GERMANY/INTERNATIONAL. German and global airport operator Fraport achieved what it described as a significant increase in revenue and net profit during both the third quarter and the first nine months (ended 30 September) of the 2021 business year.

Factors contributing to these increases included a positive operational performance and several one-off effects. Forecasts for the upcoming winter season are also optimistic. As a result, Fraport has revised its full-year outlook for revenue and other key financial figures slightly upwards. Traffic development at Frankfurt Airport is forecast to reach the upper area of the expected performance range, between under 20 million to 25 million passengers.

Revenue in the Retail & Real Estate segment in the nine-month reporting period amounted to €231.8 million (+€6.3 million or +2.6% year-on-year) due to higher real estate and parking revenue (+€5.8 million and +€1.0 million, respectively). Net retail revenue per passenger was €3.74 (down from the €4.40 figure in the first nine months last year).

For Q3 Retail & Real Estate revenue rose by an encouraging +36.0% or €24.5 million to €92.5 million.

Fraport CEO Dr. Stefan Schulte explained: “Following the massive losses experienced in 2020 and the resulting sharp rise in debt, we are now seeing brighter prospects ahead.

“Demand for holiday travel during the summer months was relatively strong. Moreover, our result has improved due to financial compensation received for pandemic-related losses incurred at various Group airports. Now, we are also expecting intercontinental traffic to gradually recover – supported by the recent re-opening of the US borders.

“Consequently, we are a bit more optimistic about the winter season than we were just a few months ago. Nevertheless, it is still a long way ahead until we reach pre-pandemic passenger levels again and are able to reduce our debt significantly.”

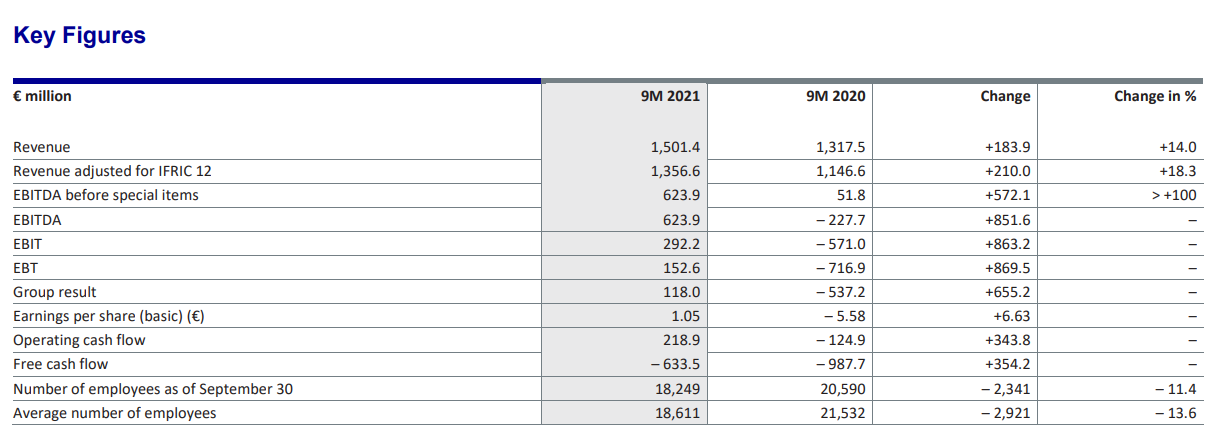

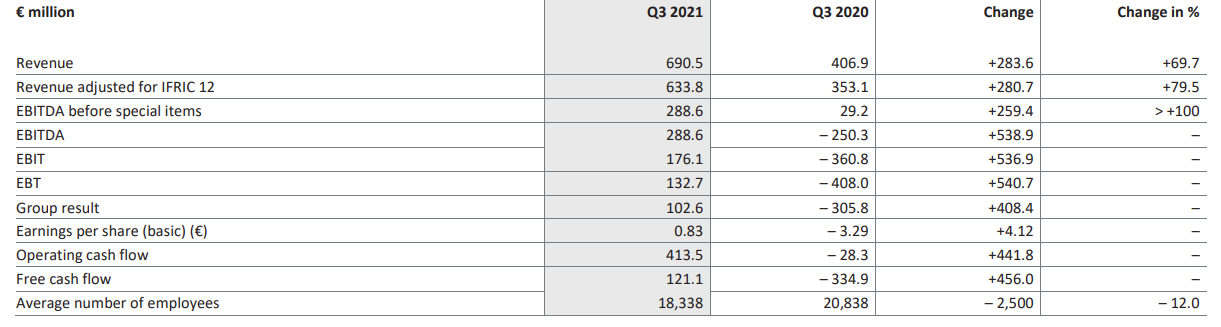

Third quarter: revenue and net profit grow strongly

Boosted by a noticeable recovery in holiday travel during the summer season, revenue soared in the third quarter of 2021 by +79.5% year-on-year to €633.8 million.

EBITDA rose to €288.6 million in the third quarter, up from minus €250.3 million in Q3/2020. However, this gain also reflected several one-off effects: In the third quarter of 2020, earnings were negatively impacted by the creation of provisions for personnel-reduction measures totalling €279.5 million.

This year, in turn, a positive contribution in the third quarter came from COVID-related compensation to Fraport subsidiaries in the USA, Slovenia and Greece – which boosted the Group’s ‘Other Income’ by some €30 million. Adjusting for these one-off effects, Fraport still posted strong EBITDA growth of +785.6% to €258.6 million in the third quarter of 2021.

The Group result – or net profit – grew to €102.6 million in Q3/2021 (including the aforementioned one-off effects), compared to minus €305.8 million in Q3/2020.

‘Solid’ first nine months of 2021, buoyed by one-off effects

During the first nine months of the current year, Group revenue rose by +18.3% year-on-year to nearly €1.4 billion. Along with passenger growth outside of Frankfurt, revenue was positively impacted by an agreement reached in the first quarter of 2021 between Fraport and the German Federal Police (Bundespolizei) for remuneration of aviation security services provided by Fraport previously. The agreement generated extra revenue of €57.8 million.

Other one-off effects also had a positive impact on the income side. These included compensation from the German and State of Hesse governments granted to Fraport for maintaining Frankfurt Airport’s operational readiness during lockdown, as well as pandemic compensation to the Group’s subsidiaries in Greece, the USA and Slovenia – which contributed a total of €275.1 million to Fraport’s ‘Other Income’.

Combined with the remuneration payment from the German Federal Police, these non-recurring effects contributed a total of €332.9 million to other income, with a corresponding positive effect on the operating result (EBITDA).

These factors drove EBITDA into positive territory again, climbing to €623.9 million in the reporting period (9 months 2020: minus €227.7 million). When adjusting the previous year’s 9M-EBITDA by the negative one-off effect resulting from personnel measures – and also adjusting this year’s 9 months EBITDA by the positive one-off effects mentioned above – the Group EBITDA still increased by €239.2 million to €291.0 million in the reporting period.

Including the one-off effects, Fraport recorded a positive Group EBIT of €292.2 million in the first nine months of 2021 (compared to minus €571.0 million in the same period last year). Group EBT improved to €152.6 million (minus €716.9 million). Fraport achieved a Group result (net profit) of €118.0 million in the reporting period, up from minus €537.2 million last year.

Passenger traffic rebounds noticeably

Frankfurt Airport (FRA), Fraport’s home-base hub, welcomed a total of about 15.8 million passengers from January-to-September 2021. This represented a small decline of -2.2% year-on-year as the pandemic only began to have a strong negative impact on traffic from mid-March 2020 onwards.

When compared to the 2019 pre-crisis year, passenger numbers dropped by -70.8% in the first nine months of 2021. However, volumes rebounded noticeably during the nine-month reporting period, reaching around 45% of the pre-crisis level between June and September.

Preliminary figures indicate that this trend also continued in October 2021, with passenger numbers soaring by +218% year-on-year to 3.4 million (representing 53% of the level recorded in October 2019). The ongoing recovery was largely driven by holiday travel during the fall break in Germany.

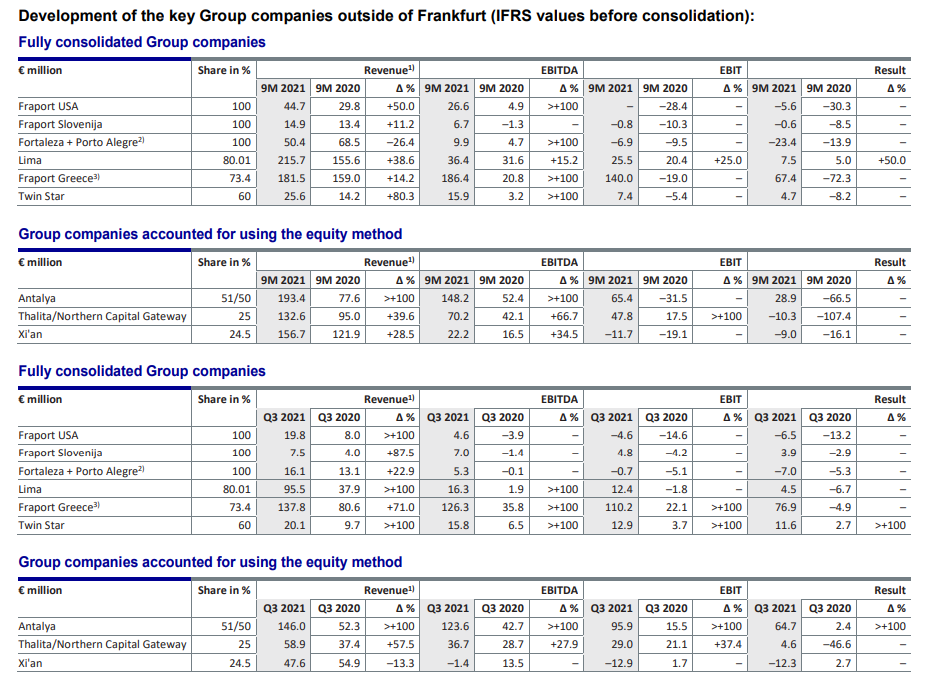

Across the Group, the airports in Fraport’s international portfolio also recorded a noticeable recovery in passenger traffic in the first nine months of 2021. In comparison to pre-crisis levels, these airports still registered lower passenger figures. However, some Group airports serving high-demand tourist destinations – such as the Greek airports or Antalya Airport on the Turkish Riviera – saw traffic rebound to over 50% of pre-crisis levels.

During the summer holiday season, these gateways even reached nearly 80% of the respective passenger volume recorded in 2019 – while exceeding more than 90% of pre-crisis levels according to the preliminary October 2021 figures.

Outlook upgraded

In view of the ongoing traffic recovery, the Fraport Executive Board now expects FRA’s passenger traffic for the full-year 2021 to reach the upper area of the forecast range, between under 20 million to 25 million passengers.

In view of the positive performance achieved in the first nine months of 2021 and the optimistic fourth-quarter forecast, Fraport’s Executive Board has raised its full-year outlook slightly upward from the forecast given in the half-year interim report. Revenue is now expected to reach just over €2 billion (previously: around €2 billion). Group EBITDA is forecast to range from approximately €650 million to just over €700 million (previously: between about €460 million to €610 million). Group EBIT is now expected to reach a range from around €200 million to just over €250 million (previously: EBIT was only generally expected to be in positive territory).

The Group result or net profit is now expected to be in positive territory (previously: slightly negative to slightly positive).

The traffic outlook remains unchanged for the medium term. Fraport expects Frankfurt Airport’s passenger traffic to reach the pre-crisis level by 2026 – or by 2025 at the earliest. Traffic at Fraport’s Group airports worldwide is forecast to recover at a faster pace, rebounding to pre-crisis levels on average by 2023.