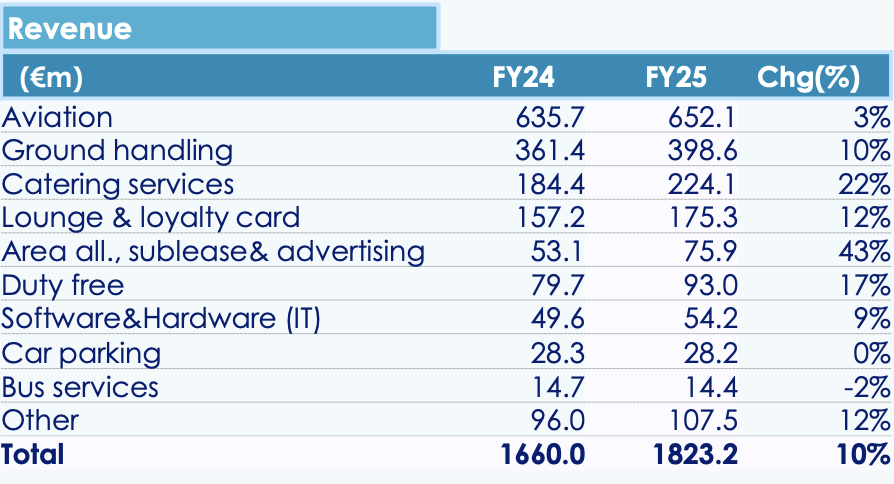

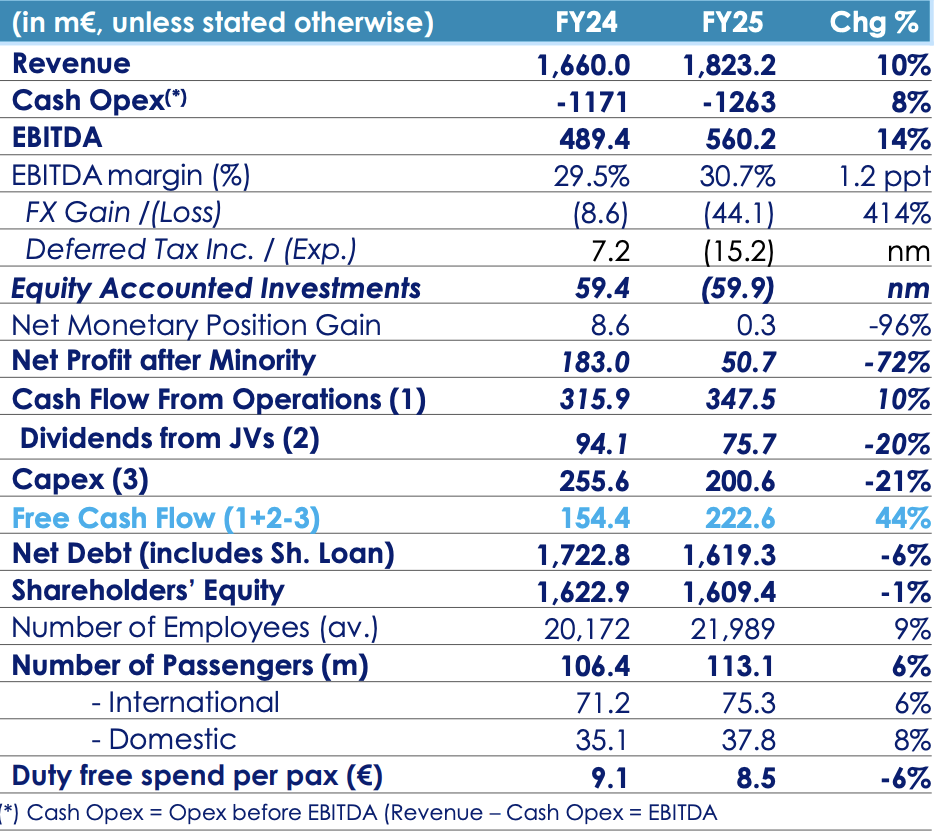

TÜRKİYE. TAV Airports, a division of Groupe ADP, posted revenue of €1,823 million in 2025, a rise of +10% year-on-year.

EBITDA climbed +14% to €560 million in the year, with net profit of €50.7 million, a fall of -72% due to deferred tax, foreign exchange and one-off cash effects, said the company.

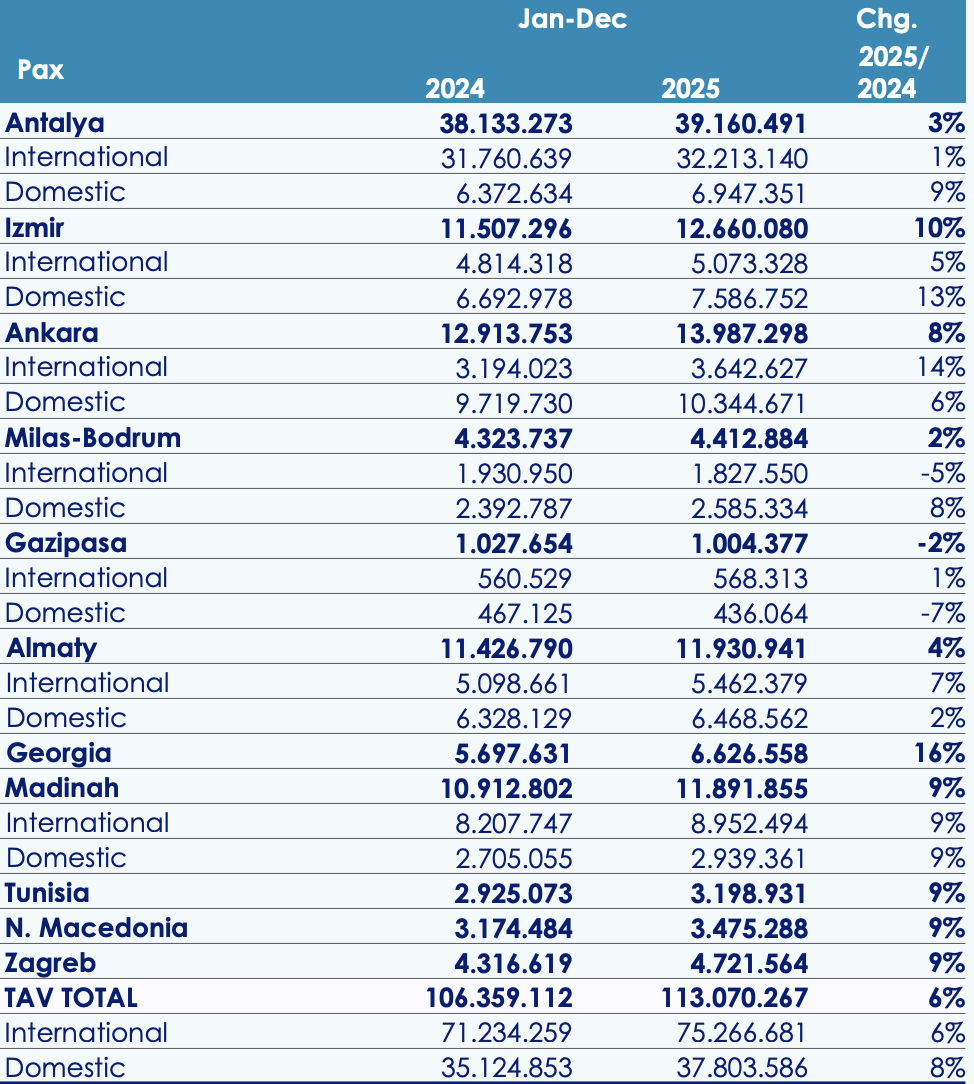

TAV Airports served 113 million passengers in the year, up +6% on 2024. This included 75 million international travellers, up +6%, and 38 million domestic, up +8% year-on-year across the network.

TAV Airports CEO Serkan Kaptan said, “The year presented challenges in the form of geopolitical developments and the relative strength of the Turkish Lira, while a shorter winter season provided some tailwinds. Non-Turkish assets performed very strongly with +9% growth, once again demonstrating the overall resiliency of our geographically diversified portfolio.”

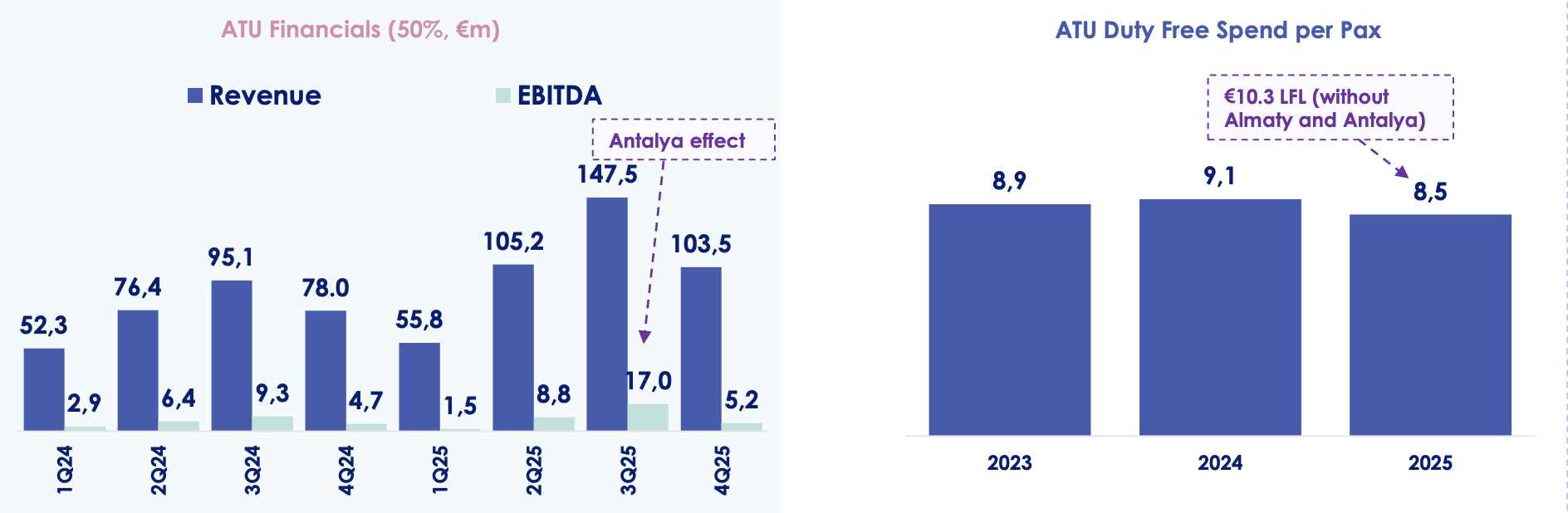

Non-aeronautical activity represented 42% of revenue in the year. Duty-free revenue – principally from TAV Airports’ 50% share in ATU Duty Free alongside Gebr. Heinemann – climbed +17% year-on-year to €93 million.

As factors lifting duty-free sales the company cited higher international traffic network-wide, the opening of new spaces at Almaty Airport plus strong growth at Izmir and Ankara, plus operations in Georgia, North Macedonia and Tunisia.

Duty free spend per passenger (SPP) dipped by -6% to €8.50, the figure diluted by the addition of Almaty and Antalya airports, which were both still in ramp-up phases. Like-for-like SPP (without Almaty and Antalya) in FY25 was €10.3- (+14% year-on-year).

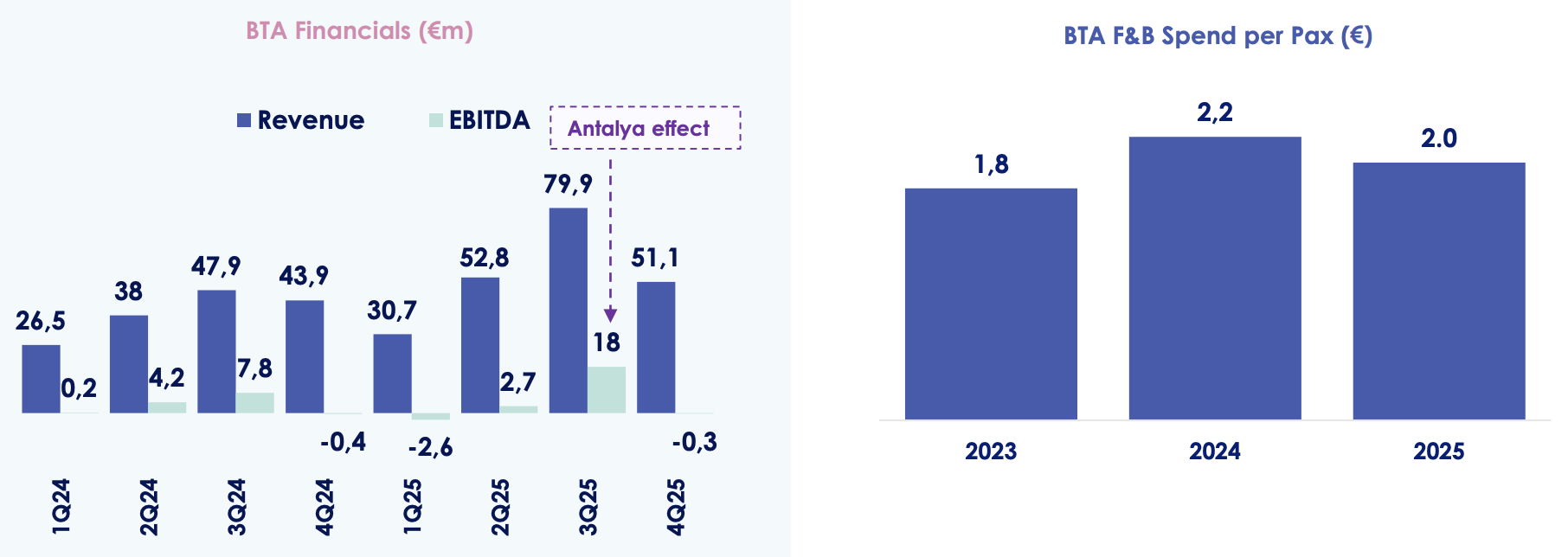

Catering revenue (mainly through F&B division BTA) rose +22% to €224.1 million. F&B was buoyed by the start of BTA operations at Antalya Airport.

In January TAV Airports secured an extension at Tbilisi Airport for five more years, taking it to 2031. The company will increase the capacity of the airport to more than ten million passengers under its new agreement.

TAV Airports also cited its recent investment in Antalya Airport, notably in duty-free, food & beverage, and lounge offerings. A statement said, “The commercial ramp up of duty-free and food & beverage operations continue, with additional fashion, speciality retail and restaurant openings. We will be operating Antalya airport until 2052.”

TAV Airports has also completed a big investment at Ankara Esenboga Airport and started to operate the airport under the conditions of its new concession, which runs to 2050.

“The profitability boost from two quarters of operations under the new concession supported our consolidated results in 2025,” it noted. “In 2026, we will be operating the airport under the new concession for the full year. Ongoing international traffic growth, supported by low-cost carriers and better operating conditions throughout the new concession are expected to further underpin profitability.”

The second phase of a €315 million airside investment at Almaty Airport has begun, while construction has started on a new international terminal in Madinah, to be completed by 2028.

In 2026 TAV Airports forecasts serving between 116 to 123 million passengers and to reach an EBITDA figure of €590 to €650 million, surpassing the previous high of €573 million in 2018. ✈