SOUTH KOREA. Incheon International Airport Corporation (IIAC) today (11 December) launched a tender for the DF1 and DF2 concessions, as anticipated by The Moodie Davitt Report earlier this week.

As reported, both contracts are up for grabs following the quitting notices served recently by incumbents The Shilla Duty Free (DF1) and Shinsegae Duty Free (DF2).

Shilla and Shinsegae are expected to exit their multi-store contracts on 17 March and 27 April 2026, respectively, in response to heavy operating losses and their failure to renegotiate financial terms with IIAC. Each contract embraces liquor & tobacco and perfumes & cosmetics.

Here are the key details of the IIAC tender (with our analyis to follow soon):

- Concession Period: From starting point of operation until 30 June 2033 (the tenure can be extended once during the concession period with a ten-year limit)

- Application to attend site briefing: By 16 December 16:00

- Site briefing: 18 December 10:00 (IIAC building)

- Application to take part in the bidding: 20 January 2026, 14:00-16:30

- Submission period: 20 January 2026, 14:00-17:00

FROM OUR EARLIER COVERAGE

So who are the likely contenders?

Shilla is bidding (albeit with a points deduction prompted by its premature departure), as are Korean rivals Lotte Duty Free and Hyundai Duty Free (which won DF5 last time around).

Like Shilla, Shinsegae Duty Free would need to overcome a points deduction if it bids.

Shinsegae Duty Free told The Moodie Davitt Report earlier this week it had not yet made a decision, adding: “We will be able to provide a clearer position once the airport authority publishes the formal tender documents.”

Several foreign travel retailers are also evaluating bids. They include China Duty Free Group, which bid unsuccessfully last time; King Power Duty Free of Thailand, which in 2014 made a serious but vain attempt; and Lagardère Travel Retail.

Avolta is not prohibited from bidding, but any bid evaluation is likely to be impacted by the early 2024 ejection of the Dufry Thomas Julie joint venture from Gimhae Airport in Busan. It may well also have bigger priorities in the wider North Asia region.

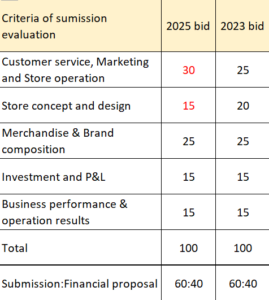

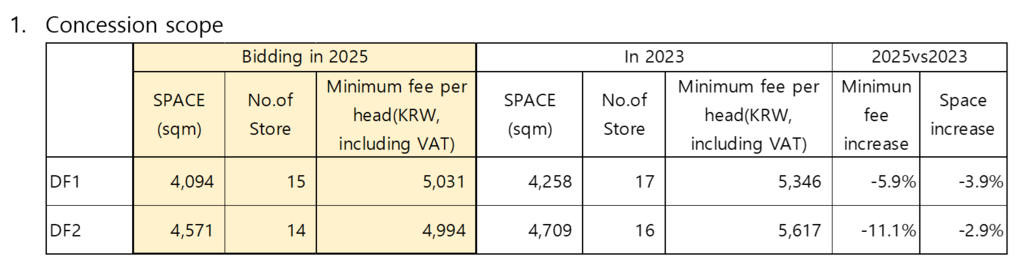

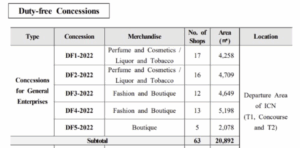

In the 2022 bid (see tables below), IIAC proposed a minimum per-passenger fee of KRW5,346 (US$3.66) for the DF1 concession won by Shilla with an KRW8,987 (US$6.16) per passenger offer +68% higher.

For DF2, IIAC proposed a minimum KRW5,617 (US$3.85) baseline for the contract secured by Shinsegae’s KRW9,020 (US$6.14) at +61% higher. ✈

TENDER ALERTThe Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport or other travel-related infrastructure revenues, simply email Martin Moodie at Martin@MoodieDavittReport.com. We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately. The Moodie Davitt Report is the only international business media to cover all airport or other travel-related consumer services, revenue-generating and otherwise. Our reporting includes duty-free and other retail, food & beverage, property, lounges and other hospitality services, art and culture, hotels, car parking, medical facilities, advertising and other related revenue streams. Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage. |