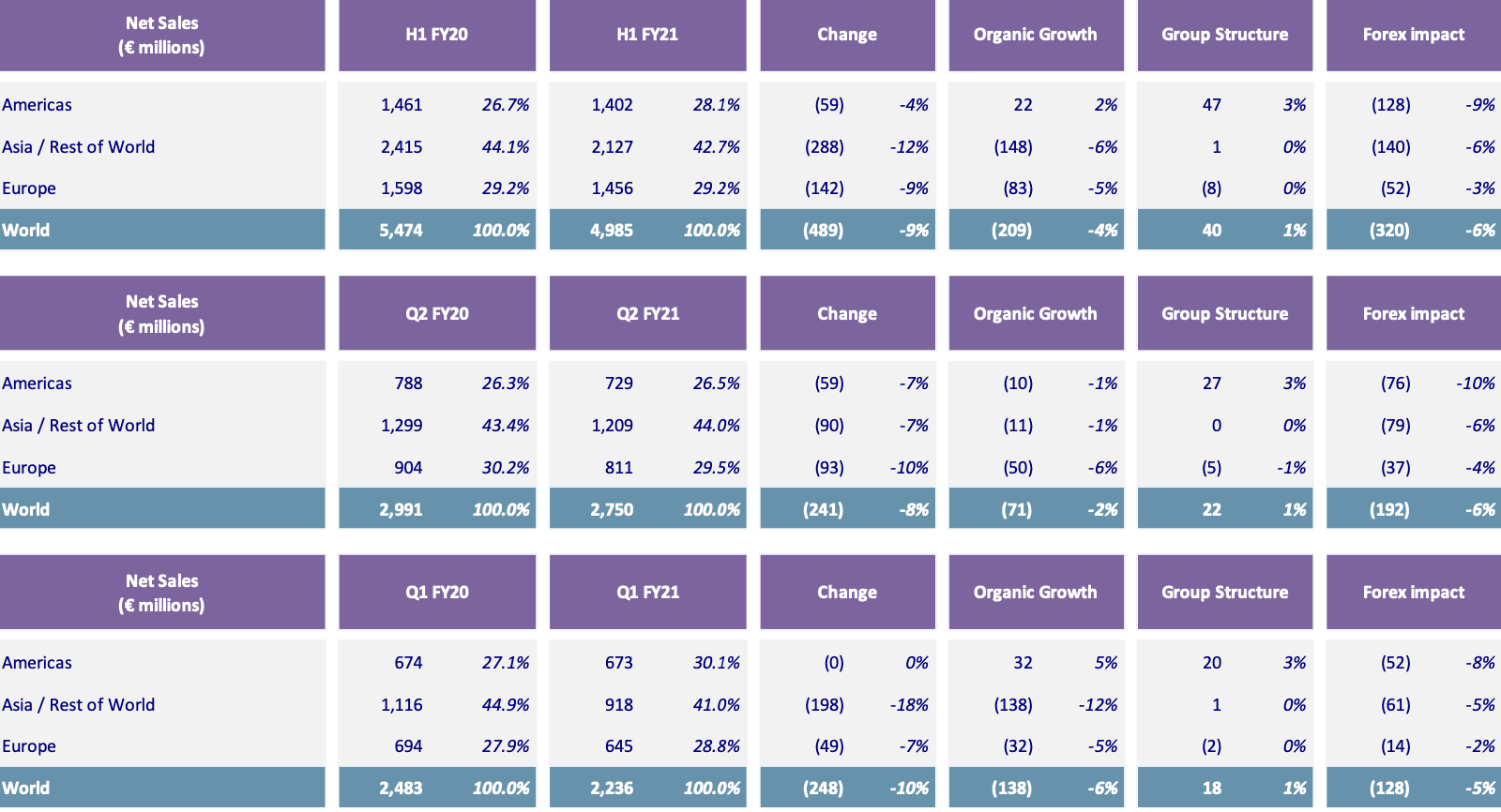

Drinks group Pernod Ricard today reported first-half sales of €4,985 million, down by -8.9% year-on-year on a reported basis and -3.9% in organic terms. Travel retail sales fell by -57% year-on-year.

Group sales excluding travel retail grew by +1%, with the channel continuing to be hit hard by the restrictions on travel across all regions. The company said that the travel retail division is “managing resources in an agile manner” and is focusing on critical business drivers, including Hainan Island.

Although travel retail remains difficult, the company highlighted a positive performance in offshore duty free, citing Hainan and Jeju islands. It also noted the strong performance of Martell, and a higher proportion of Martell sales from Cordon Bleu, Noblige and XO “thanks to Hainan”. [Click here for our story on therecent opening of the first Maison Martell boutique in Hainan, in partnership with China Duty Free Group.]

The company noted an unfavourable foreign exchange impact on H1 results, mainly linked to the appreciation of the Euro against the US Dollar in the period. Net profit fell by -6% to €984 million.

Key sales trends by region were:

- Americas +2%: The company cited good growth in most domestic markets, with particular dynamism in the USA (+5%), but “significant decline in travel retail”

- Asia-RoW -6%: double-digit growth in China (+13%), Turkey, Korea and Pacific, and a return to growth in India in Q2 of +2% (H1 -6%), but with Covid-related declines in certain Asian markets and travel retail

- Europe -5%: continued very strong growth in Germany, UK, Russia and Poland, more than offset by the Covid impact in Spain, France, Ireland and in travel retail

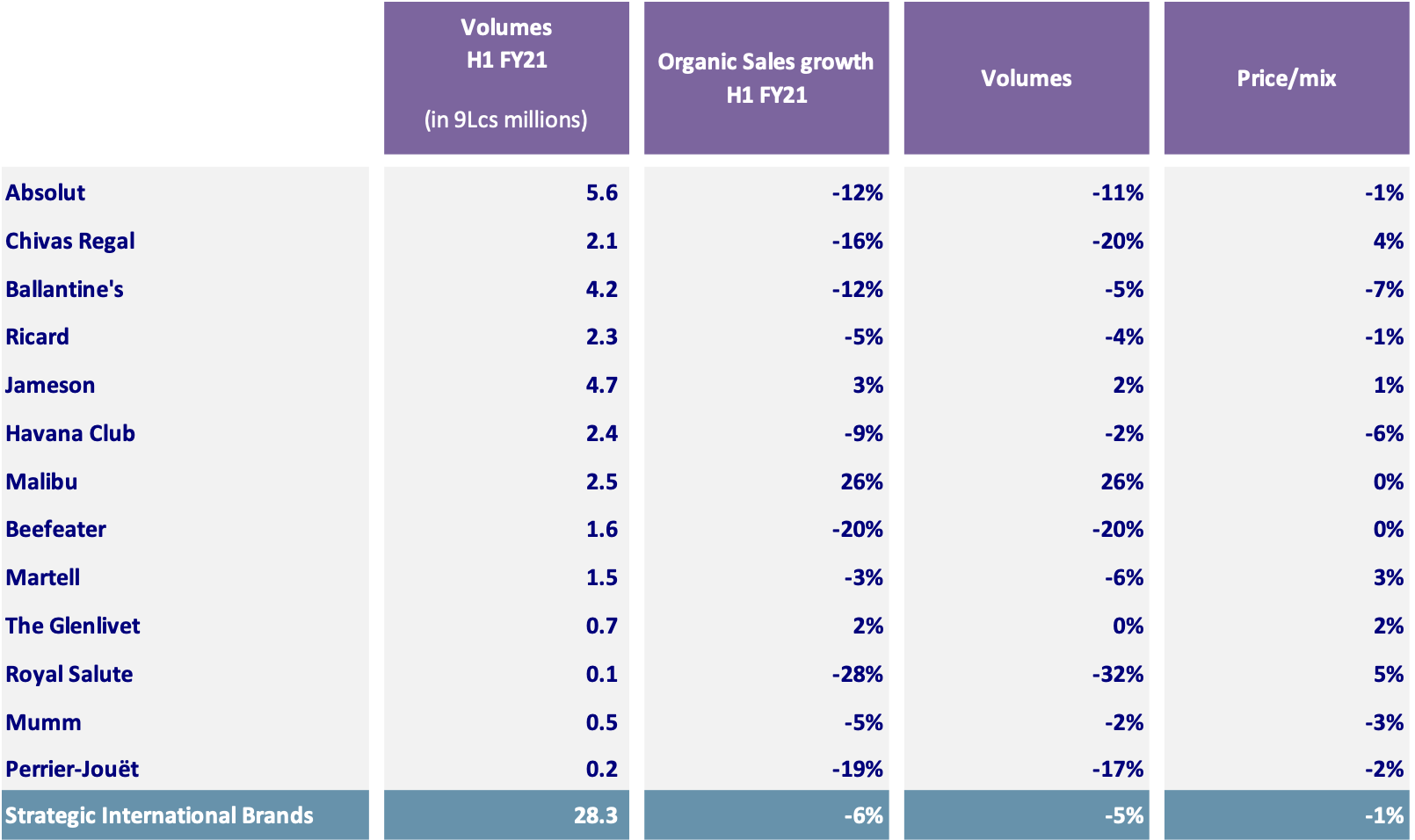

Sales of Strategic International Brands declined due to travel retail and on-trade exposure but Pernod Ricard’s specialty brands performed strongly:

- Strategic International Brands -6%: solid growth of Malibu, Jameson and The Glenlivet, but overall the category was impacted by travel retail exposure. Martell and Scotch grew in domestic markets

- Strategic Local Brands -4%: mainly driven by Seagram’s Indian whiskies and Seagram’s Gin in Spain

- Specialty Brands +22%: continued development of Lillet, Malfy, Aberlour, American whiskeys (Jefferson’s, TX, Rabbit Hole and Smooth Ambler), Avion and Redbreast

- Strategic Wines +3%: solid growth thanks mainly to Campo Viejo and Brancott Estate.

Q2 group sales were €2,750 million, down by -2.4% in organic terms but showing an improvement compared to Q1, thanks in particular to China and India.

Chairman and Chief Executive Officer Alexandre Ricard said: “We are particularly encouraged by our must-win domestic markets returning to growth in H1 FY21. The first half confirms the long-term sustainability and underlying strength of our business.

“Despite an uncertain and volatile environment, with disruption in the on-trade and a prolonged downturn in travel retail, we anticipate organic sales growth for full-year FY21, thanks in particular to our dynamic performance in domestic must-win markets USA, China and India.”