MALAYSIA. Malaysia Airports has said it expects regional travel to restart in Q1 2021 as Southeast Asian states gradually open their borders to international traffic. The company also said that pilgrimage travel to Saudi Arabia will begin again soon after the Middle Eastern state opened to Umrah visitors on 1 November.

In its nine-month results released today, Malaysia Airports said that domestic traffic had climbed more than fourfold in September since the country relaxed a ban on inter-state travel in June. The company expects domestic seat load factors to hit 70% of capacity in 2021 compared to around 50% today.

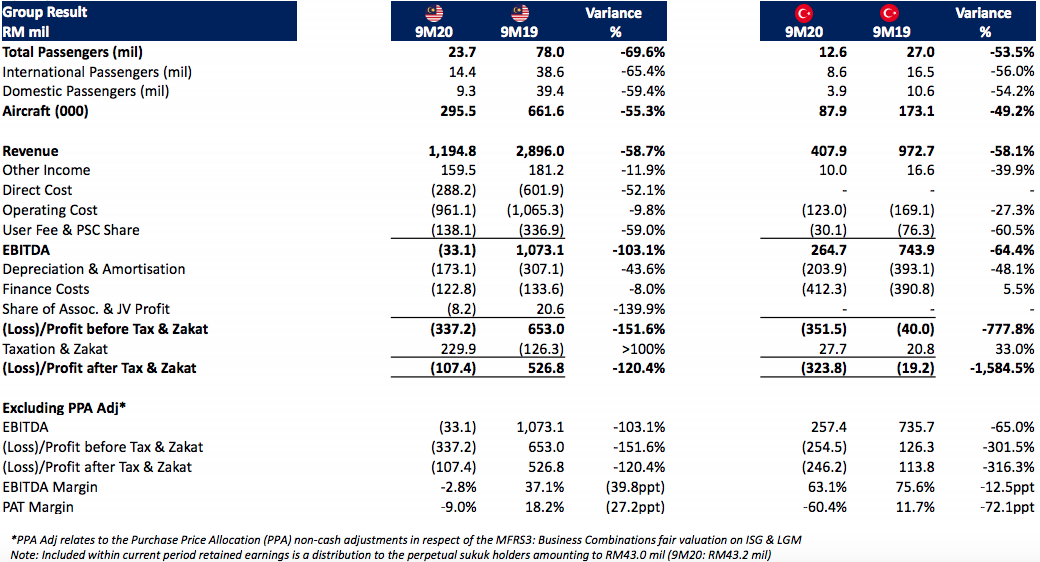

In the nine to months to 30 September, the Malaysia Airports network served 36.2 million passengers, down by -65.5% year-on-year.

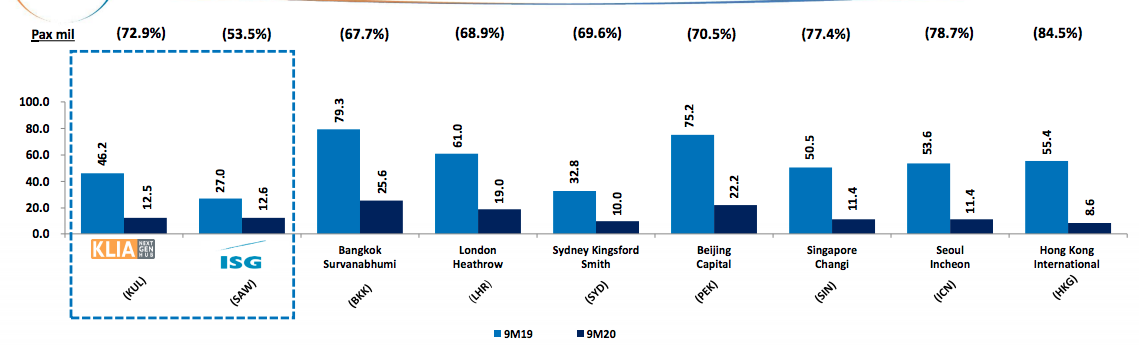

Passenger traffic for its Malaysia operations reduced by -69.6% to 23.7 million in the nine months. Kuala Lumpur International Airport recorded a -72.9% reduction to 12.5 million passengers while other airports in Malaysia recorded a combined decline of -64.9% to 11.2 million.

The performance of Istanbul Sabiha Gökçen International Airport (ISG), owned by Malaysia Airports, boosted the overall figures after Turkey opened its international borders from June. ISG handled 34.7% of the group’s passengers in the period, compared to only 25.7% in the first nine months of 2019. ISG traffic in September had recovered to 68% of February 2020 levels (pre-COVID-19 and airport closure). Malaysia Airports said: “The removal of border closures added with the strategic location of Turkey, has given ISG the edge to regain connectivity with other neighbouring regions.”

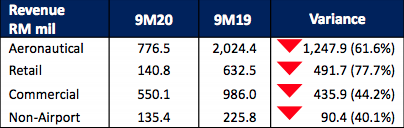

Non-aeronautical revenues at the group fell by -57.3% to RM690.8 million (US$170 million), driven by a -77% contraction in retail sales and a -44.2% slide in commercial revenues.

Total group revenue fell by -58.6% to RM1,602.7 million (US$394 million). Company losses after tax widened to RM431.2 million (US$106 million).

The company said it had also taken action to assist its commercial partners. This includes a 50% rebate of up to RM22 million (US$5.4 million) for more than 650 tenants as well as moratorium on payments of up to 180 days.