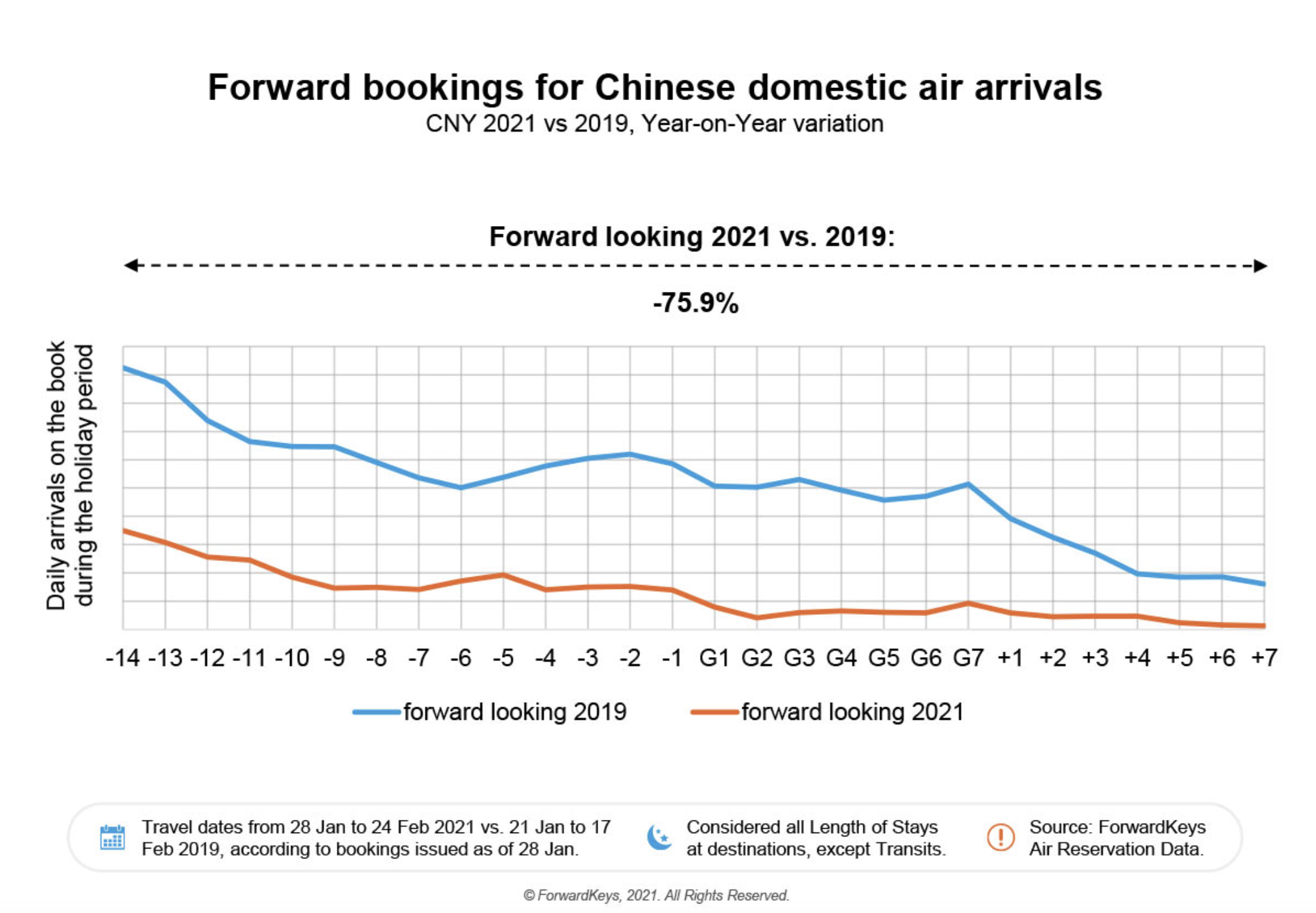

CHINA. The outlook is quickly deteriorating for Chinese New Year domestic travel, according to new figures released by travel data analyst ForwardKeys.

As of 28 January, it revealed that tickets booked for the period 28 January-24 February were down -75.9% against those booked for the comparable period of 2019, despite a more encouraging figure of -57.3% having been recorded during December for advance bookings.

ForwardKeys observed that there had been hopes for high levels of travel during this typically busy period, especially after a strong travel recovery in the domestic market by the end of Q3 2020. But localised COVID-19 outbreaks have resulted in new restrictions on travel, with travel bookings dropping sharply as a result.

Travel agencies have been restricted from selling group tours or packages to high- or medium-risk areas, and some tourist attractions have closed. Travel to the duty free hotspot of Hainan from 55 medium-risk and ten high-risk Chinese cities has been suspended.

“As of 18 January, air and rail departures from Beijing over the Spring Festival period were already down by -43% compared to 2020, and -69% compared to 2019,” said Sienna Parulis-Cook, Associate Director of Communications at Dragon Trail Interactive, which has recently partnered with ForwardKeys to examine flight booking trends and travel marketing campaigns.

She added: “Last week, the National Railway Group reported that tickets for the three days from 28-30 January were only a quarter of what they were in 2020, and tickets for the 31st were down by -75%.”

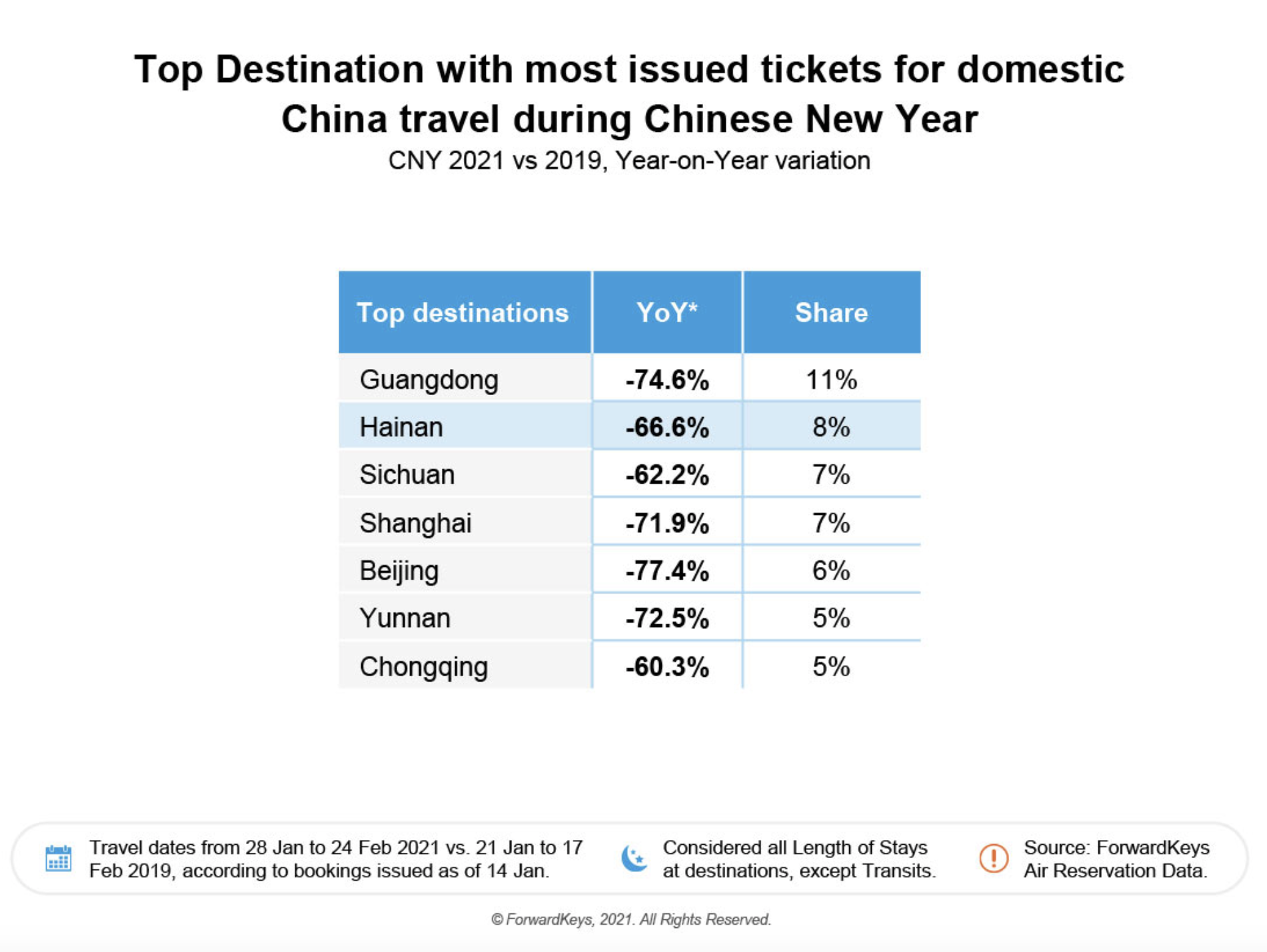

ForwardKeys China Market Expert Nan Dai said that travel to southern parts of China (with warmer weather and fewer new cases) witnessed higher levels of bookings. Guangdong tops ForwardKeys’ list and Hainan jumped to second place.

Dai added that there is still some momentum behind Hainan travel. This is partly fuelled by the fact that on 1 February, the Hainan provincial government announced that travellers from low-risk areas with a green Hainan health QR code won’t need to take a PCR test before coming to the island.

ForwardKeys noted that as of 22 January, the Trip.com Group (Ctrip) reported that Spring Festival staycation bookings were up +260%, with searches for local travel up by +40%. 80% of their users will stay local over Chinese New Year, it said, with increases all over the country.

At the same time, ForwardKeys noted, OTA Tongcheng-Elong reported that cancellations had become more common, with a trend to stay local, stay isolated, and do “slow travel” in the area.

OTA Tongcheng-Elong also identified a trend of staycations in hotels, with customers booking family suites and hi-tech offerings like e-sports rooms or audio-visual rooms popular. It reported that in the previous ten days, searches for local travel products had increased eight-fold, with a six-fold growth in searches for local accommodation and sightseeing packages.

Dai said: “This is the holiday period when families most often travel together. Our issued tickets back this further by showing that on 13 February, passengers travelling in family size (2-5 persons per booking) represents around 60% of all departures, and the share of passengers travelling alone represents only 10%, down by 20% from the day before the holiday.”

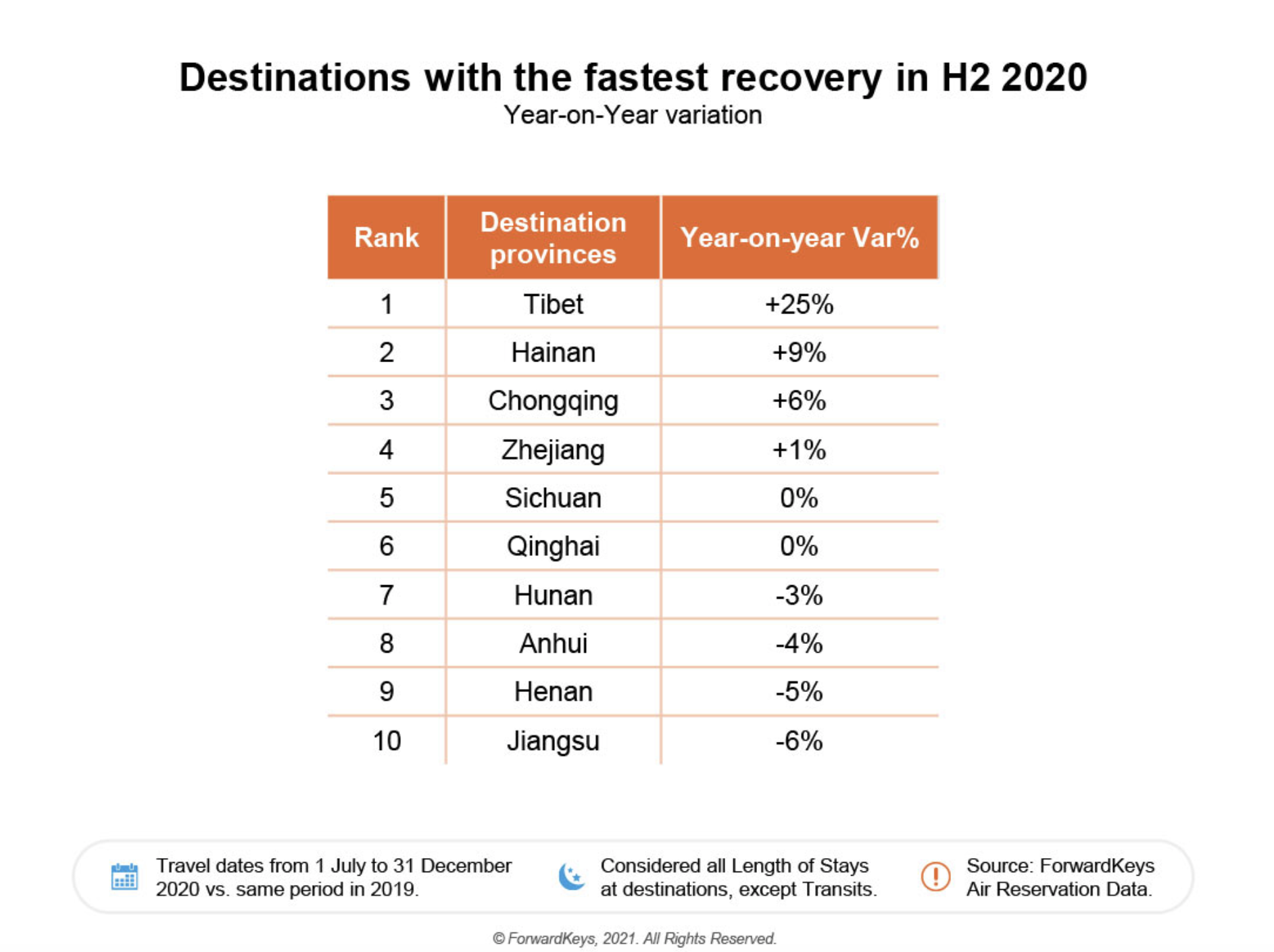

Looking at the second half of 2020 to predict the future potential for domestic travel in China in terms of issued air tickets, ForwardKeys revealed that the most resilient destination provinces (or destinations with the fastest recovery rates) were Tibet, Hainan and Chongqing.

Giving a positive view of the outlook for future Chinese domestic travel bookings, Dai concluded: “One thing we have learned from this pandemic is that the Chinese travel market is resilient and that the domestic travel market will be the first to bounce back when it can.

“The Chinese government has more experience in dealing with the outbreak situation now and people have started to receive the vaccine. I believe when the winter’s gone, the outlook for Chinese domestic travel in summer is still looking optimistic.”