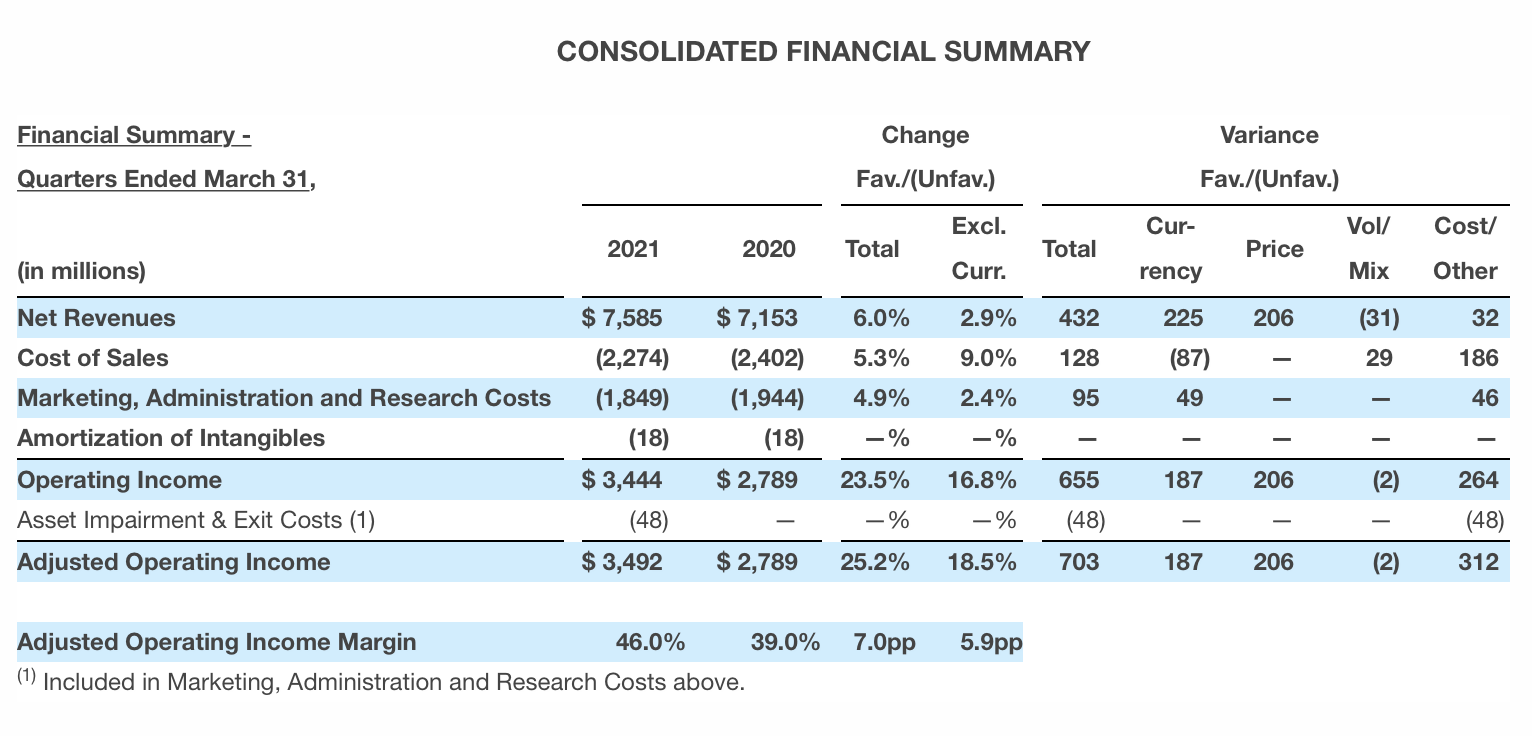

Philip Morris International (PMI) has announced a strong start to 2021, with net revenues climbing by +6% to US$7.59 billion year-on-year in Q1 (+2.9% on an organic basis), results which it noted were ahead of expectations.

In an upbeat forecast for the months ahead, PMI assumed a gradual improvement in the general operating environment. However, it cited potential volatility around the duration and effects of pandemic-related mobility restrictions across key markets. It also said that a near-term recovery in the duty free business was unlikely given the uncertain outlook for global travel.

But it also assumed that, even in the event of prolonged pandemic-related restrictions, there will not be a return to the depressed consumption levels of the second quarter of 2020.

Other highlights from the Q1 results include net revenues from smoke-free products accounting for 28% of total net revenues, with operating income up by +23.5% to US$3.44 billion and adjusted operating income rising by +18.5% to US$3.49 billion on an organic basis.

Cigarette and heated tobacco unit shipment volumes fell by -3.7%. This, PMI noted, reflected a fall in cigarette shipment volume of -7.3%, while heated tobacco unit shipment volume was up by +29.9% to 21.7 billion units.

Market share for heated tobacco units in IQOS markets, excluding the US, was up by +1.7% to 7.6%.

PMI CEO André Calantzopoulos said: “We are pleased to have delivered a very strong start to the year, with top and bottom-line results coming in well ahead of our expectations for the first quarter despite the ongoing challenges of the pandemic.

“This performance was driven by the continued strength of IQOS, in particular, reflecting excellent user, volume and market share momentum, as well as further progress with manufacturing and operating cost efficiencies.

“Our results also benefited from the timing of specific factors, notably associated with shipments in certain markets and the phasing of commercial investments, which are expected to partially reverse in the second quarter.

“While the speed and shape of the global recovery from the pandemic remains uncertain, we are raising our full-year outlook, on an underlying basis, to reflect the strong results and positive momentum of the first quarter. Our guidance now represents organic adjusted diluted EPS growth of +11% to +13%, reflecting net revenue growth of +5% to +7% on the same basis.”

The group has revised its full-year reported diluted EPS forecast to a range of US$5.93 to US$6.03, at prevailing exchange rates, representing a projected increase of around +15-17% versus reported diluted EPS of US$5.16 in 2020. This compares to the previously communicated forecast range of US$5.90 to US$6.00, provided on 10 February 2021.