SINGAPORE. Welcome to our rolling coverage of an important week in travel retail, as many in the industry community return for TFWA Asia Pacific over the week ahead (7-11 May). That event was preceded by The Moodie Davitt Smile Raising Charity Dinner, which raised funds and visibility for international cleft charity Smile Train.

11 MAY

10 MAY

Pernod Ricard Global Travel Retail introduces its industry-first Circular Making Life Analysis Tool

9 MAY

Gift with edge: Just minutes after the exhibition opened Mondelez World Travel Retail’s Toblerone personalisation service was already attracting interest. The company is introducing a “new Toblerone era in travel retail”, with revamped Toblerone messages, Sense of Place, pack sizes and new activations.

8 MAY

Toasting the launch of a Mercedes Benz trilogy: International New Creative Concepts (INCC), which specialises in the creation, development, marketing and sales of perfume products, has introduced its Mercedes-Benz Land, Sea, Air fragrances for men to the Asia Pacific market.

Created by French Master Perfumer Anne Flipo, Mercedes-Benz Land, Sea, Air is described as a “tribute to layering”. The fragrances can be customised, worn separately or combined and are available as individual eau de parfums or as a trilogy, with the packaging combining to form the signature Mercedes-Benz star.

From the Kingdom of Bhutan to the County of Surrey and now Singapore: Duty Free Global Founder Barry Geoghegan (left) and Silent Pool Distillers Global Sales Director Adam Dobson reveal a new rare Silent Pool Black Juniper gin.

The ultra-premium expression is created with high quality black juniper found only above 4,000m in the Himalayas. Botanicals include Coriander, Voatsiperifery, Grains of Paradise and the warming spices of Tasmanian Mountain Pepper, with rare teas added to optimise flavour complexity.

The gin is being released in limited batches, with a RRP of US$350.

The Economist Intelligence Unit Global Chief Executive Simon Baptist kicks off the APTRA Exchange this afternoon with insights on the most pressing issues and what they mean to businesses in Asia.

He notes recovery across G20 countries in 2024, led by India, China and Indonesia and highlights risks to the global economy.

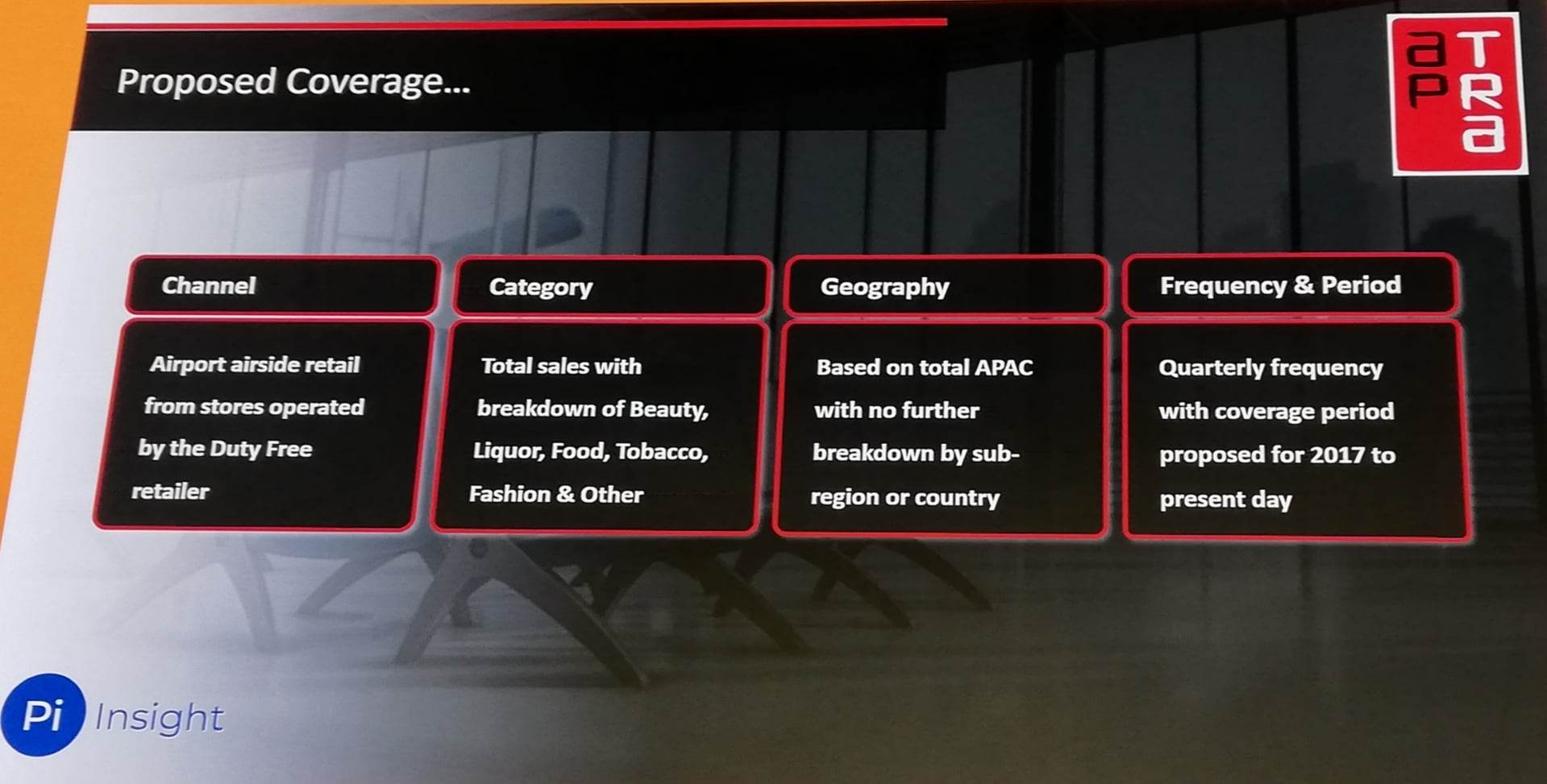

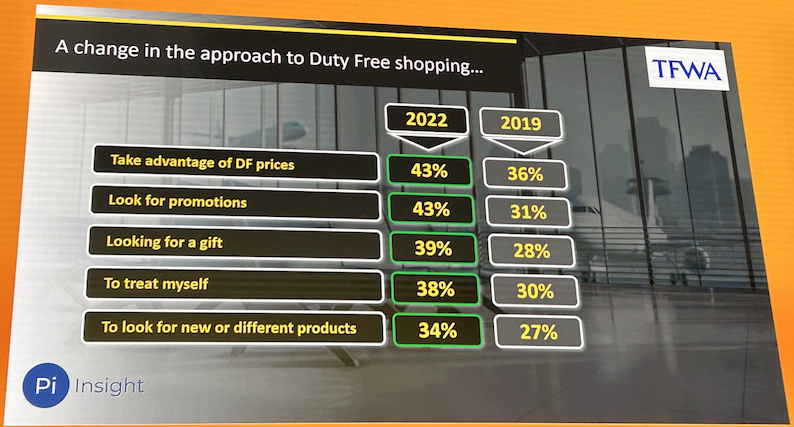

Pi Insight Managing Director Stephen Hillam introduces the APTRA Index, an initiative to provide APTRA members and participating retailers with the ability to monitor the performance of the duty free sector in the Asia Pacific region.

The concept offers an anonymised monotoring system to track regional unit and value sales performance. It would be based on retailer participation and follow the successful launch of the ETRC Index in Europe in 2021.

“We are asking for an intention to be involved,” Hillam says, “and propose a round-the-table call to go through more specific details including data sharing.”

He also points out that the Index would offer an added value service for APTRA members at no cost.

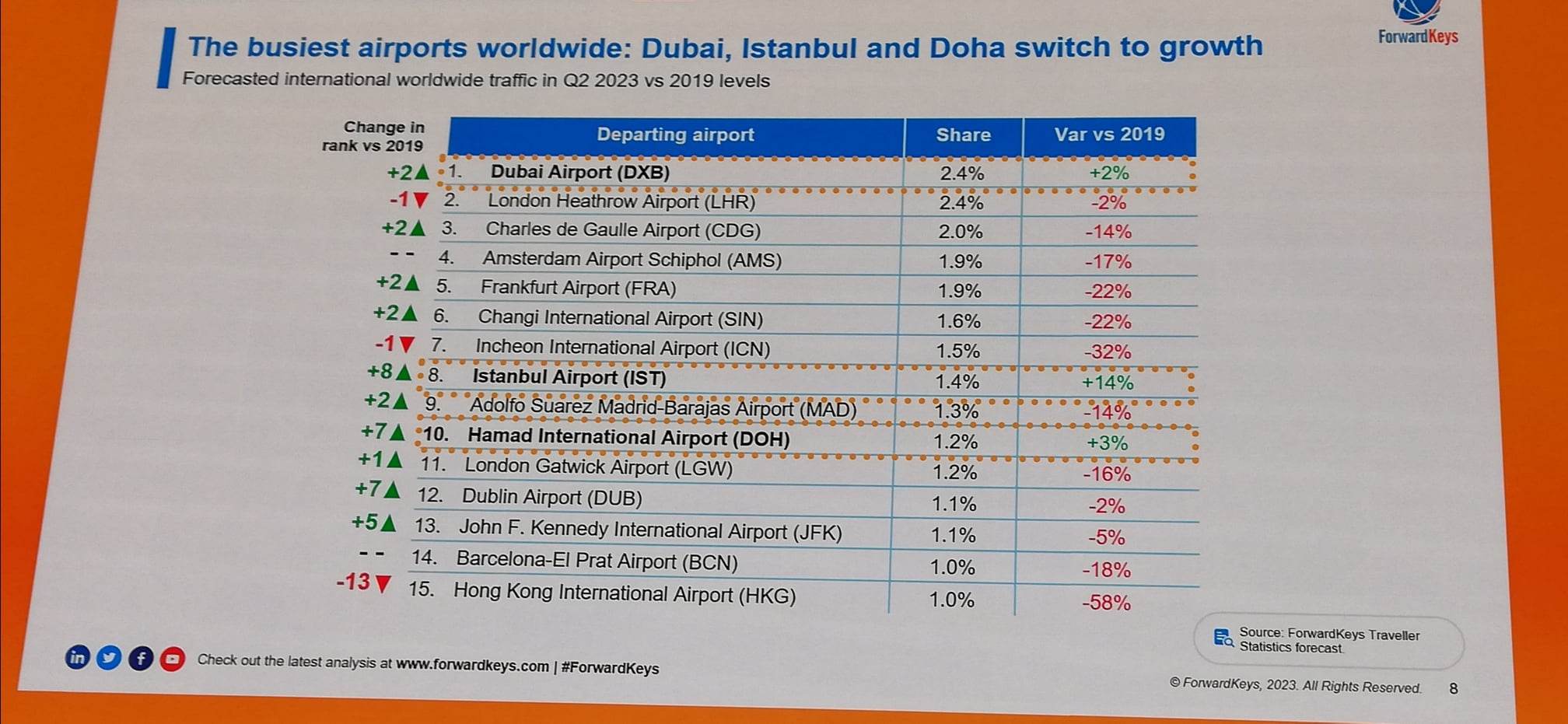

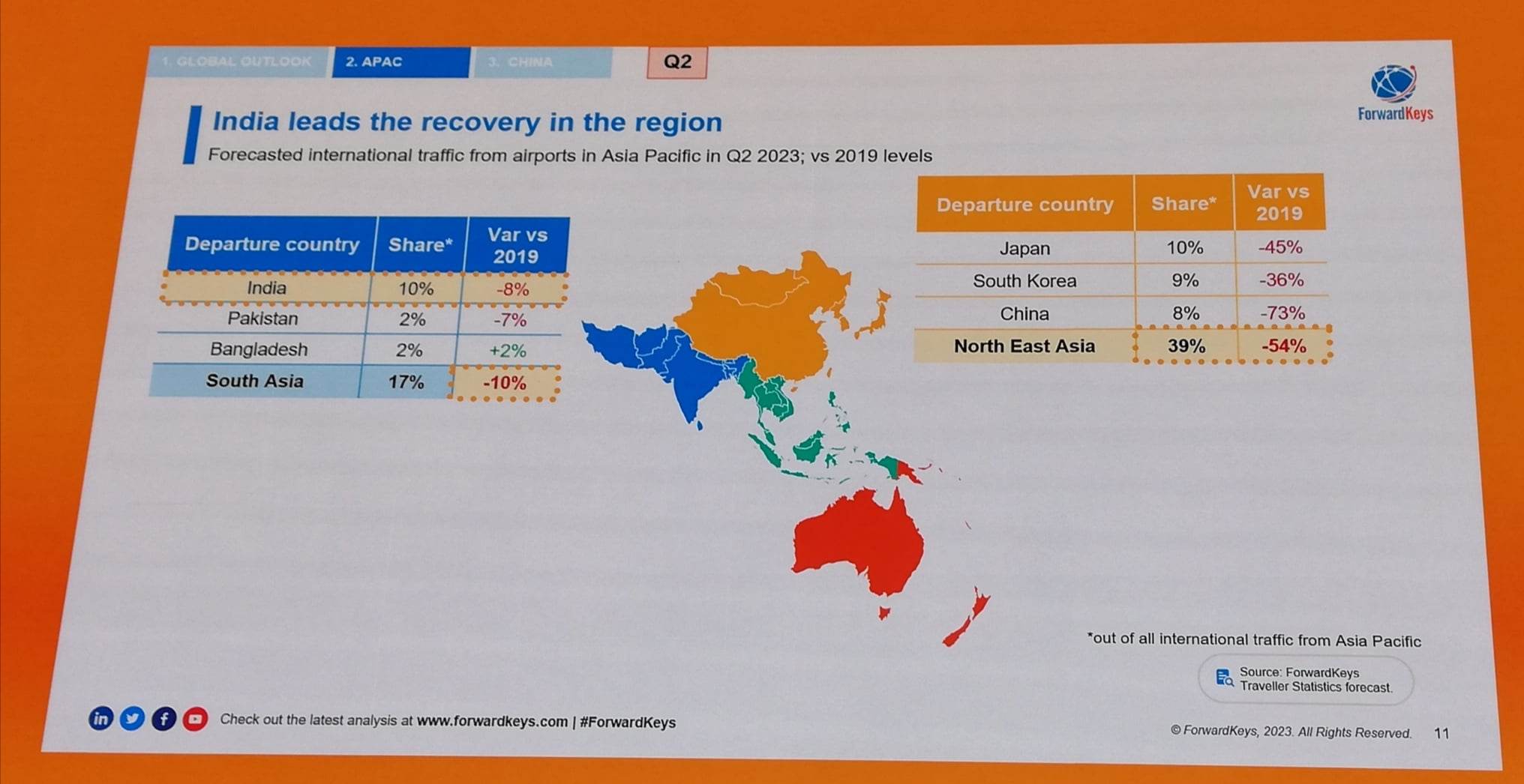

ForwardKeys Vice President of Brands, Retailers and Media Marina Giuliano looks at the latest travel forecasts in the region, and the future of the travel retail sector in terms of international departures and key airports in Q2.

She touches on ways to grow business through new opportunities in the region and spotlights the busiest airports worldwide, with Dubai, Istanbul and Doha “the ones to watch” as they switch to growth models. She also underlines India’s role in the recovery of the region.

Giuliano also reveals the top hubs for Chinese travellers going to Europe and traveller profiles.

Giuliano also reveals the top hubs for Chinese travellers going to Europe and traveller profiles.

Key take-aways of her presentation included statistics showing that APAC is the most dynamic region, set to reach 61% of 2019 levels in Q2. Indians are expected to be the second nationality in APAC in Q2, “supported by a stellar reactivation of connectivity” and Chinese travel is set to reach 32% of pre-pandemic levels in Q2 2023.

This session heard from a panel of regional industry leaders on how they are preparing their businesses for the recovery: CDFG Executive President Luke Chang, Dufry Asia Pacific President and CEO Freda Cheung, SK-II Global CEO Sue Kyung Lee, Qatar Duty Free Vice President Operations Thabet Musleh and Heinemann Asia Pacific CEO Marvin von Plato.

Lee assessed the current market for cosmetics brands in travel retail, “Overall we’re seeing a strong domestic recovery since COVID restrictions were lifted. We’ve seen very strong demand from domestic markets such as Japan where SK-II grew +47% versus the year before. In China, we saw +8% growth in the last quarter. When it comes to travel retail we’re seeing a slow and steady recovery.”

Echoing those sentiments, Cheung said: “When China reopened in January it brought in a breath of fresh air to the industry. However, while the restrictions in this region are on par with the rest of the world, the pace of recovery hasn’t been the same. We believe that is due to a supply and demand issue. To solve this, we need to work together to revolutionise the whole travel retail experience and drive that recovery.”

Von Plato added: “Over the last three years we’ve had very difficult challenges and used that time to strengthen our partnerships in the region. We have secured all our existing concessions until the end of the dace. For the first time since March 2020, all our shops are now open in the region. We’re seeing momentum and the results so far have been very confident.”

As reported, Qatar Duty Free (QDF) today announced record-high revenues for its latest financial year (April 2022-March 2023). Sales rocketed by +59% compared to 2021-2022 and by an impressive +45% over 2019-2020.

The hugely encouraging performance was driven by a more than +49% year-on-year uplift in sales per passenger (SPP). In another key indicator, QDF achieved a notable +26% turnover growth over pre-pandemic 2019 in the 2022 calendar year.

Commenting on QDF’s stellar performance, Musleh said: “We’ve had an amazing few years and that’s down to our brands and partners coming to the table with innovation and support. Tough times don’t last but tough people do. The last three years has been about being tough and taking risks. A lot of that growth was delivered through spend per passenger and we did this with lots of new shops lots of new brands. It’s a significant performance supported by all our brands and partners and all our success has been down to that collaborative approach.”

Musleh also revealed plans for the first Louis Vuitton lounge & restaurant an airport later this month. By year-end of Q1 2024, the retailer will also introduce a new omnichannel solution for its shoppers.

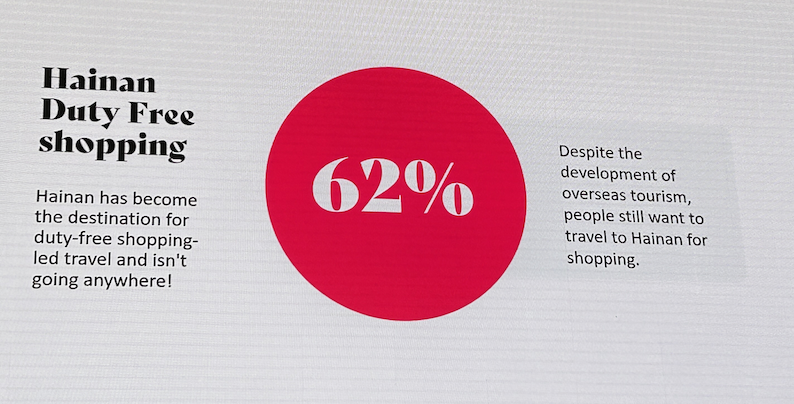

CDFG Executive Vice President Luke Chang (see also below) noted that the company was full of confidence about the future of the business in the Hainan Island offshore duty free market, with traffic returning to normal levels this year and many big infrastructure projects recently completed (led by cdf Haikou International Duty Free Shopping Complex) and others continuing.

Luke Chang, Executive Vice President of China Duty Free Group, delivered a candid and insightful overview of China’s travel retail sector and how it has been impacted by the pandemic and other more positive influences.

“First of all, I would like to share with you the challenges and opportunities to restart travel retail post-COVID,” he began.

“On the challenge side, airports, airlines, and duty-free operators are facing many practical problems, including an overall shortage of industry personnel, challenges in restarting facilities, and the slow pace of port openings and visa processing.

“It is predicted that in 2023, the number of inbound and outbound tourists in China will reach about 120 million, which is only 40% of pre-COVID levels.

“Duty free shop profitability remains significantly lower than the pre-pandemic period, while rental rates at major airports are gradually returning to 2019 levels. The overall global economic slowdown has affected Chinese consumer sentiment, leading to decreased spending. Consumers have become more price-sensitive and their purchases are more practical and rational.

“However, I would like to emphasise that despite these challenges, the Chinese market still presents tremendous opportunities.

“IMF’ (The International Monetary Fund) report of April 11, predicted that in 2023 China’s economic recovery of 5.2% will outpace global economic growth of 2.8% . UNWTO (the United Nations World Tourism Organization) predicts strong demand for international travel, with worldwide tourist numbers reaching 80% to 95% of pre-pandemic levels .

“Many countries are actively welcoming back their “old friends”— Chinese tourists.

“Despite recent softness in consumer sentiments in China, Morgan Stanley’s latest report still predicts that Chinese consumers, will remain the world’s largest consumer group of luxury goods. By 2030, Chinese consumers could account for 60% of the total growth in personal luxury spending.

“Within China, there were a total of 65 million inbound and outbound travellers in Q1, an increase of +116.2% compared to last year. We are particularly excited about the rapid recovery of traffic in Hainan. In Q1 of this year, Hainan welcomed 27 million tourists, an increase of +22.5% YoY and +22.1% higher than the same period in 2019. The total sales of offshore duty-free shops in Hainan reached RMB 20.3 billion in Q1, growing by +29% YoY. The forecast is that annual sales in Hainan this year will surpass RMB 80 billion.

“In addition, many airport authorities have extended concession agreements with duty free retailers, including our stores at Hong Kong and Macau airports.

“Over the past three years, we have made a lot of efforts to adapt to the changes. Our top priority is to maintain a continuous connection with our customers. One of our goals is to transform our store spaces into destinations that will inspire and delight our customers.

“In this regard, I would like to express my gratitude to our friends for their increasing attention on our cdf Haikou International Duty Free Shopping Complex. Recently, my team and I have received a lot of positive feedback.

“Our customers are pleased with the brand mix that we bring to the project, and they are particularly impressed by the experiential and immersive environment in our mall. They enjoy taking photos and sharing their experiences in the AURA Atrium, visiting the independent watchmakers’ shop, exploring Dunhuang culture at the Meet You Museum, or experiencing breathtaking views of China in the Flying Cinema.

“For online, we have established a pre-order platform in preparation for post-pandemic new retail business. We have continuously improved our strategy of integrating online and offline services, optimising our membership ecosystem and CRM system to enhance customer loyalty.

“Moreover, the pandemic has accelerated the development of our digital strategy, and we have launched online platforms such as ‘CDF Membership Platform’. Today, the number of CDF members exceeds 26 million.

“2022 was an extremely difficult year for CDFG. However, we are proud that we were able to retain all 16,808 of our employees and continue to invest on our long-term strategy. We opened the Haikou Xinhaigang Project in October last year and renovated our Haikou and Sanya airport stores. We opened two Duty Zero stores in downtown Hong Kong. We had the largest IPO in Hong Kong for our H shares and paid a record cash dividend of US$425.51 million (2.93 billion yuan) for our A shares in 2022.

“Recently, ChatGPT and AI have been trending all over the world. However, we believe that the offline experience is fundamental and irreplaceable for the retail industry. We hope to work closely with our partners to create greater value and open a new chapter in the travel retail industry together.

“Finally, I would like to express my sincere gratitude to TFWA for its outstanding contributions to the global travel retail industry over the years, especially for its effective work as an industry organisation during the past three deeply challenging years of the pandemic. Once again, welcome everyone and I wish the conference and indeed this week’s exhibition a great success. It is great to be back. Thank you.”

“On behalf of APTRA welcome back to our home here in Singapore. It’s fantastic to see so many of you – familiar faces, new faces – welcome,” began APTRA President Sunil Tuli in a strong and upbeat address..

“For anyone not yet familiar with APTRA, we are THE association for travel retail in Asia Pacific, a not for profit organisation delivering advocacy and regulatory response on behalf of the industry to over 45 governments; we share knowledge and research; we facilitate fantastic networking and connection opportunities. We have many members in this room today and APTRA membership is open to all businesses operating in travel retail.

“Here in Singapore we’re right at the heart of the region that will soon carry on where it left off in 2019 – the engine that drives the global growth of the travel retail industry.

“With the return of Chinese outbound traffic easing week on week, and tour groups starting to travel again to key destinations including New Zealand and Thailand – where China was the largest market before the pandemic – our prospects are strong for the rest of the year and we can finally plan for a full return in 2024 to the region’s long-term performance path.”

Tuli continued: “The regional engine is accelerating. With strong forecasts indicating a full recovery to pre-2019 traffic levels next year, there’s a great deal to look forward to, and the priority is how we optimise that recovery.

“It’s crucial that we strive to make this recovery phase in 2023 as strong as possible; the better we do this the more robust our position will be to fully exploit the growing opportunities that 2024 will bring.

“As a tangible example of what’s coming – last month, ACI’s data showed that Changi returned to the list of the world’s top ten busiest airports – just 13 months from when Changi reopened to international traffic.

“And there’s more. The latest forecast from APTRA research partner ForwardKeys points to an overall recovery in international departures from AsiaPacific to 53% of 2019 volumes in Q2 2023.

“Steady, sustained progression is apparent across the region – including highly positive spending patterns – and, ultimately, this will materialise into a manageable and stable base for full recovery.”

He added: “The intensity of the pandemic inevitably dominated the agendas of the region’s governments but, as Covid moves into the rear-view mirror, there are increasing regulatory obstacles on the road ahead.

“In fact in APTRA’s 18 year history we have never been busier on regulatory and advocacy issues – with 13 campaigns over the last 15 months.

“Last Spring, APTRA shared in a wider travel and tourism industry approach working closely with ACI, AAPA, IATA and PATA to urge governments to consider open border solutions such as travel corridors and bilateral agreements to enable the resumption of international travel and the return to business for all impacted sectors, including travel retail. We were part of a meeting with senior officials at ASEAN who were sympathetic to our representation and we had letters of support from other organisations including the Hong Kong Tourism Board.

“Looking more specifically at travel retail… in tobacco, you may be aware that New Zealand’s government has pioneered a significant strategy aimed at a ‘generational end game’ designed to ensure that no one born after 1st January 2009 – ie currently under 14, will ever be able to legally purchase cigarettes in New Zealand.

“APTRA has responded by making representation to the government to ensure the unique aspects of travel retail are properly considered, especially regarding the allocation of retail licenses – which are set to be reduced by up to 90% across the country. And we have emphasized our industry’s robust retail protocols that ensure there is no under-age selling. This is an ongoing situation and we expect an outcome later this year.

“Other countries in the region, including Malaysia and Hong Kong, look set to be considering similar strategies and we are currently working with operators in Malaysia to co-ordinate the most effective approach to the government’s recently renewed focus on the issue.

“In alcohol, APTRA’s Alcohol Working Group scoped out the optimal approach to South Korean authorities for an increase in alcohol value allowances following a review in August/September 2022, the first in 40 years, that increased value but volume remained unchanged.

“I’d like to thank Pernod Ricard, Bacardi and Diageo for helping navigate a complicated government network to find the most influential decision-makers.

“Pernod Ricard represented APTRA in a face to face meeting with Korean customs in March, making the case for increasing value allowances to reflect inflationary changes and the increasing sophistication of Korean consumers skewing towards ultra premium spirits. This is now being considered although we don’t expect it to be reviewed in the short term.”

Tuli said that sustainability is also moving up government agendas in the region.

“Last July the India government implemented a country-wide ban on single use plastics (SUP) under 100 microns – typically seen as polywrap packaging in travel retail.

“The implications for travel retail have not been officially stipulated and there was considerable ambiguity as to the interpretation of the regulation. APTRA led a strong cohesion with duty free retailers across India and brands in major categories to share information and agree best practice going forward and, given the long track record of duty free being considered an export channel, the industry aligned on this being the case for the ban on Single Use Plastics.

“These are just a few of the many issues that APTRA manages on behalf of our members and the wider industry.

“Most of our campaigns are ongoing, we still have much to do and we will of course, face new threats in the year ahead – and we have a great industry to fight for.”

7 MAY

6 MAY

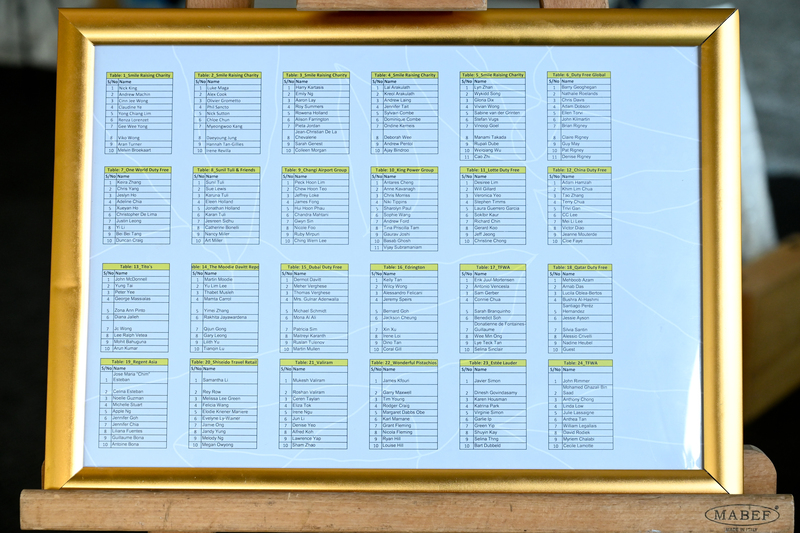

The Moodie Davitt Smile Raising Charity Dinner tonight reached sold-out status with close to 250 guests attending the event at Hotel Fort Canning, Singapore. The event rasied funds and critical visibility for international cleft charity Smile Train.

(More photos coming soon)