HONG KONG. The race for the Hong Kong International Airport core category business is about to start all over, some four years after DFS Group’s stunning triple triumph in winning all three concessions – liquor & tobacco, perfumes & cosmetics and airside general merchandise.

As revealed by The Moodie Davitt Report earlier this week, Airport Authority Hong Kong (AAHK) is returning to the market in late 2016 with what is likely to be a markedly different concession structure.

AAHK plans to revamp the category and contract mix, promising “significant changes” to the current structure in order to drive spending.

How will the reshaped concession mix look? No decisions have been made yet but certainly the ‘catch-all’ category of airside general merchandise may be redefined (and possibly fragmented), with the new-look concession offered jointly with perfumes & cosmetics. Alternatively, the various concessions (and there could be more than three) might be offered individually once more. Certain categories – confectionery and fine foods, for example – could be ‘rehoused’.

However it defines the concessions, one of AAHK’s key challenges will be to sell the opportunities to prospective bidders when the incumbent’s difficulties are well-known. However, it will be confident it can achieve that and attract a stellar line-up. The changes to the concession mix will help – in particular, airside general merchandise suffers from heavy stand-alone boutique competition so breaking up the category makes sense. The Authority is also stimulating spending through a concerted series of marketing campaigns, and a very promising home-delivery scheme in Hong Kong and other selected markets.

| As a regular traveller I like not only what Hong Kong International Airport has to offer but the way it communicates that offer. |

Set against those positives there are certain market realities. One is that DFS will certainly have considered the contractual losses it has taken in recent times as unsustainable. That’s especially so with passenger numbers (up +8.1% in 2015) – and therefore the retailer’s MAG – continuing to rise, while per-pax spending has declined.

The causes are multifold. Xi Jinping’s election as Chinese President in March 2013 ushered in the Chinese government crackdown on corruption and conspicuous consumption, which drove a sharp decline in demand for high-end luxury items. Additionally, a decline in Mainland Chinese visitors to Hong Kong in 2015 (driven by anti-Mainlander sentiment and the pro-democracy protests) accentuated the challenges for downtown and airport retailers, as did the relentless growth of cross-border e-commerce.

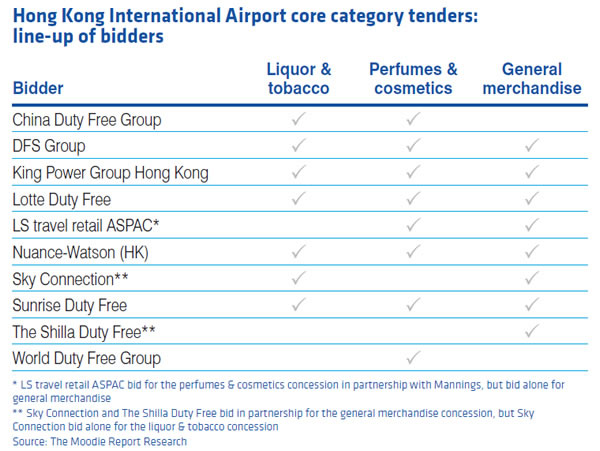

However, AAHK will underline the positives of the opportunity and history suggests that whatever the current difficulties in Hong Kong, there will be no shortage of competitive bids. As our list of potential candidates below shows, there are several powerful players who bid last time and are highly likely to do so again. After all, chances to secure contracts at such a blue-chip airport in a region deemed crucial to the growth ambitions of all the likeliest bidders do not come along that often.

POSSIBLE CONTENDERS FOR THE HONG KONG INTERNATIONAL AIRPORT (HKIA) CONTRACTS

SKY CONNECTION: A certain bidder and a serious one. The New World Development Company-owned retailer still harbours disappointment over losing its long-time liquor & tobacco stronghold last time around and it’s known to be very keen on a comeback. Interestingly the company partnered (unsuccessfully) with The Shilla Duty Free last time for the Airside General Merchandise bid (and subsequently, successfully, at Macau International Airport) but that double act is unlikely to be repeated here.

CHINA DUTY FREE GROUP: Deeply ambitious and now part of the new Chinese tourism ‘super force’ created by China International Travel Service’s merger into China National Travel Service (HK), state-owned China Duty Free Group (CDFG) had made no secret of its desire to grow internationally. Why not start with the Special Administrative Region of Hong Kong? CDFG’s stunning success at its Haitang Bay off-airport store on Hainan Island, as well as its expanding Mainland airport portfolio, has underlined its credentials for running such a blue-chip business as HKIA. Funding will not be a problem so expect a serious play here.

KING POWER GROUP (HK): Managing Director and lead shareholder Antares Cheng has history here. He was part of the former Kiu Fat Investment Corp’s famous, albeit short-lived, contract victory over incumbent DFS at Hong Kong’s old Kai Tak Airport in 1987, the start of a commercial war that is enshrined in industry legend. King Power (no relationship to the Thai company of the same name) still operates half of the duty free business at Macau International Airport, as well as having a strong presence at Shanghai Pudong Airport, and it would love to complete a Chinese trio here.

SUNRISE DUTY FREE: The privately held Mainland China retailer may be the most low-profile retailer in the industry but it is not shy in terms of growth ambitions. After all, this is the company that could have (and, some say due to its superior financial bid, should have) acquired World Duty Free ahead of eventual winner Dufry. The retailer (partly held by Hong Kong-based Boyu Capital and ably led by Madam Fengyi Zhang) wants to diversify its portfolio outside of its Shanghai Pudong, Shanghai Hongqiao and Beijing Capital International airport operations and no international gateway would appear better suited to it than HKIA. Last time it bid in vain for all three core category concessions. Four years on it is stronger, more experienced and even hungrier.

LAGARDÈRE TRAVEL RETAIL: The Lagardère Services-owned business sees Asia as pivotal to its growth strategy and despite concerns over the channel’s cash generation limitations the group remains wholeheartedly committed to travel retail. Its buying power currently falls far short of its great industry peer, Dufry, and a blue-chip airport such as HKIA would provide a welcome filip. In 2011/12 it bid on perfumes & cosmetics and airside general merchandise. Given its successful and hugely impressive bid for Abu Dhabi International Airport’s Midfield Terminal liquor & tobacco contract, one could reasonably expect an all-categories push here.

DFS GROUP: The incumbent must always be respected, especially when it’s such a class act as DFS. There’s no doubting the importance that the retailer places on HKIA but there may be a yawning chasm between what it’s prepared to pay for the privilege and AAHK’s expectations. The concession mix and financial model will be key to whether DFS bids.

LOTTE DUTY FREE: If we had suggested a year ago that Lotte would lose its trading licence for its magnificent new Lotte World Tower Duty Free store in 2016, you’d have said we were losing the plot. But that’s what indeed happened, courtesy of a uniquely Korean ‘licence lottery’ last November that resulted in the mid-2016 closure of a US$420 million business. While much of that business will have been transferred successfully to the retailer’s Seoul flagship in Sogong-dong, the closure was both a deep embarrassment and an alarm bell suggesting that growth prospects in South Korea could no longer be taken for granted. Lotte bid on all three HKIA contracts last time and with its need to internationalise now intensified, it’s likely that the company will approach this bid with deadly seriousness, especially given its intimate knowledge of the Chinese consumer.

THE SHILLA DUTY FREE: The long-time perception that a Korean travel retailer couldn’t win a major airport duty free contract abroad was laid to rest by Shilla’s January 2014 triumph in the Singapore Changi perfumes & cosmetics tender. Life has hardly been plain sailing there since, following a difficult start-up and a series of big quarterly losses, but the Samsung affiliate has proven it can operate a quality offer outside its homeland and (as with Lotte) no-one can say it lacks expertise in catering to HKIA’s all-important Chinese shopper.

SHINSEGAE DUTY FREE: The company might be one of South Korea’s newest travel retailers but it’s also one of the best. Its success in winning a downtown duty free licence in Seoul last year ahead of incumbent WalkerHill Duty Free has added further power to a formidable downtown and airport travel retail armoury in Seoul and Busan. The duty free business was spawned by Shinsegae’s long-established and very classy department store operations and the group has told The Moodie Davitt Report that it is keen to pursue offshore expansion. Last year it began that process, securing a five-year agreement to operate a Korean products store at Mission Hills Resort’s duty free shopping complex in Haikou, Hainan Island, China.

DUFRY: Well, here’s the $64 million question. No, that’s not a reference to the likely bid amount but whether or not the industry’s equivalent of a Sumo wrestler will throw its considerable weight at the kind of tender that CEO Julián Díaz historically abhors. Too much competition, too much likelihood of a ‘strategic overbid’, and too much risk to travel retail’s most robust P&L. And yet, and yet… with its Nuance and World Duty Free acquisitions starting to digest nicely and Nuance’s deep knowledge of the HKIA business (it ran the airside general merchandise and beauty concessions for many years and still operates consumer technology stores and some specialist shops), don’t bet against a Dufry play, especially given the super-sized retailer’s disproportionately small presence in Asia.

GEBR HEINEMANN: The family-owned German company is another to have identified Asia as a key growth target but it didn’t bid last time and given the deterioration in trading conditions, it’s perhaps difficult to see a change of heart. The company has its regional hands full with its mega contract in Sydney as well as a promising mini-portfolio elsewhere, and plenty of challenges in its European heartland. Don’t count them out but don’t count them in.

AER RIANTA INTERNATIONAL: Another non-bidder last time and it’s uncertain whether the concession and risk profile will attract this time around. The Irish company is working hard to make its Auckland Airport contract in New Zealand work, to complement its Indian business in Asia Pacific, but its major priority going forward is the Abu Dhabi International Midfield Terminal, due to open in 2018. That may be too much of a distraction to warrant participating in what will surely be a crowded contest, and certainly a financially demanding one.

NOTE TO AIRPORT AUTHORITIES: The Moodie Davitt Report is the industry’s most popular channel for launching commercial offers and publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or Tender, simply e-mail Martin Moodie atMartin@MoodieDavittReport.com

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.