INTERNATIONAL. Global stocks had one of their worst days in recent years on Monday (24 February) and extended their losses into the week, as new cases of COVID-19 outside of China sparked fears of a wider spread in new locations and the inevitable slowdown of the global economy.

The sudden spread of the coronavirus in South Korea, Italy and Iran, followed by a stern warning from the US Center for Disease Control and Prevention, dampened any recovery momentum from recent weeks.

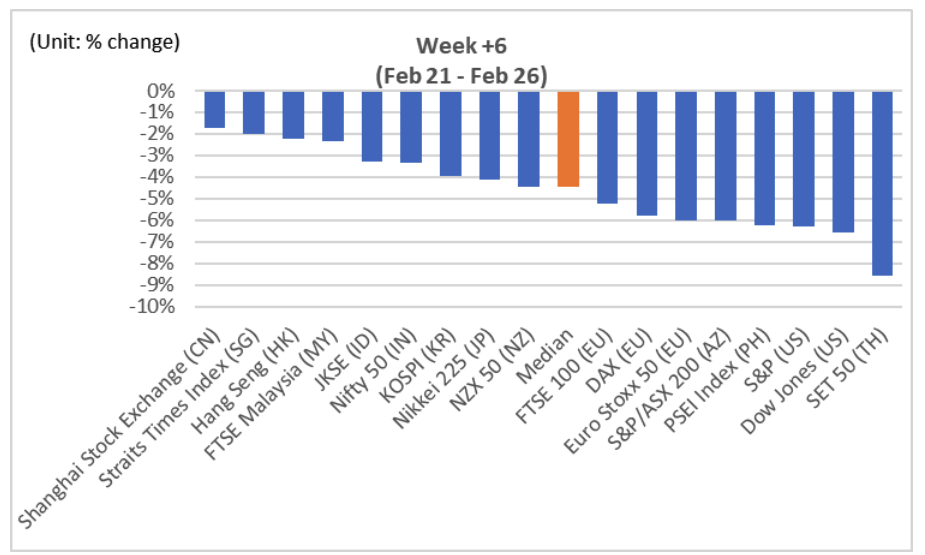

Global benchmark indices closely monitored by The Moodie Davitt Report declined by a median of -4.5% in the sixth week since the outbreak began to have an impact on the stock market. The heavy losses this week mean global stock markets are lower by a median of -6% since 17 January.

Struck by fears of new confirmed cases, stocks in Thailand and the Philippines plunged this week. The US markets were adversely impacted as Nancy Messonnier, Director of the country’s National Center for Immunization and Respiratory Diseases, said of a possible outbreak in the US: “It’s not so much of a question of if this will happen anymore but rather more of a question of exactly when this will happen.”

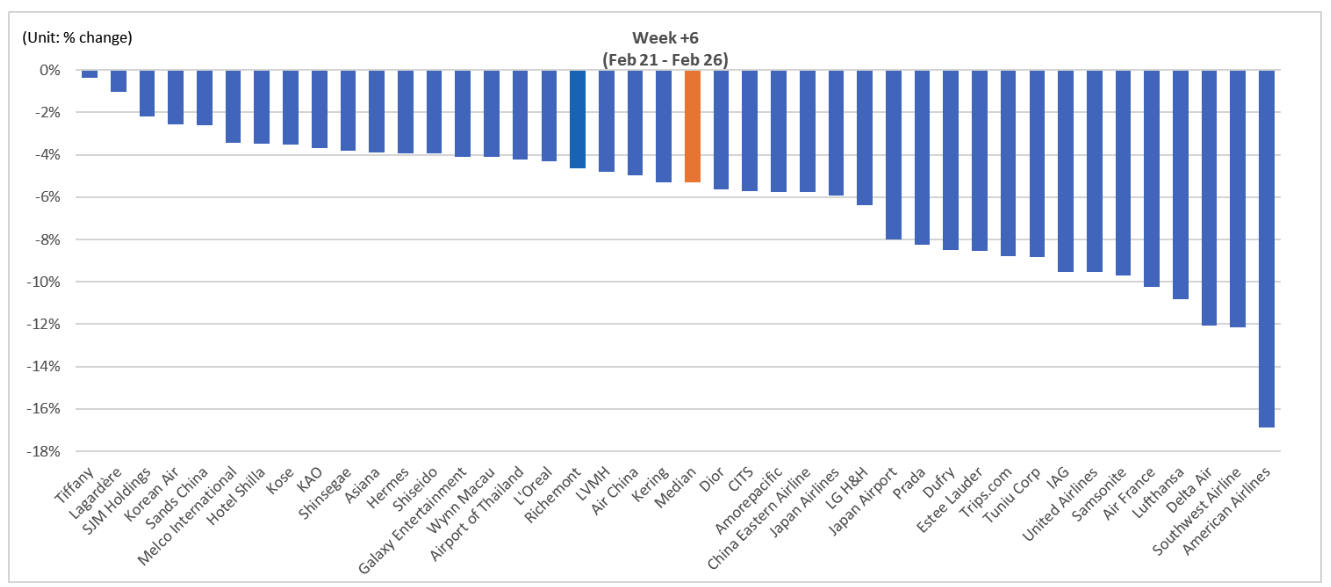

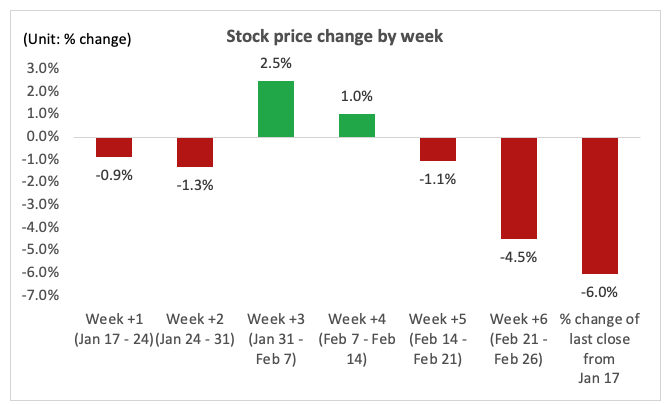

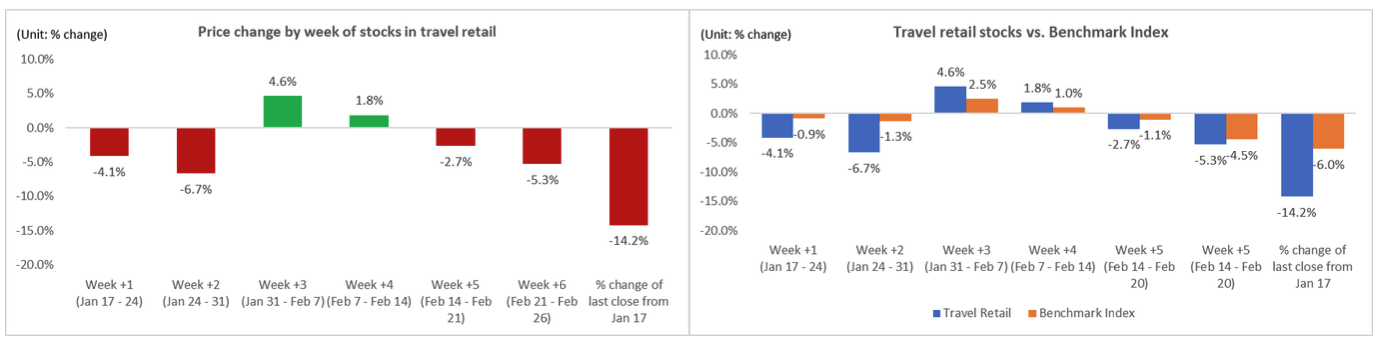

Stocks in the travel retail sector underperformed the global benchmarks. The 41 travel retail stocks monitored by The Moodie Davitt Report declined by an average of -5.3% this week and the share price compared to 17 January is lower by -14.2%.

The stock price of European and US airlines, which had previously recovered to pre-COVID-19 levels, erased their recent gains and led the decline in our monitored stocks after a number of cases, believed to be linked to a spike of cases in Italy, were reported in Europe.