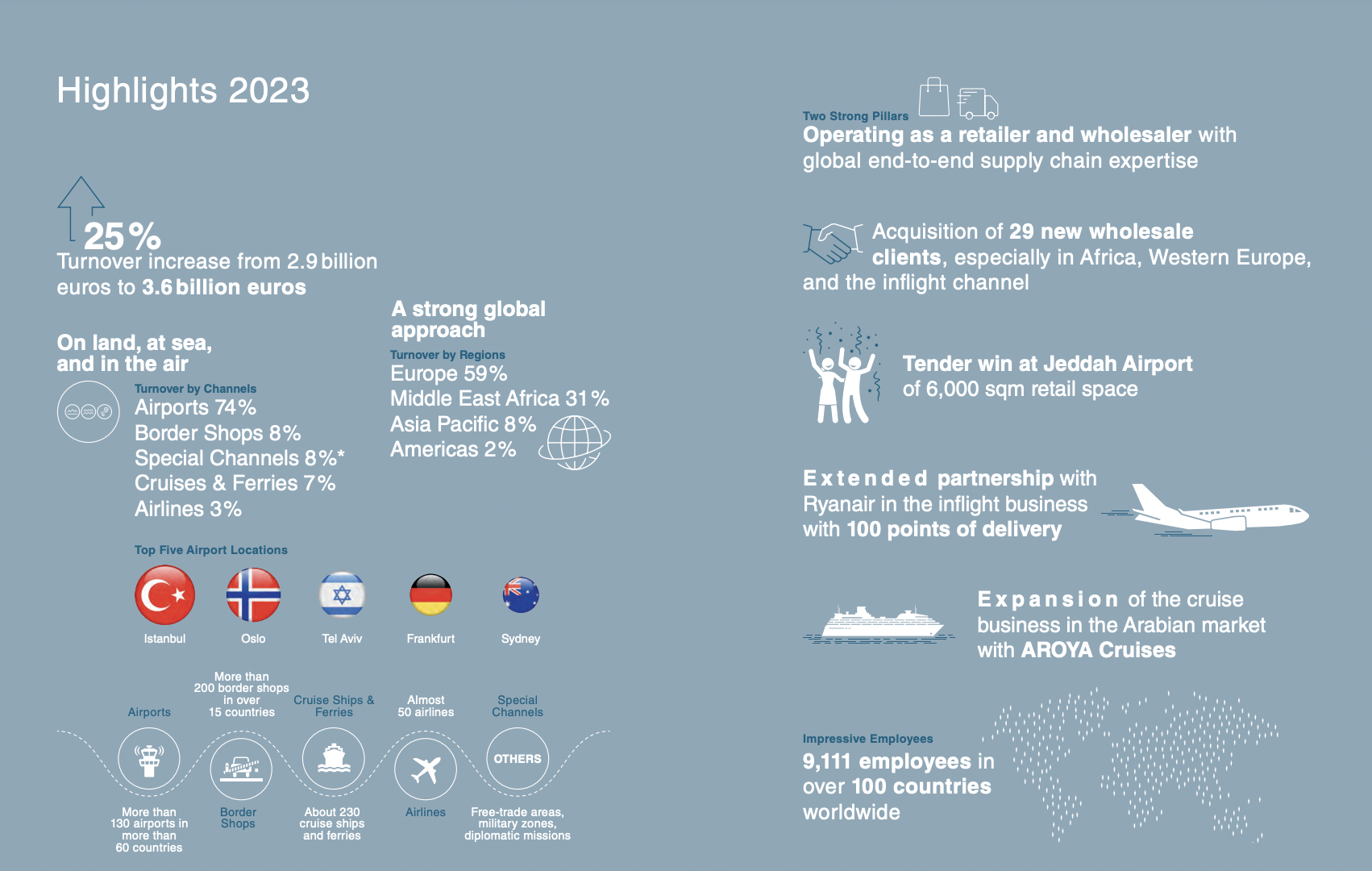

GERMANY. Gebr. Heinemann turnover climbed by +25% year-on-year in 2023 to reach €3.6 billion – slightly ahead of pre-pandemic 2019 – the family-owned travel retailer and distributor announced at its annual press conference in Hamburg on Thursday.

With +24% sales growth in Q1 2024, the company said it is ahead of budget to date this year on track to exceed €4 billion in annual turnover for the first time.

The Moodie Davitt Report joined other media for the press event, at which Co-CEOs Max Heinemann and Raoul Spanger commented on the past year alongside Chief Commercial Officer Inken Callsen.

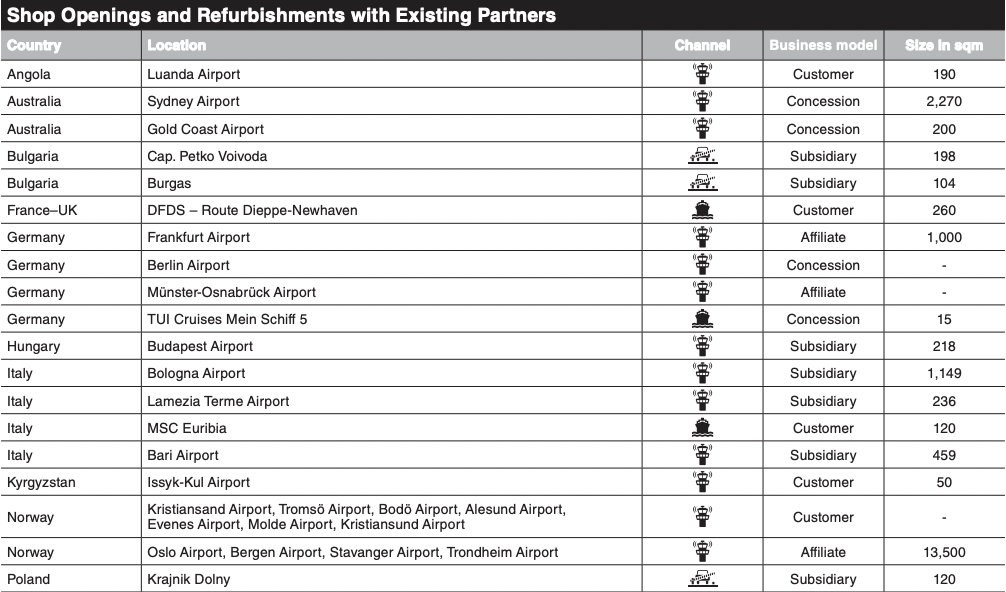

Gebr. Heinemann reinforced key messages about its diversification strategy at the media day, highlighting its purchase of the remaining 50% of JR Duty Free in Israel from the Danos family, the move to acquire border shop business Travel Free Czech in full (adding to its existing 50% stake) and its 2023 acquisition of a 50% stake in Nobilis Group, a leading distributor in the luxury/niche, prestige and lifestyle fragrances segment across the German-speaking region in Europe.

“We are very proud that we have been able to grow as a global group of companies: by entering into carefully selected new partnerships, expanding existing partnerships and making strategic investments in other business segments and channels to push the collaborative envelope of our entire industry and beyond,” said Max Heinemann.

“We continue to become more international, expand our retail space and hence grow our Heinemann Group’s headcount with impressive talent and skillset – always with our vision in mind to be the most human-centric company in global travel retail, to turn travel time into valuable time.”

Retail turnover in 2023 grew by +24% to €2,291 million while distribution rose +27% to €1,175 million. The business was driven by a strong recovery in passenger traffic across most regions, though Asia Pacific lagged behind at 62.3% of pre-crisis turnover levels, with the company’s regional airport operations hit by the delayed return of Chinese travellers.

With sales of €2,565 million, the airport business remained the largest channel, with a 74% share, up +25% year-on-year. The border shop business contributed 8% of sales at €280 million (+9% year-on-year), followed by cruises and ferries at €239 million (7% of the business, +21%) and airlines with a flat turnover year-on-year of €102 million (3% share).

In addition, other channels such as the diplomatic business, free trade zones, military bases and the Nobilis Group generated a combined turnover of €277 million.

Highlights by location included a record €1 billion-plus turnover in Istanbul from JV operations Unifree Duty Free and ATU Duty Free. This is the largest Heinemann airport location by sales, followed by Oslo, Tel Aviv, Frankfurt and Sydney. Other key developments last year included the extension of the Heinemann business at Copenhagen Airport for a further ten years and a return to Düsseldorf Airport with 3,700sq m of shop space.

The broadly positive results were partly offset by the impact of the continuing war in Ukraine and conflict in Gaza. Macroeconomic developments such as rising inflation has affected customer purchasing power, said the company. In Norway there was an impact from the 100-stick limit allowance introduced on cigarettes and the business was also negatively affected by the weakness of the Norwegian Krone.

Raoul Spanger said: “We are very satisfied with this year’s results. In comparison to the previous year, the company achieved a +25% increase in turnover. Furthermore, we were able to take important strategic steps in order to diversify our business.

“We had planned to grow in the Middle East Africa region in 2023 and achieved great success there by winning the concession at Jeddah Airport [together with joint venture partners Jordanian Duty Free Shops and the ASTRA Group -Ed] and signing the contract for the stores aboard AROYA, the first cruise ship of Cruise Saudi’s newly established cruise company.”

The Jeddah Airport business, branded as Jeddah Duty Free, will begin the first phase of operations in July, with refurbishments and full opening to be completed by Q2 2025.

Spanger added later: “What was important also was that last year’s turnover figure excluded one-off effects. In 2021 and 2022 we had the impact of government supports, or rent reduction at airports, which improved our result.”

Spanger said all of Heinemann’s most important airport contracts are secured for the long term but added that competition for airport concessions had become even more intense following the pandemic. On borders, Spanger noted: “This is lower volume but higher profit than airports, so it’s important also for our diversification.”

By region, the largest share of turnover came from Europe at 59%, up by +24% year-on-year, with the key locations being Amsterdam, Copenhagen, Frankfurt, Oslo and Vienna. Middle East & Africa turnover climbed by +18% and represented 31% of sales.

Spanger noted the strong performance of distribution last year, saying that the company gained 29 new customers, mainly in Africa, Western Europe and in the inflight channel. “Distribution offers that strong second leg of the business and means we are even more diversified,” he said.

A highlight of the distribution business in 2023 was the extension of Heinemann’s inflight partnership with Ryanair. In January 2024, Royal Caribbean International’s Icon of the Seas, the largest cruise ship in the world, set sail on its maiden voyage with 14 retail venues on board, operated by Heinemann Americas. This is the fourth Royal Caribbean ship to be awarded to Heinemann, which is currently managing retail on the ships Icon of the Seas, Wonder of the Seas, Odyssey of the Seas and Independence of the Seas.

In the Americas, Heinemann is focused on cruise retail and distribution from its Miami regional base. Spanger added that the company would not pursue airport tenders in the Americas over at least the next two years.

By category in 2023, 47% of turnover came from liquor, tobacco and confectionery (slightly down on the 2022 figure of 50%), followed by the beauty category with 41% (37% in 2022) and fashion, accessories, watches and jewellery (FAWJ) with 7% of turnover (same as in 2022).

Highlighting key trends, Inken Callsen noted that within LTC, liquor had a 33% share of sales, growing +12% last year, with tequila showing the highest growth rate.

Within beauty, fragrances occupied a 71% share (+19% year-on-year) with skincare taking a 20% share and rising by +30%.

In FAWJ, accessories at 42% had the highest share (+18%) with watches & jewellery outperforming with a 41% growth rate (36% of category turnover). More commentary on these category trends will follow.

The company said that identifying new trends and innovations continues to play a major role within all categories. Heinemann has been carrying out ‘Test & Learn’ pilot projects for new brands that have the opportunity to present their products for a limited time and enter the travel retail market if successful.

A major trend in the beauty category is niche fragrances, said the company. At Istanbul Airport, for example, niche fragrances achieved a +42% increase in turnover compared to 2022, and account for 20% of fragrances sales.

Pre-owned goods are becoming an increasing feature of sales in fashion, accessories, watches and jewellery (FAWJ). Heinemann noted: “Second-hand luxury is a growing market and Heinemann has had great success with the vintage luxury concept, which was introduced at Royal Caribbean with a dedicated shop on the Icon of the Seas. Furthermore, the FAWJ category contributed significantly to the company’s success at Istanbul Airport with a large variety of boutiques that offer a luxurious shopping experience for travellers.

Commenting further, Inken Callsen said: “We want to develop the market with the individual strengths of our partners and create added value for travellers. We attach great importance to partnerships and cooperation and want to be successful together. This is what I call the power of collaboration.”

Sustainability goals

In addition to the financial key figures, Gebr. Heinemann also highlighted its key sustainability targets.

“We have defined ambitious sustainability goals for environmental, social, governance, and responsible value chain action fields and have embedded them in our group strategy. In order to develop and implement this ambitious sustainability strategy, we need to work hand in hand with our customers, partners, and suppliers,” said Spanger. For example, on the environment, the company’s goal is to achieve net zero emissions in Scope 1 and 2 by 2030 and achieve a -50% reduction per ton of sales volume in Scope 3 by 2030.

In addition, the company said it is paying close attention to compliance with human rights in its supply chain and aims to cover at least 80% of its purchasing volume through independent supplier assessments by the end of 2024.

A newly developed global strategy for diversity, equity, and inclusion as part of the social action field should be confirmed by ISO certification in 2025.

Elaborating on Heinemann’s ESG targets, Spanger said: “We have 18 Diversity, Equity and Inclusion goals, and this is also our challenge. When we say we are a human-centric company, carrying this across global teams and cultures is not easy. We have to listen to our branches around the world and not rule from the headquarters as we don’t have all the answers. We rely on our group of companies across markets and cultures.”

These ambitious targets will play into action taken across the Gebr. Heinemann group. For example, in the beauty category, Heinemann has entered a forward-looking sustainability partnership with L’Oréal, which was announced at the 2023 TFWA World Exhibition & Conference in Cannes.

The partnership is based on a joint business plan that defines actions in the areas of assortment, point of sale, supply and social engagement. Both companies will also develop sustainable point-of-sale materials and work together to make the supply chain more sustainable. Gebr. Heinemann said is already working on entering sustainability collaborations with partners in other categories.

Of the sustainability targets, Spanger said: “This drives a lot of what we do. By taking these initiatives we want to show we are an industry leader and we even aim to go beyond our targets. It’s the most important change we are making, even if it’s not seen from the outside.”

A ‘group of companies’

Taking the big picture view of progress, Max Heinemann highlighted how Heinemann is now a ‘group of companies’.

“The story once was about Gebr. Heinemann as a nice family business from Hamburg with joint-venture partnerships. We have grown over 145 years into a global, diverse, complex, multicultural organisation. We want this to be a group of companies where all can learn from each other. The HQ is for us the platform to collect best practice from around the world, putting them on the table and seeing how we can all benefit from them. Increasing group collaboration is important for us and we communicate internally on this a lot.

“We need to leverage the great skills of our people while helping them to drive their own careers. So this we want to globalise with a global career pool where we are working on concepts, driving exchange programmes in the future as well, so that our teams can learn from one another and bring their own story and expertise to bear.”

He added: “We know that trends are not happening in the same way right across the world so we have to empower our local teams to understand and lead the strategy using their expertise.”

Of the investments made in other companies, from JR Duty Free to Nobilis, Spanger said: “These are the biggest investments we have ever made in outside companies and they show the financial strength of Heinemann. They also show the commitment of the family to the company and the commitment of the company to the market. Consolidating these will have a big impact on 2024 results.”

Supervisory board members Claus and Gunnar Heinemann also commented on the past year in the company’s annual report. They said: “In the past year, the success of our company showed once again how living and breathing trust truly pays off. Gebr. Heinemann is advancing with a resolute and robust mission statement, and we are proud to witness this. Our mission statement is fully geared toward the future. At the same time, it is rooted in traditional values that we have upheld and cultivated across all generations. This, too, is a matter of great pride for us.”

They also reinforced the importance of people and the ‘Heinemann family’ across markets and regions.

“Throughout our 144-year journey, people have been at the heart of everything we do. All the more, our thoughts are with our Heinemann family in Ukraine and Israel. It goes without saying that we are backing aid initiatives, wherever and however we can,” they added.

*More comment on the key talking points from the Gebr. Heinemann press event will follow across our platforms soon. ✈