UK. Heathrow Airport has updated its forecasts for traffic and financial performance for 2021, with retail income expected to reach to £189 million, a fall of -19.2% compared to 2020, which had the benefit of a strong first two months.

Despite the devastating consequences of COVID-19, which has seen some long-term partners exit the airport, Retail Director Fraser Brown has sounded an upbeat note about the travel retail business once traffic returns (see below).

Retail revenue per passenger, which climbed +18.6% year-on-year to £10.58, is forecast to reach £8.79 in 2021, according to the airport company’s June Investor Report. Combined, it means that total aeronautical and retail income per passenger is forecast to be £37.26 (under the airport’s base case scenario for recovery), behind the 2020 figure of £39.84.

Retail revenue per passenger, which climbed +18.6% year-on-year to £10.58, is forecast to reach £8.79 in 2021, according to the airport company’s June Investor Report. Combined, it means that total aeronautical and retail income per passenger is forecast to be £37.26 (under the airport’s base case scenario for recovery), behind the 2020 figure of £39.84.

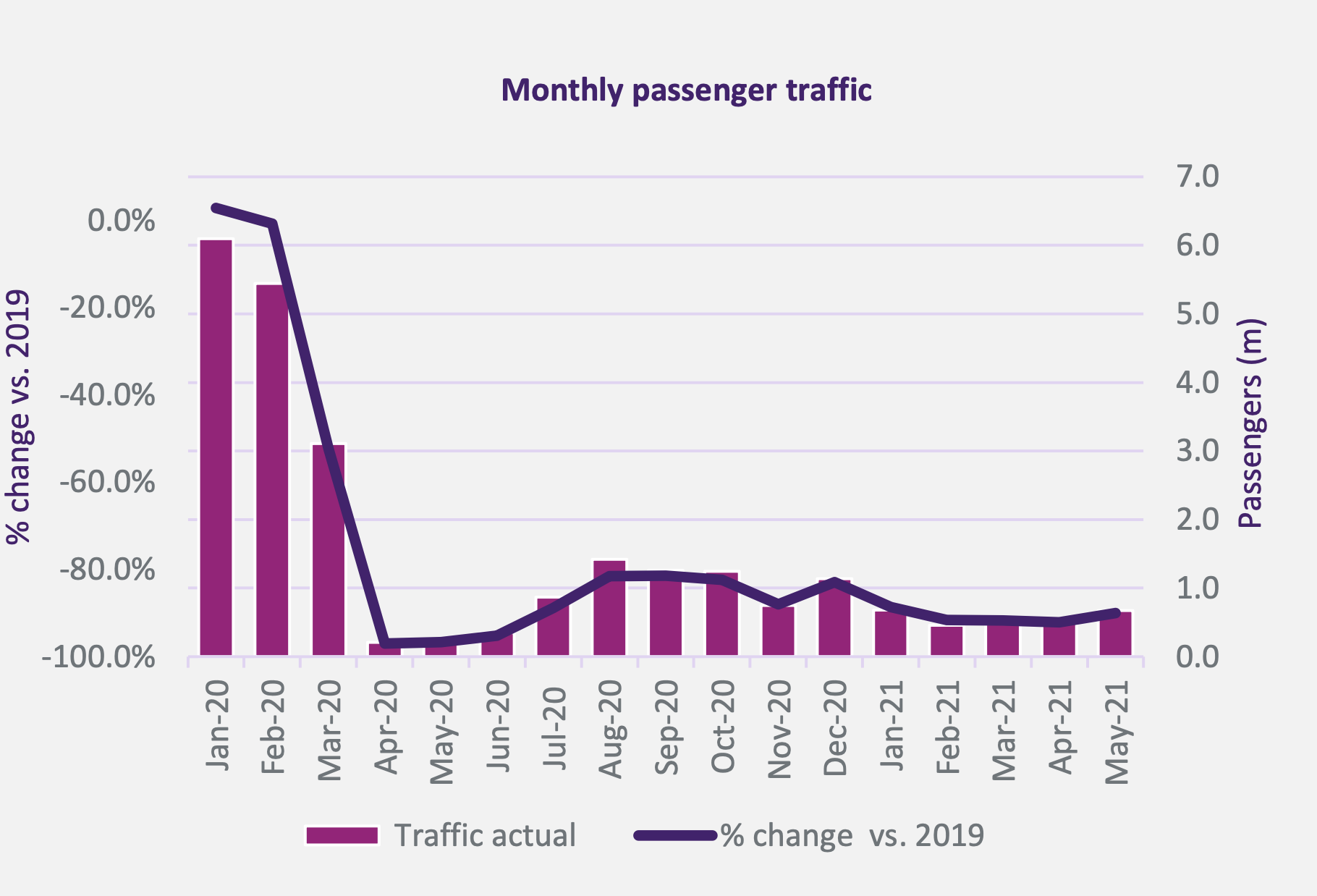

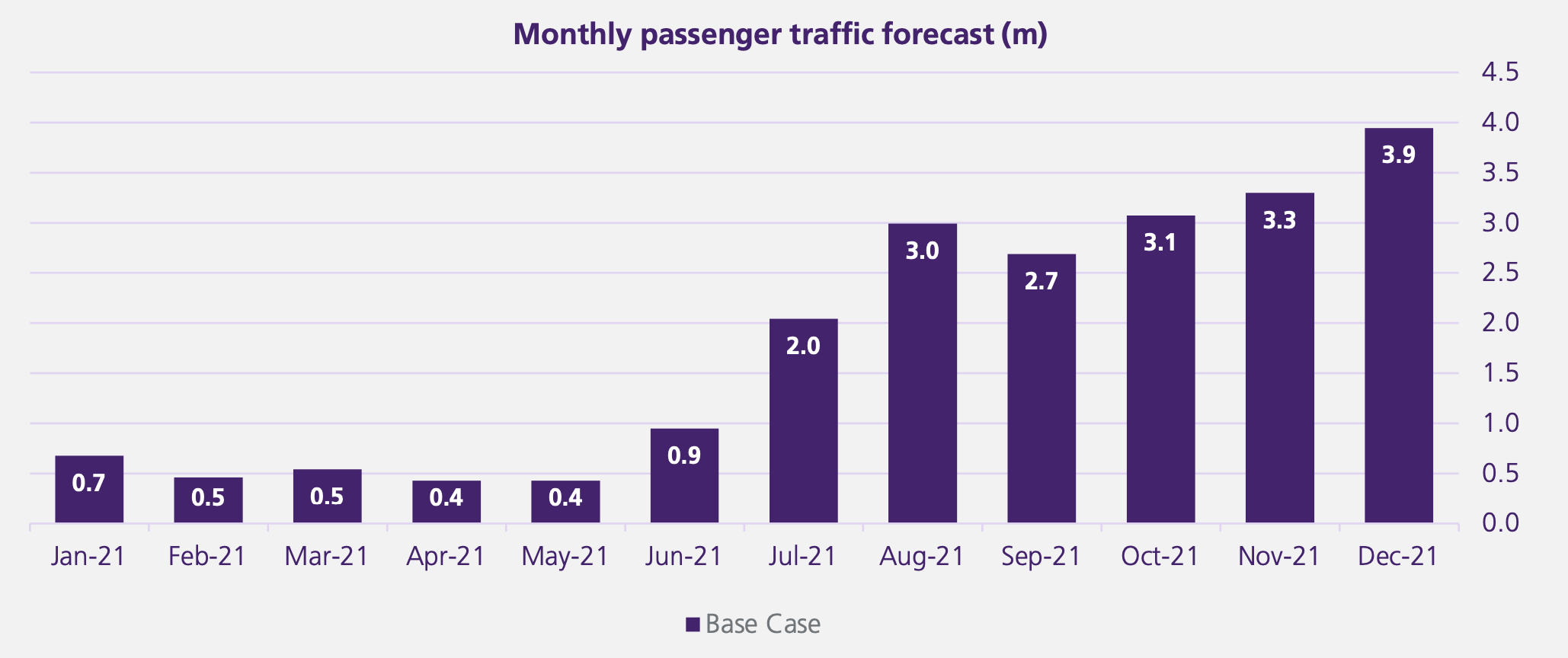

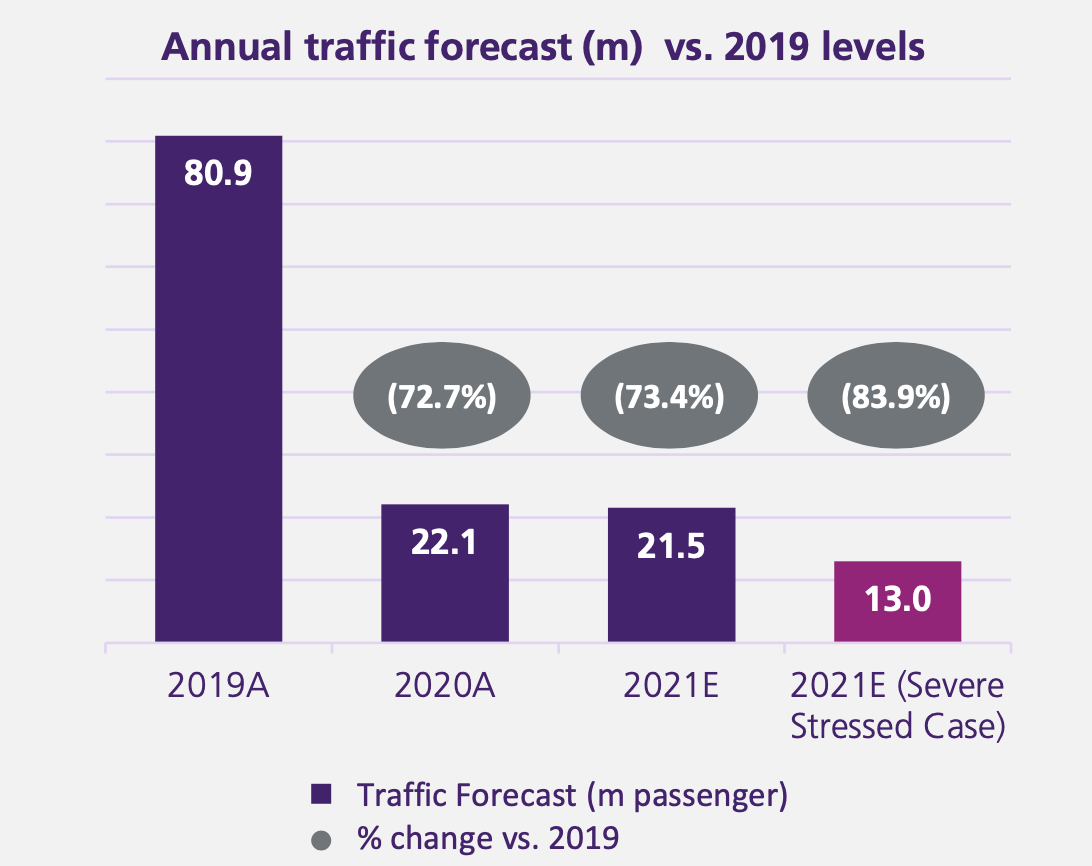

The Investor Report forecasts that passenger traffic will decrease by -2.7% to 21.5 million this year, “reflecting the continued impact of COVID-19 and the expected gradual expansion of the UK government’s ‘green list’, according to Heathrow.

Total revenue in 2021 is predicted to increase by +3% to £1,210 million. Adjusted EBITDA is forecast to increase +23% to £332 million year-on-year, aided by the annualised benefits of cost savings initiatives in 2020 as well as revenue protection initiatives.

The financial consequences of store and restaurant closures over the past year led to exits for partners such as John Lewis, Thomas Pink, Cath Kidston, Mulberry, Carluccio’s and Casual Dining Group, with Dixons recently announcing its departure from all airports.

Thomas Pink has been replaced in T2 by a new bookstore, Saint Laurent will take over the former Mulberry site, and the airport has plans for most of the Casual Dining Group locations, said Brown. In May, Australian F&B specialist Airport Retail Enterprises partnered with Surrey brewer Big Smoke Brew Co to open a new craft beer and food concept in T2. The Dixons spaces are currently being tendered. In T5, swimwear brand Orlebar Brown will be a new entrant, with other high-profile names to be revealed soon.

Speaking to The Moodie Davitt Report (the full interview will appear later this week), Fraser Brown said: “From a retail and a food & beverage point of view business has been incredibly challenging. But the conversations we are having about new brands and openings means that when we get back to a more normal Heathrow and a more normal travel landscape, you will have a vibrant travel retail business.”

“The key message is that even in a tough trading environment, it is heartening that brands who are looking at the medium to long term can see, just as we see, that this travel retail business will come back strong, and that they are prepared to invest now.”

On seeking a new partner in consumer technology, Brown said: “Dixon’s contract was concluding by the end of the year, so we were going out to tender anyway. There are eight Dixon’s stores at Heathrow across the four terminals plus some vending around the gate areas. We are right in the middle of tender evaluation so we cannot say much about that the process.

“But I can say that we have been really impressed by the quality and thoroughness of the bids that we have had. And again, that gives us real validation of our confidence in the medium term for travel retail. We will be challenging whoever is successful to evolve the retail of the category, what it looks like and the experience that we are going to give our passengers.”

Watch out for the full interview, which will appear in coming days.