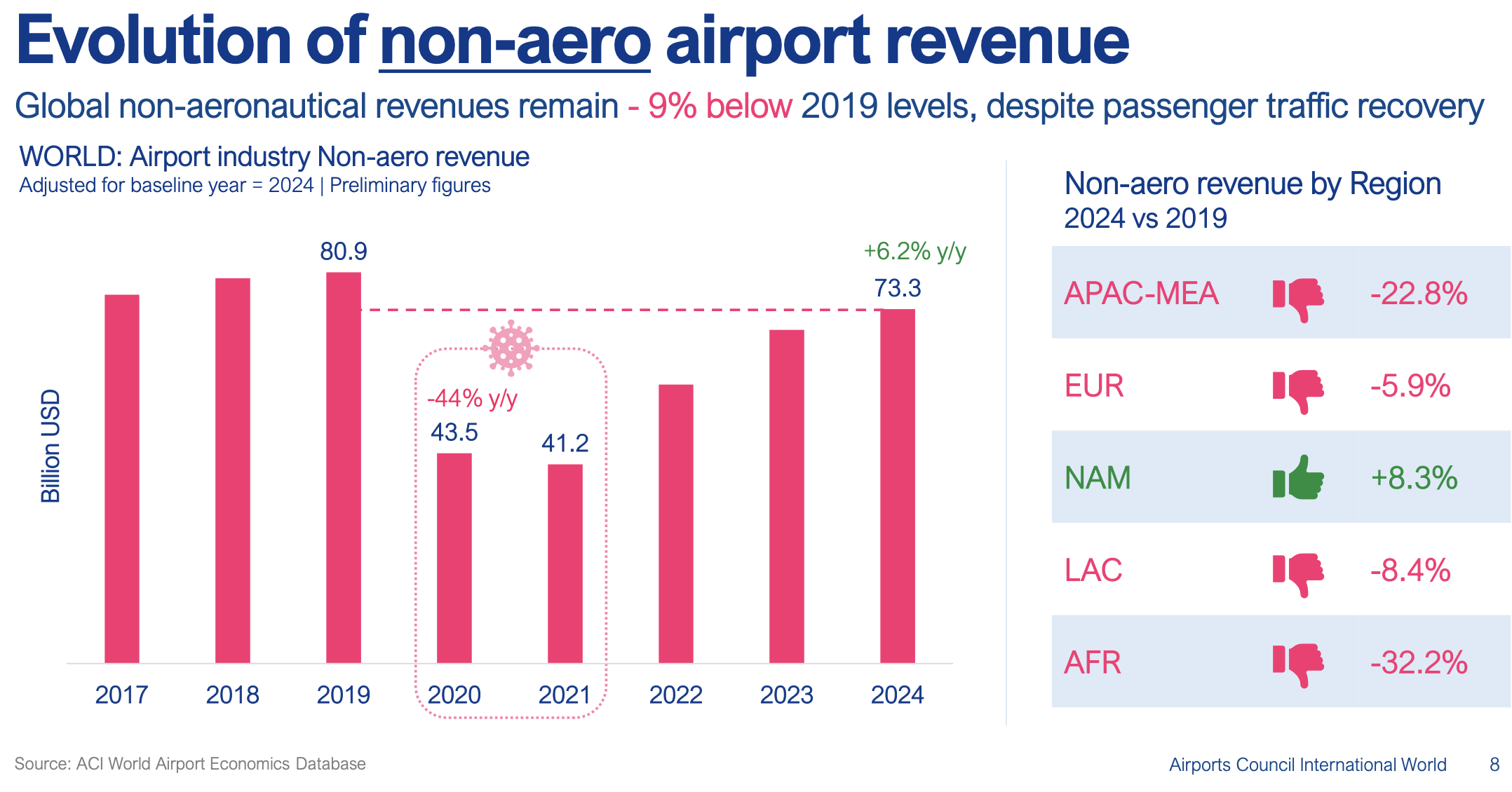

INTERNATIONAL. Global non-aeronautical revenues remained -9% below 2019 levels in 2024, despite strong passenger traffic recovery. That was among the takeaways from a special presentation at The Trinity Forum by co-organiser Airports Council international (ACI) World, which profiled the performance of commercial revenues since the pandemic.

The full findings appear in the ACI World Airport Economics Report 2026 (based on FY2024), the industry’s flagship assessment of airport economics and financial performance, with some data presented exclusively at The Trinity Forum last week (5-6 February).

The event, held in Doha last week, is a partnership between The Moodie Davitt Report, ACI World, ACI Asia Pacific & Middle East and ACI Europe. Host partners were Qatar Airways, Qatar Duty Free and Hamad International Airport.

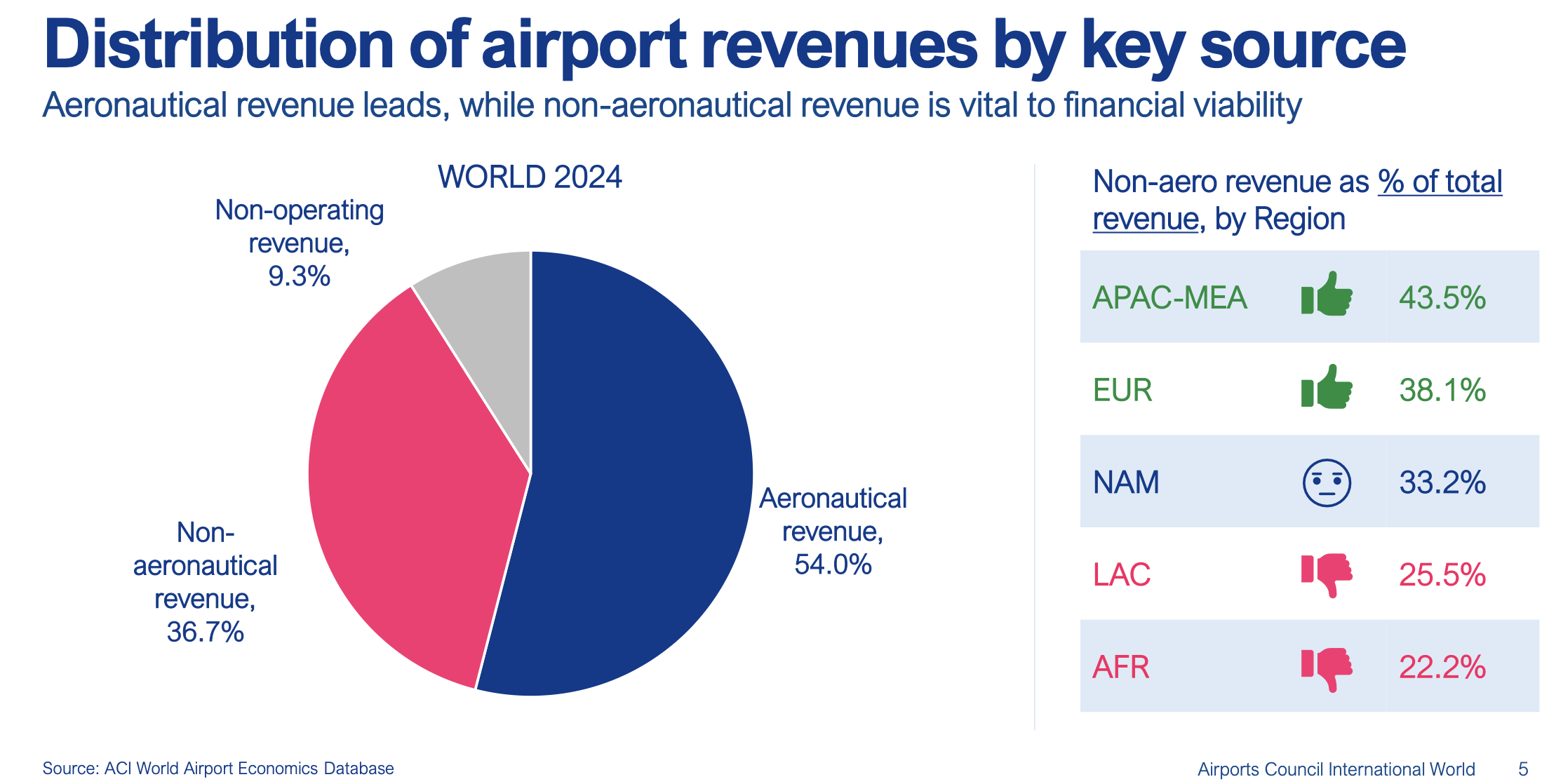

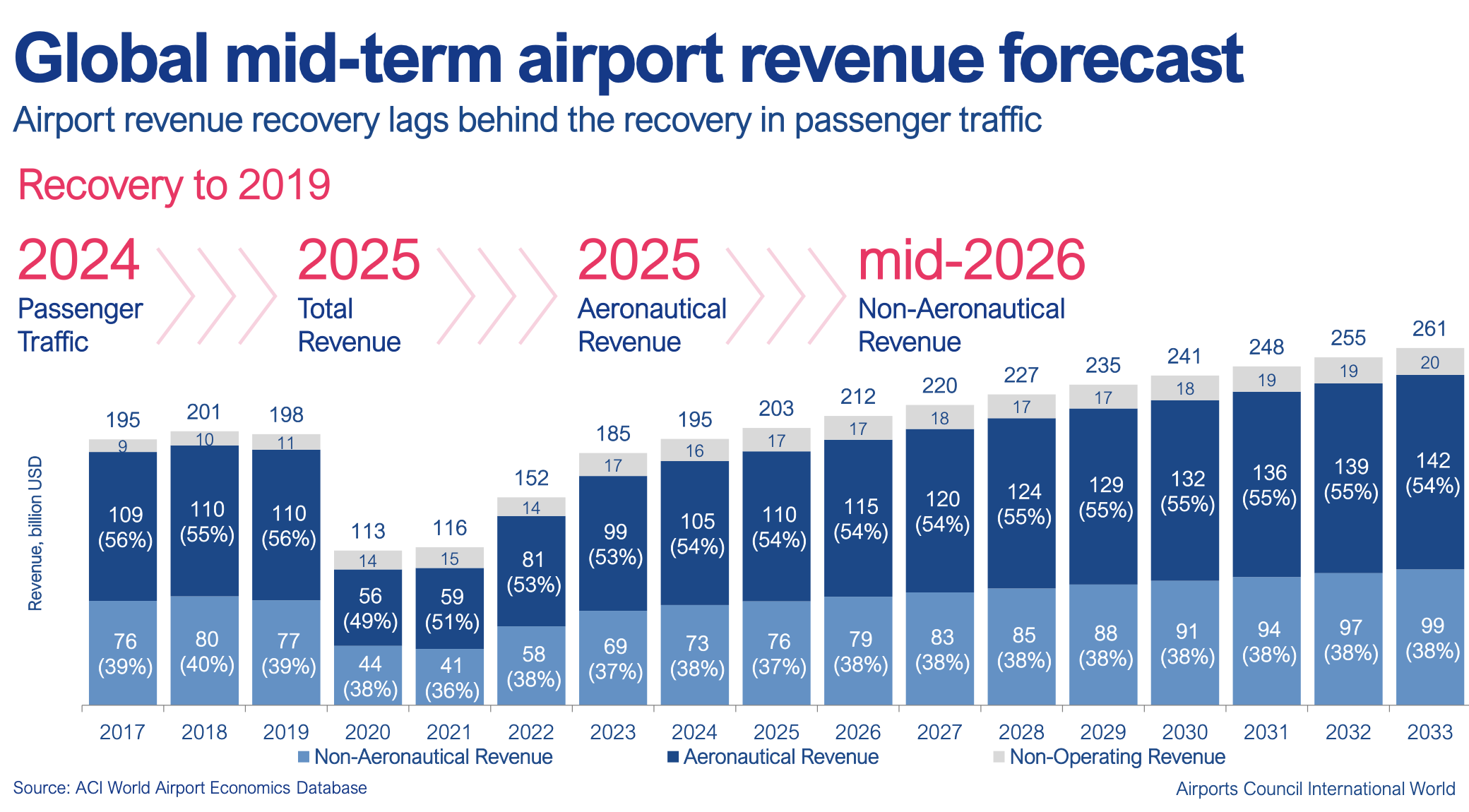

ACI World Senior Director, Economic Policy and Airport Business Slava Cheglatonyev delivered the latest research, citing a figure of US$194.9 billion for all airport income worldwide in 2024, up by +6.6% year-on-year.

He noted that while non-aeronautical revenues climbed by +6.2% year-on-year in 2024 to US$73.3 billion, they were sharply down compared to 2019 as noted above. This decline played out in most regions – APAC-MEA was behind by -22.8% for example – with the exception of North America, which saw +8.3% growth.

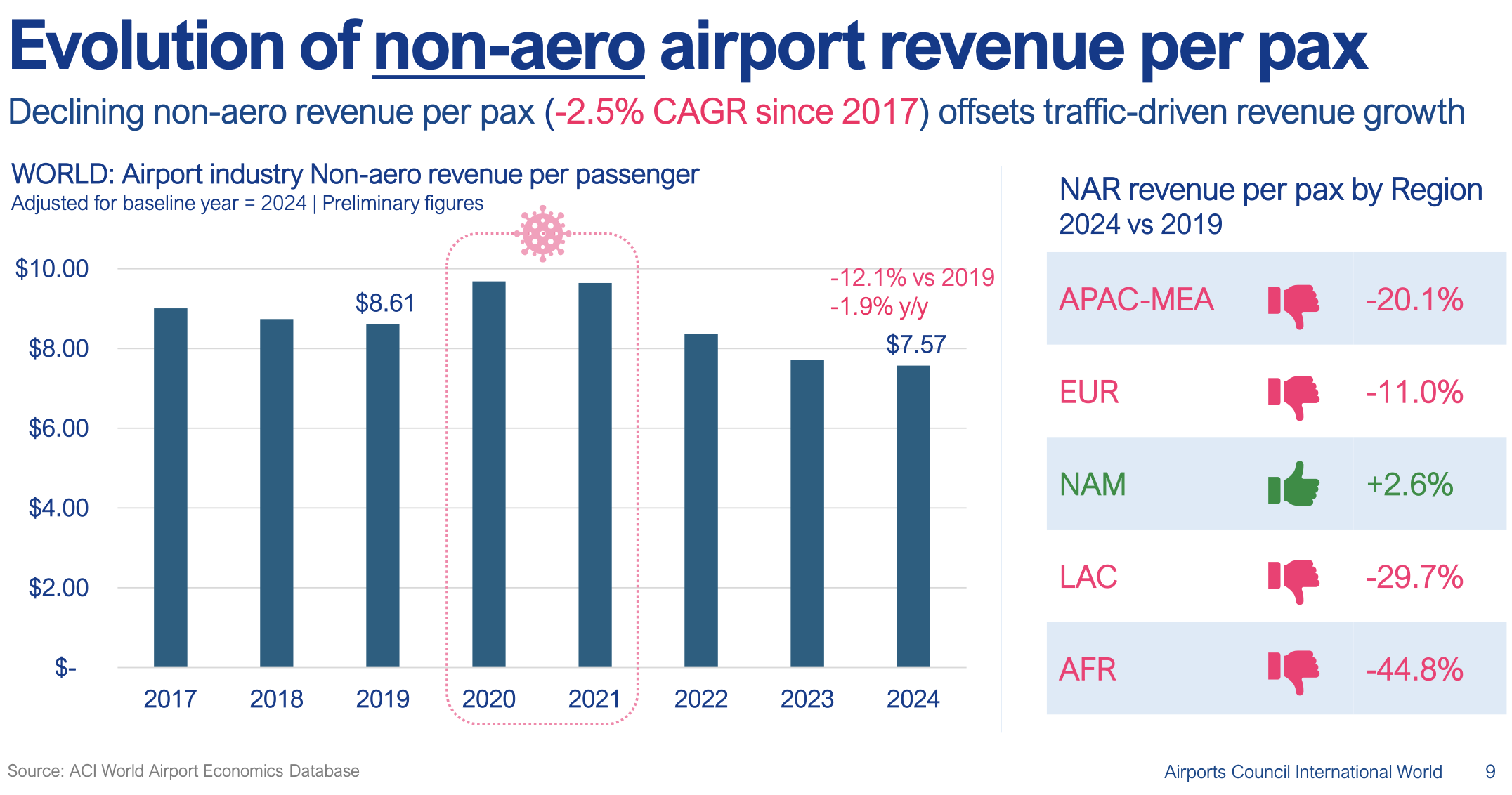

Cheglatonyev added that declining non-aeronautical revenue per passenger (-2.5% CAGR since 2017) has offset traffic-driven revenue growth in the market. The per passenger figure in 2024 stood at US$7.57 compared to US$8.61 in 2019.

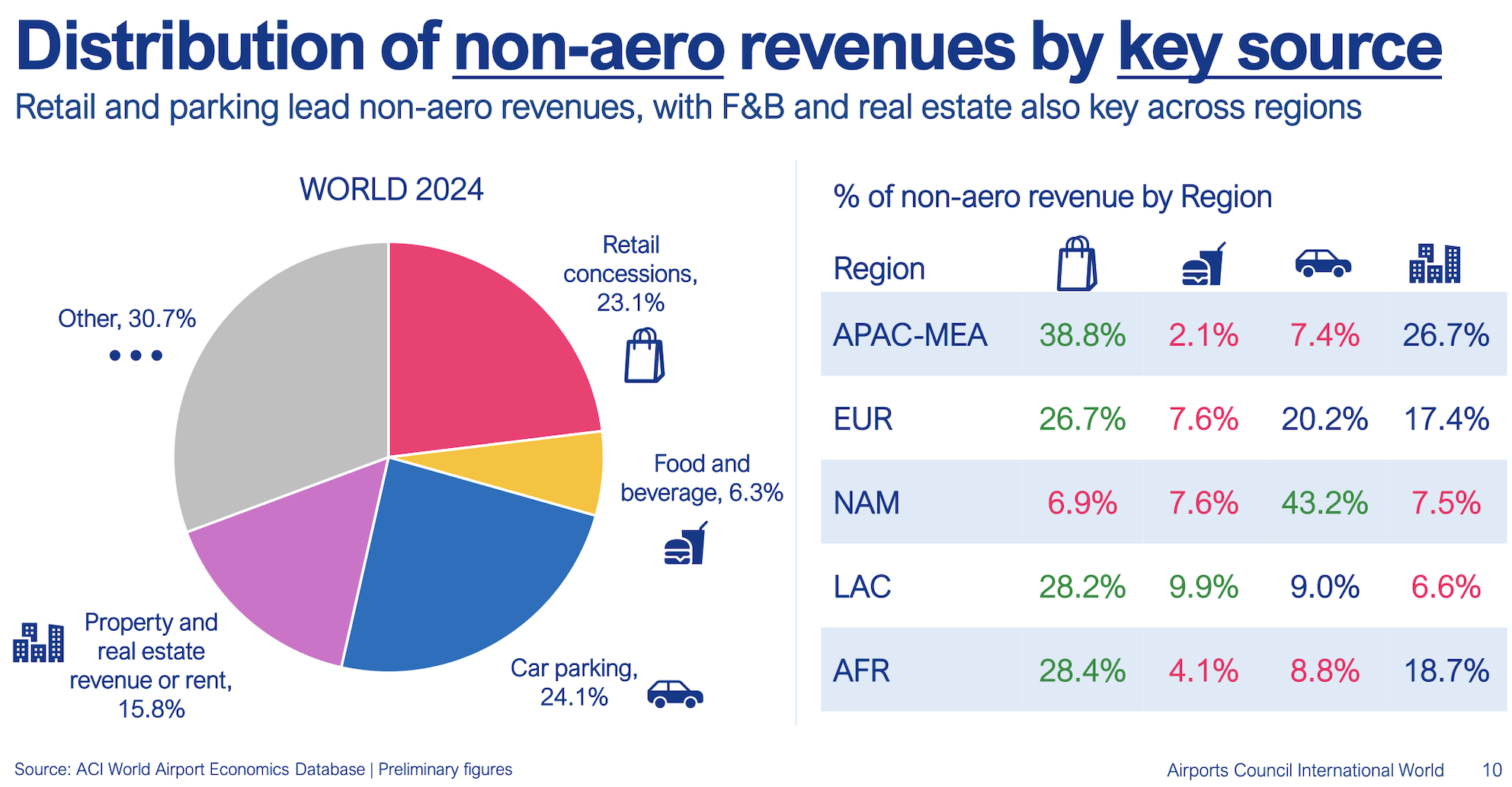

Car parking at 24.1% and retail at 23.1% lead non-aeronautical revenues by channel, with food & beverage at 6.3%. Retail commands the highest share of non-aero incomes in Asia Pacific-Middle East at 38.8%, with F&B representing just 2.1%. In Europe, retail and F&B represent 26.7% and 7.6% respectively. In North America, car parking at over 40% dwarfs the proportion in any other region.

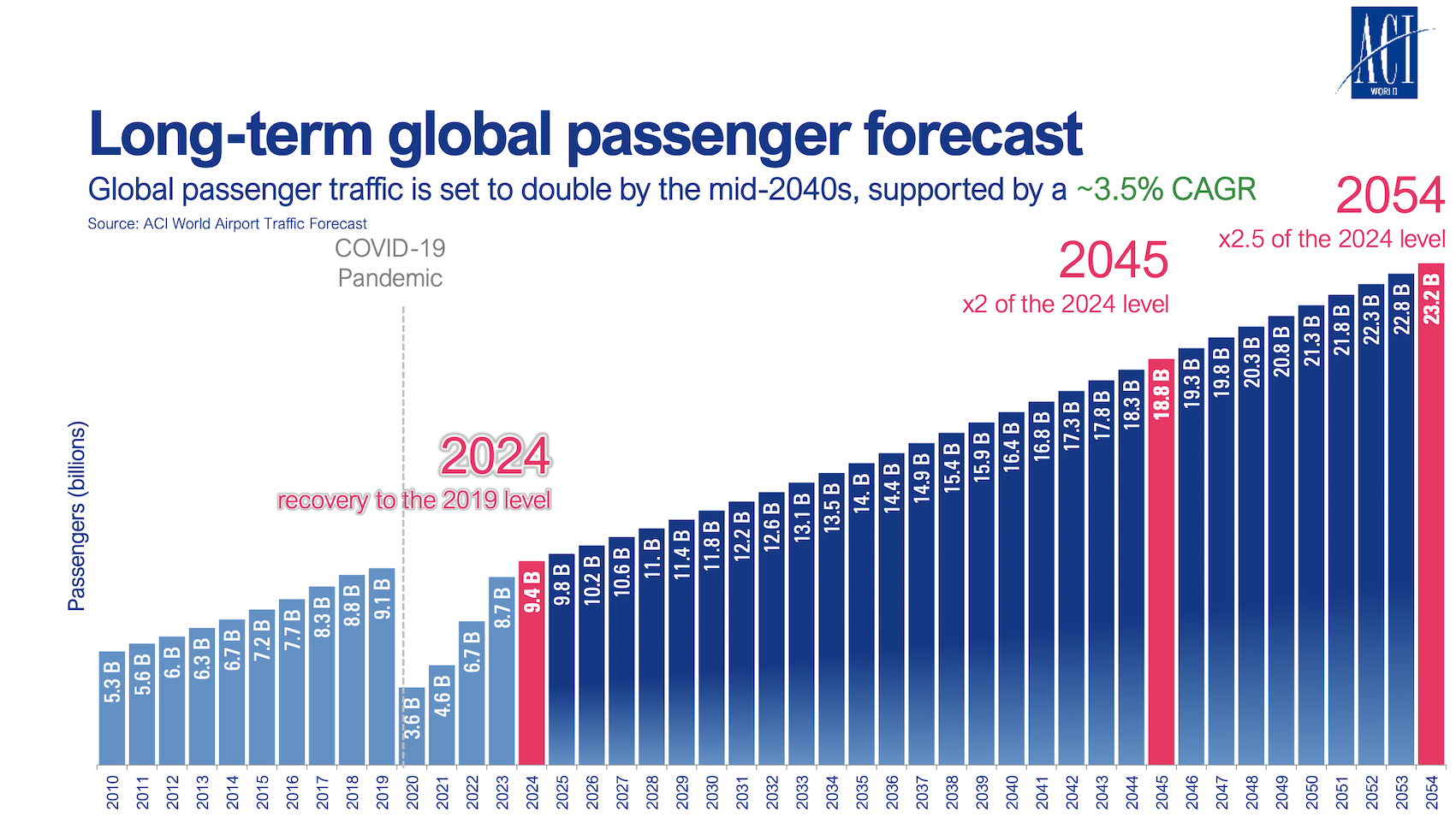

Looking ahead, ACI forecasts US$76 billion in global non-aeronautical revenues for 2025 (37% of all airport income), with the figure reaching US$99 billion by 2033 (38% of airport revenues). Recovery in the non-aeronautical sector to pre-pandemic revenue levels is estimated for around mid-2026.

The 2026 ACI World Airport Economics Report & Key Performance Indicators report will appear in March. ✈

*Click here for session by session coverage of The Trinity Forum 2026 in Doha, hosted by Qatar Airways, Hamad International Airport and Qatar Duty Free.