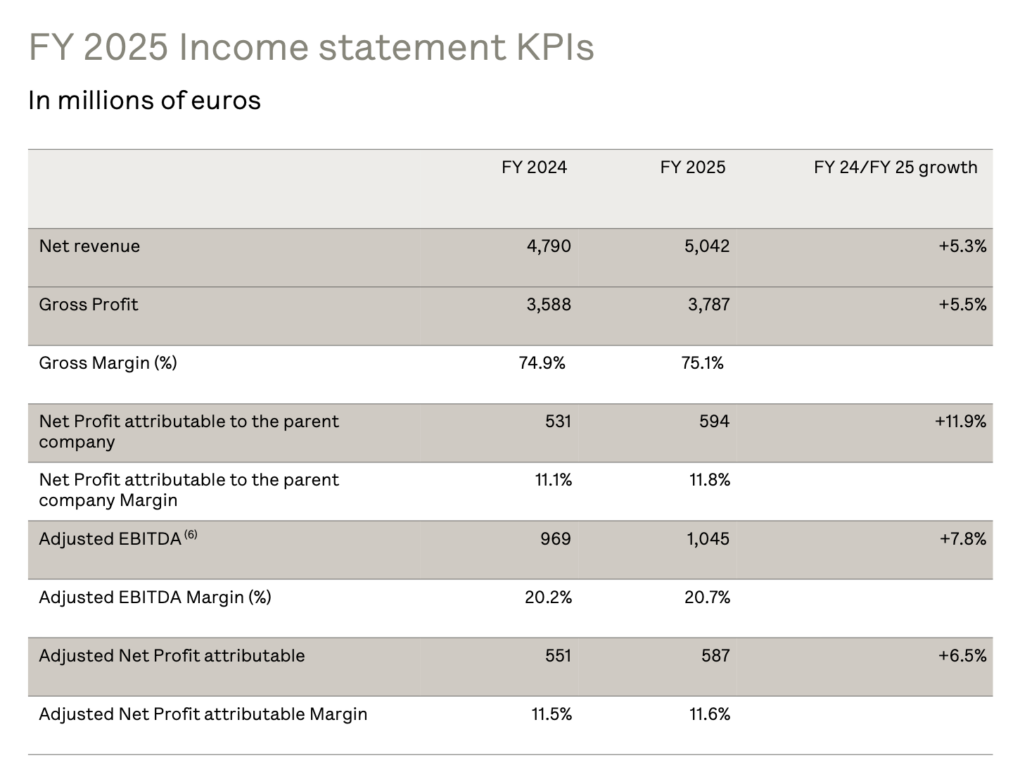

Spanish beauty and fashion group Puig has posted +7.8% like-for-like growth (+5.3% reported) in net revenues to €5.04 billion for FY2025.

The performance sits at the top end of the company’s +6-8% outlook range and marks continued outperformance of the premium beauty market, despite a challenging macroeconomic backdrop.

The group saw adjusted EBITDA rise +7.8% year-on-year to €1.05 billion, with the margin improving to 20.7% from 20.2% in FY2024, ahead of guidance.

Adjusted net profit totalled €587 million (11.6% margin), while reported net profit reached €594 million (11.8% margin). Puig recorded a gross profit margin of 75.1% in FY2025 versus 74.9% in FY2024 thanks to enhanced operational efficiencies and a favourable mix evolution due to niche fragrances.

Puig ended the year with strong performances in Q4 2025 across all business segments, particularly makeup, delivering +9.8% like-for-like growth.

Currency movements had an impact of -3.6% for the quarter. Puig continues to expect a negative impact due to foreign exchange in 2026, particularly in Q1.

Puig Chairman and CEO Marc Puig said: “In 2025, Puig delivered a strong, high-quality performance. For the full year, we achieved high single-digit, +7.8% like-for-like revenue growth, at the top end of our guided range, continuing to outperform the market.

“This reflects the strength of our portfolio, our agility and our ability to execute consistently in a more demanding environment. I am proud to confirm that we have delivered on all of our commitments made a year ago.

“In 2025, we completed our previous five-year strategic plan, communicated in early 2021, which set our ambition to double our 2020 revenue in three years and triple it in five.

“We exceeded those goals, more than doubling our revenue by 2022 and more than tripling it by 2025. Looking ahead, while we expect growth in the fragrance market to continue to normalise, we enter the new financial year with confidence.

“Given the strength of our brand portfolio and our steady pipeline of innovation, we are well placed to sustain.”

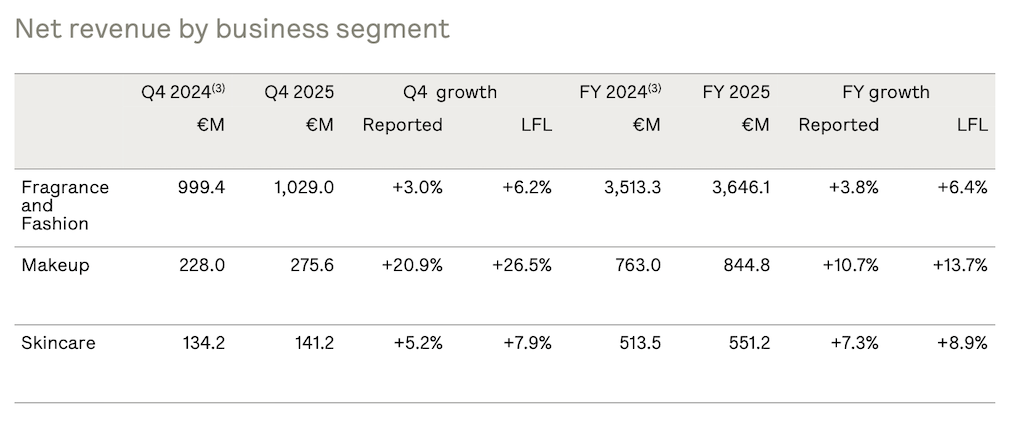

Performance by business segment

Fragrance and Fashion, Puig’s largest business segment, accounted for 72% of FY2025 net revenue. It generated €3.65 billion and like-for-like growth of +6.4%. (+3.8% reported).

The company continues to hold three positions in the global top ten fragrance brand rankings with Rabanne, Carolina Herrera and Jean Paul Gaultier.

The group’s niche fragrance portfolio recorded double-digit growth, led by Byredo which expanded its collections-led strategy through launches including Absolu and Night Veils.

The fashion division also marked key creative milestones, including Duran Lantink’s debut at Jean Paul Gaultier, the Carolina Herrera show in Madrid and the debut of Julian Klausner at Dries Van Noten.

In Q4, the Fragrance and Fashion segment generated net revenue of €1.03 billion, delivering like-for-like growth of +6.2% (+3.0% reported).

Makeup (17% of total revenues) generated €845 million in net revenue and like-for-like growth of +13.7% (+10.7% reported) for the full year. Charlotte Tilbury was the largest contributor thanks to a strong innovation pipeline and expansion in the Americas.

Fourth-quarter makeup revenue rose strongly to €276 million, delivering like-for-like growth of +26.5% (+20.9% reported).

Skincare generated €551 million, representing 11% of revenue, with a like-for-like increase of +8.9% (+7.3% reported). Growth was driven by double-digit performance at Uriage and expansion of Charlotte Tilbury skincare.

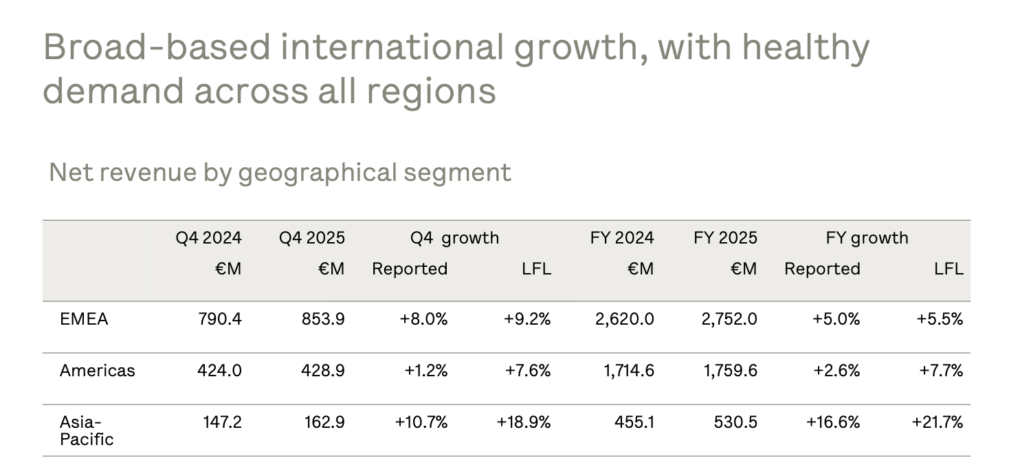

Performance by region

Europe, Middle East and Africa (EMEA) remained Puig’s largest region, accounting for 55% of revenue. EMEA delivered €2.75 billion revenues and like-for-like growth of +5.5% (+5% reported) for the full year.

The Americas, representing 35% of Puig’s net revenues, delivered €1.76 billion in revenue and like-for-like growth of +7.7% (+2.6% reported).

Asia Pacific, which represents 11% of Puig’s net revenues in FY2025, achieved the biggest growth. The region recorded revenues of €530 million and a like-for-like rise of +21.7% (+16.6% reported) for the full year. This was driven by Charlotte Tilbury, niche fragrances and dermo-cosmetics, alongside strong performance from newly consolidated subsidiaries.

Outlook

Puig said it remains confident that the strength of its brands will enable continued outperformance versus the premium beauty market. The group expects adjusted EBITDA margins to remain stable in 2026. In FY2025, Puig advanced its margin improvement by 0.5 percentage points to 20.7%, ahead of its initial outlook.

The company added that it will continue to take a highly selective approach to mergers and acquisitions while leveraging its strong balance sheet to support future growth. ✈