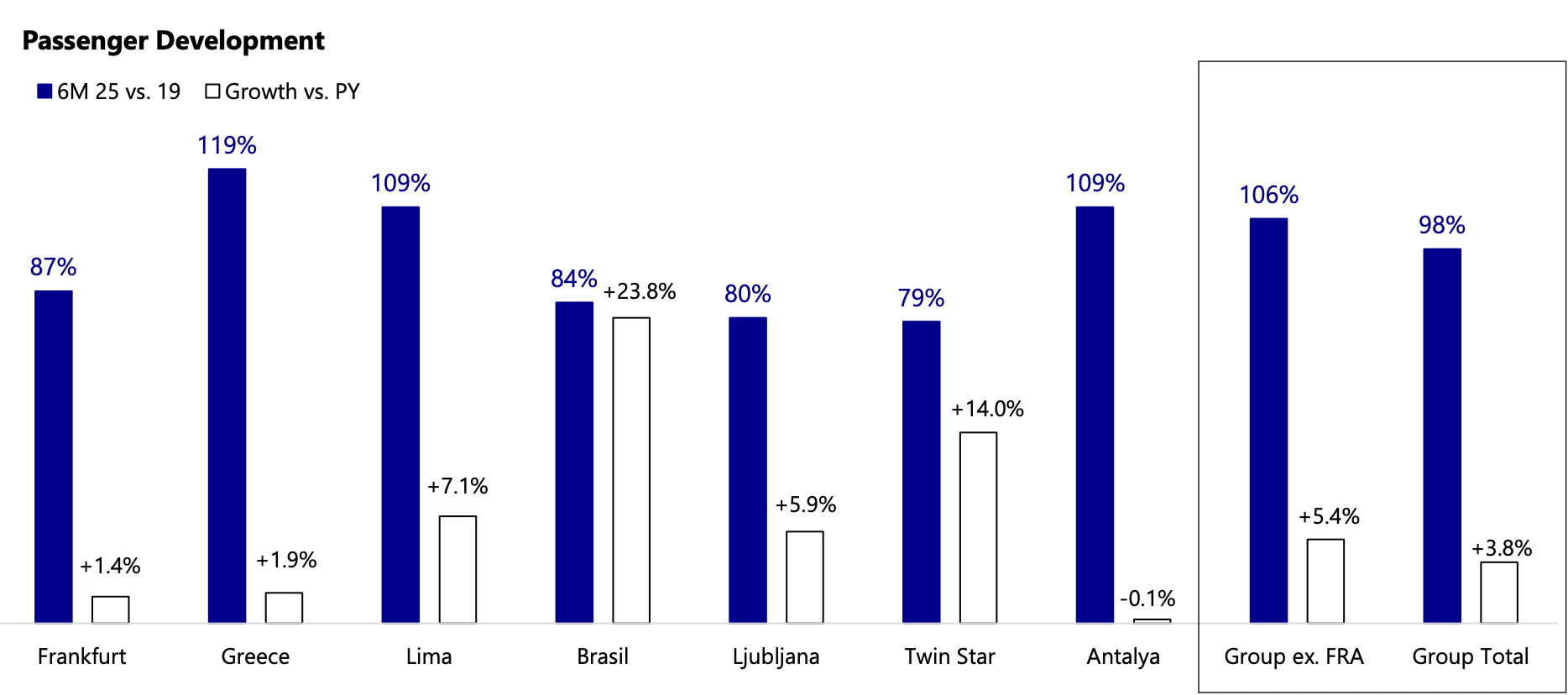

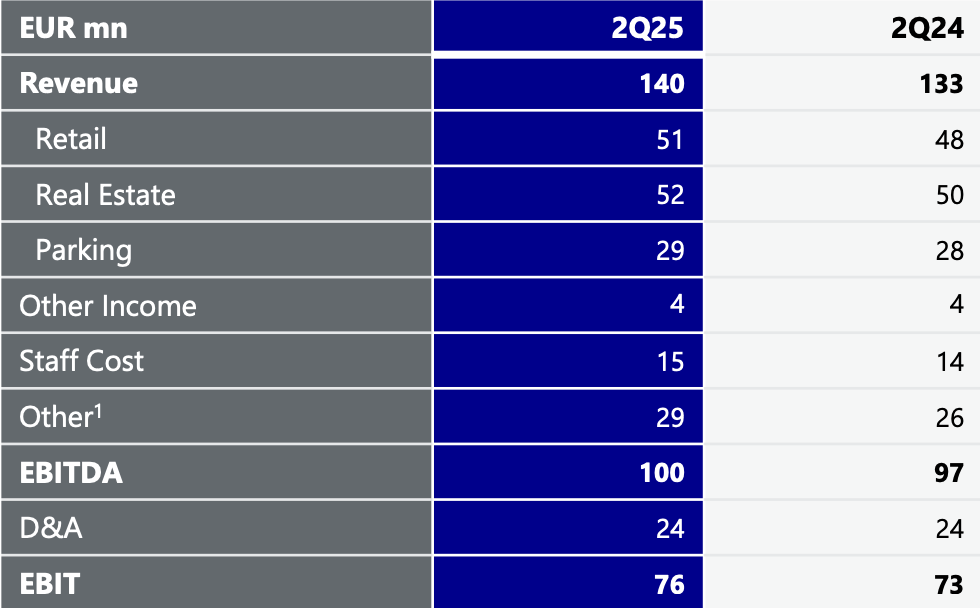

GERMANY. Frankfurt Airport owner Fraport today reported half-year results to 30 June, with Retail & Rest Estate revenues climbing by +5% year-on-year to €140 million. Within this, retail grew by +6%. This outstripped group +3.8% passenger traffic growth (to 77 million) and a +1.4% increase (to 29.1 million) at Frankfurt Airport.

Q2 retail revenue per passenger climbed €3.17 from €3.10 in the same period last year. This was driven by improved advertising and F&B spend though shopping spend weakened.

After adjustments for revenues from construction and expansion measures (in line with IFRIC 12), revenue across the group in the half rose by +7.3% to €1.9 billion.

EBITDA slipped -1% to €561.2 million and net profit fell -38.7% to €98.6 million. This was attributed to non-recurring effects in the same period in 2024.

Fraport CEO Dr. Stefan Schulte said: “We’re on track to achieve our targets for the year. Following a lacklustre first quarter – impacted by non-recurring effects from the previous year – we were able to improve our operating result significantly in the second quarter by a strong +8.2%.

“For the second half of 2025, we’re expecting growth across all of our airports, with our international portfolio performing more strongly than Frankfurt. As the German Federal Government is failing to implement its pledge under the coalition agreement to make urgent cuts to excessively high regulatory costs even in its 2026 budget, additional growth drivers for the German market are becoming an even more distant prospect.

“The Federal Government is passing up an opportunity to strengthen the competitiveness of our industry. The connectivity of German airports will reduce, to the detriment of leisure and business travellers. In contrast to Frankfurt, our international business will benefit particularly from the successful completion of expansions to our airports in Lima and Antalya.”

In 2024, the first half was impacted by non-recurring effects. In particular, these included a pandemic compensatory payment for Fraport Greece (€28 million) and compensation of €9.1 million for damage caused by flooding at the airport in Porto Alegre.

Fraport’s executive board confirmed forecasts for the fiscal year. Frankfurt Airport passenger numbers are expected to reach up to 64 million. A moderate increase in group EBITDA is forecast. Expectations for group profit remain in a range from “stable to slightly falling”. ✈