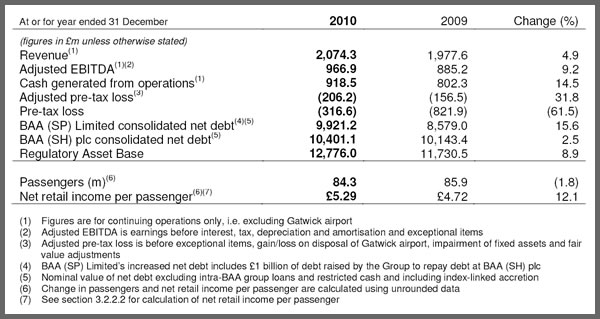

UK. A strong performance from the retail division buoyed BAA (SP), which owns London Heathrow and Stansted airports, in the year ended 31 December.

Gross retail income climbed by +8.4% year-on-year to £476.3 million, while net retail income rose by +10.1% to £445.7 million. Crucially, net retail income (NRI) per passenger increased by +12.1% to £5.29. This was driven by what BAA called an “exceptional” performance at London Heathrow, where NRI per passenger hit £5.64 (up by +14.4%).

At Heathrow gross retail income increased +11.9% to £393.2 million and most areas of the retail business performed well, with the main growth drivers through the year being airside specialist shops (with income of £83.4 million) and duty and tax free (£113.5 million). In addition there were increasing signs of recovery in car parking as the year progressed, said BAA.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

The company noted: “Heathrow’s excellent retail performance reflects the increase in the proportion of higher spending origin and destination passengers from 63% in 2009 to 65% in 2010. This benefits both the in-terminal and car parking elements of retail income. The performance also reflects the greater numbers of passengers utilising Terminal 4 following relocation of airlines prior to Terminal 2’s closure who are benefiting from its upgraded retail facilities completed as part of the terminal’s recent refurbishment.

“Further, various initiatives by the Group supported growth including advertising campaigns such as “˜West End for less’ highlighting the value proposition of Heathrow’s retail outlets, more in-terminal sales support and actively managing the mix of concessionaires. Growth in passenger spend was particularly strong in the luxury segment of Heathrow’s airside retail outlets, consistent with recent trading performance reported by many luxury fashion retailers.”

Stansted’s gross retail income declined -5.6% to £83.1 million (2009: £88.0 million), which BAA said was “a resilient performance” given passenger trends which meant that NRI per passenger increased +0.5% to £4.02.

“Growth in Stansted’s NRI per passenger reflects particularly performance in airside specialist shops and catering with net car parking income per passenger stabilising after a significant period of weakness,” said BAA.

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

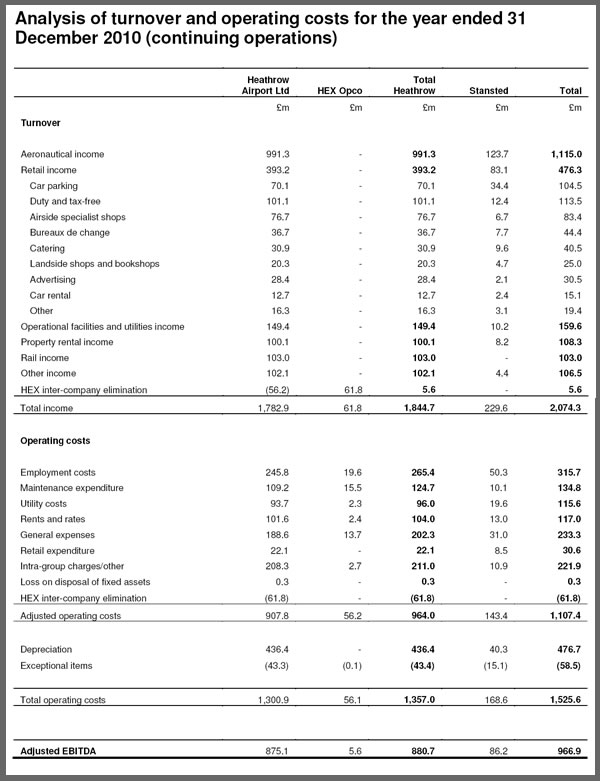

Total group turnover from continuing operations increased +4.9% to £2,074.3 million, which reflects increases of +2.0%, +8.4% and +8.4% in aeronautical income, retail income and other income respectively.

Adjusted EBITDA from continuing operations hit £966.9 million, up by +9.2% on a year ago. The company recorded a pre-tax loss of £316.6 million, down -61.6% on the previous year’s 821.9 million loss due to lower exceptional items and fair value adjustments. BAA said it expected a strong increase in profitability in 2011.

Passenger traffic

In the year ended 31 December combined passenger traffic at Heathrow and Stansted declined -1.8% to 84.3 million (2009: 85.9 million). The year-on-year performance reflects a number of exceptional events including closure of airspace due to volcanic ash, airline industrial action affecting Heathrow and severe winter weather, as well as the macroeconomic environment.

Adjusting for these factors the group’s traffic is estimated to have increased by up to +1.5%, said BAA.

At Heathrow, where traffic trends are more influenced by global economic factors than at Stansted, reported traffic declined -0.2% to 65.7 million; but adjusting for the factors outlined above, its traffic is estimated to have increased by up to +3.4%. Heathrow’s underlying growth accelerated as the year progressed driven particularly by European scheduled traffic and renewed confidence amongst business travellers.

Stansted’s reported traffic declined -7.0% to 18.6 million. Adjusting for disruption due to volcanic ash and severe winter weather, its traffic is estimated to have fallen no more than +4.8%. The underlying decline reflects inter-related capacity reductions by airlines and renewed economic uncertainty in the UK that particularly affected the outbound leisure market, a key part of Stansted’s traffic, noted BAA.

In terms of traffic trends by market served during 2010, across the two airports, North Atlantic and emerging market long-haul traffic as well as European scheduled traffic outperformed. Of particular note, within Europe, traffic with Switzerland increased by +11.1%, Italy by +7.0% and Germany by +1.8% while in emerging markets such as South America and South Asia there were increases of +8.1% and +1.1% respectively.

BAA Chief Executive Officer Colin Matthews said: “We delivered a robust financial performance in 2010, despite the volcanic ash, strikes and snow that affected major airports across Europe and North America. Strong passenger growth at Heathrow in the second half of the year reflected the ongoing improvement in the global economic climate.

“We continued to strengthen and diversify our funding position by raising £2 billion of new financing, underpinning our investment in upgrading Heathrow. BAA is undertaking the UK’s biggest privately funded development with the airport’s new £2 billion Terminal 2 which will offer passengers a quicker and easier transfer experience by grouping the Star Alliance airlines together.

“Significant progress has also been made in renovating older terminals and we are investing nearly £250 million in a new baggage tunnel between Terminal 3 and Terminal 5 to speed up passengers’ journeys.

“In 2011 we expect to deliver a strong increase in profits and cash flow, enabling us to make further investments in improving facilities and further strengthening our financial position.”

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |