INTERNATIONAL. Travel intelligence and tourism advisory firm Mabrian, part of The Data Appeal Company, projects a slight increase in international travel demand for the first half of 2026, driven primarily by inspirational travel trends across Asian destinations.

Mabrian’s latest study analysed international air capacity and flight searches to the top 50 airports in each world region, focusing only on international demand for January to June.

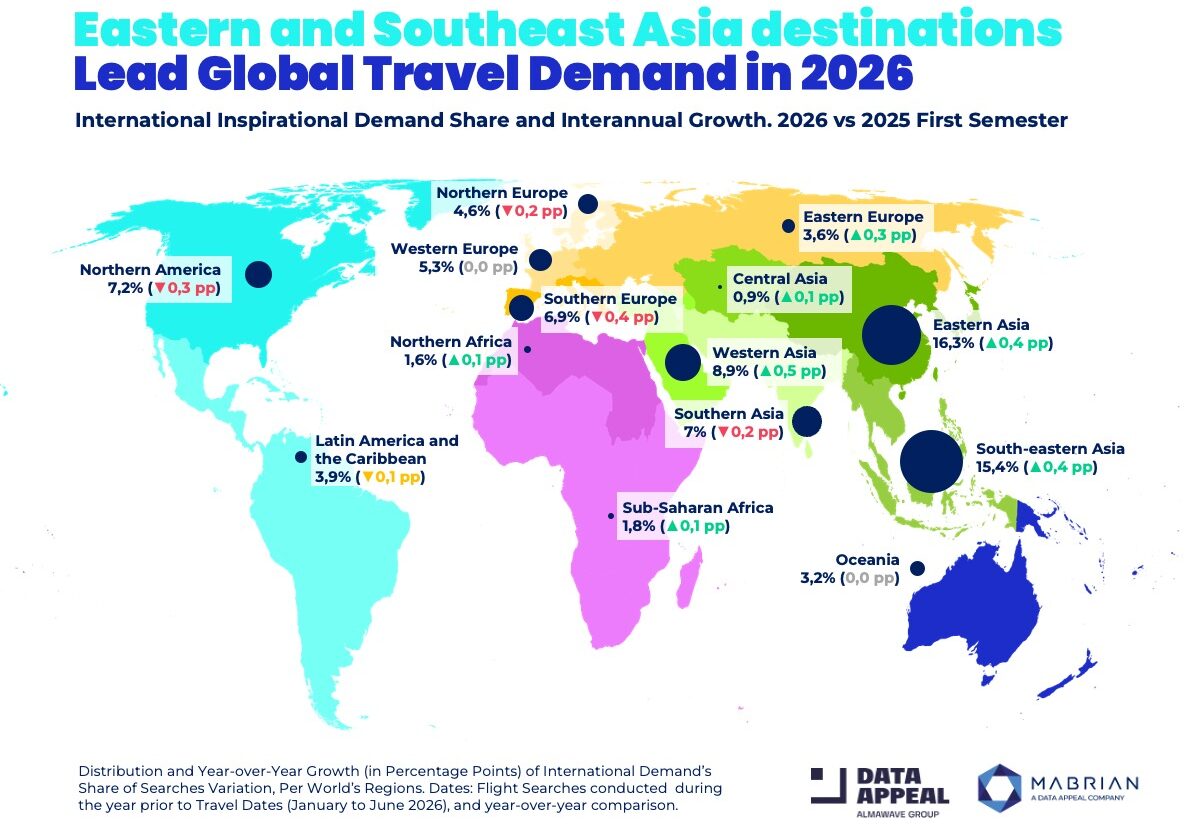

Representing 86.7% of global travel demand, the study uses a standardised approach that tracks each region’s share of flight searches, allowing comparison of evolving travel intent.

The findings project a slight year-on-year increase in international inspirational travel demand for the first half of 2026, driven by a +5.9% rise in air capacity, although regional patterns differ.

This confirms the trend from 2025, with Asia continuing to be the key driver of international travel inspiration and global demand growth, supported by its mix of established and emerging destinations.

East and Southeast Asia together represent 31.7% of international travel demand market share worldwide.

East Asia, including Japan, South Korea and China, accounts for 16.3% of global travel demand in the first half of 2026, led by Japan.

A notable trend supporting Japan’s growth is the increasing appeal of other cities, with growing interest in Fukuoka and Sapporo.

Southeast Asia captures 15.4% of global inspirational demand, driven by Vietnam’s continued rise as a top destination alongside established markets such as Indonesia, Philippines and Cambodia.

GCC destinations in the top ten for market share growth

West Asia maintains strong growth in early 2026, accounting for 8.9% of international inspirational travel demand in the first half, above last year’s levels.

A notable growth in international air capacity is also projected among GCC countries, rising +3.6% year-on-year over the next six months.

The region leads the global rise in market share, with Jeddah, Riyadh and Doha among the top ten destinations for growing travel intent. They are joined by Jakarta, Hanoi, Ho Chi Minh City, Seoul, Moscow, Manila and Tokyo.

Mabrian Director of Marketing and Communications Carlos Cendra said, “While traditionally popular regions continue to capture the largest share of global travel demand, we are seeing that lesser-known and alternative destinations are expanding their market share.

“This evolution is driven by the demand growth from emerging inbound markets and more appealing value for money, signalling that inspirational demand is diversifying like never before.”

Southern Europe and North America, home to some of the world’s most popular travel destinations, revealed a slight downward trend in international travel intent during the first six months, with similar decreases observed in Southern Asia and Northern Europe.

Cendra explained, “The performance of these regions should be analysed considering that the travel intent refers to the first half of 2026, which covers the shoulder and early summer seasons but does not include the highest peak of the summer season that typically drives demand in these regions.”

Caribbean travel demand

Despite a generally positive forecast for the first half, instability in regions such as the Caribbean requires monitoring over the medium and long term. A Mabrian spokesperson notes that “international travel intent toward the Caribbean shows a global softening, particularly among US and European markets”.

Early January flight search data for travel between January and March, as reflected in the Share of Searches Index, indicates a slight drop in the Caribbean’s global market share for early 2026.

The US market saw the steepest decline, with the Caribbean’s outbound travel share falling from 9.1% to 7.6% year-on-year during the period, following a sharp drop in January and an unstable recovery.

The decline is mainly attributed to the softer demand for the Mexican Caribbean, the Dominican Republic, Jamaica, Aruba and the Colombian Caribbean.

A similar pattern is seen in European markets, registering a slight dip in February and a partial recovery that remained below last year’s levels.

Cendra said: “The resilience of Caribbean destinations will be key to rapidly regaining market confidence, especially if conditions in the area stabilise in the short term. To do so is key for destinations to monitor source market perception and adapt their strategies.”

Notably, global travel intent toward Western Asia and GCC destinations remains stable in the first quarter despite the recent protests and unrest in Iran.

Following a minor decline in February, market share rebounded in March, marginally exceeding the previous year’s levels and highlighting the resilience of the region’s demand.

As Cendra points out, this performance underscores “the critical role that a strong destination reputation plays in cushioning the impact of unforeseen events on travel demand”.

The Data Appeal Company Founder and CEO Mirko Lalli concluded, “In today’s rapidly evolving social and economic context, data-driven travel intelligence enables destinations and DMOs to anticipate demand shifts, respond to volatility and reinforce evidence-based strategic decision-making.” ✈