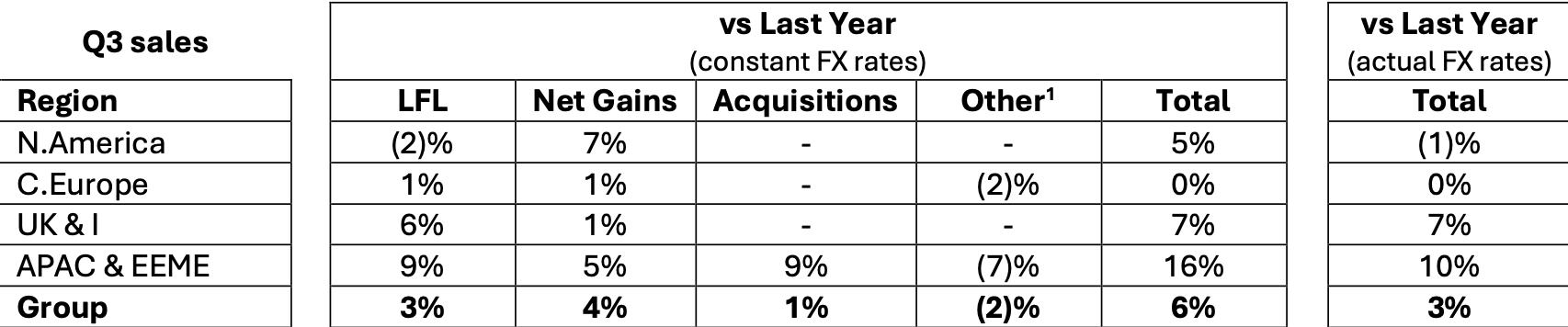

UK. SSP Group today (29 July) issued a trading update for the quarter to 30 June, with group sales climbing +6% year-on-year on a constant currency basis. This included like-for-like sales growth of +3%, net contract gains of +4% and a +1% contribution from acquisitions in Q3.

Group sales also included a combined impact of -2% from the staged exit of the German motorway services business and the deconsolidation of the Adani Airport Holdings Limited joint venture in India.

Like-for-like sales growth in the first six weeks of the quarter was +5%, while sales growth in the last seven weeks of the quarter moderated to +1%, reflecting a softening of like-for-like sales in the UK and Asia Pacific & EEME regions. More recently, like-for-like sales growth improved to around +3% in the first three weeks of the fourth quarter.

In North America, sales grew +5% year-on-year, on a constant currency basis, including strong net gains but with like-for-like sales declining -2%, reflecting lower passenger numbers compared to the prior year.

SSP noted, “This follows recent geopolitical events in the USA which led to a fall in air travel in late spring and early summer.”

In Continental Europe, sales were flat year-on-year, including like-for-like sales up +1%, reflecting weaker levels of consumer spending in many markets, which has mainly affected the rail sector. It also included an impact of -2% from the previously announced exit of 67 unprofitable motorway units in Germany, with further exits expected through Q4 2025 and into 2026 as part of the regional profit recovery plan.

In the UK, sales rose +7%, driven by strong like-for-like sales at the beginning of the quarter, helped by the timing of Easter. M&S systems issues, following its cyber incident in mid-April, affected UK like-for-like sales during the quarter, though sales have since recovered.

In APAC & EEME, sales increased +16%, as good passenger growth in Malaysia, Egypt and Australia drove strong like-for-like sales of +9% across the region. Like-for-like sales softened towards the end of the quarter due to the impact of rising geopolitical tensions and air safety incidents across the region. Sales benefitted from the acquisition of Airport Retail Enterprises in Australia, which reached its anniversary in May and has been treated as like-for-like since then.

For the nine-month period from 1 October 2024 to 30 June 2025, total group revenues increased +10%, including like-for-like sales growth of +4%, net contract gains of +5%, a benefit from acquisitions of +3% and other negative impacts at -2%. At actual exchange rates, total group revenues increased +7% year-on-year in the period.

SSP maintains its planning assumptions for revenue to be within the range of £3.7-3.8 billion (US$4.9-5.1 billion), with a corresponding underlying pre-IFRS 16 operating profit within the range of £230-260 million (US$306-346 million), and earnings per share within the range of 11.5-13.5p (15-18¢), all on a constant currency basis.

Note: The Moodie Davitt Report publishes the FAB Newsletter, which features highlights of openings, events and campaigns from around the world of airport and travel dining.

Please email Kristyn@MoodieDavittReport.com for your complimentary subscription.