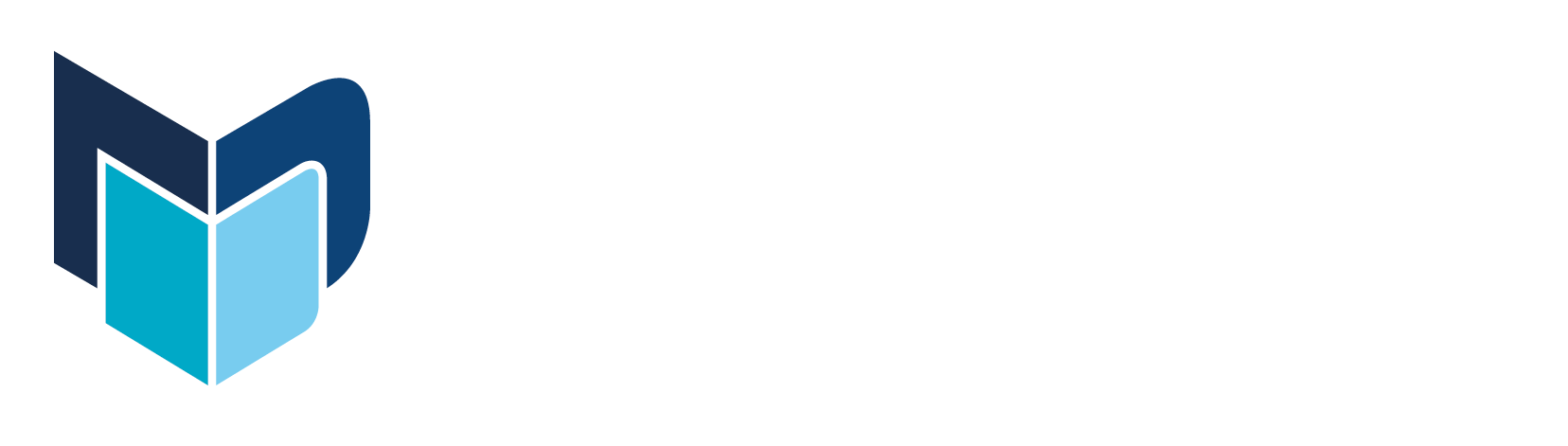

EUROPE/ASIA. Tax free shopping specialist Global Blue has reported +14% year-on-year sales growth in Asia in June, and a +8% increase in Europe.

Japanese tax free shopping sales (+52%) continued to drive all regional growth in Asia. As Korea’s economic and political situation worsens, Japan remains the main beneficiary of visits from Korean globe shoppers and their subsequent tax free shopping spend, Global Blue said. Japan’s retail sector has reacted to this surge in transactions (+36% in June) and a rise in average spend (+12%), with several high profile brands expanding operations, “further reinforcing the country’s status as a global luxury retail location”.

Singapore was negatively impacted by the softer performance of Indonesians who avoided travelling during Ramadan. Indonesians make up around a quarter of tax free shopping sales in Singapore and contributed to a flat performance (+0%) during June. Transaction growth was also limited by a high base for comparison in June 2016, when large numbers of travellers from tier two Chinese cities visited the country. Average spend was up +7% as higher value customers visited Singapore, balancing the drop in transaction growth, Global Blue noted.

Chinese, Indonesian and Korean globe shoppers drove high-value spend growth across Asia during the second quarter, with June contributing to an increase in high-value sales in Singapore and Japan. Singapore saw solid increases in sales between S$3,000 (US$2,204) and S$5,000 (US$3,674) from Chinese (+13%) and Indonesian (+16%) globe shoppers.

Chinese sales in store increased by +20%, driven by a sharp rise in average spend (+25%). Korean tax free shopping sales grew by +57% as large numbers of travellers continued to buy goods outside the country. Taiwanese and Malaysian sales in store grew by +15% and 24% respectively during June.

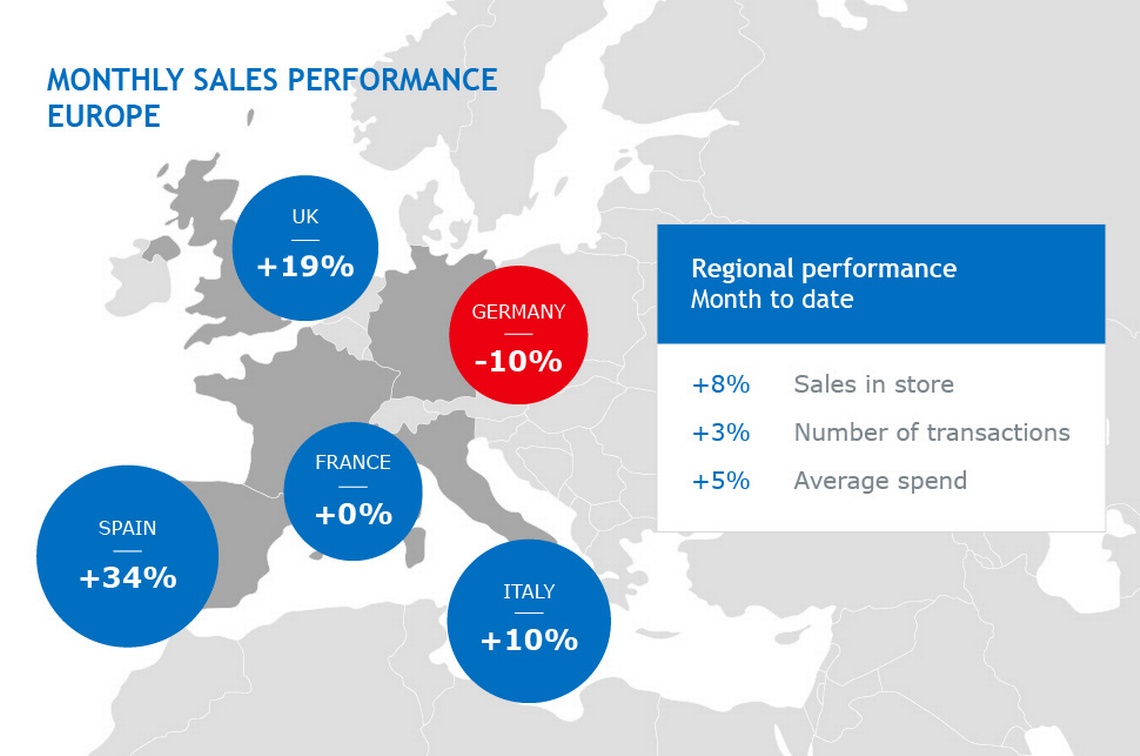

Europe

In Europe, transaction growth softened year-on-year (+3%) while average spend continued to develop positively (+5%), Global Blue said.

An early Ramadan (which took place between 27 May and 25 June compared to 7 June to 6 July in 2016) impacted the results. The UK was most exposed to the softening of tax free shopping sales, with 23% of total sales coming from Gulf Cooperation Council (GCC) countries. French growth also slowed due to 6% of sales coming from GCC nations.

“Signs point towards a post-Ramadan uplift for most of the GCC countries, with tax free shopping activities historically improving after the fasting season,” Global Blue said. “However, with Qatar still feeling the impact of embargoes, this year could see less Qatari visits to Europe and in particular the UK, a popular destination for Qatari globe shoppers.”

Europe has seen a strong first half of 2017 in terms of Chinese sales in store, the organisation reported. During June this growth (+13%) was driven by an increase in average spend, while number of transactions remained relatively flat (+1%). This flat performance was attributed to a high basis of comparison with 2016, when low cost travel to Europe encourage large numbers of travellers from tier two cities to visit the continent. A softening of the Chinese Yen against the Euro (6% since May) has seen a reduction in visits from this group and a subsequent rise in average spend across the region.

The UK continued to perform strongly (+19%) a year after the Brexit announcement, despite the mixed effects of Ramadan and a much higher basis for comparison with 2016 figures. Growth from luxury sales remained strong, with June contributing to steep increases in high-value sales, particularly from Chinese shoppers. UK sales from Chinese visitors over £5,000 (US$6,512) increased by +104% (vs +27% for all other nationalities) as the profile of Chinese travellers across Europe swung back towards higher spending individuals.

Global Blue reported a positive performance across most major European tax free shopping sales markets in June. Spain was Europe’s best performing key market, with sales up +34% due to the ongoing positive impact of key airline connections with Russia and China. Italy continued to develop well posting year-on-year growth of +10%.

Following a positive May performance (+5%), German sales in store fell by -10% during June, which Global Blue said was due to shifting travel patterns from Chinese visitors.