FRANCE/INTERNATIONAL. Global consultancy Kearney’s latest industry report highlights muted spending in travel retail, as consumer caution in China and geopolitical headwinds offset the benefits of a steady rebound in global travel.

The study, ‘The world in flux: Travel retail amid today’s geopolitical realities’, was based on a survey of over 3,000 travellers along with interviews of over 40 senior executives, and was conducted for the Tax Free World Association.

The findings come as travel retail remains one of the industries most exposed to global forces, Kearney said, shaped simultaneously by international mobility, consumer spending trends and geopolitical disruption.

Kearney said, “The industry is at a critical inflection point, as the disconnect between constantly rising passenger volumes and real sales growth becomes structural and thereby ratchets up pressures on global retailers, facing various challenges from lower shopping frequency, shifting consumer behaviour, and questioning of the duty-free price promise.”

Geopolitical tensions and tariffs fuel “domestic bias”

Key highlights of the report include five macro forces impacting the market: deepening geopolitical reordering, geoeconomic fragmentation, social polarisation, accelerating technology and an atomised climate response.

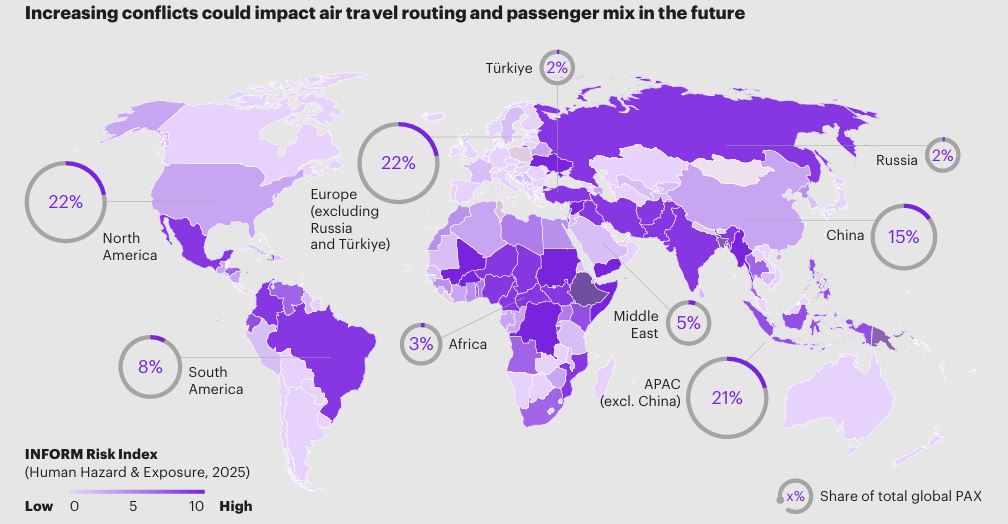

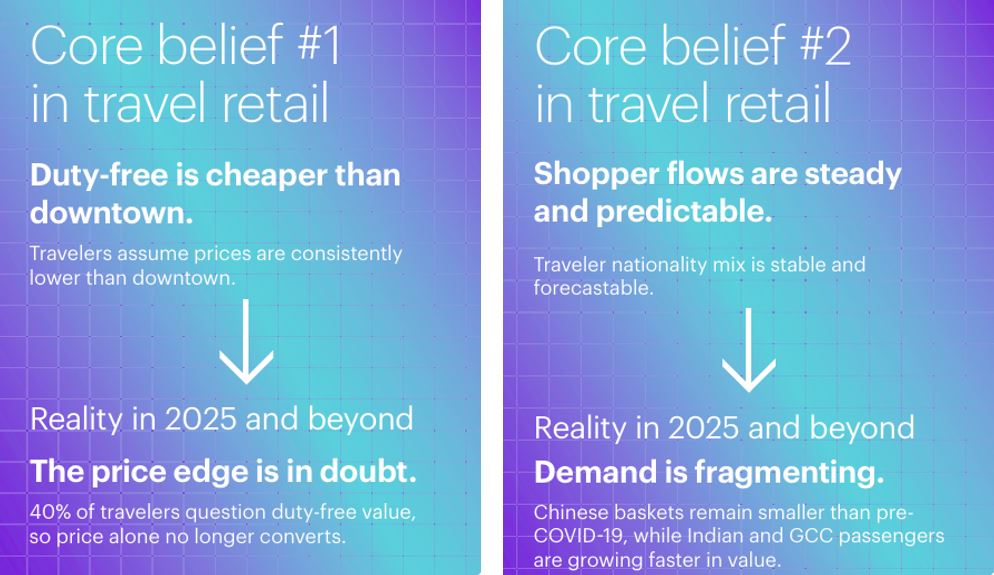

These macro forces have tangible effects on passenger sentiment, behaviour and operational strategy. Key travel retail locations face significant disruption risk, with 40% of passengers passing through high-risk Middle East countries and 30% through APAC, meaning roughly US$18 billion – or a quarter of the global market – is in volatile regions.

The Russian-Ukrainian conflict also illustrates how geopolitical events can disrupt travel retail, with East-West traffic diversions leading to a loss of 17 million passengers, and only partially offset by alternative routes. This results in over US$165 million in sales, as Russian high spenders shifted to Asia and the Middle East.

In a report that covers 2024, Kearney highlights a major opportunity emerging from global trade tensions. As tariffs potentially drive up prices for US domestic retailers, duty-free stores could gain a strong competitive edge. Tighter import duties of up to 39% for Swiss luxury watches could open a duty-free price gap of more than 35%, spurring airport purchases among travellers.

The study also revealed that geopolitical volatility is shifting travel and purchase decisions, with 57% of respondents saying it affects their destination choices, while the impact is even stronger in APAC (70%) and among Gen Z (64%).

Another consumer trend is also emerging as local heritage is becoming a key driver in purchasing decisions. Compared to the last three years, the study shows a marked increase in preference for homegrown brands.

Leading the shift toward “domestic bias” is India (83%), recognised as a rising travel retail market, followed by France (63%) and Germany (50%).

Air traffic growth outpaces retail spend

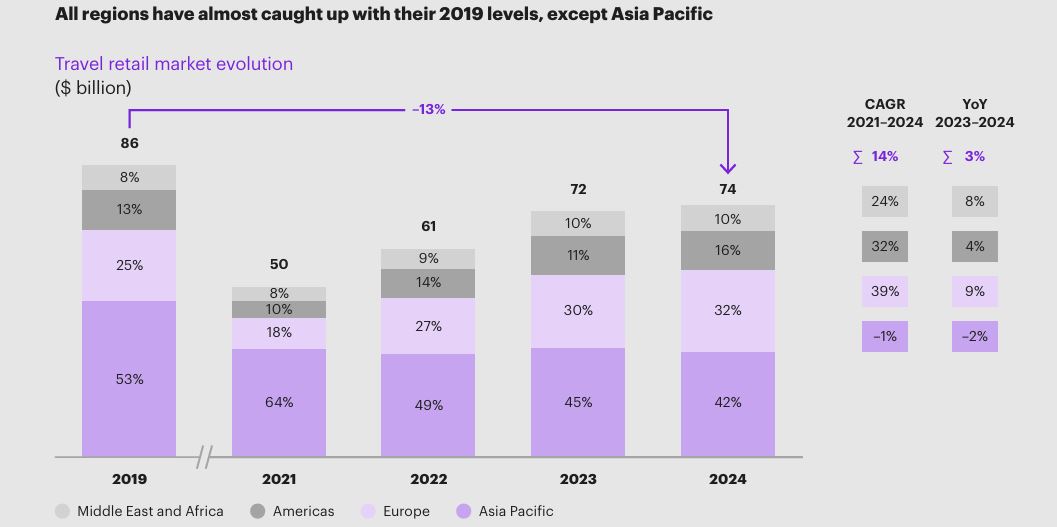

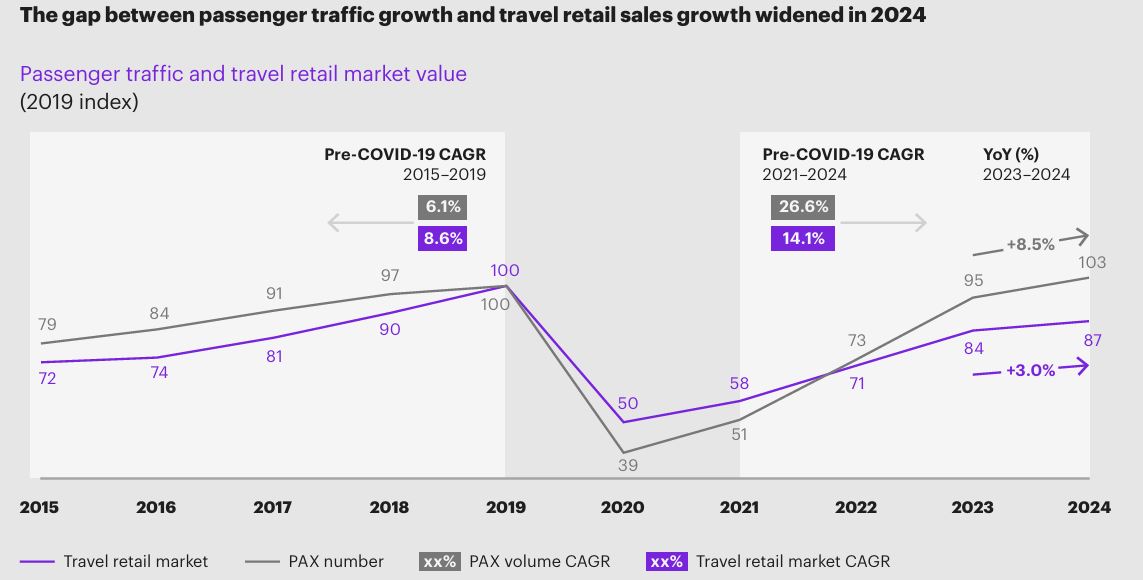

Despite the ongoing rebound in air travel, travel retail sales remain behind, reaching US$74.1 billion in 2024 – 13% below pre-pandemic 2019 levels, even with record passenger traffic.

Kearney noted that this trend has persisted for a third consecutive year, but the gap widened significantly in 2024. Average spend per passenger declined sharply since peaking at US$24.30 in 2020, falling to US$15.50 last year.

China slows as India surges

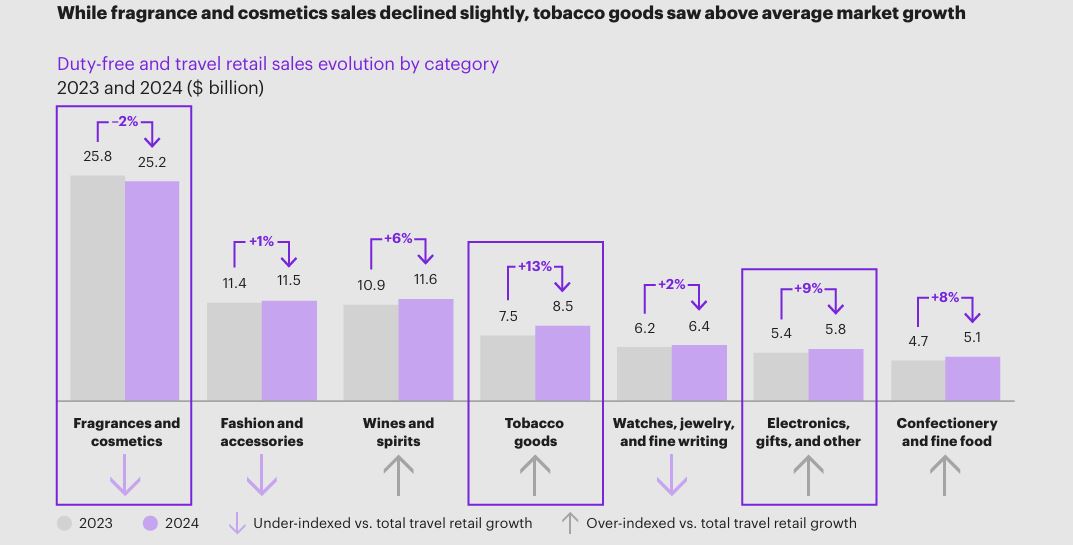

Asia Pacific, home to the largest air traffic and travel retail market, saw a -2% year-on-year sales decline due to weaker Chinese consumer spending. The slowdown was attributed to stricter customs regulations, the influence of daigou operators and greater availability of luxury goods in domestic markets outside airports.

Promotional activity by brands has also declined across key hubs such as Seoul, Singapore and Hong Kong.

India has emerged as a high-growth market, posting +21% growth on the back of airport upgrades, privatisations and an expanding affluent traveller base.

Beyond Asia, Europe’s travel retail market expanded +9.2%, exceeding passenger traffic growth (+7.7%), an improvement led by ongoing airport upgrades.

The Middle East & Africa region grew +8%, fuelled by terminal openings and an expanded selection of liquor and beauty products, with Dubai reclaiming its title as the world’s busiest airport in 2024 after recording 92 million annual passengers.

Travel retail in the Americas was slightly up +4% in 2024 reflected by scattered airport retail presence.

Globally, performance varied by category, with fragrance and cosmetics accounting for one-third of total sales, tobacco rising +13%, and confectionery, fine foods and electronics all increasing, even amid ongoing tariff concerns.

Duty-free pricing under pressure

Beyond geopolitics, travel retail players are concerned that the traditional duty-free price advantage over downtown retail is steadily declining for consumers.

The study reveals that while 58% of respondents believe airport stores offer better prices, around one in four consumers question the actual value of the deals.

This shift in perception is related to changes in the travel retail experience. Although airport dwell time remains roughly two hours, travellers now have digital tools to compare prices and access more competitive offers outside airports.

Kearney’s report also highlights other emerging fault lines and contradictory patterns in consumer behaviour.

The traditional mid-tier segment (US$50-$299) in travel retail is declining as consumers shift to either lower-priced goods or premium products (US$300-$999), a trend especially evident in the fragrance category for gifting and exclusives.

Spirits remain a notable exception, with over 50% of consumers still perceiving duty-free prices as cheaper than domestic ones.

Sense of place and star power

Beyond price, emerging markets demonstrate that well-timed, distinctive and localised products with strong value still drive purchases.

- In India, duty-free pricing appeals to 95% of shoppers, with 83% noting enhanced travel retail offerings, particularly for culturally and religiously relevant gifts.

- Travel retail confidence has increased in Saudi Arabia, with 63% of travellers more willing to spend than three years ago.

- The global success of Dubai Chocolate, launched by Fix Dessert Chocolatier at Dubai Airport in April 2024 and generating AED13 million (US$3.5 million) in just days, reflects the importance of local connection and sense of exclusivity.

European travellers show notable skepticism toward airport retail, with fewer than half in the UK, 35% in Germany and 17% in France believing it offers better value.

While duty-free consumption slows, the travel retail sector sees strong potential in airport dining, tapping on generational and regional preferences.

Sales in food & beverage climbed +8%, with Gen Z travellers embracing airport dining at three times the rate of Baby Boomers.

This success is driven by local and celebrity-led concepts, from the Louis Vuitton Lounge with Yannick Alléno at Hamad International Airport in Doha to Avolta’s Hungry Club with Dabiz Muñoz across Spanish airports.

Reaction

Kearney Partner in Zurich Victor Dijon, also a co-author of the report, said, “The latest edition of our travel retail report shows that the industry is faced with an unprecedented range of challenges, namely increasing geopolitical disruption with conflict zones and tariffs but also a longer-term erosion of the price promise of duty free.

“But it does not have to be the end of value creation for travel retail. On the contrary, it could be the start of a new operating model for the players that adapt shrewdly to this new world in flux.

“We recommend four core capabilities to navigate such turbulence: firstly, leveraging traveller-flow sensing, in which AI can help retailers anticipate consumer patterns on the ground through data on passenger movements within the airport, and secondly, enhancing the value proposition of travel retail through perks, a deep sense of place and immersive experiences embracing digital.

“Thirdly, pricing and assortment agility through calibrating price floors and ceilings and deploying ESLs (electronic shelf labels) in sales points is crucial for retailers to optimise margins.

“Finally, a strategy of adaptive staffing ensures team members – speaking multiple languages and sometimes aided by advisor copilots to have the latest sales prompts – are in the right place at the right time to convert sales.”

Dijon concluded: “Above all, centralised data-sharing and more flexible operational models are at the heart of this structural shift: those players that proactively engage with these commercial, technological and human challenges on a global level could end up being the high flyers of the future travel retail industry.” ✈