Yilin Watch: The Xiaohongshu Report is published in exclusive association with The Moodie Davitt Report

Introduction: Yilin Consulting is an acclaimed boutique consultancy based in Paris, specialising in helping travel retail brands and retailers engage the new generation of Chinese outbound travellers. Its focus lies in converting independent, experience-driven travellers through targeted omnichannel engagement and frontline cultural training.

Today, as part of our unrivalled coverage of the Chinese travel retail market at home and abroad, The Moodie Davitt Report is proud to bring you the fourth edition of our exclusive column in partnership with Yilin Consulting Founder Yilin Wang – Yilin Watch: The Xiaohongshu Report

Prologue: Yilin Watch: How China Duty Free Group (CDFG), Lotte Duty Free and Shilla Duty Free Promoted 11.11

November is a curious month – especially its early days.

In Europe, early November often feels like a long exhale: shorter daylight, colder winds, a grey softness settling over daily life. With few public holidays and no school breaks, the rhythm slows – long before Black Friday re-energises the retail calendar.

But across China, early November is electric.

After the rush of Golden Week in October — some travelling abroad, others navigating crowds at home, and many simply resting — Chinese consumers step into November with a precise mission: prepare for the year’s biggest shopping festival, 11.11, known globally as Singles’ Day.

The date itself carries a certain poetry.

Chinese culture has long assigned meaning to numbers: 6 for smoothness, 8 for fortune, 9 for eternity, 4 for misfortune. But 11.11 stands apart. Its playful symmetry (1–1–1–1) feels youthful, digital, and unmistakably modern — a symbol embraced by a generation raised online.

For Chinese Millennials like me, 11.11 is a ritual. We watched it grow from a niche Taobao promotion where we made a kind of revenge purchase to self-reward our status as singles, into the world’s biggest multi-channel shopping festival. Every November, we review what we need, fill our digital carts, and track the pre-sale, mid-sale, and final-sale phases with near-professional precision.

Gen Z takes it even further, navigating livestream rooms as effortlessly as scrolling social feeds — where a good deal is not just found, but won.

EMEA travel retail still overlooks 11.11 as a strategic sales accelerator for Chinese travellers. APAC retailers, however, embrace it instinctively.

Even today, after more than a decade in Paris, when I see ‘11.11’ in a newsletter subject line, I feel a small surge of adrenaline. It is a call to save — and saving, quite simply, feels good.

And this reaction is not personal. It is generational. It travels with us — wherever we go in the world.

Which is why, as I followed global travel retail’s key actions to leverage the commercial opportunity of my compatriots, I remain surprised: EMEA travel retail still overlooks 11.11 as a strategic sales accelerator for Chinese travellers. APAC retailers, however, embrace it instinctively.

In this fourth edition of Yilin Watch – The Xiaohongshu Report, we examine how Asia’s leading travel retailers — China Duty Free Group (CDFG), Lotte Duty Free and The Shilla Duty Free — activated 11.11 on Xiaohongshu this year, and what EMEA retailers must do next.

Our Analytical Framework — The LINXY™ Framework

Our analysis focuses on the star-performing posts (爆款笔记) between 16 October and 22 November 2025, using Yilin Consulting’s LINXY™ framework — Link, See, Engage — to decode what worked, why it worked, and what Europe needs to do now.

1. CDF Sanya

Link: The Full-Spectrum Value Engine

As China’s dominant travel retailer with a 78.7% market share (Source: 2024–2025 CDFG Consumption Whitepaper/The Moodie Davitt Report), CDFG approached 11.11 with the scale and confidence of a market leader.

Across four of its nine Xiaohongshu accounts (Sanya, Haikou, CDFG Member, and Hainan Duty Free Store), CDF published 30+ posts to a combined 870k followers, maintaining high-frequency visibility immediately after Golden Week.

Among these, the star performer came from the CDF Sanya account: a 10-slide carousel fully embodying the 11.11 mindset — ‘Spend Less. Get More’. The post lays out a fully structured savings ecosystem spanning beauty, fashion, spirits, watches, jewellery and electronics, all delivered in a vibrant ‘shopping carnival’ tone.

See: Multi-Layered Value Meets Experiential Appeal

CDF Sanya International Duty-Free Shopping Complex launched a comprehensive 11.11 promotion rooted in one promise: ‘Big Brands for Small Money’.

By combining deep category discounts, a gamified points strategy, and high-traffic experiential touchpoints, CDF created a shopping journey that blends value + experience + social amplification.

Click here for the post link.

Click here for the video link.

CDF Sanya’s 11.11 activation is a full orchestration of value, experience, and UGC triggers. By linking offline experience → online buzz → loyalty retention, CDF transforms seasonal traffic into deeper engagement and higher spend — offering a replicable blueprint for EMEA retailers ahead of Chinese New Year and Golden Week.

Engage: The New Luxury Shopping Ritual

CDF Sanya’s 11.11 star post confirms that Chinese travellers now use Xiaohongshu as a pre-trip service hub — a place to secure value, verify information, and connect with in-store advisors before they travel.

1. Demand for 1-to-1 Access to Sales Associates

Chinese travellers expect personalised, pre-arrival contact with luxury sales assistants (SAs). The comment section was dominated by requests for specific SAs from premium luxury brands such as Van Cleef & Arpels, Cartier, Omega, Moncler, Gucci, Creed, Miu Miu and more — all actively engaging via their own Xiaohongshu accounts.

Insights: Personalised guidance is now a baseline expectation for Chinese luxury shoppers, and EMEA retailers must make SAs digitally visible and reachable.

2. High Engagement in Price, Promotion & Product Queries

Travellers used the comments as a direct channel for price checks, discount mechanics and stock inquiries. CDF’s post became a real-time ‘value validation’ space for luxury fashion and prestige beauty.

Insights: Provide clear, actionable promotion mechanics to build trust is essential, as Chinese travellers benchmark value long before arriving in-store.

3. Community-Driven Commerce

Shoppers coordinated purchases to unlock higher savings. Many asked for “凑单姐妹” — partners to combine baskets and reach spend thresholds.

Insights: Tiered, stackable and group-friendly offers that incentivize social sharing and group purchasing resonate strongly with Chinese FIT travellers seeking value optimisation.

CDF Sanya’s 11.11 star post’s comments section show that today’s Chinese travellers plan their luxury purchases carefully, turning Xiaohongshu into both a value optimiser and a direct line to personalised in-store service.

2. Lotte Duty Free

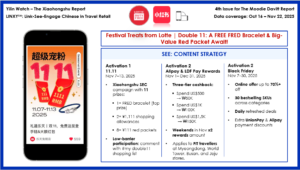

Link: The High Impact Gambit

As Korea’s No.1 travel retailer and the world’s No.4 player with a 5.9% market share (Source: CDFG Consumption Whitepaper/The Moodie Davitt Report), Lotte Duty Free approached 11.11 with a focus on simplicity, cultural resonance, and cross-channel visibility.

Across two of its three Xiaohongshu accounts (Korea and Oceania), Lotte deployed three posts to a combined 10.5k followers, maintaining a clear and targeted presence.

The star post came from Lotte’s Korea account: a 5-slide carousel blending flash-sale style design with a Xiaohongshu SEC giveaway featuring 11 high-desirability prizes, alongside Black Friday offers and Alipay LDF PAY rewards.

With a striking 11.11-led visual identity built around red packet motifs, the post became the most engaging Xiaohongshu asset among all duty-free players this Singles’ Day.

The result is a textbook example of how a simple, culturally anchored mechanic, executed with clarity and strategic timing, can drive outsized visibility with Chinese audiences.

SEE: Turning 11.11 into an Omnichannel Growth Trigger

Lotte Duty Free orchestrates 11.11 as a layered cross-channel value moment, using 11.11 as the trigger message (via a high-impact carousel cover featuring the SEC giveaway, a FRED bracelet), then extending momentum into Black Friday online deals and offline Alipay cash rewards.

Together, these elements create a high-impact cross-channel momentum that speaks directly to Chinese cross-border shoppers.

Click here for the post link.

Click here for the video link.

Lotte Duty Free smartly uses 11.11 and its red-packet symbolism as a clear, instantly recognisable call-to-action for a pragmatic, number-sensitive Chinese audience. By anchoring attention in this familiar cultural trigger, all supporting promotions — from Black Friday to Alipay rewards — can naturally ride the momentum created by 11.11.

It is a simple, cost-efficient model that offers a highly relevant blueprint for European travel retailers looking to boost visibility and capture incremental Chinese traffic during key seasonal peaks.

Engage: The Viral Power of Incentivised Participation

Lotte Duty Free’s 11.11 giveaway post demonstrates how a simple, culturally intuitive incentive can trigger exceptionally high engagement on Xiaohongshu — generating nearly 1,600 interactions, including 614 comments, the highest among all duty-free players this Singles’ Day.

1. Leverage Luck-Based Online Campaigns

The campaign’s core mechanic was a lucky draw. Users voluntarily performed the Xiaohongshu “four actions” — like, save, comment, and follow — to maximise their perceived chance of winning the 11 prizes.

Insight: Incentivised SEC mechanics remain one of the most effective ways to boost visibility and engagement among Chinese travellers at speed.

2. Long-Tail User-Generated Content Fuelled Visibility

The comments section generated a significant volume of long-tail content, extending the post’s organic reach. Users shared shopping lists, screenshots, emojis, GIFs, and personal travel anecdotes — a pattern typical of Chinese giveaway behaviour aimed at “increasing luck.”

Insight: Encouraging long-tail responses not only lifts algorithmic ranking but also drives substantial organic amplification at minimal cost.

3. Emotional & Cultural Resonance Strengthened Interaction

The SEC giveaway format tapped into familiar, low-barrier participation habits. Shoppers engaged enthusiastically because the mechanic felt intuitive, playful, and culturally aligned with Chinese 11.11 behaviour.

Insight: Simple, culturally aligned engagement formats consistently outperform complex mechanics.

Lotte’s model proves that incentivised, low-friction participation is a highly cost-effective strategy to build pre-trip visibility and brand affinity among Chinese travellers, and can be easily adapted for key travel retail moments.

3. The Shilla Duty Free

Link: The Instant-Value Converter

As Korea’s No.2 travel retailer and the world’s No.5 player with 5.2% market share (Source: CDFG Consumption Whitepaper/The Moodie Davitt Report), The Shilla Duty Free activated 11.11 with a lean, targeted messaging strategy.

Across its two Xiaohongshu accounts (Korea and Singapore), Shilla published three posts to a combined 69k followers, using a pre-sale teaser to prime attention.

The star post came from the Shilla Korea account and framed a clear, two-step value proposition: ‘Visit the store → Get instant rewards; Pay with UnionPay → Unlock extra perks.‘

Rather than deploying multi-layered mechanics like CDF Sanya or Lotte, Shilla focused on simplicity and accessibility, appealing to travellers who prefer straightforward benefits without complex thresholds.

See: Clean, Clear, Convenient

The Shilla Duty Free cuts through the 11.11 noise by focusing on ease and immediacy.

Its hero offer — an instant reward for the first 30 daily shoppers with a US$1 minimum purchase — provides a no-fuss, high-clarity incentive. Combined with UnionPay bonuses, the message positions Shilla as the convenient choice for time-pressed airport travellers.

Click here for the post link.

Click here for the video link.

The Shilla Duty Free’s Double 11 strategy is tactical and sharply focused. The immediate benefit — modest in amount but frictionless to obtain — resonates strongly with FIT travellers who prioritise speed, clarity and convenience in airport environments.

The 11.11 post also acts as a strategic visibility driver for Shilla’s wider promotional ecosystem, including its own brand-owned annual shopping festival, Korea Duty Free Festa, running concurrently from 29 October to 30 November.

Engage: The Power of Prompt, Human Response

The Shilla Duty Free’s campaign turned its comments section into a direct customer service channel. Although it generated quieter volume than its peers (158 interactions, including 19 comments), it stands out by using responsive community management to build trust and guide high-intent travellers toward purchase.

1. Active Community Management Builds Trust

Shilla’s community manager replied to nearly all operational questions — from pickup locations to point redemption — transforming a quiet comments section into a trusted information source.

Insight: Prompt replies turn the comments into a trusted information hub, reducing uncertainty for high-intent travellers.

2. High Demand for Operational Clarity

User questions were overwhelmingly practical, focusing on the ‘how’ and ‘where’ of redeeming offers: “Departure or Arrival hall?”, “How to claim points?”.

Insight: Even low-complexity offers require clear, precise instructions, as Chinese travellers benchmark process clarity before value.

3. Low-Barrier Mechanics Encourage Peer Sharing

The simple act of users @-mentioning travel partners to share the promotion created cost-free, peer-to-peer visibility.

Insight: Easy-entry, instantly understandable offers naturally encourage peer-to-peer circulation and expand reach at minimal cost.

Shilla demonstrates that in complex airport environments, fast and helpful community management is not just a support function — it is a critical conversion lever that builds the trust necessary to support pre-trip decision.

The Yilin Takeaway

The 11.11 activations of Asia’s leading travel retailers reveal a unified playbook for engaging Chinese travellers: win the pre-trip moment, design for participation, and build trust through operational excellence. For EMEA, the question is no longer if to engage Chinese travellers on Xiaohongshu — but how to activate with precision for a segmented, value-driven audience.

1. Value Must Be Visible Early — and Clearly

Chinese travellers now use Xiaohongshu as a strategic planning tool, finalizing purchases long before arrival. CDF’s orchestrated savings ecosystem, Lotte’s culturally resonant triggers, and Shilla’s operational clarity all serve one goal: securing the customer during the crucial pre-trip decision window.

Action: Position your Xiaohongshu presence as a pre-departure concierge service. Make value transparent, logistics explicit, and human contact accessible.

2. Design for Participation, Not Just Promotion

The strongest campaigns invited travellers to act, not just observe.

CDF used in-store rituals to spark UGC; Lotte activated mass engagement through a gamified SEC mechanic; Shilla drove peer-to-peer tagging with a low-barrier reward. Participation became the engine of organic amplification.

Action: Embed a participatory hook — gamification, content creation, group incentives, social sharing — into every major campaign to fuel organic reach and build community.

3. Engagement Thrives on Simplicity, Cultural Relevance & Low Friction

From Lotte’s intuitive red-packet giveaway to Shilla’s instant welcome reward, the most effective mechanics were simple, low-barrier, and culturally familiar. This frictionless design is what spurred the long-tail UGC, shopping lists, and peer-to-peer sharing.

Action: Prioritise effortless, culturally-aligned engagement tools that feel natural to Chinese users, removing any barrier to entry and sharing.

Conclusion

11.11 has evolved from a regional sales event into a global behavioural trigger. For EMEA travel retailers, the mandate is clear: activating before arrival, speaking the cultural language of value, and connecting digital intent to in-store delivery are now essential conditions for winning the Chinese traveller in 2026.

At Yilin Consulting, we help EMEA brands turn messages and promotions into bespoke experiences, activation moments, and in-store service protocols — built for the new wave of Chinese travellers who plan digitally and convert emotionally.

To discuss your 2026 Chinese traveller strategy, please contact: yilinwang@yilinconsulting.com

Yilin Wang | Founder & CEO, Yilin Consulting

Previously on Yilin Watch: The Xiaohongshu Report

Edition 2: Yilin Watch: The Xiaohongshu Report – Focus on Qatar Airways, Cathay Pacific and All Nippon Airways

Edition 1: Announcing a key new editorial column – Yilin Watch: The Xiaohongshu Report