SOUTH KOREA. Details are emerging of Lotte’s extraordinarily aggressive bid to secure its dominant position in the Incheon International Airport duty free tenders, where last week it snapped up four of the eight contract packages available to bigger companies.

And in related news, controversy has arisen over the failure of the bidding process for three of the four contract packages reserved for small & medium enterprises (SMEs) and the all-Korean nature of the winning line-up.

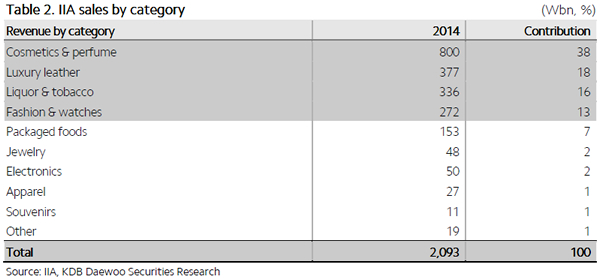

IIAC has yet to reveal financial details of the tender though The Moodie Report has learned that the airport company’s first full-year combined guarantees amount to a staggering US$808 million, which equates to 40.04% of 2014 revenues (US$2 billion). That compares with approximately US$500 million in the first year of the last concessions, awarded in 2007, a near +60% increase.

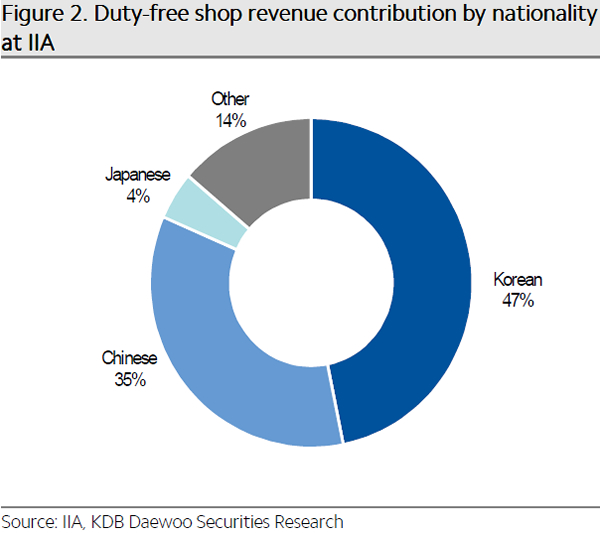

Even with the anticipated strong sales growth in 2015 on the back of burgeoning Chinese tourism, that still represents a huge guarantee to IIAC, which will be understandably delighted with the result. The bid levels though are likely to place tremendous pressure on the winning retailers and, inevitably, their brand suppliers.

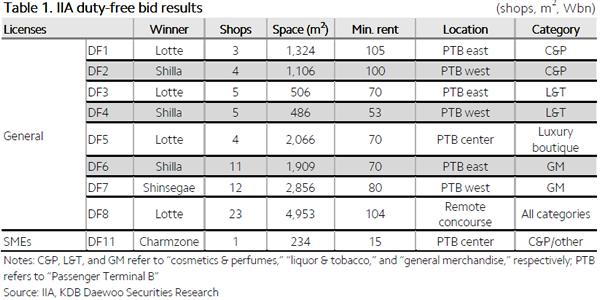

According to one of the bidding parties, Lotte outbid Shilla by more than +60% across all eight packages (winning four), offering a total of KRW6.425 trillion (US$5.8 billion) over five years (for all eight) compared with Shilla’s KRW3.914 trillion (US$3.5 billion).

The Moodie Report has verified with bidders that Lotte will pay KRW3.617 trillion (US$3.25 billion) for its four packages over the five-year term or KRW720 billion (US$647 million) annually. Shilla will pay KRW1.325 trillion (US$1.19 billion) over five years or KRW260 billion (US$234 million) annually for its three packages.

According to The Korea Times, Shinsegae will pay KRW380 billion (US$342 million) for five years or KRW76 billion (US$68 million) a year.

|

How The Korea Times described Lotte’s super bid |

THREE OUT OF FOUR SME TENDERS FAIL

Incheon International Airport Corporation claimed that the failure to award a concession in three of the four duty free packages reserved for SMEs was due to the bidders’ inability to fund the necessary deposits.

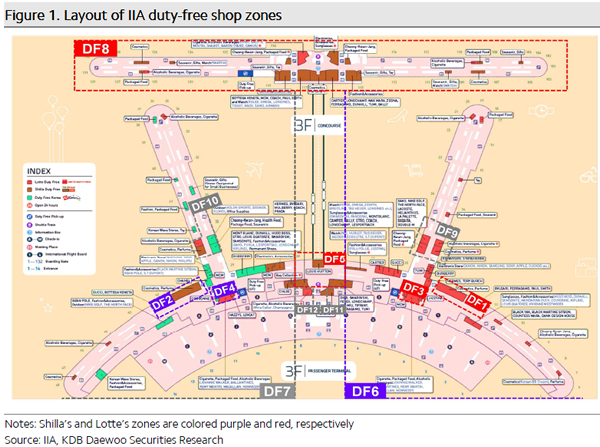

The only award made was DF11, a cosmetics & perfumes and other merchandise, 234sq m contract in the Passenger Terminal Building centre to Korean cosmetics house Charmzone.

But one highly informed source close to the bidding told The Moodie Report that lack of deposits was not the sole reason for the SME tender failures.

“This is incorrect,” he said. “There was only one such case. As you know, each package must have at least two qualified bidders. On DF9 and 10, there was only one bidder each, which nullified the bidding process. On DF12, Entas DF and one other bidder submitted proposals, but the other bidder did not submit the bid deposit as required.”

As a result, DF12 was not awarded and IIAC plans to retender the business.

The source said: “It is no secret that IIAC was forced by the Korean government to carve-out the SME packages. The reason for the failure to attract more bidders for the SMEs packages were IIAC’s high MAGs (sales fee rates are as same as the general enterprises) and, more importantly, the unattractive store locations of the SMEs packages.”

|

KOREAN DOMINANCE PROMPTS DISAPPOINTMENT AND CRITICISM

Meanwhile the all-Korean profile of the winning bidders has attracted criticism and, in the case of the sole international contender King Power International Group of Thailand, disappointment.

One source close to the bid told The Moodie Report: “Before bidding IIAC proudly announced in The Moodie Report that this bidding will be fair and transparent but it became untrue. Who except IIAC believes this is fair and transparent bidding?

“King Power was the only foreign bidder to make this bidding international to keep IIAC’s face. Otherwise it would have been local bidding only. They should have appreciated King Power’s role and awarded them the DF2 package if there was no critical discrepancy. Then other major global players would come in next time around, trusting IIAC.

“IIAC should carefully review why major global players did not come. Incheon is for 9 years consecutively the best airport in the world; accordingly the bidding process should be done in the style of the number one airport.”

|

King Power International Group Senior Executive Vice President Susan Whelan was more tempered in her reaction, telling The Moodie Report: “We are quite disappointed and were very surprised to read the IIAC announcement and bid results for the duty free concessions at Incheon.

“Our business unit, King Power Duty Free Company Limited, had tendered a bid for the DF2 perfumes & cosmetics concession. We fully understand the tender structure and, in accordance with the RFP, that the financial aspect of the bid would equate to 40% of the scoring and that the remaining 60% would be attributed to the marketing plan and retail concepts.

“At the same time, for DF2 Lotte had tabled the highest financial bid; however their financial proposal would have been disregarded as soon as they were awarded the DF1 Perfume and cosmetics package. We therefore had the highest financial bid for DF2, and our financial proposition was higher than The Shilla Duty free bid by in excess of +7%.

“We had what I feel was a stunning retail concept and very exciting marketing plan, and in fact received a robust round of applause from the judging committee after we made our presentation in Seoul last week. We are at a loss therefore to understand where our bid may have fallen down, as a lot of very intense work and input from the latest technological and retail innovations within the industry had gone into our proposal.

“The submission for the marketing and design aspects alone ran to 224 pages of written work. We had understood that IIAC aspired to add an international dimension to the commercial offer at Incheon, and through our experience of operating all categories of duty free at the international airports in Thailand, being the master concessionaire for one of the largest airports in the world, and having won numerous industry awards over the years, that we stood a good chance of success. In any case, we would like to wish all at IIAC continued success at Incheon Airport.”

Another respected source close to the action was openly critical of the whole tender process, telling The Moodie Report: “How could they fairly evaluate such big volume documents in such a short period [bids closed on 30 January with awards being made on 11 February -Ed]? It is physically impossible. From now they better change into local bidding only.

“Who will come to Incheon bidding from abroad if there is no possibility at all to win? As for the SME bidding, three concessions became invalid because the companies did not submit bid deposits which were too big for them.”

|

|

|