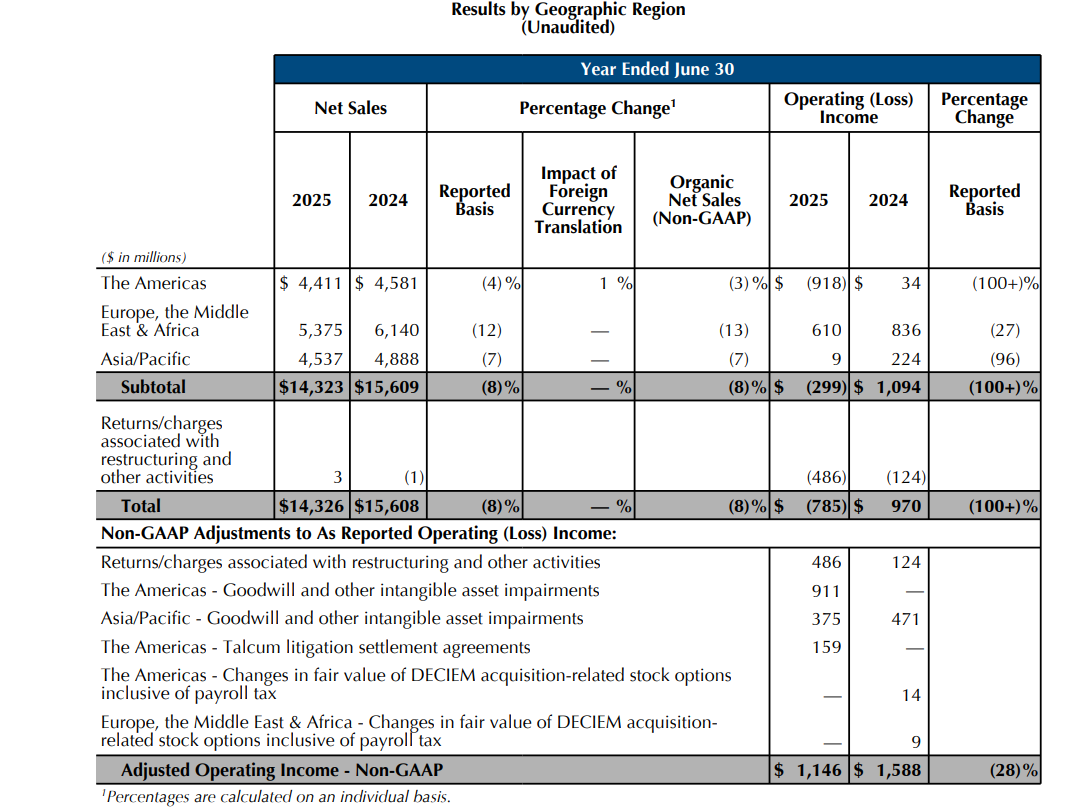

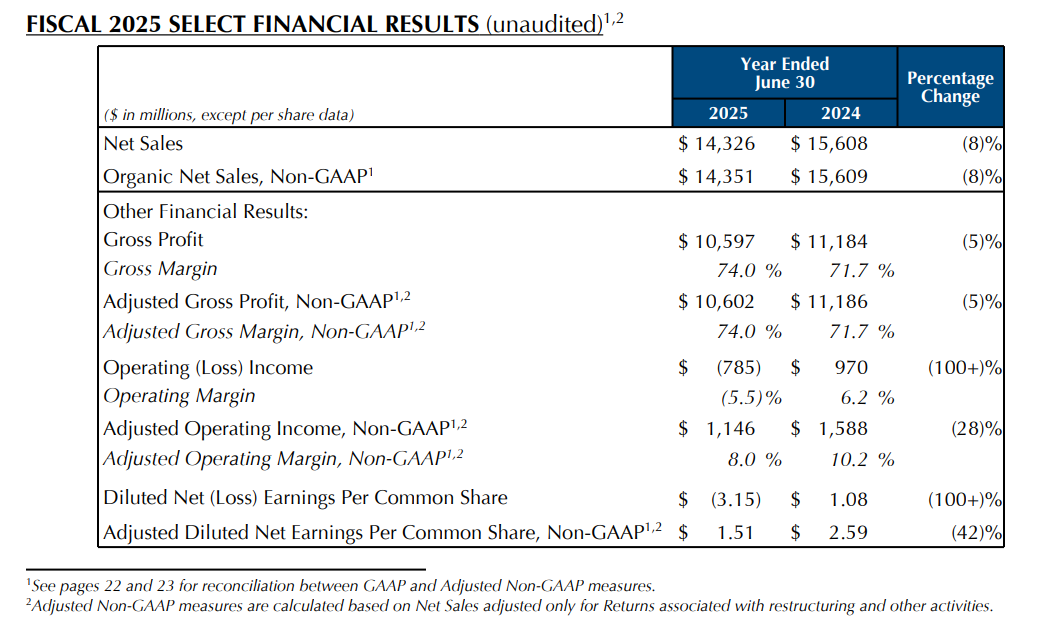

Travel retail drove almost two-thirds of a -8% year-on-year decline in The Estée Lauder Companies’ (ELC) full-year results for the year ended 30 June.

But an improving inventory position in North Asian travel retail, an improving Hainan market and a breakthrough agreement with Duty Free Americas in the US, collectively offer cause for optimism in the channel.

Those were some of the key messages from ELC President and CEO Stéphane de La Faverie on a post-results earnings call yesterday.

Additionally, as reported, travel retail will now become part of the Asia Pacific division instead of EMEA in a group restructuring.

“Nearly two-thirds of our -8% organic sales decline came from travel retail as it decreased -28% driven by strategic decision and prolonged weak conversion,” de La Faverie said.

“Importantly, we ended fiscal ’25 much better positioned than fiscal ’24 with healthier trade inventory, especially in travel retail Asia for currently forecasted demand.

“Travel retail represented approximately 15% of reported sales, down 4 percentage points from fiscal ’24 and 14 percentage points below its fiscal ’21 peak reached during the pandemic, making it more similar to the channel global prestige beauty share and reducing our exposure to its volatility.”

Back with Duty Free Americas after 17 years

In a major revelation, de La Faverie said the company has struck a breakthrough “all-new” agreement with the Duty Free Americas, the powerful family-owned force that ranks as the biggest travel retailer in the USA.

The companies have not done business since a bitter dispute 17 years ago and the new deal is set to be transformative for both companies {we will bring you an exclusive report on this critical development soon}.

“In travel retail, we are greatly expanding our presence in the Americas through the all-new distribution with Duty Free Americas. This builds on progress in EMEA to expand the presence of our luxury fragrance brand in airports,” de La Faverie confirmed.

Travel retail improvement

But the US beauty powerhouse said it had delivered “strategic progress”, and affirmed its fiscal 2026 outlook to restore positive sales growth and enhance operating profitability {we will bring you full analysis, including a close look at travel retail performance, after tonight’s earnings call}.

Commenting on the group’s recent performance Executive VP & CFO Akhil Shrivastava said, “Organic net sales declined -13% in the fourth quarter, reflecting declines across all product categories, except fragrance as well as across every geographic region, primarily driven by global travel retail as we expected.”

Looking forward Shrivastava commented: “For fiscal ’26, we assume modest global prestige beauty growth in the range of 2% to 3%, which is an improvement versus fiscal ’25. While there are early signs of stabilisation in Mainland China, travel retail conversion continues to be weak, and challenges persist in the West, including subdued consumer sentiment in the US and Western Europe.

“For the full year, we expect [groupwide] organic net sales to be flat to +3%. Our outlook assumes mid-single-digit net growth in Mainland China as well as meaningful improvement in our global travel retail business. It also assumes more broad-based improvements across the rest of the business compared to last year.

“We expect full-year organic net sales in a global travel retail business to return to growth at the midpoint of our outlook.

“This reflects the improvement in shipments compared to last year in Asia travel retail, particularly in the first half as we anniversary the impact of actions taken to improve retailer inventory levels, along with the strategic decision to reduce our exposure to reseller activity.

“However, this improvement is expected to be offset to some extent by persistent challenges in the broader retail environment, including weak conversion. As a result, we expect a wider range of net sales growth in global travel retail in the second half, reflecting ongoing uncertainty.

“In terms of the first quarter, we expect organic net sales to be down low single digits to slightly positive. This reflects high single-digit growth in our global travel retail business, while maintaining a strategic initiative to keep the mix of business in line with industry norms.”

Hainan turns positive

De la Faverie concluded on an optimistic note regarding travel retail, saying the company’s guidance pointed to “modest growth” in the channel.

“We still have ways to influence like we did with the reduction of the inventory last year,” he added. “It is true that we are starting from a lower base, but we have a new team in place in travel retail, and we are really focused on accelerating retail.

“We’ll be happy to show you many of the activities that we are doing in travel retail across Asia, the Americas and Europe – we are expanding distribution in the Americas and in Europe.

“So there’s still a lot of untapped potential for us in many airports around the world.”

De la Faverie highlighted a key data point in the key Hainan offshore duty-free market. “In the month of May, we turned positive in Hainan, thanks to all the activities that we’ve put in retail with Estée Lauder, La Mer, Jo Malone, and you name it pretty much across the brands.

“Now the rest of our business is gradually and sequentially getting better with the intent and the ambition that by the end of fiscal ’26, we will be positive in the rest of the business.” ✈