SOUTH KOREA. The Shilla Duty Free (Hotel Shilla) is, as anticipated, quitting its Incheon International Airport DF1 duty-free concession awarded in the 2023 tender, tentatively effective 17 March 2026.

Shilla’s decision follows Incheon International Airport Corporation’s (IIAC) formal rejection on 16 September of Incheon District Court’s mediation order in favour of -25% and -27.5% rent reductions, respectively, for it and Shinsegae Duty Free’s T1 and T2 retail concessions.

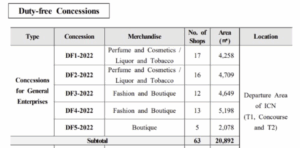

This will mean a new tender for the extensive DF1 concession (see table below for details) in due course.

Both retailers were then faced by a choice of two unenviable options – proceed to a full lawsuit or withdraw from the contracts in question. Despite facing heavy termination penalties of around KRW200 billion (US$144 million), Shinsegae and Shilla had earlier threatened to terminate their concessions if negotiations were unsuccessful.

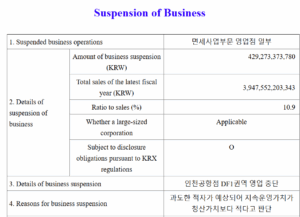

“Due to the expected excessive deficit, the continuing operating value is judged to be less than the liquidation value,” Hotel Shilla said in a regulatory filing today.

“While a short-term decline in sales is expected, we anticipate a significant improvement in the company’s overall financial performance in the medium to long term.

“Along with risk management, we are pursuing overall business growth strategies,” the company concluded.

Rival Shinsegae Duty Free is still considering its options (limited to two, see below) though many local observers expect it to follow suit.

However, that view is balanced by the fact that Shinsegae lacks other airport businesses to compensate for any loss of Incheon, unlike Shilla which also has beauty concessions at Changi and Hong Kong International airports.

“So Shinsegae Duty Free’s business would be severely affected by an Incheon exit in terms of trade conditions and margin strategies,” one informed observer told The Moodie Davitt Report.

“As reported, Incheon International Airport has rejected the court’s mediation order. We regret that the airport authority has chosen not to accept the court’s decision,” a Shinsegae Duty Free spokesperson told The Moodie Davitt Report yesterday (17 September).

“Our company will carefully review the situation and determine our course of action with due consideration.”

Litigation would likely take years and involve not only big legal expenses but recurring, likely escalating, losses at Incheon. While the temporary new visa-free status for Chinese visitors being introduced on 29 September (until 30 June 2026) is set to revitalise tourism, the influx may actually worsen both retailers’ position.

That’s due to the per-passenger rental structure – if arrivals surge but spending doesn’t, as appears likely given the prevailing soft Chinese consumer sentiment, the retailers will end up paying more.

IIAC is concerned that by agreeing to any reductions, whether court-driven or not, it would be creating a dangerous precedent for future tenders while also opening itself up to legal challenges from any unsuccessful bidder – notably Lotte Duty Free – in the 2023 contest.

In rejecting the court’s verdicts, IIAC President Lee Hak-jae stated: “If IOAC reduces the rents of the two duty-free shops in compliance with the court’s compulsory mediation order, it would undermine the very foundation of the Public Contracts Act.”

Earlier this month IIAC was quoted by the Kyunghyang Shinmun media title saying: “If this kind of adjustment is made, in the future if the bidder with the highest bid is selected and then runs a deficit, the way will open up for them to apply to the court for mediation and receive a rent reduction.”

As reported, the two retailers have been in a prolonged row with IIAC after the airport company’s refusal to agree to -40% fee reductions relating to their respective T1 and T2 concessions. After that was rejected, both parties applied for court mediation. ✈

TENDER ALERTThe Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport or other travel-related infrastructure revenues, simply email Martin Moodie at Martin@MoodieDavittReport.com. We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately. The Moodie Davitt Report is the only international business media to cover all airport or other travel-related consumer services, revenue-generating and otherwise. Our reporting includes duty-free and other retail, food & beverage, property, passenger lounges, art and culture, hotels, car parking, medical facilities, the internet, advertising and related revenue streams. Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage. |