|

AENA commercial management and bidders in Madrid on a dramatic day in duty free |

SPAIN. Sociedad de Distribución Comercial Aeroportuaria de Canarias, S.L. (Canariensis; a joint venture based in the Canary Islands and led by World Duty Free Group) has captured Lot 3 in today’s dramatic Spanish airports duty free mega-tender, The Moodie Report can reveal. As we reported first earlier in the day, World Duty Free Group España has also captured Lots 1 and 2. [Track the auction via our timeline below and our Twitter feed – link below – for our updates during the day.]

LIVE AUCTION UPDATE (UK time; most recent news first)

19.51 There is a party atmosphere at WDFG’s headquarters in Madrid as senior executives gather to celebrate a momentous day. The company plans to issue a statement about the hugely dramatic events of today on Tuesday morning.

19.28 All three lots will be ratified by the AENA board on 18 December.

19.26 AENA hails the auction process as a big success, saying that it will double its revenues from the duty free business on average each year over the seven years, adding €100 million per year to its incomes in the process.

19.21 Canariensis will operate 13 outlets covering 8,000sq m at the six airports in the Canary Islands. Its bid amounts to 41.78% of total income from the concessions, including a minimum guarantee, AENA says.

19.18 Other financial offers were made by Gebr Heinemann and Dufry Canary Islands. Dufry’s bid was later excluded due to incomplete documentation provided, while Gebr Heinemann subsequently withdrew its initial offer, AENA reports.

19.14 Sociedad de Distribución Comercial Aeroportuaria de Canarias, S.L. (Canariensis; a joint venture based in the Canary Islands and led by World Duty Free Group) has captured Lot 3. It placed an offer of €323.5 million over the life of the contract. WDFG has a 60% stake in the joint venture.

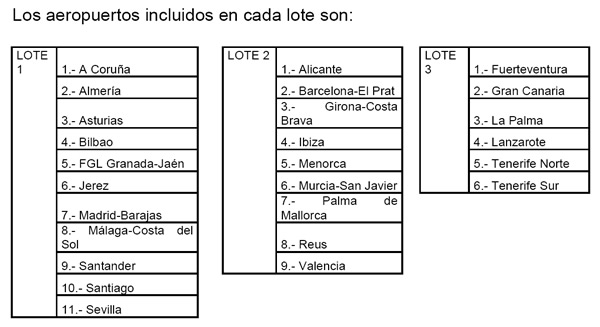

17.50 In Lot 3, the six airports where concessions are being auctioned are Fuerteventura, Gran Canaria, La Palma, Lanzarote, Tenerife South and Tenerife North (scroll down for full list of airports in each lot). Contracts at each begin at different periods between 2013 and 2016 due to the staggered expiry of existing concessions, but all will end in October 2020.

17.26 To recap, there are four qualified bidders for Lot 3, where the auction is ongoing:

*Sociedad de Inversión y Gestión de Mercancías y Artículos SA (SIGMA; a legal entity of specialist retailer SGEL, part of LS travel retail)

*Sociedad de Distribución Comercial Aeroportuaria de Canarias, S.L. (Canariensis; a joint venture based in the Canary Islands and led by World Duty Free Group)

*Dufry Islas Canarias SL (Dufry’s representative in the Canary Islands)

*Gebr. Heinemann SE & Co KG

17.20 As with Lot 1, the AENA Board will ratify the decision to award WDFG the business of Lot 2 on 18 December.

16.50 WDFG’s Lot 2 concession tenancy runs from 2013 through to 31 October 2020. Apart from Barcelona, other airports in this package include Alicante, Girona, Ibiza, Menorca, Murcia San Javier, Palma de Mallorca, Reus and Valencia.

16.48 The auction for Lot 3 (six airports in the Canary Islands) is about to begin, AENA confirms to The Moodie Report, meaning that all three packages should be decided today.

16.44 Three bids are placed for Lot 2, the others coming from SIGMA (LS travel retail) and Gebr Heinemann. Neither Dufry nor the Nuance-Ãreas partnership made a financial offer and the SIGMA bid did not reach “specified limits” for consideration, said AENA.

16.43 The sales space at the nine airports under Lot 2 comprises 18,700sq m and 29 stores.

16.36 WDFG offers €887 million over the lifetime of the Lot 2 tenancy. It will pay 36.55% of its total income from the operations, says AENA.

16.34 AENA confirms that WDFG has also captured the key Lot 2, comprising Barcelona and eight other airports.

16.00 A reminder of what’s at stake today as news of Lot 2 bidding nears: 80 units at 26 airports to be auctioned in three lots. From a commercial base of 33,000sq m currently, duty free will occupy 45,000sq m (up by +36.4%) at the 26 airports once work is completed to extend the business at some key locations. Beauty accounts for 35% of the business today, with tobacco representing 15% and liquor 13% among the other major categories.

13.30 Bidding on Lot 2 (including Barcelona and eight other airports) is well under way, with completion expected this afternoon.

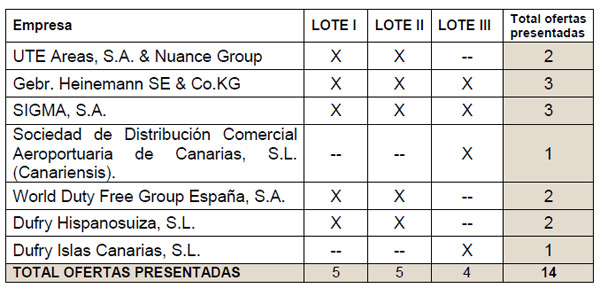

13.00 Four companies submitted bids for Lot 1, AENA confirms: WDFG, Dufry Hispanosuiza, Gebr Heinemann and SIGMA (a legal entity of specialist retailer SGEL, part of LS travel retail). The Heinemann bid was excluded because of incomplete documentation, says AENA. The Nuance-Ãreas partnership did not make a financial offer, it adds.

12.57 The award of Lot 1 to WDFG is expected to be ratified by the AENA Board on 18 December. In the Lot 1 package the retailer will run 38 stores occupying 18,200sq m of space in the 11 airports.

12.50 AENA Aeropuertos confirms that WDFG is the highest bidder for Lot 1, offering €753.1 million in total operating income over the lifetime of the concession (to 31 October 2020). The company will pay an average of 36.71% of total anticipated sales over the contract period, says AENA.

11.20 News emerges that World Duty Free Group España (the incumbent) has captured Lot 1, including Madrid Barajas. The other lots are down for decision this afternoon.

09.00 Bids for Lot 1 have been assessed and the auction process between leading bidders, expected to take several hours, is under way, AENA confirms. The opening of bids for Lots 2 and 3 will follow once the process is complete.

07.00 The bids for Lot 1 are opened at AENA’s Madrid offices.

THE MOODIE REPORT’S LIVE TWITTER FEED

Tweets by @TheMoodieReport

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0];if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=”//platform.twitter.com/widgets.js”;fjs.parentNode.insertBefore(js,fjs);}}(document,”script”,”twitter-wjs”);SUMMARY AND BACKGROUND

A momentous day in European travel retail draws to a close as AENA confirms that Lot 3 in the Spanish duty free auction is won by Canariensis, a joint venture in which WDFG has a 60% stake. The company offers more than 41% of total income over the life of the concession for Lot 3.

This complements Lots 1 and 2, won earlier in the day. The concessions cement long-time incumbent WDFG’s status as Spain’s leading airport duty free concessioaire.

The Lot 2 package, where AENA confirmed World Duty Free Group (WDFG) as top bidder mid-afternoon on Monday, comprises nine airports and 18,700sq m of retail space – with Barcelona El Prat the jewel in the crown. Notably, WDFG offered €887 million in total operating income over the lifetime of the Lot 2 tenancy. This equates to 36.55% of total income from the operations, AENA said. The figure is significantly higher than that for Lot 1 (including Madrid) though Lot 2 comprises a number of vital tourist and high-volume traffic locations including Palma de Mallorca and Alicante.

The crucial Lot 1 package contains 11 airports, including Madrid Barajas along with Málaga, Seville and Bilbao. Madrid represents the largest of the airport concessions on offer in the tender (14,000sq m, 30 points of sale). The business there will benefit from additional space that is planned by AENA Aeropuertos through a major investment in 2013. In total, the retailer will run 38 stores occupying 18,200sq m of space in the 11 airports on offer as part of Lot 1.

As noted in our timeline above, WDFG has offered €753.1 million over the period to 31 October 2020 for Lot 1. The year-by-year figures (adjusted and re-stated by AENA) appear here:

|

WDFG’s minimum guarantees year-by-year to 2020 for Lot 1 (Note: The figures add up to more than the total of €753.1 million as they are adjusted to reflect future payments at today’s values, AENA has said) |

The company saw off competition from Dufry, LS travel retail entity SIGMA and Gebr Heinemann, which was excluded over incorrect documentation, AENA said. The Nuance-Ãreas partnership did not place a financial offer on Lot 1, though it had qualified.

As reported, a multi-stage auction was conducted for the business today, covering 37,000sq m at 26 airports. It was overseen by a public notary, Pablo Taboada Ramallo. AENA said the decision to conduct the final phase of the tender via an auction process “ensures transparency”. External auditors BDO also assisted.

As previously noted, duty free operations (and 80 outlets) at the country’s airports were up for grabs (see table). The contracts run for seven years from 2013 with a five-year break clause. They cover the core categories of liquor, tobacco, beauty, confectionery & food, with luxury goods, as reported, to be covered under a separate tender.

The bidding field included the two heavyweight incumbents World Duty Free Group and Dufry, as well as powerful European rivals LS travel retail, Nuance (in a blockbuster combination with Ãreas) and Gebr Heinemann.

|

AENA has split the concessions into three lots, including debut duty free stores for the airports of A Coruña, Asturias, Federico García Lorca Granada-Jaén, Murcia-San Javier and Santander |

As noted, Lot 1 includes Madrid Barajas and Málaga airports among others, Lot 2 includes Barcelona El Prat, Alicante and others, while Lot 3 comprises the Canary Islands. AENA said that the bidders presented new-look designs for the 80 duty free stores across the 26 airports in their technical bids.

As we revealed at the weekend, each lot was to be conducted in several rounds, with the winner of Lot 1 being announced before Lot 2 commenced and so on. The top two bidders in the first round – and any company within 10% of the second highest financial offer – had two hours to re-evaluate their positions before asked to contest the second round, in which parties could raise the level by any amount. In subsequent rounds any raised bid had to be at least +2% higher than the previous top figure. The contract was awarded to the final highest bidder, in each case WDFG.

Before the process began, AENA said it believed sales across the network could hit €700 million a year, compared to the €535 million from the operations of Aldeasa (World Duty Free Group), Canariensis and Dufry in 2011. From those gross revenues, AENA derived €161 million in income.

From a commercial base of 33,000sq m today, duty free will occupy 45,000sq m (up by +36.4%) at the 26 airports once works are completed to extend the business at some key locations.

Beauty accounts for 35% of the business today, with tobacco at 15% and liquor at 13% the other major core categories.

|

A heavyweight field came together for Monday’s unique duty free ‘auction’ |