USA. Welcome to our coverage of the IAADFS-organised Summit of the Americas in Miami, Florida, in which we bring you our choice of the event’s highlights in words, images and videos. Over 1,000 delegates from the regional industry and around the world attended across the event dates from 8-11 March.

11 March

IAADFS management has said the mood was broadly positive about the shift to a new venue and timing for the Summit of the Americas, with Miami likely to remain the host city for the 2026 event.

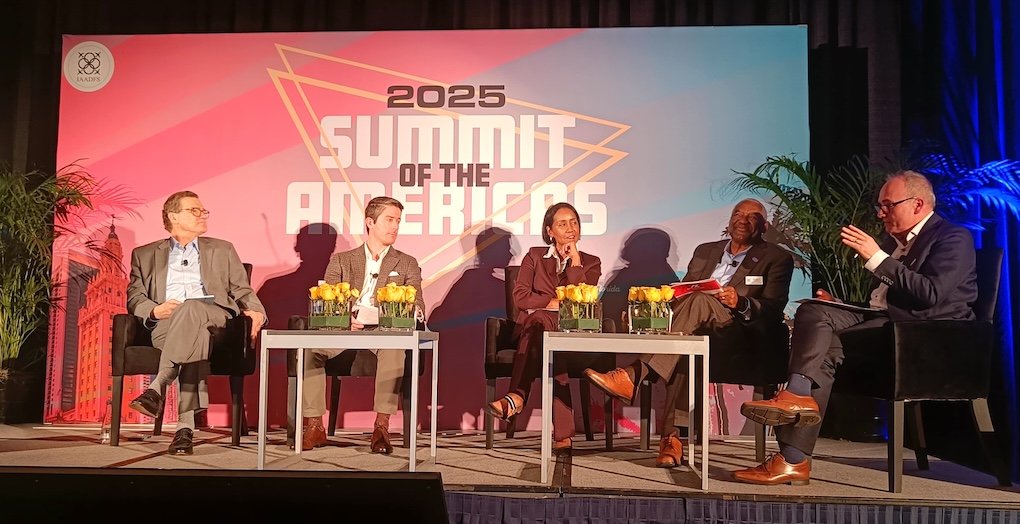

President and CEO Michael Payne (above left) and Executive Director Steven Antolick (right) hosted a closing press conference this morning, in which they shared early feedback and key numbers.

By end of day two on Monday total delegates were 1,024, with a half day on Tuesday still to go. This compares to last year’s figure of 1,209 for the full event. There were 50 exhibitors, fewer than last year, though this number was capped due to space limitations.

Payne said: “The early feedback is positive. The property at The Intercontinental Hotel is easy to navigate and all of the facilities are together under one roof. We will review some aspects. We had logistical issues moving into the venue. And we were disappointed not to see more of an uplift from locally-based industry people, many of whom we thought would come at least for a day. The Sunday start was not ideal but that was our only option this year and in future we will probably go back to our traditional timings. The board is also engaged in trying to attract those who did not attend, retailers as well as more from categories such as beauty.”

A number of conference sessions, while high quality, were modestly attended, with the association likely to review the timings, perhaps front-loading these to allow more people to join without clashing with exhibitor meetings.

Payne said that a rebranding of the association, plans for which were announced last year, was still a work in progress, and not yet ready to reveal.

He also said that that the event remit could be broadened in future. “We expanded years ago beyond airports and with the changes in the industry it makes sense to consider the opportunities in other channels. The retailers will probably drive it as some now work across duty free, convenience and food and may want to see those areas represented in future. It is a question for the board but there may be opportunities to expand.”

10 March

Monday afternoon featured a panel discussion titled ‘Creating a Vibrant Future’, co-organised by the Airport Restaurant & Retail Association and The Moodie Davitt Report, focusing on the challenges and potential solutions for the airport concessions industry in North America.

The panel included (pictured above, from left) Airport Restaurant & Retail Association Executive Director Andrew Weddig; Paradies Lagardère Chief Development Officer David Bisset; Byrd Retail Group President & CEO Judy Byrd; and Avolta Chief Development Officer North America Derryl Benton. The session, moderated by The Moodie Davitt Report President Dermot Davitt, called for bold strategies and new business models to drive the future of airport retail.

Bisset emphasised that this is not an optimal time to launch a request for proposal in North America. He said, “There are more opportunities than available capital. Paradies Lagardère passed on 40% of RFPs last year because the economics doesn’t add up.” Benton agreed, noting that with over 100 RFPs issued last year, the return on responding to them often isn’t worthwhile.

The speakers also reflected on 2024 metrics which showcase that 60% of North American airport sales are in food & beverage, 30% in duty-paid retail and 10% in duty free, but space allocation often does not reflect this. They also debated the role of third-party developers and the need for a moratorium (or at least a deceleration) on RFPs due to economic headwinds.

Bisset also touched upon the lack of profit sharing and joint-venture models – which is quite successful globally – at North American airports. He illustrated, “We operate one profit-sharing contract (since 2011) at Charlotte Douglas International Airport. It’s incredibly successful but I’m surprised that it has not become more common in the market.

“In 2024 two airports approached us to understand that model in greater details, which tells me there are airports out there that believe this is a viable way forward and want to be aligned as true partners versus the landlord model.”

9 March

View this post on Instagram

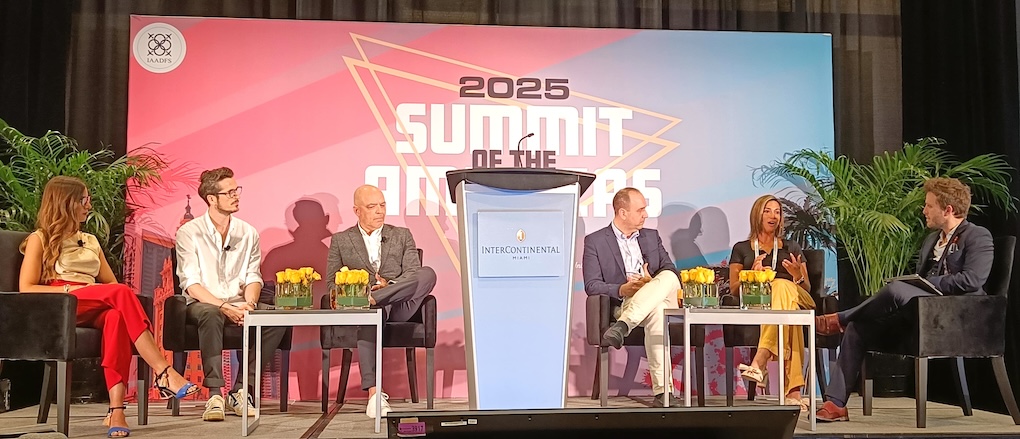

Sunday also featured a breezy session on the operational and commercial challenges facing airports in the Americas. Speakers on a panel led by IAADFS Chair Rene Riedi included Airports Council International (ACI) Latin America & Caribbean Director General Rafael Echevarne and ACI North America Executive Vice President Matt Cornelius.

Both highlighted the capacity and infrastructure issues facing airports today, exacerbated, said Echevarne, by the lack of planes to satisfy demand.

Cornelius pointed out that US$153 billion is needed to upgrade airports in North America, adding that much investment only represents “a band-aid solution. We are not getting the most out of the experience today.”

In Latin America, said Echevarne, “we have not yet made the airport a destination in itself. That’s on the to-do list, to make it a true experience.”

Expanding on the opportunities, Echevarne said airports in the region are working to introduce mixed terminals where domestic and international passengers can mix, something that does not exist currently. “This would also offer commercial opportunities, with shops that cater for a wider variety of audiences plus a more sustainable use of space.”

Offering a view from airports on regulation that affects duty free in particular, Cornelius said that arrivals duty-free in North America was unlikely to be introduced any time soon.

He said that removing gate delivery of duty-free goods at US airports represented a lower bar to overcome, but still demanded multiple federal agencies to accept the idea in time. “We are looking at regulatory reforms and this one makes sense to us,” he said.

Americas Market Intelligence Managing Director John Price brought his insights on the changing Latin American consumer to an excellent keynote address on Sunday morning.

He noted that tourism growth has resumed post-pandemic but faces bottlenecks in capacity at a time when there is a tremendous need to build travel infrastructure. He cited travel & tourism hotspots for 2025 and beyond, including the Dominican Republic, Yucatan peninsula in Mexico, The Bahamas, Argentina and Chile as among those markets making strong tourism investments.

Addressing where the strongest economic growth come from, Price said simply, “It’s all about Argentina” – saying the country, so long beset by economic instability, will dominate net regional growth in 2025/26.

“The leading outbound tourism markets are the largest for spend, namely Brazil, Argentina and Mexico. We are also seeing good growth in the number of mass affluent households (with income of US$75k a year plus), led by Mexico and Brazil. For your industry at regional level we are really talking about a target audience of 60 million people who shop at luxury retail and in duty free.”

Homing in on the impact of changing demographics, Price said that groups to watch include Gen Z – which will represent 27% of the Latin American population by 2035, from 20% today – and the over-60s, at 18% of the population by 2035 from 13% now. On the latter, he said this is the first generation in the region to retire with savings. “They are empty nesters, avid travellers and brand loyal.”

Summarising the biggest opportunities for those who rely on the travel sector in Latin America, Price cited the increased spending power of Argentineans abroad; the Brazil domestic market and the strength of travel to the Caribbean.

IAADFS Chair René Riedi welcomed guests to the first day of the Summit this morning. He said the move to Miami is strategically important for the association, given the city’s importance as a connection point in the Americas region. “We hope this change will ensure industry participation is more convenient and broader than ever,” he said.

Riedi noted the increase in trade tensions between the US and its neighbours Mexico and Canada, adding that how travel retail will be affected “is the burning question for us”. Despite economic uncertainties, he said, the outlook for travel remains robust.

7-8 March

View this post on Instagram