SOUTH KOREA. With overhanging issues regarding Chairman Dong-bin Shin’s indictment now resolved, the Lotte Group has been preparing for a wide-ranging shake-up of its management since as early as September, writes The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung from Seoul.

The changes were announced earlier this month and were as eventful as promised. Two of the four Business Unit (BU) Chiefs were replaced and a hefty seven of the total fourteen leadership positions within the Retail Business Unit will be led by new management staff. Lotte Duty Free’s much-respected CEO Kap Lee remains in place.

The new management staff will take over from existing executives on March 2020.

Hotel Lotte’s IPO and related corporate restructuring of subsidiaries is required to both reduce the ownership from Lotte Group’s Japanese affiliates and inject funds required to realise the company’s dream of becoming the world’s number one duty free retailer.

Lotte Group has four Business Units (Hotel & Service, Retail, Food, Chemical) which are led by Vice Chiefs. This month’s announcement saw the heads of the Hotel & Service Business Unit and the Retail Business Unit replaced by executives with clear mandates.

The Retail Business Unit will now be led by President Heetae Kang who has successfully grown the department store business despite an overall slump in the retail business. The Retail Business Unit has been negatively impacted by the THAAD row between South Korea and China, depressed consumer sentiment and competition from emerging ecommerce operators.

Under President Kang’s leadership, the Lotte Department Store has successfully restructured to ease losses from overseas stores. It is currently growing profits with the luxury segment driving sales this year. The department store’s operating profit grew +16.8% in Q3 2019, while the parent company Lotte Shopping’s operating profit fell -56% year-on-year.

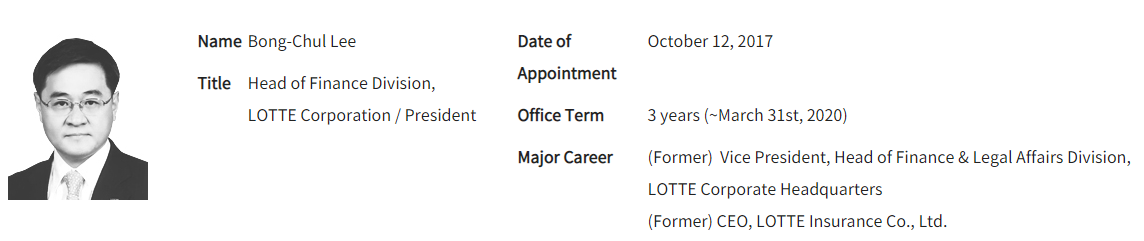

Unlike the appointment of Chairman Heetae Kang – an experienced executive with successful track record in restructuring the operations to overcome difficulties – the appointment of Bong-chul Lee as the Vice Chief of the Hotel & Service Business Unit carries a different mandate. President Lee is the CFO and Head of the Finance Division of Lotte Corporation, the ‘control tower’ of the Lotte Group.

Unlike President Kang, and his predecessor Yong-dok Song, President Lee’s prime expertise and experience is in finance and corporate restructuring rather than business operations.

Getting the all clear for an IPO

His predecessor Song began his career at Lotte Hotel and has worked in the hotel industry for over forty years. Song makes way for President Lee by being promoted as the joint CEO of Lotte Corporation. Lee’s appointment as head of the Hotel & Service BU signals Lotte Group’s desire to finally and successfully launch its much-delayed IPO for Hotel Lotte.

Plans for the long-planned US$4.5 billion IPO had to be scrapped in June 2016 due to political scandal surrounding the group and the fall-out from the THAAD crisis (the anti-missile system is sited on Lotte land, much to China’s chagrin).

Now a resumption of the IPO schedule looks to be on the near horizon with the appointment of President Lee. Under an experienced leader with a wealth of experience in corporate restructuring (his CV includes the listing of Lotte Corp & Lotte REITs), previous obstacles to a successful listing have seemingly been resolved.

– Obstacle #1: Chairman Shin’s corruption charges resolved

In June 2016, around 200 prosecutors raided 17 Lotte Group offices and Chairman Shin’s home in relation to former South Korean President Park’s corruption scandal and accusations surrounding a slush fund. The raid put a question mark on Lotte Group’s IPO filing which had been made to the Korea Stock Exchange on 19 May, 2016. With rumors rife that the IPO was to be delayed or suspended, Lotte Group finally filed a withdrawal of its IPO proceedings on 13 June, 2016.

An ongoing criminal investigation or trial proceedings would have made it extremely difficult for the underwriters of the IPO to attract demand for shares from both institutional and retail investors. The conclusion of Chairman Shin’s trial was widely believed to be necessary for the Lotte Group to once again begin the much-needed IPO proceedings. Hotel Lotte’s IPO and related corporate restructuring of subsidiaries is required to both reduce the ownership from Lotte Group’s Japanese affiliates and inject funds required to realise the company’s dream of becoming the world’s number one duty free operator.

Chairman Shin was initially sentenced to a two and a half year prison sentence in February 2018 but an appeal to the Seoul High Court resulted in a four-year suspended sentence. The Supreme Court finally upheld the Seoul High Court’s ruling in October 2019, bringing the matter to a close.

– Obstacle #2: Lotte World Tower Duty Free to continue operation

Korea Customs Service announced in December 2019 that the Supreme Court’s confirmation of a suspended sentence for Chairman Shin was insufficient to warrant the termination of Lotte World Tower Duty Free’s store operations.

The World Tower Duty Free store plays an integral part in Hotel Lotte’s IPO ambitions. The store grossed over KRW1.2 trillion (US$1.03 billion) in 2018, accounting for roughly 15% of Lotte Duty Free’s total duty free sales.

The store’s proximity to one of Korea’s most prominent theme parks, Lotte World, is a clear distinguishing factor for Lotte in a duty free industry that finds it hard to differentiate stores through products or pricing. The World Tower duty free store’s importance will only grow stronger in the event that package tours from China resume and tourists are provided with free passes to the theme park.

Having operations continue at the World Tower store is a clear advantage for Lotte when relations normalise between Korea and China.

– Obstacle #3: Hotel Lotte’s earnings improves

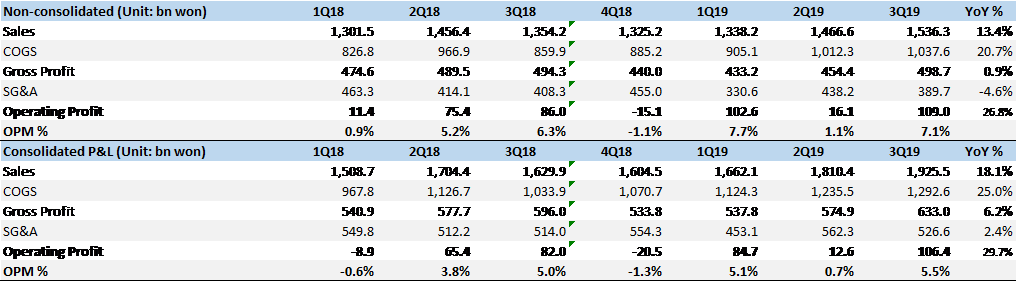

Hotel Lotte reported a +18.1% year-on-year increase in consolidated net sales to KRW1,925.5 billion (US$1,614 million) in Q3 2019, improving from a modest +6.2% year-on-year increase in Q2 2019. More importantly, operator profit was up +29.7% year-on-year to KRW106.4 billion (US$89 million), dispelling fears that profitability was deteriorating following a dismal -80.7% year-on-year decline in Q2 2019 operating profit.

Hotel Lotte’s duty free business stands at the heart of the improvement in sales growth and profitability improvement. Duty free sales grew 19.4% year-on-year in Q3 2019 to KRW 1,569.2 billion (USD 1,316 million) and operating profit increased 22.1% year-on-year to KRW 89.3 billion (USD 75 million).

![]()

Lotte Vice Chairman Gak-kyu Hwang told reporters back in November 2018, “We will go public when things are ready. We still need time to prepare. Hotel Lotte’s earnings should improve to a certain extent, so that investors can evaluate it as one worth funding.”[1]

Typically, local institutional investors will look for three consecutive quarters of earnings improvement and a long-term vision that sales and profits will increase. Hotel Lotte’s Q3 2019 performance marks the first quarter of the three-quarter period and Q4 2019 won’t be a difficult hurdle as the company had recorded a loss in the duty free business in Q4 2018.

– Obstacle #4: Resolving risks associated with long-term earnings

Incheon Airport Duty Free Concession Tender: Incheon Airport Authority Corporation is expected this month or early January to announce the tender for the duty free concessions that will expire in August 2020.

The tender will see Shilla Duty Free under attack, defending three concessions for DF2, DF4 and DF6. Lotte Duty Free will be eager to erode Shilla’s strength in the fast-growing cosmetics and perfumes category. Equally, Lotte’s recent successful bid for Changi Airport’s liquor and tobacco concession implies that it is imperative for the retailer to defend its own current Incheon business.

The aggressive Changi bid in isolation will mean great pressure on profitability. Retaining the liquor and tobacco category at Incheon will produce important economies of scale.

[1] http://m.theinvestor.co.kr/view.php?ud=20180511000572

48% of Korea duty free’s sales are from resellers who mostly bring their goods back into China to sell. The total size of the Korean duty free reseller sector is larger than the 2018 China duty free market.

THE CHALLENGES AHEAD

– Challenge #1: More competition for daigou spend from new Hyundai store

Hyundai Department Store Duty Free is set to open its second Seoul in a location close to the highly lucrative Myeong-dong area by taking over the previous Doota Duty Free store.

Doota Duty Free parent company Doosan Corporation announced that it will exit from the duty free business faster than previously announced and will now suspend operations on 25 January, 2020 instead of the planned 30 April. Doota Duty Free’s announcement was expected as Hyundai is set to open its new business on 28 February 2020.

Hyundai’s new downtown duty free store may provoke heightened competition among duty free retailers to gain the favour of large scale resellers (daigou). Industry experts contacted by The Moodie Davitt Business Intelligence Unit state that Lotte’s duty free operations may see the biggest impact from Hyundai’s opening – partly because of location but even more importantly because the large reseller which Hyundai is expected to cooperate with is a major Lotte Duty Free client.

Lotte Duty Free’s Q1 2020 financial performance will be important in continuing the positive earnings story. But Hyundai’s new operation and expected aggressive promotions from March 2020 looms as a big challenge.

– Challenge #2: Chinese desire to maximise domestic consumption

China’s much-touted new e-commerce law introduced on 1 January 2019 had a surprisingly limited impact on Korea’s duty free market. However as the impetus to repatriate overseas consumption back into China grows, additional regulatory measures may be introduced in 2020.

The Moodie Davitt Business Intelligence Unit estimates that 48% of Korean duty free’s sales are from resellers who mostly bring their goods back into China to sell. Here’s a key statistic: The total size of the Korean duty free reseller sector is larger than the 2018 China duty free market.

Lotte’s management reshuffle at a glance The year-end reshuffling of Lotte’s management now sees President Bong-chul Lee as the head of the Hotel & Service Business Unit. Lee’s expertise in corporate restructuring and past successes in new listings should serve him well in executing Chairman Shin’s mandate to finally IPO Hotel Lotte and complete the corporate restructuring initiatives that began more than five years ago. – Hotel Lotte’s year-end management promotions relevant to the travel retail industry Hotel & Service Business Unit President Bong-chul Lee Hotel Lotte CEO: Hyun-sik Kim Director A: Sang-min Kim, Hee-seung Shim Director B: Yong-sung Cho, Yeo-jin Jang Lotte Duty Free Executive Director: Jong-hwan Lee Director: Seung-guk Lee, Joo-nam Kim Director A: Jung-min Lee, Sung-jun Hong Director B: Jun-young Lee, Dae-hyun Ahn Lotte World CEO: Hong-hoon Choi Director A: Sang-il Park Director B: Mi-suk Park * The names were translated from an official Korean document by The Moodie Davitt Report and may be different to spelling and style used by the management staff. Please email the Moodie Davitt Report at minyong@moodiedavittreport.com with any suggested changes. |