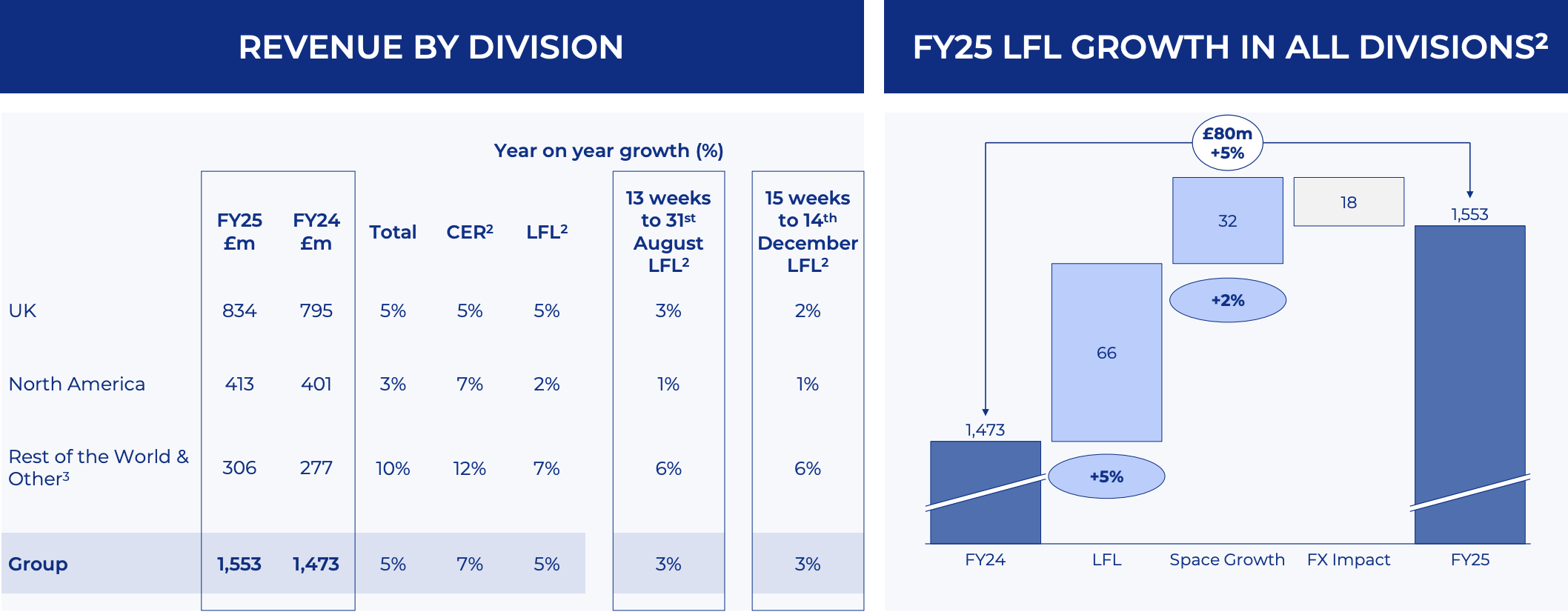

UK. Leading travel retailer WHSmith today (19 December) reported results for the year ended 31 August, with group revenue climbing +5% year-on-year to £1,553 million, and headline group trading profit of £159 million, down from £170 million a year earlier.

The results announcement follows a review into an accounting error related to the travel retailer’s profitability in North America, which led to CEO Carl Cowling stepping down last month.

The company also noted that following the findings of the Deloitte Review into its North American accounts, “a comprehensive remediation plan is in place and progressing at pace”. The Financial Conduct Authority has also begun an investigation into the company.

WHSmith also set out a set of priorities for each division with a “more focused strategy” aimed at delivering profitable growth and enhanced return on capital.

This includes:

*An enhanced focus on the North America travel essentials business, a plan to exit fashion and speciality stores in the region, and a review of its InMotion portfolio;

*A drive to strengthen category leadership in UK travel essentials, scaling health and beauty and the food-to-go offer;

*Strengthen core Rest of the World markets, with new growth driven through a franchise model, plus a review and possible exit from non-core markets.

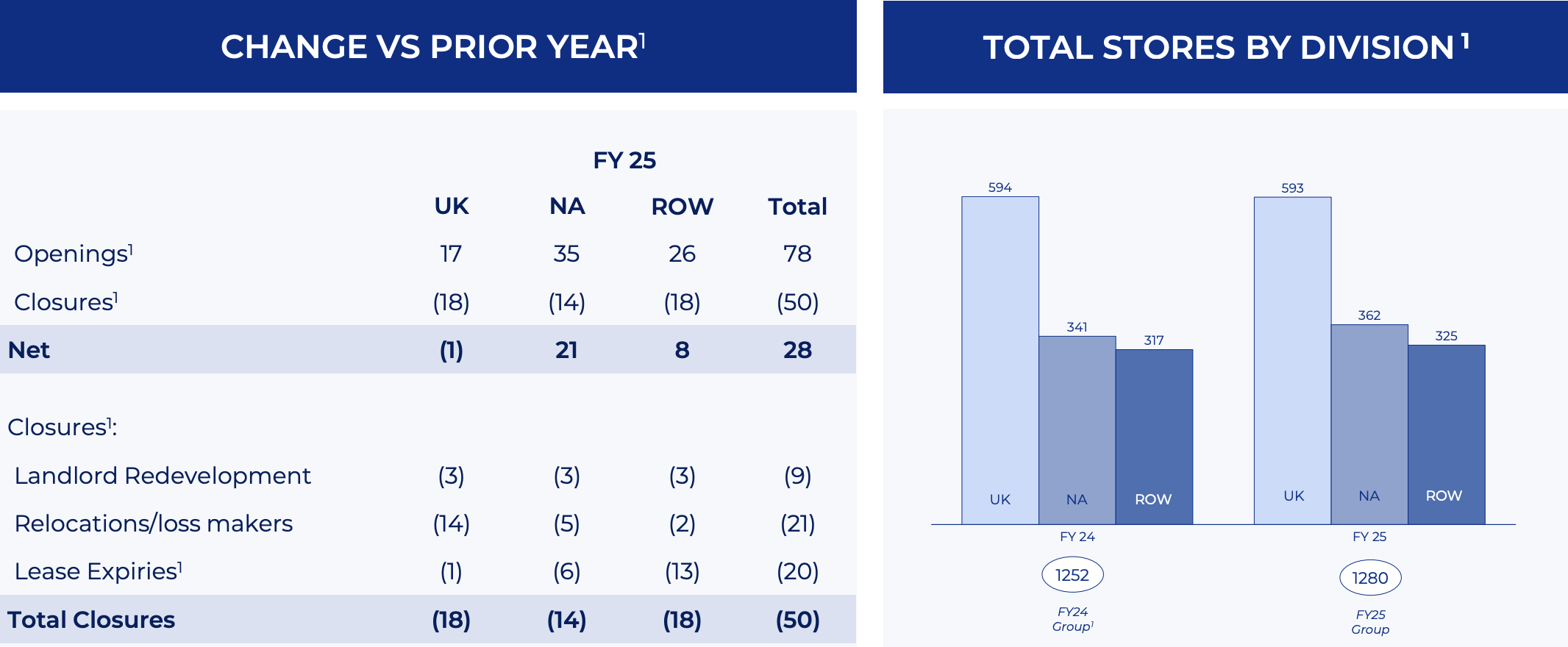

Elaborating on this in its year-end statement, the company said: “In North America, we will focus on improving and investing in our core travel essentials business. Following a review of our Resorts business, we are in the process of exiting a number of unprofitable fashion and speciality stores.

“We are also undertaking a review of our North America InMotion business and the breadth of the portfolio. Across the business, we have put in place a more rigorous approach to any future store openings with new InMotion stores only being considered as part of a strategically important tender package.”

In the UK, the focus lies on retaining category leadership in travel essentials through the one-stop-shop format.

In the ROW division, WHSmith said: “We will focus our investment in our core, strategically important markets, including Australia, Ireland and Spain, resulting in reducing our presence in or exiting sub-scale markets and using a less capital-intensive franchise model for future openings.”

Trading outlook

In the 13 weeks to 31 August 2025, the company delivered like-for-like (LFL) revenue growth of +3%. By division, the UK delivered LFL revenue growth of +3% reflecting softer passenger numbers through the summer period and a reduced level of spend per passenger growth.

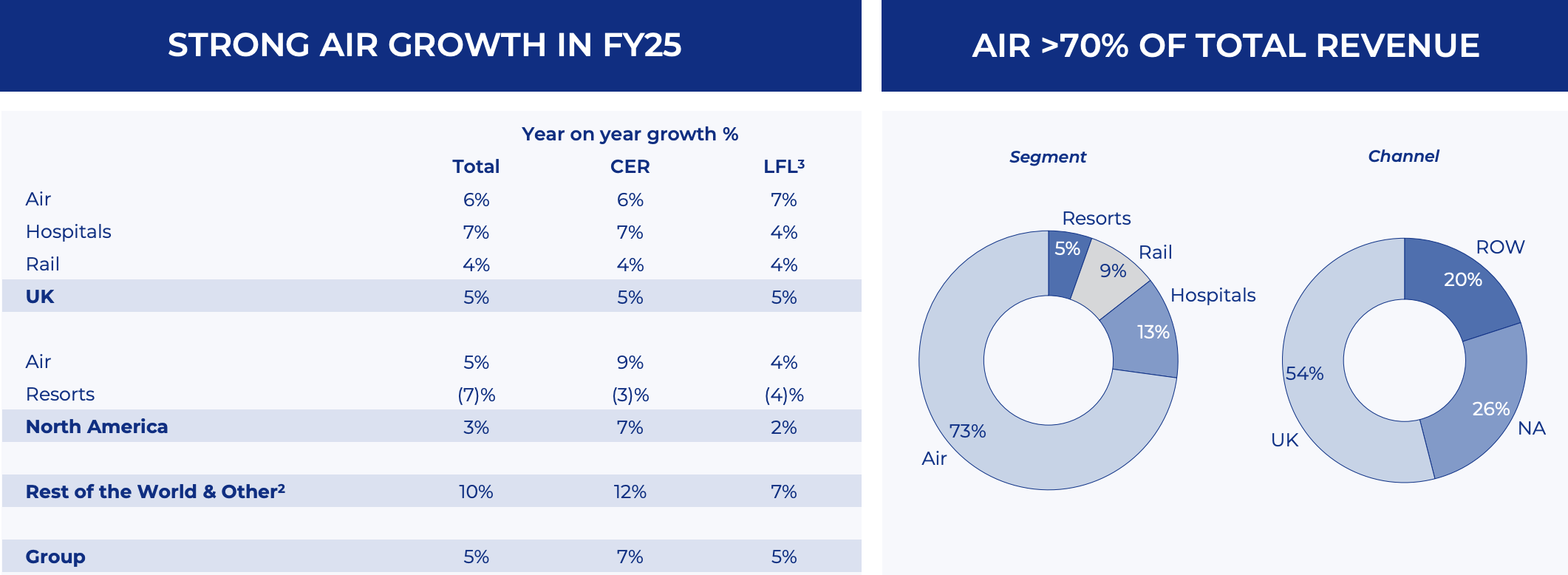

In North America, WHSmith delivered LFL revenue growth of +1%. The core Travel Essentials business showed revenue growth of +8% with InMotion down -7% and Resorts down -6%. Rest of the World delivered LFL revenue growth of +6%.

These sales trends have continued into the first 15 weeks of the current financial year, noted the company.

In the first 15 weeks of FY26, the Group delivered LFL growth of +3%, with the UK softening slightly to +2%, largely reflecting a softening in rail. North America revenue trends were in line with the last 13 weeks of FY25 with LFL growth of +1%, and Rest of the World showed growth of +6%.

For the full year ending 31 August 2026, total revenue growth of +4-6% is expected.

In the UK, total revenue growth is expected to be around +3-5%, in North America +6-8%, and in the Rest of the World division +4-6%.

Headline trading profit margin in the UK is expected to be at around 14-15%, North America 7-8% and 5% in the Rest of the World.

“This reflects the different dynamics in each market: a year of investment in the UK, a focus on rebuilding profitability in North America and strengthening our foundations internationally,” said a statement.

Interim Group Chief Executive Andrew Harrison commented: “It has been a difficult end to the year for the Group. The Board and I are acutely aware that we have much to do to rebuild confidence in WHSmith and deliver stronger returns as we move forward. We are acting at pace progressing our remediation plan and are committed to ensuring that we strengthen our financial controls and governance as we move forward.

“Following the sale of our UK High Street business and Funky Pigeon during the year, we are now a pure-play global travel retailer. Travel retail is a high growth market, and we have attractive market positions in the UK, North America and our international markets from which we are well-positioned to grow.

“I would like to thank our colleagues who have shown the utmost commitment and professionalism during an uncertain and busy period for the business.

“As Interim CEO, my focus is to provide stability and to lead the Group with transparency and discipline. WHSmith is a business with an exciting future and I look forward to executing against our clear priorities to ensure we capitalise on the attractive opportunities ahead.”

More to follow. ✈