MIDDLE EAST. Brands that want to succeed in the Middle East domestic and travel retail luxury markets need to become “consumer-centric” instead of “price-oriented”, according to a new ‘white paper’ from The Chalhoub Group.

To help brands better understand luxury Gulf Cooperation Council (GCC) consumers, Chalhoub Group conducted consumer research to identify key luxury consumption trends and profiles among this group.

|

Chalhoub Group Co-CEO Patrick Chalhoub outlined the key findings of this year’s white paper at a press event in London this month |

Chalhoub Group Co-CEO Patrick Chalhoub presented the findings of this year’s white paper at a roundtable discussion in London earlier this month. Chalhoub Group produced its first white paper last year.

GCC luxury consumers account for some of the highest consumption spends at home and abroad of any consumer group worldwide. Visit Britain said GCC consumers were the UK’s biggest shoppers in 2013; the German National Tourist Office said in 2013 they spent seven times more in Germany than the average European visitor; Middle Eastern tourists spend over US$6,600 a day in France, according to Atout France in 2012.

While the report focused on retail trends for the Middle East domestic market, the themes also apply to the travel retail market, said Patrick Chalhoub. He added that GCC luxury consumers travel extensively within the region, spending large sums on gifts for family and friends as gifting is central to Arabic culture.

He said: “It’s important for us and for our partners that we capture the market before others and are able to adapt, to adjust and move quickly into it. This is why we have launched this initiative of white papers about the market in general, dynamic of market and distribution. This year, we felt it was important to speak about GCC customers, mainly new upcoming customers.”

With over half of the population under 30 years of age, Chalhoub said the region a “very young and dynamic” market.

He added: “It’s a population that is shifting habits extremely fast. We need to make sure we understand the market. It’s unlike more mature and developed countries where things are very stable and change very slowly. The whole dynamic changes very quickly.”

Spending habits of Gulf luxury consumers are driven by the quest for indulgence, the need for recognition and the longing to create and nurture bonds. Consumer research showed these consumption trends are present in all affluent Gulf nationals to varying degrees, depending on their consumer profile.

The main driver behind the first trend is the desire to have the latest in everything they own. For example, 78% of GCC affluent consumers said they like to keep up with the latest trends, with 76% of them converting that desire into consumption.

|

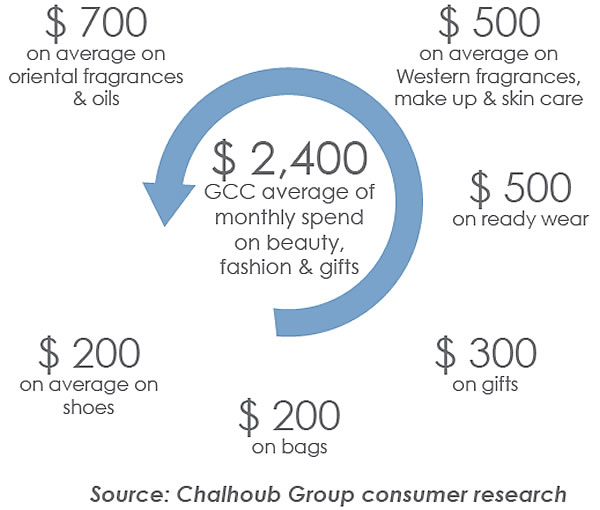

On their quest for indulgence, GCC consumers rack up an average of US$2,400 in spending each month on beauty, fashion and gifts |

The second luxury consumption trend is backed up by 74% of respondents who claimed that it is important to stand out and be noticed. At the same time, 83% of affluent Gulf nationals feel it is important to be accepted.

|

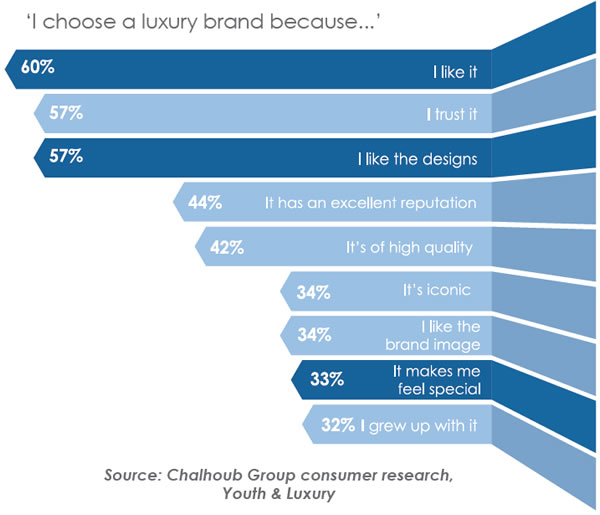

The key drivers of purchase among GCC luxury consumers |

For the third trend, research showed that 32% of affluent Gulf nationals choose a luxury brand because they grew up with it and 57% because they trust it.

|

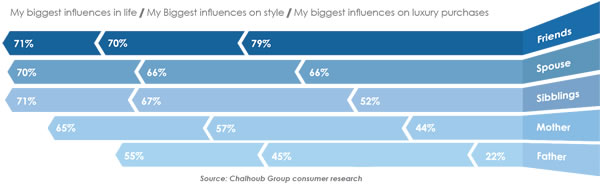

Friends and family still have a large influence over what GCC consumers buy; retailers need to establish relationships with consumers in order to gain trust |

Chalhoub Group identified three consumer archetypes that correspond to the above trends. These are: the gazelle, the horse and the hawk. While the gazelle looks for self-expression through luxury, is an avid social media user and looks up to Western influences such as bloggers and celebrities, the horse is more status oriented, sees luxury as a means to gain social acceptance and is influenced by national celebrities and sheikhs. The hawk, meanwhile, appreciates luxury for the experiences and enjoyment it can bring. They are also sensitive to personal relationships, including with sales people.

|

It’s all about me: Luxury GCC consumers want to feel that they belong but at the same time seek individuality |

In future, Chalhoub said luxury Gulf consumers will expect brands, retailers and malls to make them feel unique in several ways. These include linking the in-store experience with the online experience and social media platforms and retailers becoming part of the circle of trust.