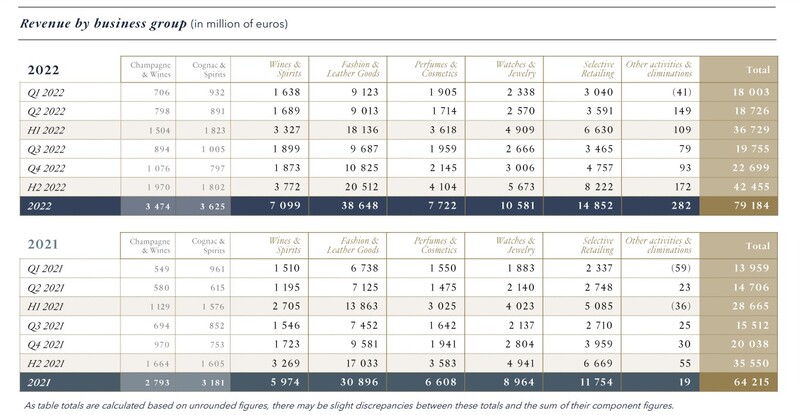

INTERNATIONAL. Leading luxury goods group LVMH Moët Hennessy Louis Vuitton, recorded revenue of €79.2 billion in 2022 and profit from recurring operations of €21.1 billion, both up +23% year-on-year.

All business groups achieved significant organic revenue growth over the year with Fashion & Leather Goods reaching record levels, with organic revenue growth of +20%. Profit from recurring operations stood at €21.1 billion for 2022, also up +23%. Operating margin remained at the same level as 2021.

Group share of net profit was €14.1 billion, up +17% compared to 2021. Operating free cash flow surpassed €10 billion.

By region, Europe, the USA and Japan rose sharply, benefiting from strong demand from local customers and the recovery of international travel. Asia sales were stable through the year.

By division, Selective Retailing revenue climbed +26% year-on-year in 2022 (+17% on an organic basis). Profit from recurring operations rose +48%.

Within this, DFS Group (owned by LVMH and DFS co-founder Robert Miller) remained affected by the COVID situation in China. LVMH said: “The flagship destinations of Hong Kong and Macau particularly suffered as a result of the suspension of domestic travel and the complete absence of tourists but just reopened in January.”

Commenting on DFS Group’s performance in a post-results call, LVMH Chairman & Chief Executive Officer Bernard Arnault said: “DFS is slightly more challenging. Airports have been deserted up till now so of course it’s difficult to remain out in front… but there are green shoots in China. Macau has started again… in our stores in Macau business is back and the Chinese are buying.”

LVMH Chief Financial Officer Jean-Jacques Guiony added, “DFS had two very different half years. H1 was not outstanding but it was alright. But H2 was a challenging half year because, of course, the local circumstances and the fact that Macau was locked down starting in July – no Chinese visitors and so no sales in Macau from July to December. And as Mr. Arnault pointed out, now things are back in business. Macau is one of the few places where the COVID test is not compulsory for Chinese nationals. But H2 was challenging compared to 2021 where Macau was open.”

The Wines & Spirits business group recorded revenue growth of +19% (+11% on an organic basis) while profit from recurring operations rose +16%. Champagne volumes climbed +6%, driven by sustained demand leading to growing pressure on supplies. Momentum was particularly strong in Europe, Japan and in emerging markets, particularly in “high energy” channels and gastronomy.

Hennessy Cognac benefited from further “value creation” with price increases “offsetting the effects of the health situation in China, while the United States was affected at the start of the year by logistical disruptions”. Still wines, in particular the Château d’Esclans rosé, achieved an “excellent performance”.

The Fashion & Leather Goods business group posted revenue growth of +25% year-on-year (+20% organic). Profit from recurring operations increased by +22%. Louis Vuitton had an “excellent year”, with many new products unveiled in leathergoods, jewellery and watches.

LVMH added: “Christian Dior continued its remarkable growth trajectory across all its product lines. After three years of renovations, the Maison’s historic store at 30 avenue Montaigne, which reopened in Paris in early 2022, enjoyed huge success, offering a new experience of the highest refinement.”

Celine experienced strong growth aided by Hedi Slimane’s creations, as did Loewe, driven by the creativity of J.W. Anderson. Fendi celebrated the 25th anniversary of its Baguette bag while Loro Piana, Rimowa and Marc Jacobs also performed well.

The Perfumes & Cosmetics business group recorded revenue growth of +17% (+10% organic). Profit from recurring operations was slightly down as a result of a selective policy of distribution.

Christian Dior enjoyed “a remarkable performance”, said LVMH, with Sauvage, Miss Dior and J’Adore boosting growth. Dior Addict in make-up and Prestige in skincare also contributed.

Guerlain sustained its growth, driven by the vitality of its Abeille Royale skincare, Aqua Allegoria collection and perfumes range L’Art et la Matière. The group also highlighted the performance of Parfums Givenchy and said that Fenty Beauty doubled its revenue thanks to the expansion of its distribution network and new launches.

The Watches & Jewelry business group posted revenue growth of +18% (+12% organic). Profit from recurring operations climbed by +20%. Tiffany & Co. had a record year, with revenue from its High Jewelry range doubling. Bvlgari showed strong momentum, particularly in Europe, Japan and the USA.

Product innovation and high-profile campaigns boosted the performance of Chaumet and Fred in jewellery and TAG Heuer, Zenith and Hublot in watches.

Arnault said: “Our performance in 2022 illustrates the exceptional appeal of our Maisons and their ability to create desire during a year affected by economic and geopolitical challenges. The group once again recorded significant growth in revenue and earnings.

“Our growth strategy, based on the complementary nature of our activities, as well as their geographic diversity, encourages innovation and the quality of our creations, the excellence of their distribution, and adds a cultural and historical dimension thanks to the heritage of our Maisons.

“This was showcased during our hugely successful LVMH Journées Particulières, when we opened our doors to all in fifteen countries in 2022 and saw a record number of visitors come to learn about the know-how of our artisans. We approach 2023 with confidence but remain vigilant due to current uncertainties. We count on the desirability of our Maisons and the agility of our teams to further strengthen our lead in the global luxury market and support France’s prestige throughout the world.”